m00m00000

voted

Hi, mooers! ![]()

YTL Power $YTLPOWR (6742.MY)$ is expected to release its latest quarterly earnings on November 26*. How will the market react to the company's results? Vote your answer to participate!

*The exact release date depends on the company's announcement.

🎁 Rewards

![]() An equal share of 5,000 points: For mooers who correctly guess the price range of $YTLPOWR (6742.MY)$'s closing price on 26 November!

An equal share of 5,000 points: For mooers who correctly guess the price range of $YTLPOWR (6742.MY)$'s closing price on 26 November!

(Vote will clos...

YTL Power $YTLPOWR (6742.MY)$ is expected to release its latest quarterly earnings on November 26*. How will the market react to the company's results? Vote your answer to participate!

*The exact release date depends on the company's announcement.

🎁 Rewards

(Vote will clos...

50

90

m00m00000

commented on

$PBBANK (1295.MY)$ How can you tell if you have received a dividend?

Translated

3

7

m00m00000

Set a live reminder

Missed the live? Watch the replay now and join Justin, Michael and Jessica as they dives deep into US rate cuts!

701

1018

m00m00000

Set a live reminder

Dear Mooers,

Are you ready to take your investment knowledge to the next level? We’re excited to invite you to our upcoming live stream event: “Understanding and Investing in ETFs Listed on Bursa Malaysia”.

Participate in this live stream, you will have a chance to receive 88 moomoo points!

In this comprehensive live stream, we’ll guide you through everything you need to know about Exchange Traded Funds (ETFs) and how you can leverage them...

Are you ready to take your investment knowledge to the next level? We’re excited to invite you to our upcoming live stream event: “Understanding and Investing in ETFs Listed on Bursa Malaysia”.

Participate in this live stream, you will have a chance to receive 88 moomoo points!

In this comprehensive live stream, we’ll guide you through everything you need to know about Exchange Traded Funds (ETFs) and how you can leverage them...

Unlock the Secrets of ETFs with Our Upcoming Live Stream!

Sep 4 07:00

288

103

m00m00000

voted

(Kuala Lumpur, March 3) The overall performance of the banking industry in the second quarter of 2024 is good. Analysts predict that the net interest margin will stabilize in the future, and the prospects for profit growth remain bright, maintaining a positive rating.

According to Malayan Banking Investment Bank's latest report, based on its tracking of bank stocks, the core net profit of China's banking industry grew by 9% year-on-year in the first half of the year, mainly due to the continuous growth of operating profit by 7% and stable credit costs.

Therefore, analysts maintain a growth forecast of 7.6% in operating profit for the whole year of 2024.

This is mainly based on the forecasted domestic loan growth of 5.5%, average net interest margin expected to be 2.07%, non-interest income ratio of 25.1%, and cost-to-income ratio (CIR) forecasted to be 44.7%.

Taking into account the support of lower credit costs, namely 22 basis points, lower than 23 basis points in 2023, we have raised our core net profit growth expectation from 6.8% to 7.8%, while the average return on equity (ROE) of the banking industry is expected to be 10.4%.

Subtask: Low inflation can be maintained this year.

Analysts pointed out that the overall inflation rate last year was 2.5%. The bank's economists have lowered their inflation forecast for 2024 from the previous 3% to 2%, and expect inflation in 2025 to be in the range of 2.5% to 3%, due to the expected implementation of targeted fuel subsidies next year.

Although the current deposit interest rate has a positive return, given the prospect of rising inflation next year, it means that the central bank is unlikely to cut interest rates in the short term...

According to Malayan Banking Investment Bank's latest report, based on its tracking of bank stocks, the core net profit of China's banking industry grew by 9% year-on-year in the first half of the year, mainly due to the continuous growth of operating profit by 7% and stable credit costs.

Therefore, analysts maintain a growth forecast of 7.6% in operating profit for the whole year of 2024.

This is mainly based on the forecasted domestic loan growth of 5.5%, average net interest margin expected to be 2.07%, non-interest income ratio of 25.1%, and cost-to-income ratio (CIR) forecasted to be 44.7%.

Taking into account the support of lower credit costs, namely 22 basis points, lower than 23 basis points in 2023, we have raised our core net profit growth expectation from 6.8% to 7.8%, while the average return on equity (ROE) of the banking industry is expected to be 10.4%.

Subtask: Low inflation can be maintained this year.

Analysts pointed out that the overall inflation rate last year was 2.5%. The bank's economists have lowered their inflation forecast for 2024 from the previous 3% to 2%, and expect inflation in 2025 to be in the range of 2.5% to 3%, due to the expected implementation of targeted fuel subsidies next year.

Although the current deposit interest rate has a positive return, given the prospect of rising inflation next year, it means that the central bank is unlikely to cut interest rates in the short term...

Translated

20

1

m00m00000

voted

Updated on October 15

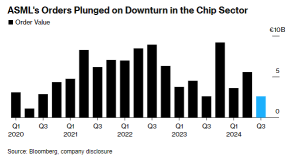

Semiconductor company $ASML Holding (ASML.US)$ experienced its largest drop in 26 years on October 15 after reporting only about half the orders that analysts had anticipated from chipmakers, signaling a significant slowdown for this key industry player, according to Bloomberg.

The disappointing results were further exacerbated by the company accidentally releasing its earnings report a day early. This news prompted a wid...

Semiconductor company $ASML Holding (ASML.US)$ experienced its largest drop in 26 years on October 15 after reporting only about half the orders that analysts had anticipated from chipmakers, signaling a significant slowdown for this key industry player, according to Bloomberg.

The disappointing results were further exacerbated by the company accidentally releasing its earnings report a day early. This news prompted a wid...

+2

442

195

m00m00000

voted

Hi, mooers! ![]()

Malayan Banking Bhd $MAYBANK (1155.MY)$ is expected to release its quarterly earnings on August 28*. How will the market react to the company's results? Vote your answer to participate!

*The exact release date depends on the company's announcement.

🎁 Rewards

![]() An equal share of 5,000 points: For mooers who correctly guess the price range of $MAYBANK (1155.MY)$'s closing price on 29 August!

An equal share of 5,000 points: For mooers who correctly guess the price range of $MAYBANK (1155.MY)$'s closing price on 29 August!

(Vote will close a...

Malayan Banking Bhd $MAYBANK (1155.MY)$ is expected to release its quarterly earnings on August 28*. How will the market react to the company's results? Vote your answer to participate!

*The exact release date depends on the company's announcement.

🎁 Rewards

(Vote will close a...

77

142

m00m00000

voted

Hi mooers! Are you ready for the Malaysian earnings season?![]()

This week, $INARI (0166.MY)$ and $TENAGA (5347.MY)$ are said to report their quarterly earnings.

Who will surprise the market more, the semiconductor giant or the electricity monopoly? Make your prediction to grab point rewards!![]()

Rewards

● An equal share of 5,000 points: For mooers who correctly guessed the winner who makes the biggest % gains in intraday trading this week (e.g., ...

This week, $INARI (0166.MY)$ and $TENAGA (5347.MY)$ are said to report their quarterly earnings.

Who will surprise the market more, the semiconductor giant or the electricity monopoly? Make your prediction to grab point rewards!

Rewards

● An equal share of 5,000 points: For mooers who correctly guessed the winner who makes the biggest % gains in intraday trading this week (e.g., ...

36

28

m00m00000

voted

Hi, mooers!

Ever wonder how to make your idle money work smarter? Are you looking for ways to boost your idle funds while keeping them readily available?![]()

You might want to get familiar with Cash Plus!![]()

Here's a snapshot of what Cash Plus offers:

1. Daily returns: Enjoy returns of up to 3.5% p.a.*, even on non-trading days.

2. Ultra-low threshold: Dive in with as little as RM0.01 without any cap.

3. Flexible redemption: Cash out for stoc...

Ever wonder how to make your idle money work smarter? Are you looking for ways to boost your idle funds while keeping them readily available?

You might want to get familiar with Cash Plus!

Here's a snapshot of what Cash Plus offers:

1. Daily returns: Enjoy returns of up to 3.5% p.a.*, even on non-trading days.

2. Ultra-low threshold: Dive in with as little as RM0.01 without any cap.

3. Flexible redemption: Cash out for stoc...

224

370

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)