Madiq Izichi

voted

I always remind myself to review my trades and strategies each quarter. ![]()

It helps me to be disciplined, to check my positions and make adjustments timely.![]()

Securities Position: Looking good with gradual profits![]()

Asset Distribution:

For me my Golden Ratio (Stocks/Funds) was previously 20/80. Seems like I’ve moved towards 50/50 with my bullishness on $NVIDIA (NVDA.US)$ .![]()

Currency Exposure:

40/60 is sufficient for my golden ratio for trading in US market.![]()

YTD Return:

56% So ...

It helps me to be disciplined, to check my positions and make adjustments timely.

Securities Position: Looking good with gradual profits

Asset Distribution:

For me my Golden Ratio (Stocks/Funds) was previously 20/80. Seems like I’ve moved towards 50/50 with my bullishness on $NVIDIA (NVDA.US)$ .

Currency Exposure:

40/60 is sufficient for my golden ratio for trading in US market.

YTD Return:

56% So ...

+3

38

13

Madiq Izichi

voted

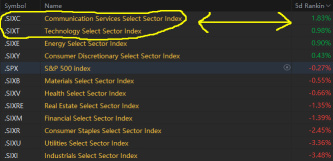

Intro

Last week's mixed markets are showing indications of investors rotating their capital between sectors. Tech appears to be on a comeback at least temporarily. The China reopening trade is still in full effect but when and how big will the first initial correction be? Commodities appear to be joining the China trade. Technically speaking US equity markets are still looking long-term bearish and short-term bullish. After seeing last week'...

Last week's mixed markets are showing indications of investors rotating their capital between sectors. Tech appears to be on a comeback at least temporarily. The China reopening trade is still in full effect but when and how big will the first initial correction be? Commodities appear to be joining the China trade. Technically speaking US equity markets are still looking long-term bearish and short-term bullish. After seeing last week'...

+3

3

3

Madiq Izichi

commented on

Event Description:

This event is to help mooers learn more about the differences among companies and industries, review Fundamental Analysis indicators, and better navigate the market.

"You only have to do a very few things right in your life so long as you don't do too many things wrong. You do things when the opportunities come along."— Warren Buffett

Challenge Start >>

Rewards

1) 4,000 points: The first 200 users who give ...

This event is to help mooers learn more about the differences among companies and industries, review Fundamental Analysis indicators, and better navigate the market.

"You only have to do a very few things right in your life so long as you don't do too many things wrong. You do things when the opportunities come along."— Warren Buffett

Challenge Start >>

Rewards

1) 4,000 points: The first 200 users who give ...

+3

56

236

9

Madiq Izichi

reacted to

$Apple (AAPL.US)$ the fighting between bear and bull have been going on for the past 30 mins at 140 🤣🤣🤣🤣🤣🤣

4

2

most, if not all IPOs will see a price drop after launch, enter position after then, but I am staying away from China as of now, at least until after Xi is overthrown.

1

Madiq Izichi

commented on

When to start investing? The standard answer you heard is probably NOW!

This is true to some extent, but if we dig a bit deeper, a better interpretation might be: the best time to start learning about investing is NOW, but the best time to invest is when an asset's market value is below intrinsic value.

Amid such a sharp pullback from last December, some investors have cashed in on their money, waiting for the"right" moment to enter trades again. F...

This is true to some extent, but if we dig a bit deeper, a better interpretation might be: the best time to start learning about investing is NOW, but the best time to invest is when an asset's market value is below intrinsic value.

Amid such a sharp pullback from last December, some investors have cashed in on their money, waiting for the"right" moment to enter trades again. F...

122

1210

36

Madiq Izichi

voted

In a life-and-death struggle, failure will not be tolerated.

Deathmatches are everywhere in the stock market.

Some people fight alone, and some carry the whole team to victory.

No matter what means are used, only the strongest will remain standing.

Now let's see those who worked hard to turn the tide.

@Sam The Greater: $AMC Entertainment (AMC.US)$ $SPDR S&P 500 ETF (SPY.US)$

@RyanEatBuffet: $AMC Entertainment (AMC.US)$

@LeicesterM: TO THE MOON INEVITABLE $AMC Entertainment (AMC.US)$

���������...

Deathmatches are everywhere in the stock market.

Some people fight alone, and some carry the whole team to victory.

No matter what means are used, only the strongest will remain standing.

Now let's see those who worked hard to turn the tide.

@Sam The Greater: $AMC Entertainment (AMC.US)$ $SPDR S&P 500 ETF (SPY.US)$

@RyanEatBuffet: $AMC Entertainment (AMC.US)$

@LeicesterM: TO THE MOON INEVITABLE $AMC Entertainment (AMC.US)$

���������...

+11

44

36

14

Madiq Izichi

voted

Inflation in the US has reached 8.3%, which hit a 4-year high (Source: Statista, data as of August 2022). In Singapore, core inflation rose to 5.1% in August, a nearly four-year high (Source: MAS, data as of Oct 5, 2022). The prospect of higher interest rates has dampened demand for various financial products, and real estate investment trusts ( REITs ) are one of them.

However, with the higher interest rates increasingly looking like the ne...

However, with the higher interest rates increasingly looking like the ne...

9

1

9

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)