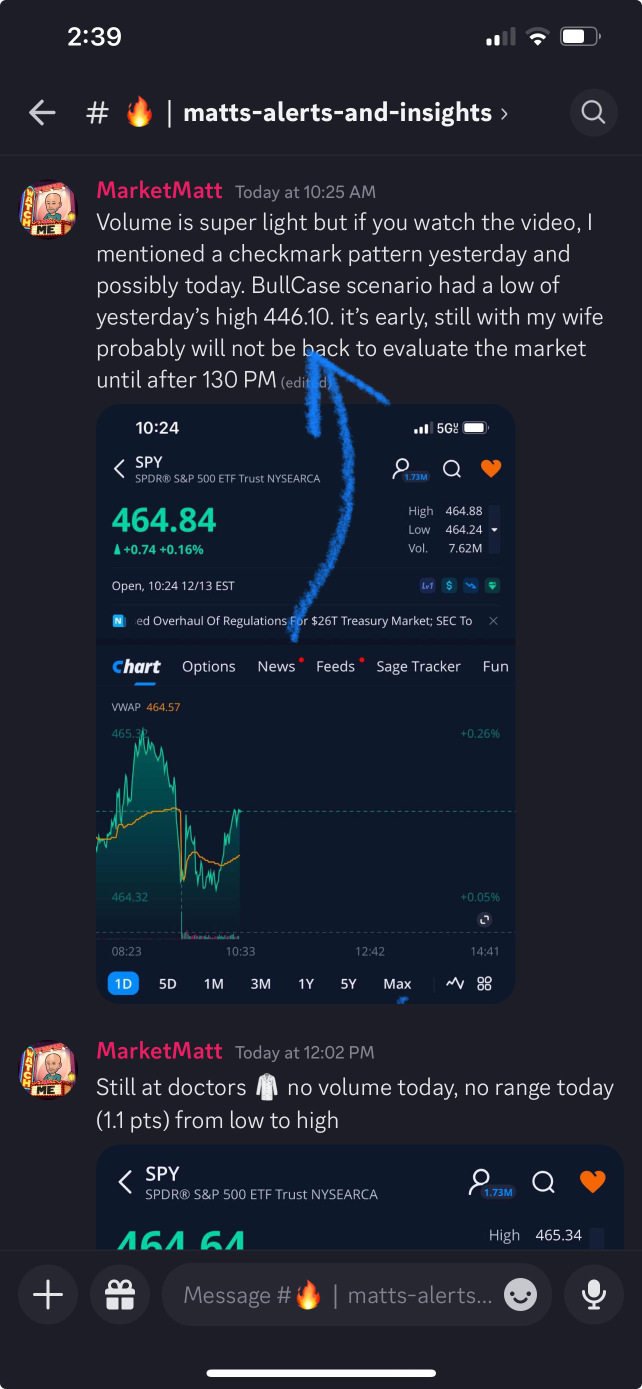

Good morning everybody, Premarket analysis for Tuesday. Let’s first review Monday’s action. SPY 462 high, 459 low. 2.7 pt day range. Volume 63 million. Tuesday premarket 8:30 AM CPI - Estimates 3.0, OK Bull case 2.9 Dollar goes lower Yields come down SPY 460-465 Volume +84 million Bear case 3.1 Dollar heads back higher Yields creep higher SPY 462 headed down to 457.80 End of year approaching, I mentioned this yesterday, watch for window dressing. Where are money manager...

10

$Alphabet-C (GOOG.US)$ ⚠️ JUST IN: *ALPHABET LOSES LANDMARK GOOGLE PLAY ANTITRUST FIGHT WITH EPIC GAMES

5

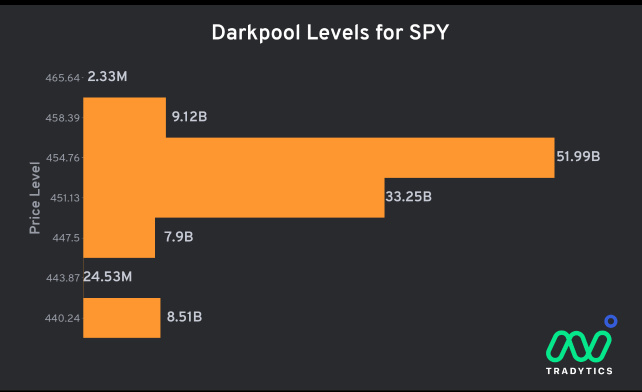

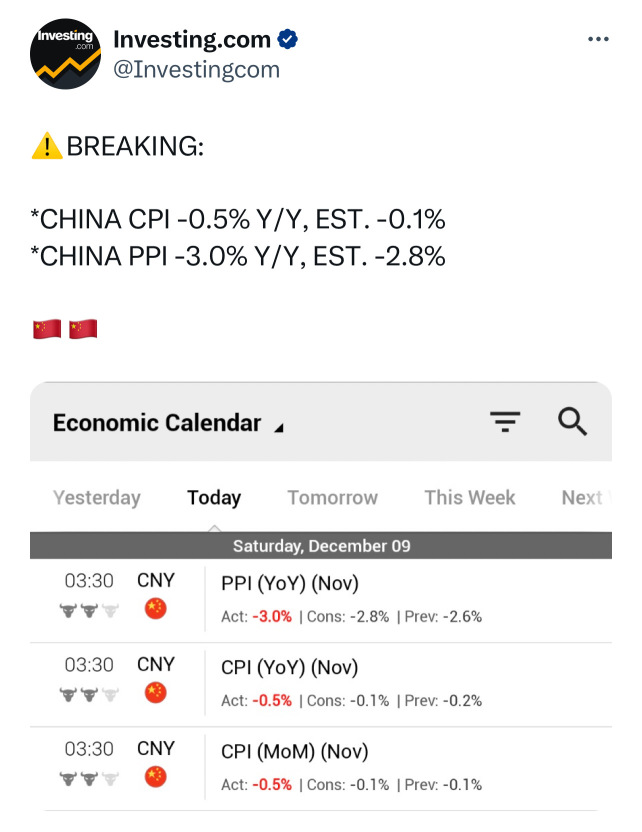

Good morning everybody, Tuesday, premarket, posting above Moody, cuts China’s credit Outlook to negative. This will have an effect on the Chinese market for a few days. Looking at our market specifically the SPY - Friday’s top was $459 and change. Monday’s top was $458 and change. The dark pool levels posted above are somewhat limited. You can see the two largest levels $454.76 is right below where we are premarket at $455.12. Bull case scenario SPY drops to 454.40 and ...

9

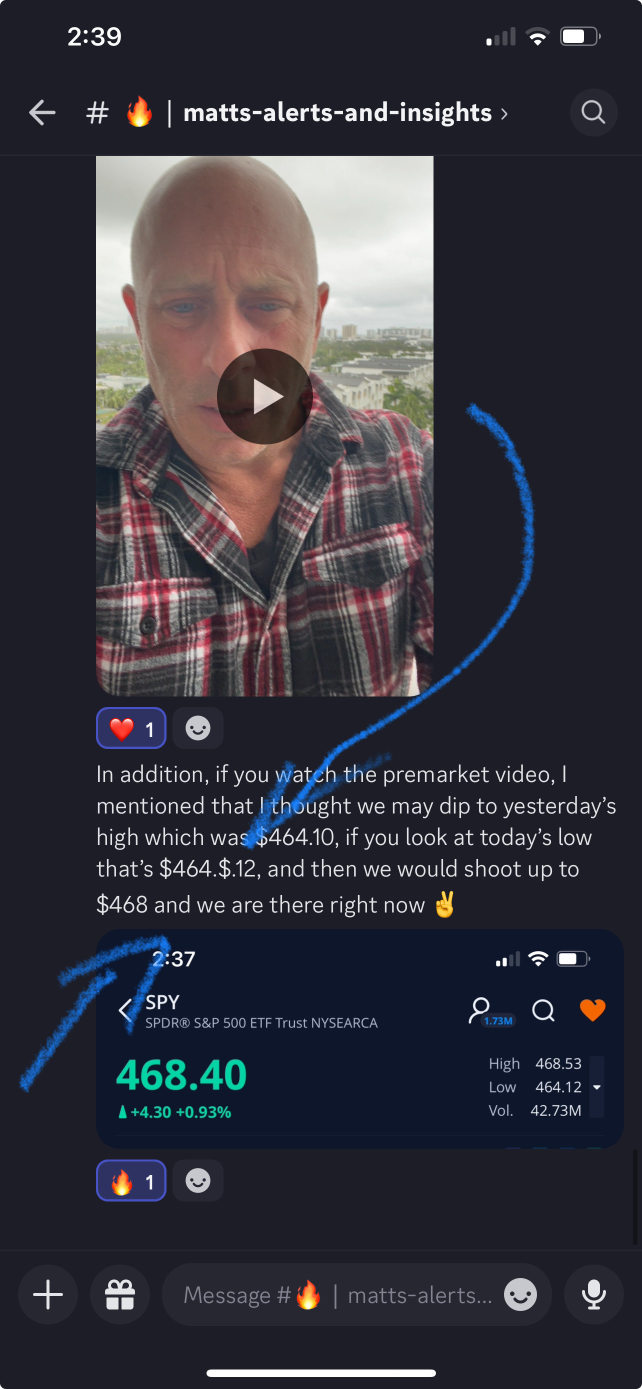

Premarket analysis, Monday : good morning everybody, hope you enjoyed your weekends. SPY dealer delta’s turned positive Friday early afternoon, the market continued to fade higher. if the delta is continue to grow positive, then the market will continue to retract. I’m not talking about Mark I’m talking consolidation as the markets ripped higher in November by 10%. CRYPTO & GOLD at 2 yr highs as the dollar firms up a little. Hang Seng Big30 down another 1%, as some Chin...

18

Tuesday premarket analysis 🧐 European stocks, open lower as momentum stalls. Oil prices rise on weak dollar. Expectations OPEC output cut. Gold hits 6 month high, as expectations on Fed rate pause. GDP numbers on Wednesday am, PCE (most important data this week IMO) on Thursday premarket. Yesterday tight range on SPY 1.41 pts from top to bottom. Light volume. China (Hang Seng) dropped another 1% - Real estate company’s continue to take a beating. (NIKKEI -0.12) (Shangha...

12

1

$SPDR S&P 500 ETF (SPY.US)$ No fed speakers today. New home sales drop 10 am. A number of companies still need to report earnings. Cyber sales reported by ADBE up 7.5% from last year but still LESS than pre pandemic numbers. Friday volume was extremely light under 30 million. I’ll be watching volume today, as long as I see 10 mil by 10 am on SPY, I will believe the direction. Watching US Dollar 103.26, heads to 103 or under = bullish, if u see a spike to 103.55, I would b...

12

1

1

FED SPEAKERS THIS WEEK: *FOMC

MEMBER GOOLSBEE (TUES. 10:00AM) *FOMC MEMBER WALLER (TUES. 10:05AM) *FOMC MEMBER BOWMAN (TUES. 10:45AM) *FOMC MEMBER BARR (TUES. 1:05PM) *FOMC MEMBER MESTER (WED. 1:45PM) *FOMC MEMBER WILLIAMS (THURS. 9:05AM) *FOMC MEMBER GOOLSBEE (FRI. 10:00AM) *FED CHAIR POWELL (FRI. 11:00AM)

MEMBER GOOLSBEE (TUES. 10:00AM) *FOMC MEMBER WALLER (TUES. 10:05AM) *FOMC MEMBER BOWMAN (TUES. 10:45AM) *FOMC MEMBER BARR (TUES. 1:05PM) *FOMC MEMBER MESTER (WED. 1:45PM) *FOMC MEMBER WILLIAMS (THURS. 9:05AM) *FOMC MEMBER GOOLSBEE (FRI. 10:00AM) *FED CHAIR POWELL (FRI. 11:00AM)

6

1

HAVE A GAME PLAN & MAKE SURE YOU FOLLOW IT…

Examples; If your game plan is to invest $4000 and make 10% in a single day by executing a quick scalp, then there is no reason to find yourself in an option position of 8000-$10,000, flat on the day, caring that position over to the next day

If your account is smaller and you’re looking to make $40 on the day, then there’s no reason that you should have $1000 position carried over at any given time

If your game plan is to buy calls on the...

Examples; If your game plan is to invest $4000 and make 10% in a single day by executing a quick scalp, then there is no reason to find yourself in an option position of 8000-$10,000, flat on the day, caring that position over to the next day

If your account is smaller and you’re looking to make $40 on the day, then there’s no reason that you should have $1000 position carried over at any given time

If your game plan is to buy calls on the...

20

3

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)