Markets Dilemma

liked

I started with moomoo, officially started investing for a year, and this week I went from 0.5 million initial capital to 7 million. The moomoo community has many talented individuals. However, the official team told me a few days ago that I am an important community user among the Chinese in australia. I have been following this before. $Tesla (TSLA.US)$ You can view my previous historical messages, always focusing on the few big opportunities I see within the US stock market.

Every day in the past year, I have been watching the market for several hours, knowing that diligence can bring wealth. I have no intention of stopping investing. Investing is a long-term topic, and I will continue to express opinions in the community. (Not investment advice, just for communication purposes. Adults should be responsible for their actions ☕️)

![]()

![]()

![]()

Every day in the past year, I have been watching the market for several hours, knowing that diligence can bring wealth. I have no intention of stopping investing. Investing is a long-term topic, and I will continue to express opinions in the community. (Not investment advice, just for communication purposes. Adults should be responsible for their actions ☕️)

Translated

648

183

Markets Dilemma

Set a live reminder

US markets trade around record all time highs with the S&P500 up 22% this year, highs, thanks to better-than-expected US corporate news and US economic data. But what's ahead? Big tech earnings and the US election and stimulus from two biggest countries, China and the US. ![]()

Tesla shares rose 22%, its biggest gain since May 2013 spurring a rally in the “Magnificent Seven” stocks, which hit a three-month high. If $Tesla (TSLA.US)$ 's...

Tesla shares rose 22%, its biggest gain since May 2013 spurring a rally in the “Magnificent Seven” stocks, which hit a three-month high. If $Tesla (TSLA.US)$ 's...

Live preview: US tech mega-caps earnings preview - What's driving the market

Oct 30 01:00

246

178

High dividend is not so attractive as capital gains because dividends are usually pay yearly or half yearly. whereas capital gains may occur within a few weeks or earlier

double bottom is hit the rock bottom. But the stock may remain at the bottom for quite some time

Markets Dilemma

commented on

Global communication indices have outperformed broader global benchmarks this year, with Singapore telecommunications stocks standing out: Singtel and AIS TH SDR have surged by 33.84% and 48.68% respectively, while NetLink and StarHub have each risen by over 10%.

The telecommunications industry has been actively implementing and expanding strategic transformation plans in recent years, including Singtel28, StarHub's Dare+...

The telecommunications industry has been actively implementing and expanding strategic transformation plans in recent years, including Singtel28, StarHub's Dare+...

115

55

Markets Dilemma

voted

Do you have difficulties navigating the app, especially if you're new to moomoo? Do you feel frustrated while choosing the right tool to enhance your trading decisions?

At moomoo Learn, we're always listening to user feedback and striving to help you trade with ease and efficiency. We understand that moomoo’s numerous features can sometimes feel overwhelming. Today, we’re excited to walk you through some useful but often overlooked guides. By th...

At moomoo Learn, we're always listening to user feedback and striving to help you trade with ease and efficiency. We understand that moomoo’s numerous features can sometimes feel overwhelming. Today, we’re excited to walk you through some useful but often overlooked guides. By th...

+2

694

254

Markets Dilemma

commented on

Hey Mooers!

The Fed announced a 50 basis point interest rate cut on Sep 18, once again starting a monetary easing cycle after four years.

How will US rate cuts influence the global market?

What assets are more likely to outperform in the U.S. interest rate cut cycle?

Join moomoo’s global strategists for an in-depth discussion on how the Fed’s move could potentially impact your portfolio in the short and long term. And here’s a recap ...

The Fed announced a 50 basis point interest rate cut on Sep 18, once again starting a monetary easing cycle after four years.

How will US rate cuts influence the global market?

What assets are more likely to outperform in the U.S. interest rate cut cycle?

Join moomoo’s global strategists for an in-depth discussion on how the Fed’s move could potentially impact your portfolio in the short and long term. And here’s a recap ...

330

223

Markets Dilemma

Set a live reminder

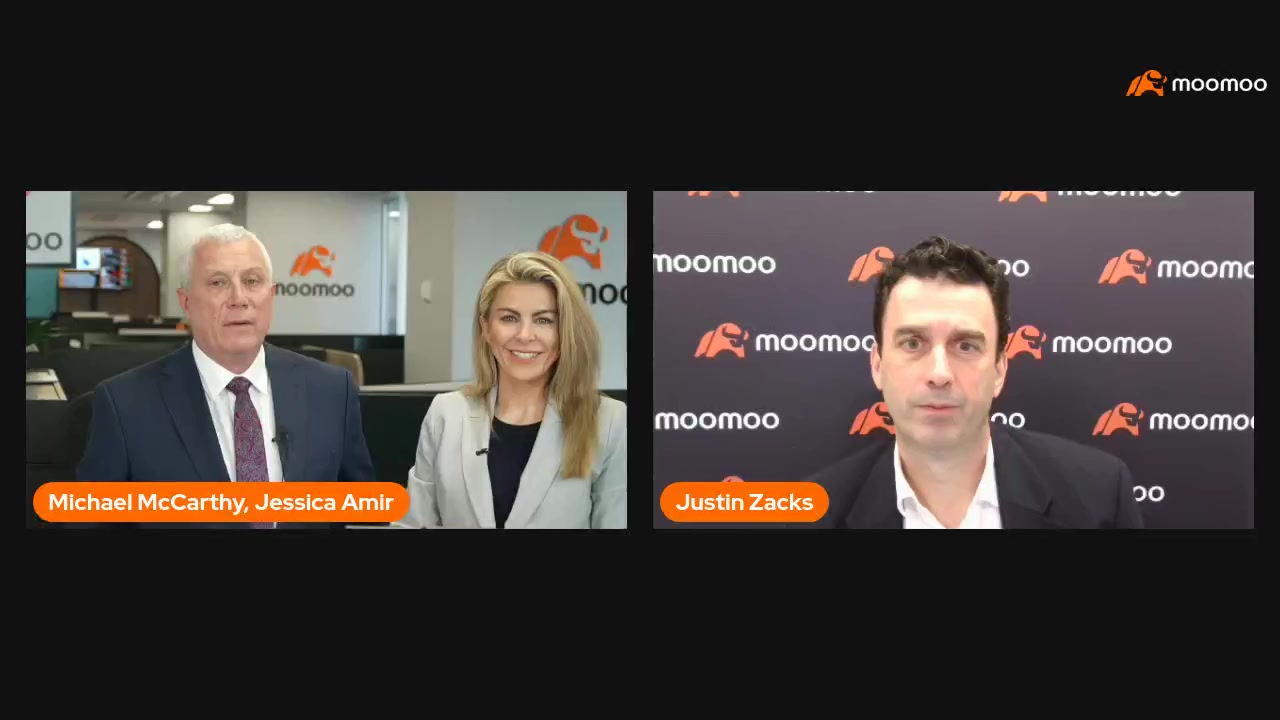

Missed the live? Watch the replay now and join Justin, Michael and Jessica as they dives deep into US rate cuts!

701

1018

Markets Dilemma

commented on

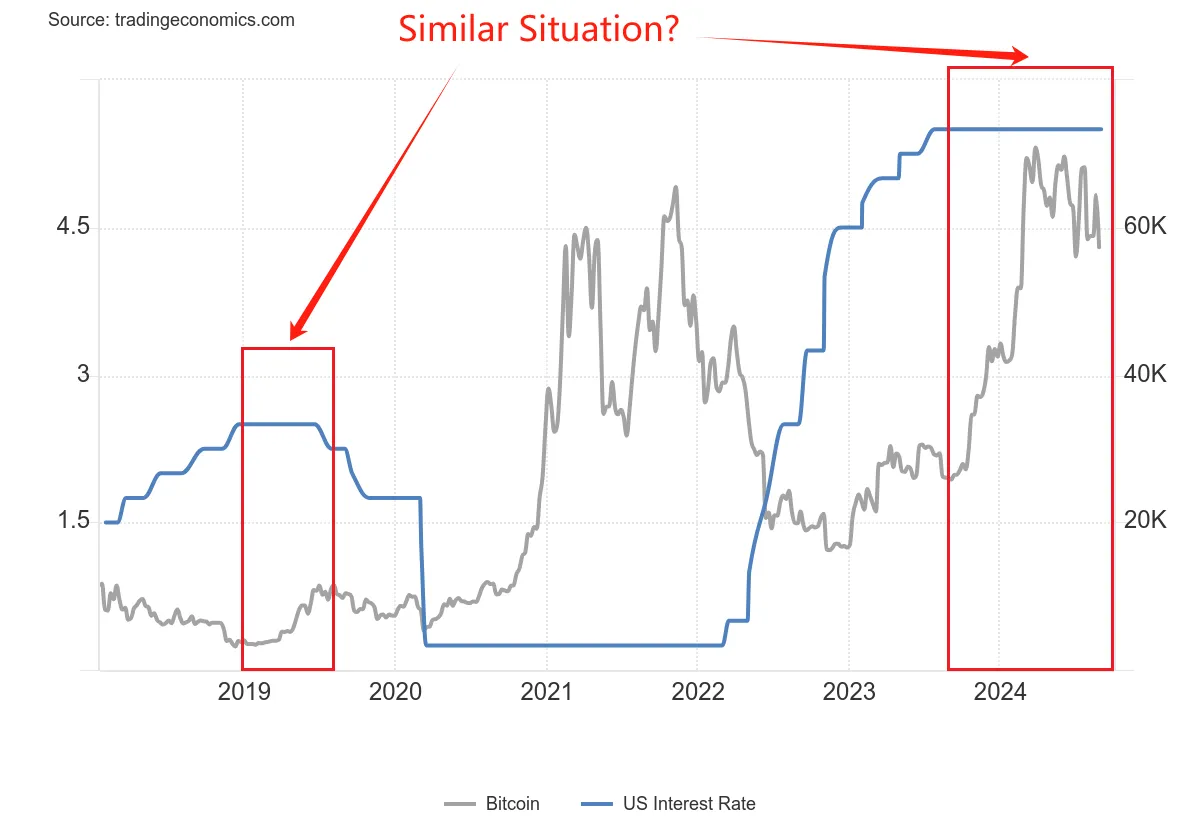

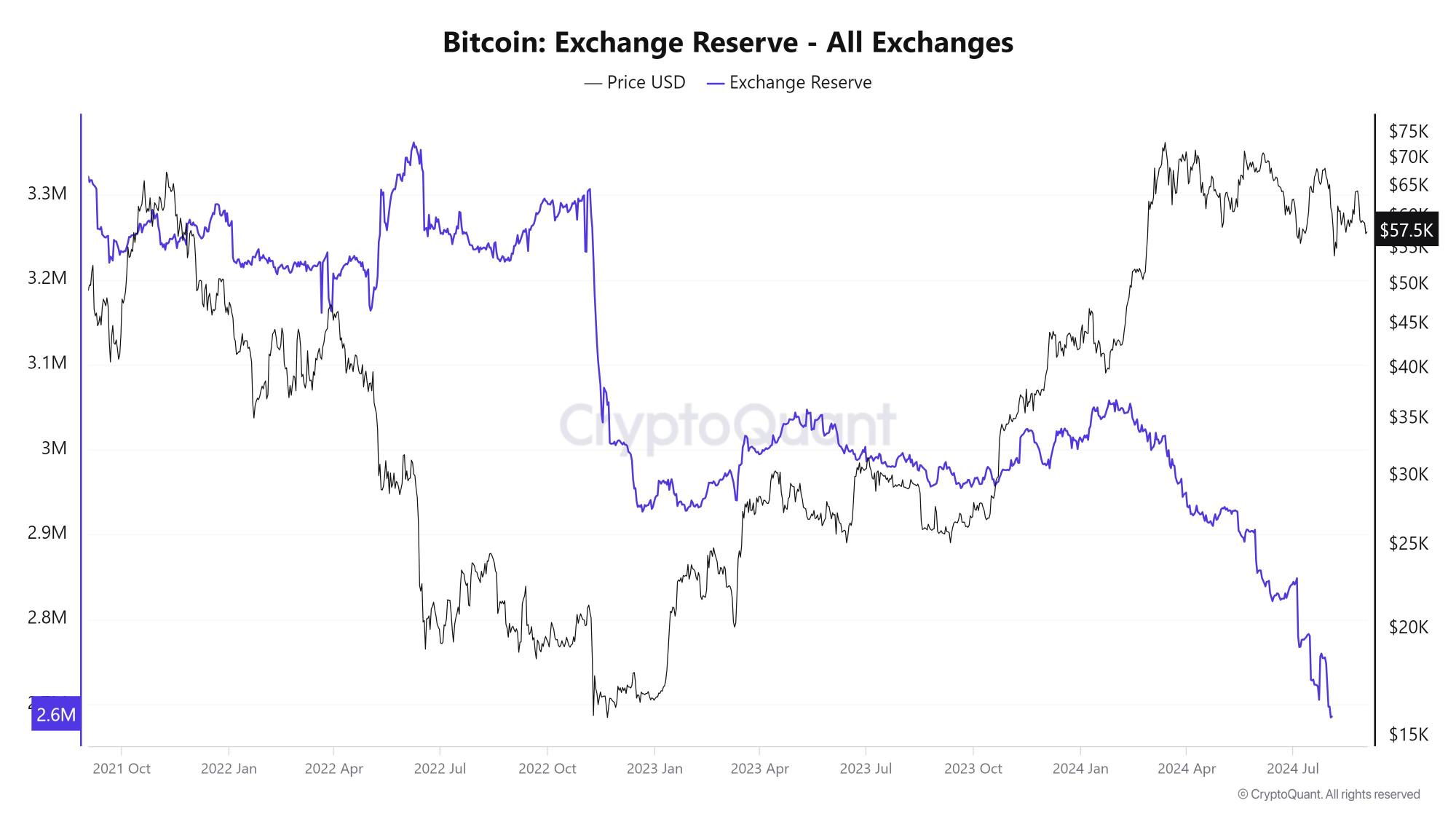

There's a common belief that Federal Reserve rate cuts may boost Bitcoin's price. While this idea has merit, it's too simplistic. With rate cuts now happening, let's delve deeper:

- Why do rate cuts affect Bitcoin's price?

- Does Bitcoin always rise immediately after a rate cut?

- How much can rate cuts boost Bitcoin's price?

These questions are crucial for our investment strategy. Let's explore them in this article.

Rate cuts: Boosting liquidity and ...

- Why do rate cuts affect Bitcoin's price?

- Does Bitcoin always rise immediately after a rate cut?

- How much can rate cuts boost Bitcoin's price?

These questions are crucial for our investment strategy. Let's explore them in this article.

Rate cuts: Boosting liquidity and ...

+2

355

104

Markets Dilemma

commented on

The volatility in the crypto market is drawing attention. After Bitcoin fell below the $58,000 mark, it must prove its resilience to avoid a potentially dangerous trend reversal. Can Bitcoin maintain its upward trajectory, or are we facing a correction?

Bitcoin at a tipping point after a fall below $58,000

The Bitcoin price experienced a notable decline, falling below the psychological threshold of $58,000. According to Matthew HYLAND, a ...

Bitcoin at a tipping point after a fall below $58,000

The Bitcoin price experienced a notable decline, falling below the psychological threshold of $58,000. According to Matthew HYLAND, a ...

+2

121

52

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)