The original English version of this article was first published on January 15

In this article, I'd like to share with you another way to gain an advantage in trading. This method is related to public information. Most people either don't know they have this information or don't know how to use it to their advantage.

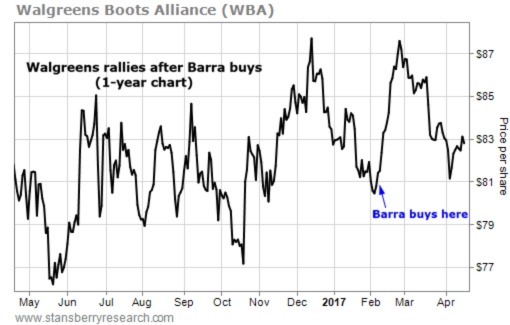

This approach looks at “insider buys.”

A company insider is a management team, board member, or shareholder who holds at least 5% of the company's shares. They have access to information not available to the public, but they cannot trade based on this information because it is illegal “insider trading.”

Legitimate insider trading is different.

These insiders are allowed to trade based on publicly available information and their in-depth knowledge of the business. In most cases, they have to report their trades to the US Securities and Exchange Commission (SEC) within two days, then their trading information is made public.

If you know how to interpret this information, they can alert you to a great opportunity to trade.

You need to know that not all insider purchases are important; in order to select important information, you need to figure out the following questions.

1. Question 1: Who is buying it?

Generally speaking, you want the highest-level insiders, that is, company executives, such as the CEO (CEO), chief financial officer (CFO), and chief operating officer (COO), to buy.

Often these insiders know more about the details of a company's operations than anyone else, so when the market abuses the company's stock too much...

In this article, I'd like to share with you another way to gain an advantage in trading. This method is related to public information. Most people either don't know they have this information or don't know how to use it to their advantage.

This approach looks at “insider buys.”

A company insider is a management team, board member, or shareholder who holds at least 5% of the company's shares. They have access to information not available to the public, but they cannot trade based on this information because it is illegal “insider trading.”

Legitimate insider trading is different.

These insiders are allowed to trade based on publicly available information and their in-depth knowledge of the business. In most cases, they have to report their trades to the US Securities and Exchange Commission (SEC) within two days, then their trading information is made public.

If you know how to interpret this information, they can alert you to a great opportunity to trade.

You need to know that not all insider purchases are important; in order to select important information, you need to figure out the following questions.

1. Question 1: Who is buying it?

Generally speaking, you want the highest-level insiders, that is, company executives, such as the CEO (CEO), chief financial officer (CFO), and chief operating officer (COO), to buy.

Often these insiders know more about the details of a company's operations than anyone else, so when the market abuses the company's stock too much...

Translated

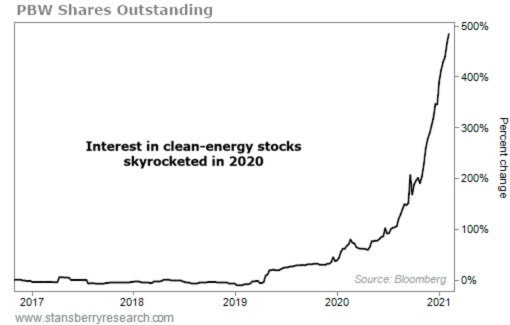

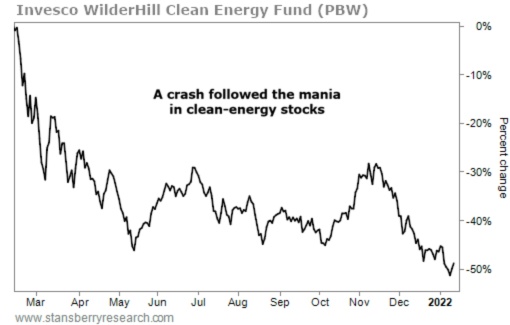

Trend investing can generate attractive returns, but there is one condition: it needs to be invested when no one is paying attention, or when everyone is avoiding such assets.

Even if you discover an obvious trend, if other investors have already gone all-in on this opportunity, your returns will still be affected.

This is exactly what happened to all investors in a sector last year.

In the following, I will share what happened in that sector, what we can learn from it, and how to avoid this trap.

The story behind an obvious major trend is always intriguing, especially one that will undoubtedly change our lives in the coming decades.

Investors who are betting on this investment theme are generally right in the big picture. The sector they are flocking to is highly likely to take off in the coming years. However, this does not change the basic principle of investment: if the timing is wrong, you will still suffer huge losses.

The sector we are discussing today is the clean energy sector.

Investor enthusiasm for clean energy was high in 2020. Ford Motor released the all-electric Mustang Mach-E, shifting from its signature muscle cars to electric vehicles. That same year, General Motors also introduced a pure electric SUV. Honda plans to launch a pure electric SUV called the Honda Prologue in 2024.

In addition to the companies mentioned above, Jaguar, Cadillac, Volvo, and other car brands plan to produce only electric vehicles by 2030.

Not only car companies are driving the development of clean energy, but the U.S.

Even if you discover an obvious trend, if other investors have already gone all-in on this opportunity, your returns will still be affected.

This is exactly what happened to all investors in a sector last year.

In the following, I will share what happened in that sector, what we can learn from it, and how to avoid this trap.

The story behind an obvious major trend is always intriguing, especially one that will undoubtedly change our lives in the coming decades.

Investors who are betting on this investment theme are generally right in the big picture. The sector they are flocking to is highly likely to take off in the coming years. However, this does not change the basic principle of investment: if the timing is wrong, you will still suffer huge losses.

The sector we are discussing today is the clean energy sector.

Investor enthusiasm for clean energy was high in 2020. Ford Motor released the all-electric Mustang Mach-E, shifting from its signature muscle cars to electric vehicles. That same year, General Motors also introduced a pure electric SUV. Honda plans to launch a pure electric SUV called the Honda Prologue in 2024.

In addition to the companies mentioned above, Jaguar, Cadillac, Volvo, and other car brands plan to produce only electric vehicles by 2030.

Not only car companies are driving the development of clean energy, but the U.S.

Translated

The S&P 500 index is usually considered a barometer of the U.S. economy, but sometimes don't be misled by it.

The current S&P 500 index is different from the past. Nowadays, only a few companies account for the majority of its weight in the S&P 500 index components.

The few companies refer to FAAMG companies, including Meta platform (FB), Apple, Amazon, Microsoft, and Alphabet.

These 5 companies have a combined market cap of 22.3% of the S&P 500 index. If we include Tesla, with a market cap of $1.1 trillion, these 6 companies account for a quarter of the S&P 500 index.

Therefore, although the S&P 500 index is supposed to represent the broad market, often its movements are directly linked to these large technology giants.

Smaller companies may face challenges, and their stock prices may fall, but if the stock prices of these 6 tech giants rise, the S&P 500 index may also rise. Therefore, it is often difficult to distinguish whether a bull market is truly healthy or simply supported by a few companies.

One way to evaluate this is to look at the ups and downs of the S&P 500 index.

The trend line is a simple indicator that subtracts the number of stocks that rise from the number of stocks that fall on a given day. If there are more stocks that rise on a given day, the trend line will rise; if there are more stocks that fall, the trend line...

The current S&P 500 index is different from the past. Nowadays, only a few companies account for the majority of its weight in the S&P 500 index components.

The few companies refer to FAAMG companies, including Meta platform (FB), Apple, Amazon, Microsoft, and Alphabet.

These 5 companies have a combined market cap of 22.3% of the S&P 500 index. If we include Tesla, with a market cap of $1.1 trillion, these 6 companies account for a quarter of the S&P 500 index.

Therefore, although the S&P 500 index is supposed to represent the broad market, often its movements are directly linked to these large technology giants.

Smaller companies may face challenges, and their stock prices may fall, but if the stock prices of these 6 tech giants rise, the S&P 500 index may also rise. Therefore, it is often difficult to distinguish whether a bull market is truly healthy or simply supported by a few companies.

One way to evaluate this is to look at the ups and downs of the S&P 500 index.

The trend line is a simple indicator that subtracts the number of stocks that rise from the number of stocks that fall on a given day. If there are more stocks that rise on a given day, the trend line will rise; if there are more stocks that fall, the trend line...

Translated

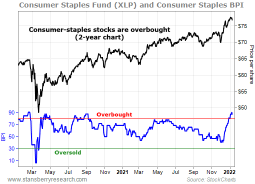

In the past month, consumer staples stocks have been one of the best performing stocks in the stock market. While the benchmark S&P 500 index has fallen by 0.9% since December 10th, the S&P 500 Consumer Staples Index has risen by 4%.

As we all know, consumer staples are the stores and items that people can't live without in their daily lives, such as grocery stores, food companies, and housewares manufacturers like toilet paper, toothpaste, and garbage bags.

Regardless of the economic situation, people always need to go to these stores to buy these products, so these companies don't need to go through dramatic fluctuations in demand like other sectors of the economy. Additionally, due to their stability, these companies often regularly distribute growing dividends to shareholders.

With these two advantages, consumer staples become a "risk-averse" sector. When other sectors in the market appear risky, investors often move their funds to this sector.

Recently, the stock market has been risky, and the S&P 500 Information Technology Index (one of the most popular "risk investment" sectors) has fallen by 5% in the past month, and many stocks in this sector have suffered even more.

But the upward trend of consumer staples stocks may lose momentum, at least in the short term.

One of our favorite methods to assess trader sentiment is to look at the Bullish Percentage Index (BPI). The BPI tracks the percentage of stocks in a...

As we all know, consumer staples are the stores and items that people can't live without in their daily lives, such as grocery stores, food companies, and housewares manufacturers like toilet paper, toothpaste, and garbage bags.

Regardless of the economic situation, people always need to go to these stores to buy these products, so these companies don't need to go through dramatic fluctuations in demand like other sectors of the economy. Additionally, due to their stability, these companies often regularly distribute growing dividends to shareholders.

With these two advantages, consumer staples become a "risk-averse" sector. When other sectors in the market appear risky, investors often move their funds to this sector.

Recently, the stock market has been risky, and the S&P 500 Information Technology Index (one of the most popular "risk investment" sectors) has fallen by 5% in the past month, and many stocks in this sector have suffered even more.

But the upward trend of consumer staples stocks may lose momentum, at least in the short term.

One of our favorite methods to assess trader sentiment is to look at the Bullish Percentage Index (BPI). The BPI tracks the percentage of stocks in a...

Translated

1. What needs to be done is not prediction, but risk assessment.

For humans, the world is unpredictable mainly because the future is unpredictable.

We live in a complex, interconnected world where no one can know for sure what will happen next.

Looking back at the recent major events in the market, any genuine evaluation will acknowledge that they are unpredictable.

No one specifically predicted the outbreak of COVID-19, and we don't know where it came from. In fact, looking back, we still haven't fully clarified its origin.

The subsequent astonishing bull market also seemed unpredictable. After the global lockdown, the stock market experienced a frenzy of a bull market, which was unprecedented.

Other market driving factors are not non-human "black swans" (like COVID-19), but depend on a small group of people's decisions, which can have any driving effect.

Although you can't predict a pandemic, when you assess the risks seriously, you will estimate the possibility of such situations occurring, even if you don't know the exact time or manner of occurrence.

However, these are all assessments of risk, not predictions. Because you are aware that stock prices will be affected by wide-ranging and unpredictable events, you need to ensure that you do not increase leverage, and you will also know that a 50% decline may occur.

If you trust your forecasts for your investment portfolio (or someone else's forecasts), then you are taking a risk with your own funds.

Therefore, when we were planning the 2022 column content, we shifted to doing risk assessments...

For humans, the world is unpredictable mainly because the future is unpredictable.

We live in a complex, interconnected world where no one can know for sure what will happen next.

Looking back at the recent major events in the market, any genuine evaluation will acknowledge that they are unpredictable.

No one specifically predicted the outbreak of COVID-19, and we don't know where it came from. In fact, looking back, we still haven't fully clarified its origin.

The subsequent astonishing bull market also seemed unpredictable. After the global lockdown, the stock market experienced a frenzy of a bull market, which was unprecedented.

Other market driving factors are not non-human "black swans" (like COVID-19), but depend on a small group of people's decisions, which can have any driving effect.

Although you can't predict a pandemic, when you assess the risks seriously, you will estimate the possibility of such situations occurring, even if you don't know the exact time or manner of occurrence.

However, these are all assessments of risk, not predictions. Because you are aware that stock prices will be affected by wide-ranging and unpredictable events, you need to ensure that you do not increase leverage, and you will also know that a 50% decline may occur.

If you trust your forecasts for your investment portfolio (or someone else's forecasts), then you are taking a risk with your own funds.

Therefore, when we were planning the 2022 column content, we shifted to doing risk assessments...

Translated

+1

Rewards Giveaway for joining the Q&A session:

Q1: How many years has the US been in a bull market?

A: 13 years @71274309

Q2: The S&P 500 entered 2021 with a P/E ratio of 30.7 and ended with a P/E ratio of 23.6.

Why did multiples decline?

A: earning growth outpaced the s&p 500 gain @71274309

Q3: what sector will Shaoping most avoid in 2022?

A: Casinos @102866915

The rewards have been issued. Thank you for joining the show!

Q1: How many years has the US been in a bull market?

A: 13 years @71274309

Q2: The S&P 500 entered 2021 with a P/E ratio of 30.7 and ended with a P/E ratio of 23.6.

Why did multiples decline?

A: earning growth outpaced the s&p 500 gain @71274309

Q3: what sector will Shaoping most avoid in 2022?

A: Casinos @102866915

The rewards have been issued. Thank you for joining the show!

2

This is a trap that many investors can't stop and can easily fall into.

When the market falls sharply, they will have the desire to buy stocks, hoping to break the bottom.

After all, as the old saying goes, we want to “buy low and sell high.” However, buying while stock prices are still falling is sometimes a dangerous game and usually results in losses.

Today, let's talk about a market that is in its downturn, but investors are flocking in, which sends a red flag that there may be further losses in 2022.

Zhonggai has caused quite a few people to lose money this year (we said it a year ago; stay away from China Securities; I don't know how many friends have done it). It has been particularly affected by the return to Hong Kong boom, but at this point, many friends will be curious. Is it really time to get to the bottom of it? After all, buying at the bottom is very attractive, and the potential profit is greatest. If you can make a big order, it will be enough to show off for a while.

As a result, many investors are ready to go undercover.

ETF-iShares (FXI) holds a basket of shares of leading Chinese companies listed in Hong Kong. This is one of the easiest ways for US investors to invest in Chinese stocks.

Importantly, FXI has continued to decline since peaking in February of last year, and since then FXI has declined by about 32%.

However, investors have not given up on this market. We can see this from FXI's total circulation share. The principle is simple:

FXI's unique fund structure allows it to increase or liquidate shares according to investors' needs. If investors are bullish on China's blue chips...

When the market falls sharply, they will have the desire to buy stocks, hoping to break the bottom.

After all, as the old saying goes, we want to “buy low and sell high.” However, buying while stock prices are still falling is sometimes a dangerous game and usually results in losses.

Today, let's talk about a market that is in its downturn, but investors are flocking in, which sends a red flag that there may be further losses in 2022.

Zhonggai has caused quite a few people to lose money this year (we said it a year ago; stay away from China Securities; I don't know how many friends have done it). It has been particularly affected by the return to Hong Kong boom, but at this point, many friends will be curious. Is it really time to get to the bottom of it? After all, buying at the bottom is very attractive, and the potential profit is greatest. If you can make a big order, it will be enough to show off for a while.

As a result, many investors are ready to go undercover.

ETF-iShares (FXI) holds a basket of shares of leading Chinese companies listed in Hong Kong. This is one of the easiest ways for US investors to invest in Chinese stocks.

Importantly, FXI has continued to decline since peaking in February of last year, and since then FXI has declined by about 32%.

However, investors have not given up on this market. We can see this from FXI's total circulation share. The principle is simple:

FXI's unique fund structure allows it to increase or liquidate shares according to investors' needs. If investors are bullish on China's blue chips...

Translated

1

Editor's note: As part of the New Year series, we will once again analyze the real estate market.

1. The real estate market is just beginning

l Choose between gold and real estate investment; Steve will no doubt choose the latter

Admittedly, the US real estate market is the focus of 2021, and record low interest rates and high demand have led to crazy housing bidding wars and skyrocketing housing prices.

These are all speculative frenzy, reminiscent of the real estate bubble before the financial crisis. But according to Dr. Steve Sjuggerud, the real estate bull market is not a bubble, but the beginning of a long-term trend that is far from over.

As Steve stated in a research report published on September 9, he believes that real estate is an excellent investment today and even the next 10 years. If he had no choice, he would choose to give up all of his gold investments. Old readers probably know that Steve is very optimistic about investing in the US real estate market.

Steve called this real estate bull market his most important prediction for the 1920s. In the following, Steve shares the three best ways to seize this huge trend.

If I had to opt out, I (Steve, same point below) would choose to never invest in gold and instead invest in the real estate market.

Around 2000, gold was about to end its 10-year bear market.

It would be too conservative to say that no one paid attention to gold at the time.

I remember the first time I went to the coin fair. The exhibition hall was half full, and everyone who came to the exhibition was over 60 years old....

1. The real estate market is just beginning

l Choose between gold and real estate investment; Steve will no doubt choose the latter

Admittedly, the US real estate market is the focus of 2021, and record low interest rates and high demand have led to crazy housing bidding wars and skyrocketing housing prices.

These are all speculative frenzy, reminiscent of the real estate bubble before the financial crisis. But according to Dr. Steve Sjuggerud, the real estate bull market is not a bubble, but the beginning of a long-term trend that is far from over.

As Steve stated in a research report published on September 9, he believes that real estate is an excellent investment today and even the next 10 years. If he had no choice, he would choose to give up all of his gold investments. Old readers probably know that Steve is very optimistic about investing in the US real estate market.

Steve called this real estate bull market his most important prediction for the 1920s. In the following, Steve shares the three best ways to seize this huge trend.

If I had to opt out, I (Steve, same point below) would choose to never invest in gold and instead invest in the real estate market.

Around 2000, gold was about to end its 10-year bear market.

It would be too conservative to say that no one paid attention to gold at the time.

I remember the first time I went to the coin fair. The exhibition hall was half full, and everyone who came to the exhibition was over 60 years old....

Translated

1

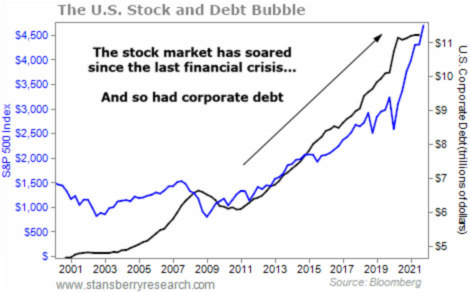

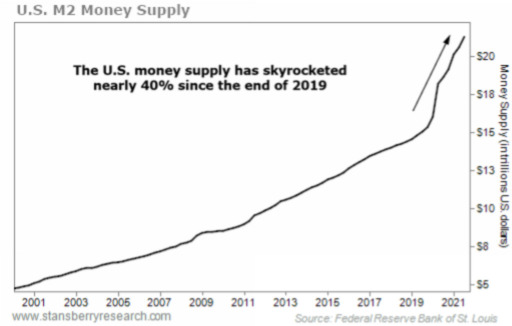

1. I personally think that there may be a market crash in 2022.The "market" here refers to the stock market and the corporate bond market, which is much larger than the stock market.I'm not the only one who thinks so. Michael Burry is one of the few people who can foresee the financial crisis in 2008. In 2007, he bought credit default swaps on mortgage bonds through his hedge fund, betting heavily on a fall in the market.The deal earned $750 million for Burry investors and $100m for himself. Michael Lewis wrote a book about him, which was later adapted into the movie Big short.We should all pay attention to Burry.He doesn't often share his thoughts, and when he does, he usually speaks on Twitter these days.Now that Burry predicts that the "mother of the crash" is emerging, he says the market is like dancing on the cutting edge. He recently posted a message about the market on Twitter:More speculative than in the 1920s, higher than the overvaluation of the 1990s, and worse than the geopolitical and economic conflicts of the 1970s.In addition to posting on Twitter, Burry is selling most of his shares.At his hedge fund Thain Asset Management (Scion Asset Management), he cut his portfolio from more than 20 stocks to six at the end of the third quarter.Not all my colleagues like it.

Translated

+2

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)