marso12

liked

According to a filing with the U.S. Securities and Exchange Commission, Chipmaker GlobalFoundries is marketing 33 million shares while Abu Dhabi’s Mubadala Investment Co., its major shareholder, plans to sell 22 million shares.

Mubadala currently owns 100% of the company and “continue to have substantial control after this offering.”

GlobalFoundries plans to list on the Nasdaq under the symbol GFS. It plans to raise as much as $2.6 billion in a U.S. initial public offering. At the top of that range,it would have a market value of $25 billionbased on the outstanding shares listed in its filing.

The offering is being led by Morgan Stanley, Bank of America, JPMorgan Chase, Citigroup and Credit Suisse.

Business Overview

$GlobalFoundries (GFS.US)$is one of the world’s leading semiconductor foundries. The company was created by purchasing the manufacturing operations of Advanced Micro Devices Inc. in 2009 and later combining it with Singapore’s Chartered Semiconductor.

According to Gartner,in 2020, the company was the third largest foundry in the world based on external sales.

GlobalFoundries previously gave up on the kind of leading-edge production that would match the capabilities of Taiwan Semiconductor or Samsung.Instead,it's serving the market for less advanced chips, which are increasingly critical to carmakers and other industries.

GlobalFoundries has over50ecosystem partners spanning IP, electronic design automation, outsourced assembly and test and design services. Building on an existing library of more than4,000IP titles, it currently has more than950IP titles in active development across26process nodes and34IP partners.

The company has built deep strategic partnerships witha broad base of more than 200 customers as of December 31, 2020, many of whom are the global leaders in their field.

In the first six months of 2021, the top ten customers, based on wafer shipment volume, included Qualcomm, MediaTek, NXP Semiconductors, Qorvo, Cirrus Logic, Advanced Micro Devices (“AMD”), Skyworks Solutions, Murata Manufacturing, Samsung Electronics and Broadcom.

The company attracted a large share of single-sourced products and long-term supply agreements. As of the date of the company's prospectus,the aggregate lifetime revenue commitment reflected by these agreements amounted to more than $19.5 billion.

A key measure of GlobalFoundries's position as a strategic partner to the customers is the mix of wafer shipment volume attributable to single-sourced business (Single-sourced products are defined as those that can only be manufactured with GlobalFoundries's technology and cannot be manufactured elsewhere without significant customer redesigns).It represented approximately61% of wafer shipment volume in 2020, up from 47% in 2018.

Financial Performance

Revenue at GlobalFoundries dropped last year by 17% to $4.85 billion. GlobalFoundries said the reason is that it divested a business that brought in $391 million in 2019, and more broadly the company shifted contractual terms with most of its customers, changing how and when it recognizes revenue.

In the first half of 2021, revenue climbed by 13% from a year earlier to just over $3 billion.

Click to view the prospectus

Mubadala currently owns 100% of the company and “continue to have substantial control after this offering.”

GlobalFoundries plans to list on the Nasdaq under the symbol GFS. It plans to raise as much as $2.6 billion in a U.S. initial public offering. At the top of that range,it would have a market value of $25 billionbased on the outstanding shares listed in its filing.

The offering is being led by Morgan Stanley, Bank of America, JPMorgan Chase, Citigroup and Credit Suisse.

Business Overview

$GlobalFoundries (GFS.US)$is one of the world’s leading semiconductor foundries. The company was created by purchasing the manufacturing operations of Advanced Micro Devices Inc. in 2009 and later combining it with Singapore’s Chartered Semiconductor.

According to Gartner,in 2020, the company was the third largest foundry in the world based on external sales.

GlobalFoundries previously gave up on the kind of leading-edge production that would match the capabilities of Taiwan Semiconductor or Samsung.Instead,it's serving the market for less advanced chips, which are increasingly critical to carmakers and other industries.

GlobalFoundries has over50ecosystem partners spanning IP, electronic design automation, outsourced assembly and test and design services. Building on an existing library of more than4,000IP titles, it currently has more than950IP titles in active development across26process nodes and34IP partners.

The company has built deep strategic partnerships witha broad base of more than 200 customers as of December 31, 2020, many of whom are the global leaders in their field.

In the first six months of 2021, the top ten customers, based on wafer shipment volume, included Qualcomm, MediaTek, NXP Semiconductors, Qorvo, Cirrus Logic, Advanced Micro Devices (“AMD”), Skyworks Solutions, Murata Manufacturing, Samsung Electronics and Broadcom.

The company attracted a large share of single-sourced products and long-term supply agreements. As of the date of the company's prospectus,the aggregate lifetime revenue commitment reflected by these agreements amounted to more than $19.5 billion.

A key measure of GlobalFoundries's position as a strategic partner to the customers is the mix of wafer shipment volume attributable to single-sourced business (Single-sourced products are defined as those that can only be manufactured with GlobalFoundries's technology and cannot be manufactured elsewhere without significant customer redesigns).It represented approximately61% of wafer shipment volume in 2020, up from 47% in 2018.

Financial Performance

Revenue at GlobalFoundries dropped last year by 17% to $4.85 billion. GlobalFoundries said the reason is that it divested a business that brought in $391 million in 2019, and more broadly the company shifted contractual terms with most of its customers, changing how and when it recognizes revenue.

In the first half of 2021, revenue climbed by 13% from a year earlier to just over $3 billion.

Click to view the prospectus

+2

82

22

42

marso12

liked

Hey mooers, welcome to Technical DNA's column ![]()

![]()

![]() . I'm using technical indicators to seek good investment opportunities. Today I'm going to introduce an extremely useful indicator, the MACD divergence

. I'm using technical indicators to seek good investment opportunities. Today I'm going to introduce an extremely useful indicator, the MACD divergence ![]()

![]()

![]() . Follow me pls to know more about indicators!

. Follow me pls to know more about indicators! ![]()

![]()

![]()

What is MACD divergence?

The 'MACD divergence' is a situation where the price creates higher tops and the MACD creates a raw of lower tops, or the price creates a lower bottom and the MACD creates higher bottoms, MACD divergence after a significant uptrend indicates that the buyers are losing power and MACD divergence after downtrend indicates the sellers losing power.

Therefore, the indicator 'MACD bottom divergence' aims to find stocks that are likely to go up in the future.

Tips: As shown in the pic, the indicator could be useful in short-term investment, so don't hold the stocks too long if you buy them on the indicator. Sell them in time when you make a profit!

Learn More: How to trade using MACD indicator?

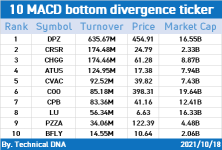

Technical DNA collects 10 most-traded bottom divergence tickers from stocks with market cap of more than $2B, aiming to help investors look for good investment opportunities.

$Domino's Pizza (DPZ.US)$ $Corsair Gaming (CRSR.US)$ $Chegg (CHGG.US)$ $Altice USA (ATUS.US)$ $CureVac (CVAC.US)$

Btw I'm collecting feedbacks so please leave your comments here if you have any suggestions, and I will continue to improve!![]()

![]()

![]()

What is MACD divergence?

The 'MACD divergence' is a situation where the price creates higher tops and the MACD creates a raw of lower tops, or the price creates a lower bottom and the MACD creates higher bottoms, MACD divergence after a significant uptrend indicates that the buyers are losing power and MACD divergence after downtrend indicates the sellers losing power.

Therefore, the indicator 'MACD bottom divergence' aims to find stocks that are likely to go up in the future.

Tips: As shown in the pic, the indicator could be useful in short-term investment, so don't hold the stocks too long if you buy them on the indicator. Sell them in time when you make a profit!

Learn More: How to trade using MACD indicator?

Technical DNA collects 10 most-traded bottom divergence tickers from stocks with market cap of more than $2B, aiming to help investors look for good investment opportunities.

$Domino's Pizza (DPZ.US)$ $Corsair Gaming (CRSR.US)$ $Chegg (CHGG.US)$ $Altice USA (ATUS.US)$ $CureVac (CVAC.US)$

Btw I'm collecting feedbacks so please leave your comments here if you have any suggestions, and I will continue to improve!

24

4

13

marso12

reacted to

Hey mooers, welcome to Technical DNA's column ![]()

![]()

![]() . I'm using technical indicators to seek good investment opportunities. Today I'm going to introduce an extremely useful indicator, the MACD divergence

. I'm using technical indicators to seek good investment opportunities. Today I'm going to introduce an extremely useful indicator, the MACD divergence ![]()

![]()

![]() . Follow me pls to know more about indicators!

. Follow me pls to know more about indicators! ![]()

![]()

![]()

What is MACD divergence?

The 'MACD divergence' is a situation where the price creates higher tops and the MACD creates a raw of lower tops, or the price creates a lower bottom and the MACD creates higher bottoms, MACD divergence after a significant uptrend indicates that the buyers are losing power and MACD divergence after downtrend indicates the sellers losing power.

Therefore, the indicator 'MACD bottom divergence' aims to find stocks that are likely to go up in the future.

Tips: As shown in the pic, the indicator could be useful in short-term investment, so don't hold the stocks too long if you buy them on the indicator. Sell them in time when you make a profit!

Learn More: How to trade using MACD indicator?

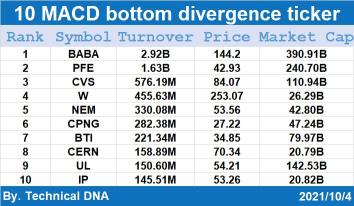

Technical DNA collects 10 most-traded bottom divergence tickers from stocks with market cap of more than $2B, aiming to help investors look for good investment opportunities.

$Alibaba (BABA.US)$ $Pfizer (PFE.US)$ $CVS Health (CVS.US)$ $Wayfair (W.US)$ $Newmont (NEM.US)$

Btw I'm collecting feedbacks so please leave your comments here if you have any suggestions, and I will continue to improve!![]()

![]()

![]()

What is MACD divergence?

The 'MACD divergence' is a situation where the price creates higher tops and the MACD creates a raw of lower tops, or the price creates a lower bottom and the MACD creates higher bottoms, MACD divergence after a significant uptrend indicates that the buyers are losing power and MACD divergence after downtrend indicates the sellers losing power.

Therefore, the indicator 'MACD bottom divergence' aims to find stocks that are likely to go up in the future.

Tips: As shown in the pic, the indicator could be useful in short-term investment, so don't hold the stocks too long if you buy them on the indicator. Sell them in time when you make a profit!

Learn More: How to trade using MACD indicator?

Technical DNA collects 10 most-traded bottom divergence tickers from stocks with market cap of more than $2B, aiming to help investors look for good investment opportunities.

$Alibaba (BABA.US)$ $Pfizer (PFE.US)$ $CVS Health (CVS.US)$ $Wayfair (W.US)$ $Newmont (NEM.US)$

Btw I'm collecting feedbacks so please leave your comments here if you have any suggestions, and I will continue to improve!

28

11

8

marso12

liked and commented on

By Danilo

Hey, moomooers! Here are things you need to know before the opening bell:

-U.S. stock futures were lower in early morning trading Tuesday as bond yields see a continued rise that pressures growth pockets in the market.

-The popular video-sharing app announced the milestone after saying earlier this summer that it plans to let users post longer videos on the platform.

Market Snapshot

U.S. stock futures were lower in early morning trading Tuesday as bond yields see a continued rise that pressures growth pockets in the market.

$Dow Jones Industrial Average (.DJI.US)$futures declined 180 points. $S&P 500 Index (.SPX.US)$futures were lower while $NASDAQ 100 Index (.NDX.US)$futures traded in moderately negative territory.

Top News

Stocks finish mixed as energy rallies

U.S. share benchmarks wobbled, bond yields rose and oil hit its highest level in nearly three years, as investors bet on further economic reopening but remained concerned about supply-chain disruptions.

Fed's Williams: tapering bond buying 'may soon be warranted'

Federal Reserve Bank of New York President John Williams said the time for the central bank to pull back on asset buying is coming up, but he indicated rate rises still lie well off.

SEC panel backs letting ordinary investors into private equity

The SEC's Asset Management Advisory Committee recommended that the regulator increase ordinary investors' access to private-equity, private-debt and real-estate vehicles, a change long sought by asset managers.

Ford fortifies EV bet with four new U.S. factories

$Ford Motor (F.US)$The auto giant plans to spend $7 billion to build two battery factories in Kentucky and a third in western Tennessee-part of a collaboration with SK Innovation-as well as a factory for producing electric trucks.

U.S. units of Trane reach proposed $545 million settlement in bankruptcy

$Trane Technologies (TT.US)$Roughly 80,000 asbestos claims pushed the two units, Aldrich Pump and Murray Boiler, into chapter 11 last year. The settlement still requires bankruptcy court approval.

TikTok tops 1 billion monthly users

The popular video-sharing app announced the milestone after saying earlier this summer that it plans to let users post longer videos on the platform.

TSLA touches 7-month highs

$Tesla (TSLA.US)$'s shares surged after reporting its Shanghai factory is expected to produce 300k cars in its 1st 9 months despite the semi shortage as auto sector another area of outperformance today.

Read More

Merck nears deal to acquire Acceleron Pharma

Natural gas notching biggest one-day rise since February

Oil extends rally into 6th day on tight supply, Brent hitting three year high

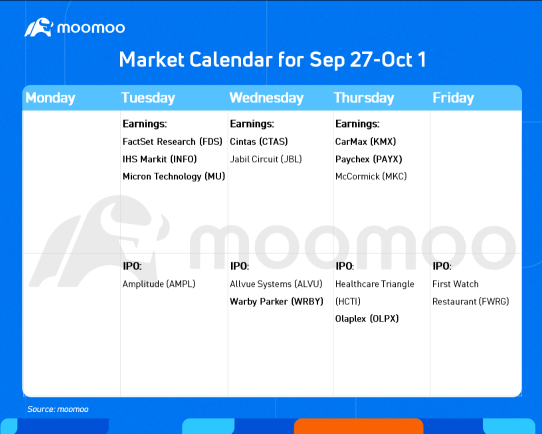

Key Events This Week

Source: CNBC, Dow Jones Newswires, Bloomberg

Hey, moomooers! Here are things you need to know before the opening bell:

-U.S. stock futures were lower in early morning trading Tuesday as bond yields see a continued rise that pressures growth pockets in the market.

-The popular video-sharing app announced the milestone after saying earlier this summer that it plans to let users post longer videos on the platform.

Market Snapshot

U.S. stock futures were lower in early morning trading Tuesday as bond yields see a continued rise that pressures growth pockets in the market.

$Dow Jones Industrial Average (.DJI.US)$futures declined 180 points. $S&P 500 Index (.SPX.US)$futures were lower while $NASDAQ 100 Index (.NDX.US)$futures traded in moderately negative territory.

Top News

Stocks finish mixed as energy rallies

U.S. share benchmarks wobbled, bond yields rose and oil hit its highest level in nearly three years, as investors bet on further economic reopening but remained concerned about supply-chain disruptions.

Fed's Williams: tapering bond buying 'may soon be warranted'

Federal Reserve Bank of New York President John Williams said the time for the central bank to pull back on asset buying is coming up, but he indicated rate rises still lie well off.

SEC panel backs letting ordinary investors into private equity

The SEC's Asset Management Advisory Committee recommended that the regulator increase ordinary investors' access to private-equity, private-debt and real-estate vehicles, a change long sought by asset managers.

Ford fortifies EV bet with four new U.S. factories

$Ford Motor (F.US)$The auto giant plans to spend $7 billion to build two battery factories in Kentucky and a third in western Tennessee-part of a collaboration with SK Innovation-as well as a factory for producing electric trucks.

U.S. units of Trane reach proposed $545 million settlement in bankruptcy

$Trane Technologies (TT.US)$Roughly 80,000 asbestos claims pushed the two units, Aldrich Pump and Murray Boiler, into chapter 11 last year. The settlement still requires bankruptcy court approval.

TikTok tops 1 billion monthly users

The popular video-sharing app announced the milestone after saying earlier this summer that it plans to let users post longer videos on the platform.

TSLA touches 7-month highs

$Tesla (TSLA.US)$'s shares surged after reporting its Shanghai factory is expected to produce 300k cars in its 1st 9 months despite the semi shortage as auto sector another area of outperformance today.

Read More

Merck nears deal to acquire Acceleron Pharma

Natural gas notching biggest one-day rise since February

Oil extends rally into 6th day on tight supply, Brent hitting three year high

Key Events This Week

Source: CNBC, Dow Jones Newswires, Bloomberg

+1

30

8

12

marso12

liked

On Sep 15 at 8:00 PM SGT, Xiaomi is bringing the spotlight back by launching a series of flagship devices.

Subscribe to join the live event!

Disclaimer: The live video is made available for informational purposes only. Before investing, please consult a licensed professional.

Subscribe to join the live event!

Disclaimer: The live video is made available for informational purposes only. Before investing, please consult a licensed professional.

Xiaomi New Products Launch Event

Sep 15 07:00

54

10

15

yuP! full of knowledge but amp on trading

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)