MarvanLoveMuffin

liked

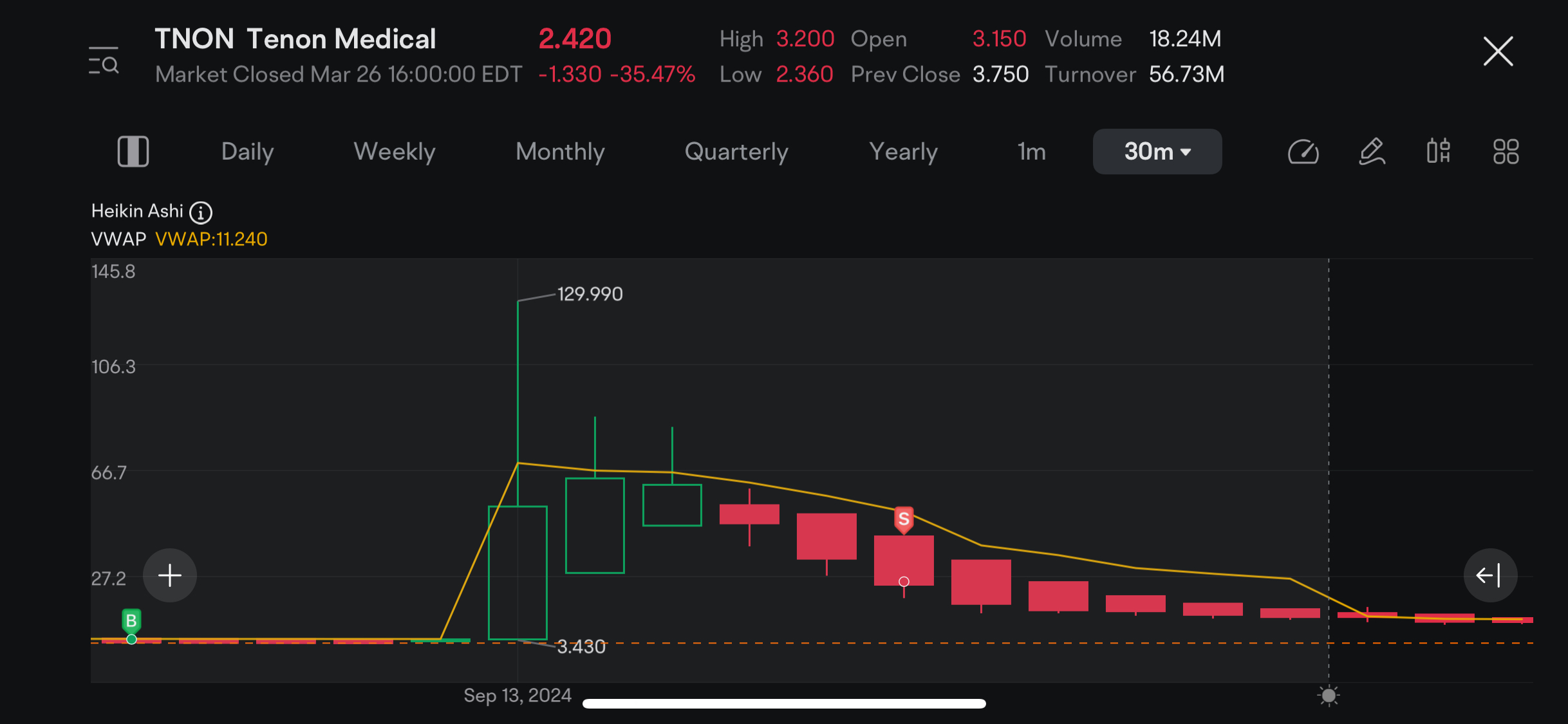

Sept. 2024 i noticed a trend of low float and news causing TNON to sometimes pop well above 2-3x pre-market and after-hours. Got a starter postion around $5 and just 25 shares for a swing trade. Woke up at 7:00 am ish sept 13th to see my postion was up 400% + and sold at $25. Best % trade I ever had. Crazy part is if I didn’t “sleep in” i could have sold around for another 500-600%. Rare extremely low float bio-tech short squeeze . get in get out and stay out kinda play. o...

22

1

MarvanLoveMuffin

liked

MarvanLoveMuffin

liked

$Netflix (NFLX.US)$ (NASDAQ: NFLX) recently acquired MoffettNathansonMajor upgrades, the target price is increased to $1,100, and is considered to have “won the streaming war”. The agency believes Netflix has established itself as an industry leader with its advertising subscription model, strong free cash flow, and fine-tuned management of content spending. However, is this assessment reasonable for investors? Does Netflix really have enough growth momentum to support such an optimistic stock price prediction? This article will be from Financial Data, Subscription Patterns, Competitive Advantage and Market Risk From a one-size-fits-all perspective, we analyze Netflix's investment potential to help investors make smarter decisions.For more US stock market dynamics and in-depth analysis, follow US Stocks 101 for the latest investment opportunities!

Netflix Revenue and Profitability: Growth Still Strong?

Netflix showed strong financial performance in 2023,Q4 Revenue at $88 Billion, Up 12% YoY, and created 937 million US Dollars Net profit. What is more worth paying attention to Significant increase in free cash flow (FCF), Dat $67 billion, showing that the company has entered a stable earnings phase, breaking free of its past reliance on massive content investment in exchange for order...

Netflix Revenue and Profitability: Growth Still Strong?

Netflix showed strong financial performance in 2023,Q4 Revenue at $88 Billion, Up 12% YoY, and created 937 million US Dollars Net profit. What is more worth paying attention to Significant increase in free cash flow (FCF), Dat $67 billion, showing that the company has entered a stable earnings phase, breaking free of its past reliance on massive content investment in exchange for order...

Translated

12

MarvanLoveMuffin

liked

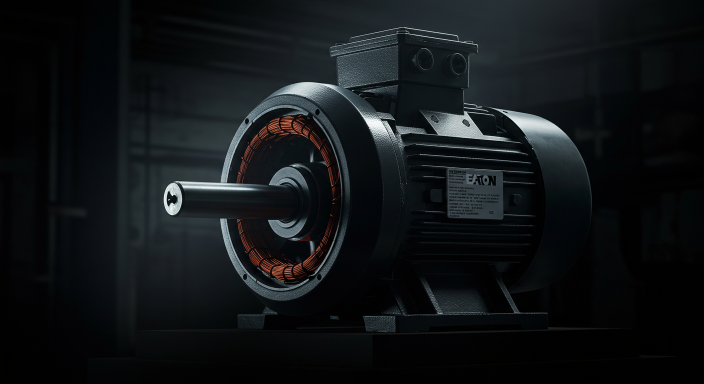

Recently, the power management giant $Eaton (ETN.US)$ (Eaton Corporation, NYSE: ETN) has become the focus of market attention.Morgan Stanley's latest report raised Eaton's Target Price to $385, and is Bullish on the company's growth potential in AI Datacenter Energy demand, electrification development, and sustainable energy transition. Eaton's stock price experienced some fluctuations in 2025, but Analysts generally believe that the companyStrong long-term growth momentum.As the demand for energy consumption in Global Datacenters surges, Eaton's Electrical Utilities solutions business may enter a prosperous development period.

This article will analyze Eaton's growth potential from the following perspectives:Earnings Reports data, Target Price forecasts, industry trends, competitive advantages, and investment risks.Combining this with market analysis of "US stocks 101", this will help investors grasp investment opportunities in this industrial stock.

Morgan Stanley raises the Target Price, where does Eaton's growth momentum lie?

According to Morgan Stanley's latest research report, Eaton's Target Price has been raised from $350 to $385, indicating over 20% upside potential. The main reasons includethe surge in demand for AI servers and Datacenters, the acceleration of Smart Grids construction, the trend of global electrification, and Eaton's leadership in the Electrical Utilities management solutions sector.

Market research Institutions indicate that as artificial intelligence...

This article will analyze Eaton's growth potential from the following perspectives:Earnings Reports data, Target Price forecasts, industry trends, competitive advantages, and investment risks.Combining this with market analysis of "US stocks 101", this will help investors grasp investment opportunities in this industrial stock.

Morgan Stanley raises the Target Price, where does Eaton's growth momentum lie?

According to Morgan Stanley's latest research report, Eaton's Target Price has been raised from $350 to $385, indicating over 20% upside potential. The main reasons includethe surge in demand for AI servers and Datacenters, the acceleration of Smart Grids construction, the trend of global electrification, and Eaton's leadership in the Electrical Utilities management solutions sector.

Market research Institutions indicate that as artificial intelligence...

Translated

9

MarvanLoveMuffin

liked

Have you heard of the $On Holding (ONON.US)$ brand? Lately, I’ve been spotting this sneaker brand everywhere—even in TRX’s sports stores, where its “footprint” is clearly visible.

On Holding AG (ON) is a Swiss company specializing in the development and sales of sports products, including footwear, apparel, and accessories. Founded in 2010 and headquartered in Zurich, Switzerland, the company has quickly gained recognition for its innovative designs and technology-driven pro...

On Holding AG (ON) is a Swiss company specializing in the development and sales of sports products, including footwear, apparel, and accessories. Founded in 2010 and headquartered in Zurich, Switzerland, the company has quickly gained recognition for its innovative designs and technology-driven pro...

8

1

1

MarvanLoveMuffin

liked

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)