Master Your Money

voted

Hey all! ![]()

Before I say anything about this post, I would like to put a heads up disclaimer!

Disclaimer: I am not affiliated to any political parties in America. I do have a small holdings of options of $Trump Media & Technology (DJT.US)$ and shares of $Tesla (TSLA.US)$. All of the information provided here is based on my 2 cents opinion and is for education purpose. It is not a recommendation to buy or sell the shares...

Before I say anything about this post, I would like to put a heads up disclaimer!

Disclaimer: I am not affiliated to any political parties in America. I do have a small holdings of options of $Trump Media & Technology (DJT.US)$ and shares of $Tesla (TSLA.US)$. All of the information provided here is based on my 2 cents opinion and is for education purpose. It is not a recommendation to buy or sell the shares...

25

4

5

Master Your Money

voted

With the Fed’s recent rate cut of 50 bps, I’ve revisited my current positions and updated my strategy for Q4:

5 Dos:

1. Do manage sold puts carefully: Roll them if necessary to avoid further losses, especially on tech stocks.

2. Do capitalize on tech strength: Consider adding more long positions or calls in tech (e.g., Nvidia, Microsoft).

3. Do stay updated on Fed actions: Rate cuts will impact market trends, especially in growth sectors.

4. Do adjus...

5 Dos:

1. Do manage sold puts carefully: Roll them if necessary to avoid further losses, especially on tech stocks.

2. Do capitalize on tech strength: Consider adding more long positions or calls in tech (e.g., Nvidia, Microsoft).

3. Do stay updated on Fed actions: Rate cuts will impact market trends, especially in growth sectors.

4. Do adjus...

+9

50

2

2

Tesla (TSLA.US) and other major corporations have volatile stocks, often influenced by large market players. These big players have overheads, including employee salaries. Retail investors often bear the brunt due to fear of stock declines. If you accumulate shares and avoid trading on margin, you're better positioned to weather these market fluctuations. If all retail investors unite, short sellers and even maj...

1

Master Your Money

voted

Hello, I'm “to the moo”, sharing a potential investment opportunity every day to help mooers get a head start on investing!![]()

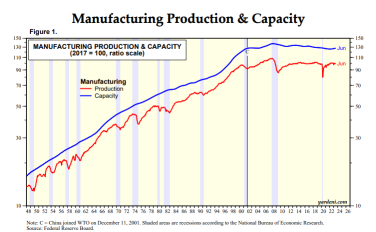

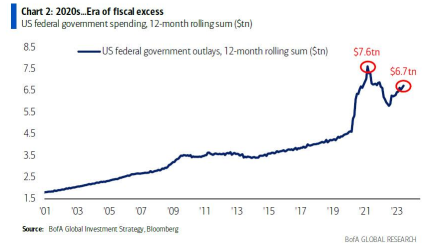

Recently there has been a hot topic on Wall Street, which is the "reindustrialization" of the United States.

Wilson, a Morgan Stanley strategist who has long been bearish on US stocks, admitted in a previous report that he had misjudged the extent of the bull market in US stocks. He believes that the reason fo...

Recently there has been a hot topic on Wall Street, which is the "reindustrialization" of the United States.

Wilson, a Morgan Stanley strategist who has long been bearish on US stocks, admitted in a previous report that he had misjudged the extent of the bull market in US stocks. He believes that the reason fo...

53

5

3

Master Your Money

voted

1

Master Your Money

liked

$Tattooed Chef (TTCF.US)$ 👍 bad News all in 😂😂✅

2

Master Your Money

liked

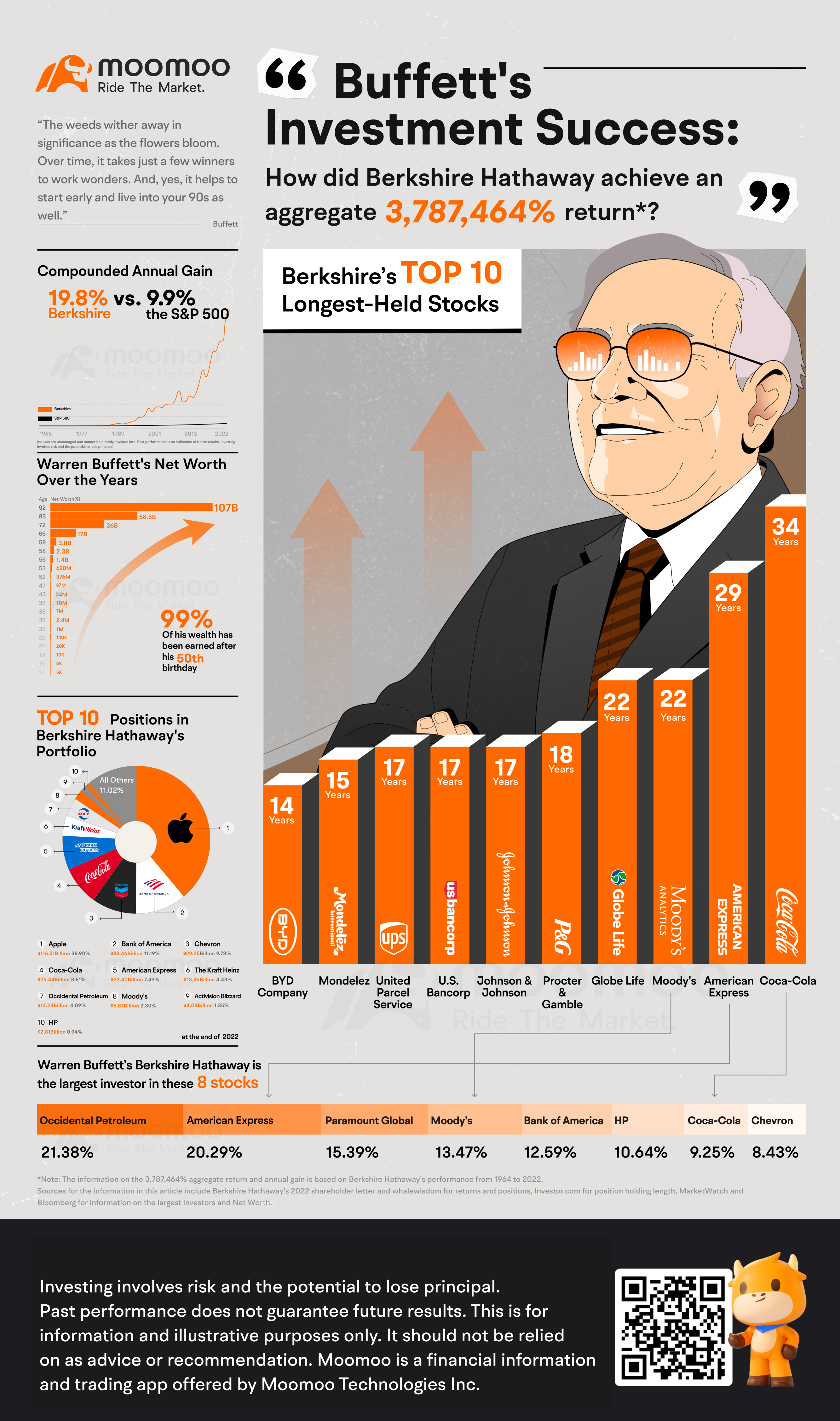

In 2022, the U.S. stock market was in turmoil, but in the midst of the storm, 92-year-old Warren Buffett still wears the "crown" - in the year the S&P 500 fell 18.1%, Warren Buffett's Berkshire gained 4% positive return, for the stock god Warren Buffett is still "a good year". ![]()

On a longer timeline, from 1965-2022, Berkshire's annualized return was 19.8%, significantly outpacing the S&P 500's 9.9%, for a cumulative ...

On a longer timeline, from 1965-2022, Berkshire's annualized return was 19.8%, significantly outpacing the S&P 500's 9.9%, for a cumulative ...

130

12

49

Master Your Money

voted

At the beginning of 2022, the FED started the quantitative tightening policy. Since then, the stock market has gone all the way down without any hesitation. But a shocking plot twist happened in the first month of 2023. Almost everything went up crazily.

Some investors are benefiting from the upward trend. However, others with negative expectations might feel like taking a mighty punch right in their faces.

@Johnsh: Powell Pummeling Puts Visual $SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$

���������...

Some investors are benefiting from the upward trend. However, others with negative expectations might feel like taking a mighty punch right in their faces.

@Johnsh: Powell Pummeling Puts Visual $SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$

���������...

+10

57

78

9

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)