Matthew Bryson

liked

$Palantir (PLTR.US)$ as a leading company in the strategic decision-making AI field, ($PLTR.US$) stands firm against any challenges and is highly worth investing in.

作为战略决策AI领域的领先公司,($PLTR.US$) 能稳固地面对任何风浪,非常值得投资。![]() 💕

💕

作为战略决策AI领域的领先公司,($PLTR.US$) 能稳固地面对任何风浪,非常值得投资。

5

2

Matthew Bryson

liked

Matthew Bryson

liked

Individual retail investors in stock trading often experience significant emotional fluctuations, this is because their trading decisions are often influenced by external market information, personal psychological factors, and trading experience.

Individual retail investors in stock trading often experience significant emotional fluctuations, this is because their trading decisions are often influenced by external market information, personal psychological factors, and trading experience. Below are several typical manifestations of the emotions of individual retail investors and their impact on trading:

---

1. Greed and Fear

Emotional Behavior:

1. Greed: During rapid stock market growth, retail investors tend to have a 'fear of missing out' mentality (FOMO) and rush to buy high.

2. Fear: During stock market declines, retail investors often hastily cut losses due to fear of further expansion of losses.

Impact:

Greed leads to buying at high levels, ignoring risks.

Fear leads to selling at low levels, missing out on rebound opportunities.

Recommendation:

Develop a trading plan and strictly adhere to stop-loss and take-profit.

Avoid emotional trading and maintain rationality.

---

2. Herd Mentality

Emotional performance:

Many retail investors tend to blindly follow the "majority" or "hot trends" when investing, thinking what everyone else is buying must be right.

Keen on chasing after "limit up stocks" and "hot sectors", even relying on recommendations from social media or WeChat groups.

Impact:

容易在市场高峰时买入,低谷时卖出。

缺乏独立分析,依赖他人导致决策失误。

建...

Individual retail investors in stock trading often experience significant emotional fluctuations, this is because their trading decisions are often influenced by external market information, personal psychological factors, and trading experience. Below are several typical manifestations of the emotions of individual retail investors and their impact on trading:

---

1. Greed and Fear

Emotional Behavior:

1. Greed: During rapid stock market growth, retail investors tend to have a 'fear of missing out' mentality (FOMO) and rush to buy high.

2. Fear: During stock market declines, retail investors often hastily cut losses due to fear of further expansion of losses.

Impact:

Greed leads to buying at high levels, ignoring risks.

Fear leads to selling at low levels, missing out on rebound opportunities.

Recommendation:

Develop a trading plan and strictly adhere to stop-loss and take-profit.

Avoid emotional trading and maintain rationality.

---

2. Herd Mentality

Emotional performance:

Many retail investors tend to blindly follow the "majority" or "hot trends" when investing, thinking what everyone else is buying must be right.

Keen on chasing after "limit up stocks" and "hot sectors", even relying on recommendations from social media or WeChat groups.

Impact:

容易在市场高峰时买入,低谷时卖出。

缺乏独立分析,依赖他人导致决策失误。

建...

Translated

19

Matthew Bryson

liked

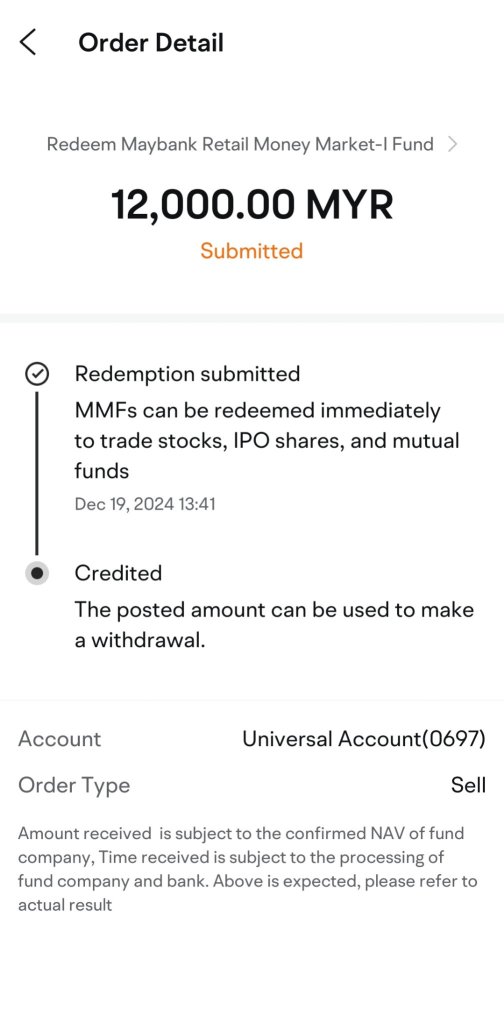

Redeem early morning few times from. money market and invest in YTL and earn a good sum of daily returns 🙏

14

2

Matthew Bryson

liked

$ProShares UltraPro Short QQQ ETF (SQQQ.US)$

Currently on the middle bolinger band, of the daily chart.

you have to be aware that this is pretty much normal correction of the current previous bearish movement.

I know someone is saying things like, please go up to like 35. However, if it does go up to like 35, which would be like close to top bolinger band or bottom ichimoku cloud, it means that major market crash like August,

and I don’t think we all want that tbh.

Currently on the middle bolinger band, of the daily chart.

you have to be aware that this is pretty much normal correction of the current previous bearish movement.

I know someone is saying things like, please go up to like 35. However, if it does go up to like 35, which would be like close to top bolinger band or bottom ichimoku cloud, it means that major market crash like August,

and I don’t think we all want that tbh.

6

Matthew Bryson

liked

$Oklo Inc (OKLO.US)$

The recent low was 17.14, very close to lower ichimoku cloud, now 21.30 which is so happens to be around middle bolinger band and the top of the red ichimoku cloud.

is this the reversed pull back or, is it still down trend… onlt time will tell but the next several trading days can be important. i have placed limit orders if I remember correctly around 16.70, which unfortunately did not touch so what this means is that it might still be a bull trap…

The recent low was 17.14, very close to lower ichimoku cloud, now 21.30 which is so happens to be around middle bolinger band and the top of the red ichimoku cloud.

is this the reversed pull back or, is it still down trend… onlt time will tell but the next several trading days can be important. i have placed limit orders if I remember correctly around 16.70, which unfortunately did not touch so what this means is that it might still be a bull trap…

11

3

1

Matthew Bryson

liked

Matthew Bryson

liked

Matthew Bryson

liked

$Invesco QQQ Trust (QQQ.US)$ $Tesla (TSLA.US)$ $NVIDIA (NVDA.US)$ US stocks: Tesla and Google surged, Large Cap continues to be bullish, will you miss Boeing as well? Missed NVIDIA in the first half of the year, missed Tesla in the second half NVDA TSLA AMD NKE BA SMCI INTC PLTR AMZN GOOG QQQ SPY IWM, if you find my video helpful, please support by subscribing to YouTube, turn on the notification bell, like and Share, greatly appreciated.

Translated

From YouTube

7

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)