meggg

voted

meggg

liked

73

meggg

liked

27

meggg

liked

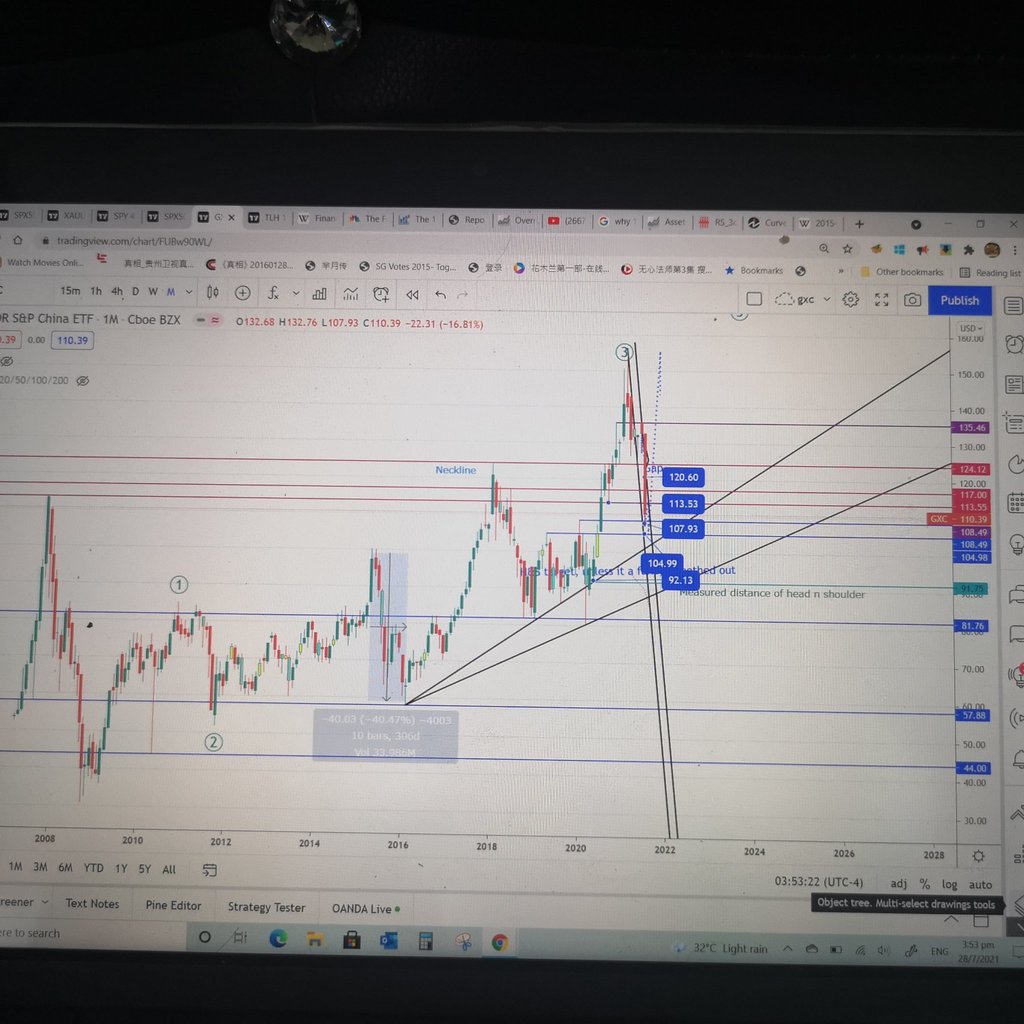

$SPDR S&P China ETF (GXC.US)$

Zoom out to month chart and u will see a distinctive pattern.. Its a correction but its the speed and velocity that is alarming.

Price reached the target 40 percent correction in record time compared to mkt turbulence in 2015

Zoom in weekly chart

Price closed the gap (29 Jun 2020) .

Head & shoulder pattern. Price broke neckline. The measure distance should be 92.3

However, there is a multiple confluence of zone at 107 ish.

Bullish pin bar forming on day chart. Hence expect a rebounce.

Draw a straight line from top to bottom, chart presents a perfect sig wave.

Sell volume is decreasing..

To summarize

There is a good chance of rebounce, even though there is a lingering concern, drop to measured target distance of H&S. Price can go lower Unless pattern smooth out.

I am thinking, price will rebound, then retest the low. 104.7...

Zoom out to month chart and u will see a distinctive pattern.. Its a correction but its the speed and velocity that is alarming.

Price reached the target 40 percent correction in record time compared to mkt turbulence in 2015

Zoom in weekly chart

Price closed the gap (29 Jun 2020) .

Head & shoulder pattern. Price broke neckline. The measure distance should be 92.3

However, there is a multiple confluence of zone at 107 ish.

Bullish pin bar forming on day chart. Hence expect a rebounce.

Draw a straight line from top to bottom, chart presents a perfect sig wave.

Sell volume is decreasing..

To summarize

There is a good chance of rebounce, even though there is a lingering concern, drop to measured target distance of H&S. Price can go lower Unless pattern smooth out.

I am thinking, price will rebound, then retest the low. 104.7...

5

meggg

liked

$TENCENT (00700.HK)$

Too many people actually look at short-term growth, the longest is only a quarter, revenue growth of 20%, revenue growth of more than 10%, let alone the impact of corporate operating leverage on corporate profits

Too many people actually look at short-term growth, the longest is only a quarter, revenue growth of 20%, revenue growth of more than 10%, let alone the impact of corporate operating leverage on corporate profits

4

2

meggg

liked

$Hang Seng Index (800000.HK)$ downward trend for two weeks already. any signs of recovery?

7

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)