meltingkevin

liked and voted

Last week, the markets were dominated by escalating trade tensions, with tariffs on steel and aluminum imports sparking fears of a global trade war. The European Union retaliated with counter-tariffs on $28 billion worth of U.S. goods, further spooking investors. Meanwhile, concerns over valuations and earnings continued to weigh on the tech sector, with $Adobe (ADBE.US)$ and $Intel (INTC.US)$ making headlines f...

+13

2073

359

23

meltingkevin

voted

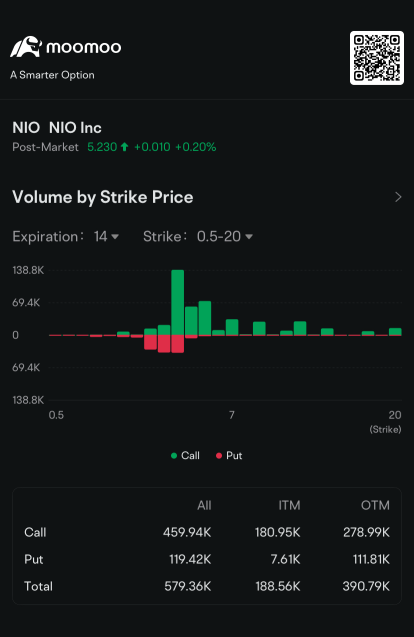

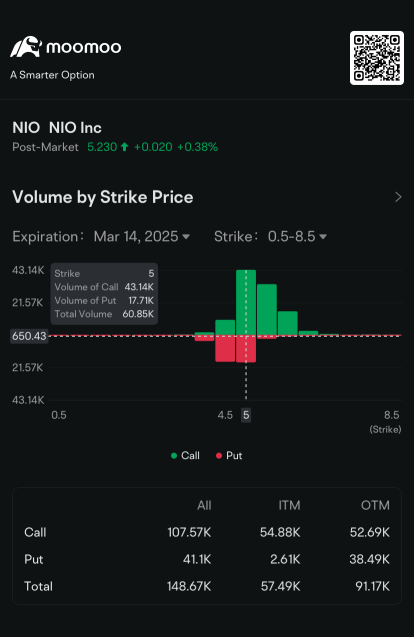

Nio joined $NVIDIA (NVDA.US)$, $Tesla (TSLA.US)$, $Apple (AAPL.US)$, $Palantir (PLTR.US)$ and $Amazon (AMZN.US)$ in the six most active stock options Tuesday as more investors favored Chinese equities amid mounting uncertainty over the impact of Trump tariffs on US equities.

$NIO Inc (NIO.US)$’s American depositary receipts jumped almost 17% after the Securities Times reported that the Chinese electric vehicle maker’s chai...

$NIO Inc (NIO.US)$’s American depositary receipts jumped almost 17% after the Securities Times reported that the Chinese electric vehicle maker’s chai...

25

4

36

meltingkevin

commented on

$Opendoor Technologies (OPEN.US)$ be ready for the rockets after hours

2

2

Good time to put rrsp before 2025 tax season

meltingkevin

liked

$Opendoor Technologies (OPEN.US)$ Just withdraw all the garbage stocks.

Translated

1

2

meltingkevin

commented on

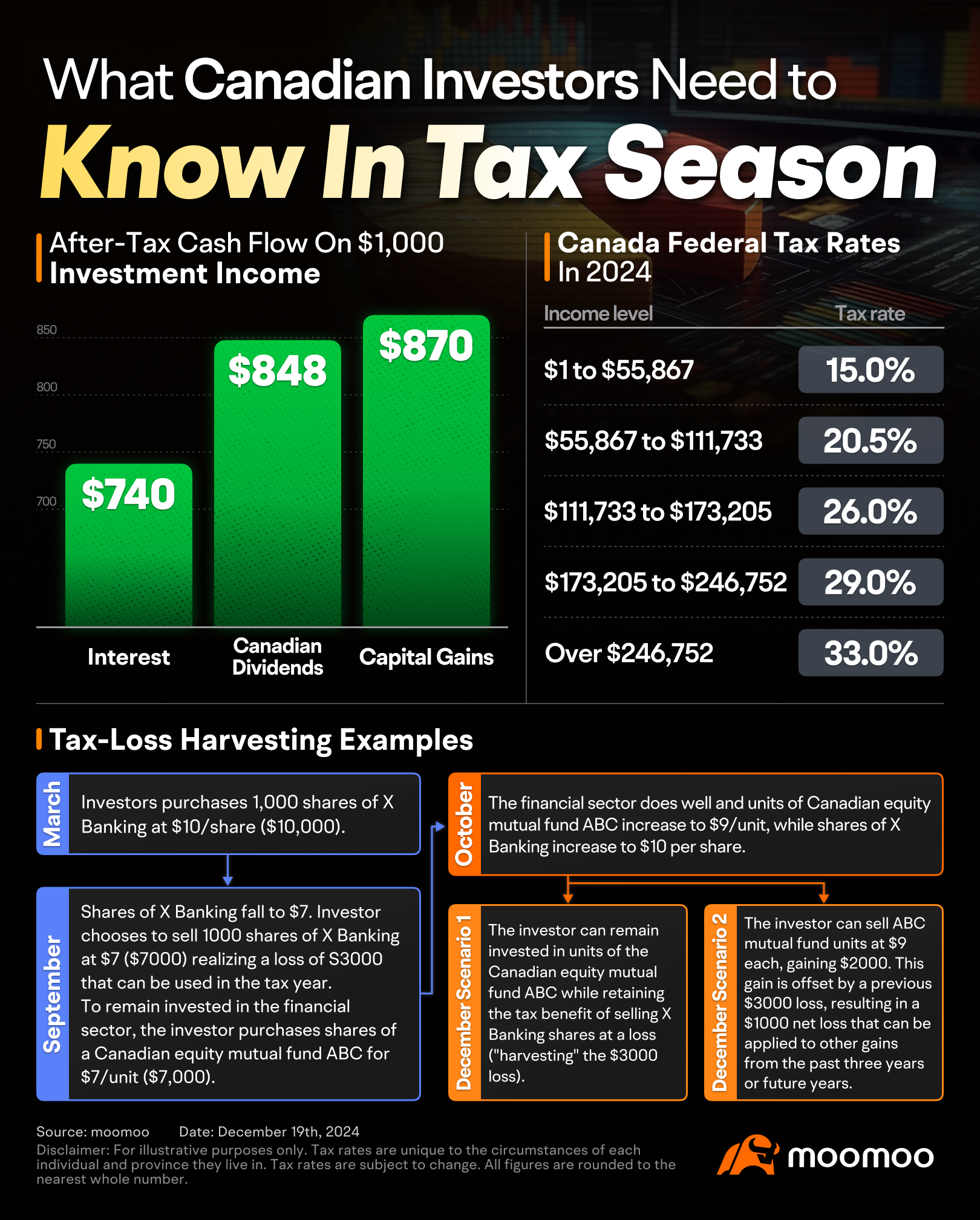

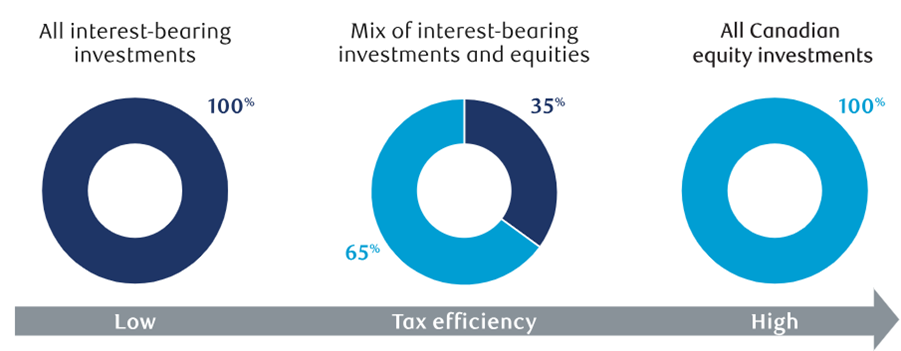

Most Canadians take advantage of tax sheltering within a Registered Retirement Savings Plan (RRSP) or through the tax-free benefits of a Tax-Free Savings Account (TFSA). However, outside of registered accounts, tax efficiency plays a key role in building wealth.

■ Not all income is taxed the same way

Investment income varies in form, with the most common types being interest, dividends, and capital gains.

Like wages, interest incom...

■ Not all income is taxed the same way

Investment income varies in form, with the most common types being interest, dividends, and capital gains.

Like wages, interest incom...

209

234

49

meltingkevin

voted

Hi, mooers!

Canada's Big 5 banks are set to unveil their earnings reports throughout the remainder of the month, starting with $Bank of Nova Scotia (BNS.CA)$ initiating the reporting cycle on December 3, followed closely by $Royal Bank of Canada (RY.CA)$, $The Toronto-Dominion Bank (TD.CA)$, and $Bank of Montreal (BMO.CA)$, which will release their reports on December 4. $Canadian Imperial Bank of Commerce (CM.CA)$ will wrap...

Canada's Big 5 banks are set to unveil their earnings reports throughout the remainder of the month, starting with $Bank of Nova Scotia (BNS.CA)$ initiating the reporting cycle on December 3, followed closely by $Royal Bank of Canada (RY.CA)$, $The Toronto-Dominion Bank (TD.CA)$, and $Bank of Montreal (BMO.CA)$, which will release their reports on December 4. $Canadian Imperial Bank of Commerce (CM.CA)$ will wrap...

32

22

5

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)