meymeymey

Set a live reminder

A special, final Q&A for 2024, focusing on the US Federal Reserve's interest rate decision. Feel free to ask your questions below. For each question you post, moomoo will reward you with points. moomoo Australia's market strategist covers investing, trading and all market matters - live. Ask questions, comment, and share your view, as the markets trade.

Ask a strategist - Fed rate decision

Dec 17 08:00

175

187

8

meymeymey

Set a live reminder

US markets trade around record all time highs with the S&P500 up 22% this year, highs, thanks to better-than-expected US corporate news and US economic data. But what's ahead? Big tech earnings and the US election and stimulus from two biggest countries, China and the US. ![]()

Tesla shares rose 22%, its biggest gain since May 2013 spurring a rally in the “Magnificent Seven” stocks, which hit a three-month high. If $Tesla (TSLA.US)$ 's...

Tesla shares rose 22%, its biggest gain since May 2013 spurring a rally in the “Magnificent Seven” stocks, which hit a three-month high. If $Tesla (TSLA.US)$ 's...

Live preview: US tech mega-caps earnings preview - What's driving the market

Oct 30 14:00

246

178

19

meymeymey

voted

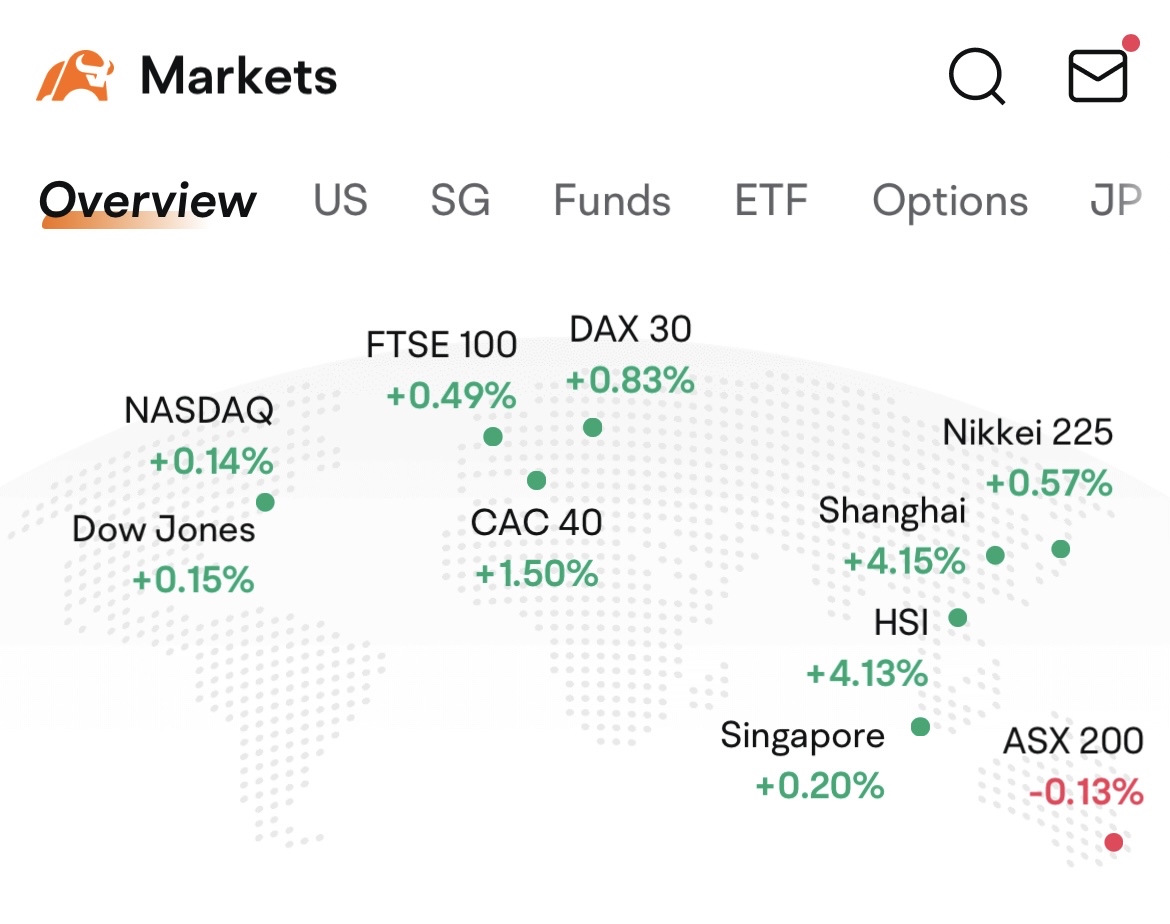

The US Federal Reserve initiated its easing cycle with 50 basis points rate cut last week. This week, Chinese markets joined the trend on Tuesday by cutting the rate by 50 basis points. This decision sparked a rally, with the $Hang Seng Index (800000.HK)$ and $SSE Composite Index (000001.SH)$ rising more than 4% in a single day. On the same day, the Reserve Bank of Australia left its cash rate unchanged at 4.35%. Howe...

+2

350

146

76

meymeymey

Set a live reminder

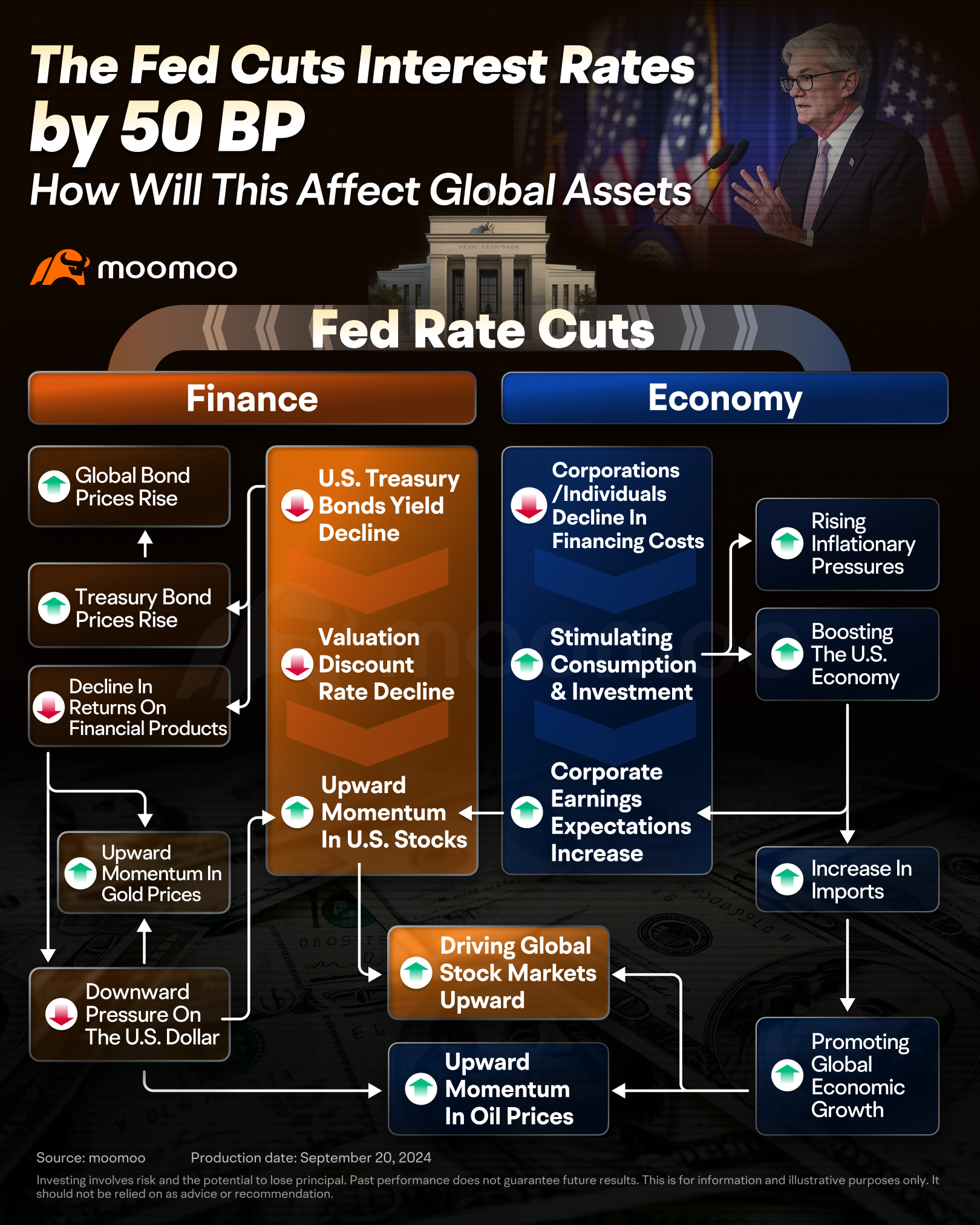

The long-awaited interest rate cut is finally here and what a cut it was! - a 50 basis point cut that took the market slightly by surprise.

The decision lowers the federal funds rate to a range between 4.75% - 5%. In addition to this reduction, the committee's dot plot shows the equivalent of 50 more basis points of cuts by year-end, another full percentage point in cuts by the end of 2025 and a half point in 2026. In all, the Fed's dot ...

The decision lowers the federal funds rate to a range between 4.75% - 5%. In addition to this reduction, the committee's dot plot shows the equivalent of 50 more basis points of cuts by year-end, another full percentage point in cuts by the end of 2025 and a half point in 2026. In all, the Fed's dot ...

[Trader’s Talk] What do interest rate cuts mean for you?

Sep 24 11:00

32

1

meymeymey

Set a live reminder

Missed the live? Watch the replay now and join Justin, Michael and Jessica as they dives deep into US rate cuts!

703

1018

29

meymeymey

voted

Updated on October 15

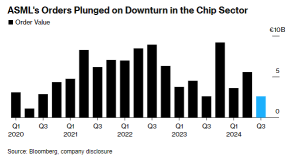

Semiconductor company $ASML Holding (ASML.US)$ experienced its largest drop in 26 years on October 15 after reporting only about half the orders that analysts had anticipated from chipmakers, signaling a significant slowdown for this key industry player, according to Bloomberg.

The disappointing results were further exacerbated by the company accidentally releasing its earnings report a day early. This news prompted a wid...

Semiconductor company $ASML Holding (ASML.US)$ experienced its largest drop in 26 years on October 15 after reporting only about half the orders that analysts had anticipated from chipmakers, signaling a significant slowdown for this key industry player, according to Bloomberg.

The disappointing results were further exacerbated by the company accidentally releasing its earnings report a day early. This news prompted a wid...

+2

442

195

164

meymeymey

liked

Hi, mooers! ![]()

In the "Funds Talk 04: Why CSOP can be considered as a safe haven for investors?" session, Csop Asset Management provided mooers with an extensive discussion on their investment philosophy, offering insights into the current market trends and introducing their prominent Cash Plus product: $CSOP USD Money Market Fund (SGXZ96797238.MF)$

Under the post, a wealth of questions from mooers has come in. We've put CSOP back in the center...

In the "Funds Talk 04: Why CSOP can be considered as a safe haven for investors?" session, Csop Asset Management provided mooers with an extensive discussion on their investment philosophy, offering insights into the current market trends and introducing their prominent Cash Plus product: $CSOP USD Money Market Fund (SGXZ96797238.MF)$

Under the post, a wealth of questions from mooers has come in. We've put CSOP back in the center...

147

54

9

meymeymey

liked

Hi, mooers! ![]()

Over the past three months, the Federal Reserve is rumored to be ending rate hikes, leading to a rise in US Treasury yields and market uncertainty. As a result, investors are seeking diversified asset allocation. Experts and institutions have shared their interpretations and suggestions on moomoo, while mooers have also contributed their investment performance and insights.

Join us for a summary of moomoo's most t...

Over the past three months, the Federal Reserve is rumored to be ending rate hikes, leading to a rise in US Treasury yields and market uncertainty. As a result, investors are seeking diversified asset allocation. Experts and institutions have shared their interpretations and suggestions on moomoo, while mooers have also contributed their investment performance and insights.

Join us for a summary of moomoo's most t...

280

122

3

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)