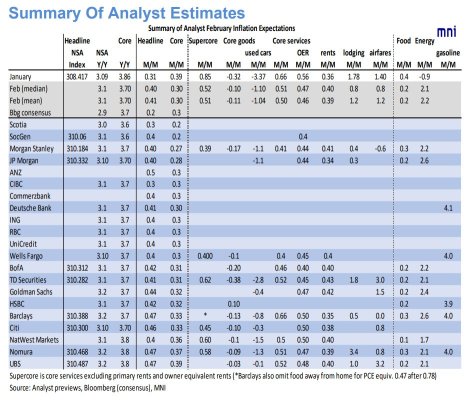

Summary Of Analyst Estimates

Morgan Stanley:

❖ CPI M/M: 0.40%

❖ CPI Y/Y: 3.1%

❖ Core M/M: 0.27%

❖ Core Y/Y: 3.7%

JP Morgan:

❖ CPI M/M: 0.40%

❖ CPI Y/Y: 3.1%

❖ Core M/M: 0.28%

❖ Core Y/Y: 3.7%

BofA:

❖ CPI M/M: 0.42%

❖ CPI Y/Y: 3.1%

❖ Core M/M: 0.31%

❖ Core Y/Y: 3.7%

Goldman Sachs

❖ CPI M/M: 0.44%

❖ CPI Y/Y: 3.2%

❖ Core M/M: 0.32%

❖ Core Y/Y: 3.7%

$S&P 500 Index (.SPX.US)$ $Nasdaq Composite Index (.IXIC.US)$ $Dow Jones Industrial Average (.DJI.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$

Morgan Stanley:

❖ CPI M/M: 0.40%

❖ CPI Y/Y: 3.1%

❖ Core M/M: 0.27%

❖ Core Y/Y: 3.7%

JP Morgan:

❖ CPI M/M: 0.40%

❖ CPI Y/Y: 3.1%

❖ Core M/M: 0.28%

❖ Core Y/Y: 3.7%

BofA:

❖ CPI M/M: 0.42%

❖ CPI Y/Y: 3.1%

❖ Core M/M: 0.31%

❖ Core Y/Y: 3.7%

Goldman Sachs

❖ CPI M/M: 0.44%

❖ CPI Y/Y: 3.2%

❖ Core M/M: 0.32%

❖ Core Y/Y: 3.7%

$S&P 500 Index (.SPX.US)$ $Nasdaq Composite Index (.IXIC.US)$ $Dow Jones Industrial Average (.DJI.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$

2

S&P 500 Opening Bell Heatmap (Mar. 11, 2024)

$SPDR S&P 500 ETF (SPY.US)$ -0.38%

$Invesco QQQ Trust (QQQ.US)$ -0.64%

$Dow Jones Industrial Average (.DJI.US)$ -0.391%

$iShares Russell 2000 ETF (IWM.US)$ -0.73%

Stocks on move: $MSTR +6.2%, $COIN +1.4%, $AAPL +1.7%, $TSLA +3.6%, $PDD +3.1%, $BABA +2.4%, || $SMCI -9.2%, $META -4.9%, $ARM -4.3%, $NVDA -2.2%, $BA -2.9%, $LLY -3.4%, $AMZN -1.7% (🔴)

$SPDR S&P 500 ETF (SPY.US)$ -0.38%

$Invesco QQQ Trust (QQQ.US)$ -0.64%

$Dow Jones Industrial Average (.DJI.US)$ -0.391%

$iShares Russell 2000 ETF (IWM.US)$ -0.73%

Stocks on move: $MSTR +6.2%, $COIN +1.4%, $AAPL +1.7%, $TSLA +3.6%, $PDD +3.1%, $BABA +2.4%, || $SMCI -9.2%, $META -4.9%, $ARM -4.3%, $NVDA -2.2%, $BA -2.9%, $LLY -3.4%, $AMZN -1.7% (🔴)

1

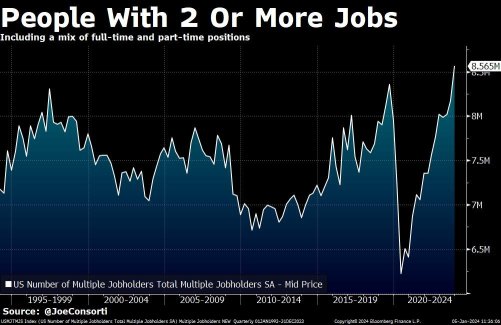

All the headline numbers have showed that the labor market is incredibly strong.

But is it really?

Currently, the US has a record ~8.6 MILLION people that are holding 2 or more jobs.

Since 2020, nearly 2.6 million people have taken on an additional job.

Even in the 2008 financial crisis, the worst recession since the Great Depression, this did not happen.

On top of this, 10 of the last 11 months have seen downward revisions in their jobs number.

Is the labor market really THAT strong?

$S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$ $Nasdaq Composite Index (.IXIC.US)$

But is it really?

Currently, the US has a record ~8.6 MILLION people that are holding 2 or more jobs.

Since 2020, nearly 2.6 million people have taken on an additional job.

Even in the 2008 financial crisis, the worst recession since the Great Depression, this did not happen.

On top of this, 10 of the last 11 months have seen downward revisions in their jobs number.

Is the labor market really THAT strong?

$S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$ $Nasdaq Composite Index (.IXIC.US)$

1

3

🔹 Adj EPS: $2.00 (Est. $1.69)

🔹 Sales: $13.60B (Est. $13.54B)

🔹 Passenger Revenue: $12.42B (Est. $12.39B)

🔹 Operating Revenue: $13.63B (Est. $13.54B)

🔹 Available Seat Miles: 73.73B (Est. 73.48B)

🔹 PRASM: 16.85C (Est. 16.87C)

🔹 Q4 Capacity: Up 14.7% YoY

🔹 Avg. Fuel Price Per Gallon: $3.13, Down 11.6% YoY

🔹 Sees Q1 Adj EPS Loss b/w $0.35-$0.85 (Est $0.21)

🔹 Sees FY'24 Adj EPS b/w $9-$11 (Est. $9.45)

CEO Scott Kirby's Comments:

🔸 "Delivered on ...

🔹 Sales: $13.60B (Est. $13.54B)

🔹 Passenger Revenue: $12.42B (Est. $12.39B)

🔹 Operating Revenue: $13.63B (Est. $13.54B)

🔹 Available Seat Miles: 73.73B (Est. 73.48B)

🔹 PRASM: 16.85C (Est. 16.87C)

🔹 Q4 Capacity: Up 14.7% YoY

🔹 Avg. Fuel Price Per Gallon: $3.13, Down 11.6% YoY

🔹 Sees Q1 Adj EPS Loss b/w $0.35-$0.85 (Est $0.21)

🔹 Sees FY'24 Adj EPS b/w $9-$11 (Est. $9.45)

CEO Scott Kirby's Comments:

🔸 "Delivered on ...

On Thursday, Congress passed a stopgap bill to avert a partial government shutdown this weekend and keep the federal government funded through March 1 and March 8.

The measure passed 77-18 in the U.S. Senate, followed by a vote of 314-108 in the House of Representatives. The bill has now been sent to President Joe Biden to become law.

This is the third such stopgap bill to be passed since last September, while lawmakers ...

The measure passed 77-18 in the U.S. Senate, followed by a vote of 314-108 in the House of Representatives. The bill has now been sent to President Joe Biden to become law.

This is the third such stopgap bill to be passed since last September, while lawmakers ...

1

Stocks making the biggest moves after hours

These are the stocks moving the most in extended trading hours:

$iRobot (IRBT.US)$

— The Roomba manufacturer tumbled more than 30%. The Wall Street Journal reported late Thursday that the European Union's antitrust watchdog anticipates blocking Amazon's acquisition of iRobot.

$Super Micro Computer (SMCI.US)$

— Shares of the information technology firm gained 6% after Super Micro Computer reported preliminary s...

These are the stocks moving the most in extended trading hours:

$iRobot (IRBT.US)$

— The Roomba manufacturer tumbled more than 30%. The Wall Street Journal reported late Thursday that the European Union's antitrust watchdog anticipates blocking Amazon's acquisition of iRobot.

$Super Micro Computer (SMCI.US)$

— Shares of the information technology firm gained 6% after Super Micro Computer reported preliminary s...

1

Out of the 11 sectors, only two are currently set for week-to-date gains: information technology and communication services.

Technology stocks were the best performer, with the sector up 1.92% for the week. Communication services stocks are set to add 0.31%.

Utilities stocks were the worst performers, with the sector down 3.58% this week. Energy and real estate are also respectively down 3.43% and 3.07% thus far. $SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$

Technology stocks were the best performer, with the sector up 1.92% for the week. Communication services stocks are set to add 0.31%.

Utilities stocks were the worst performers, with the sector down 3.58% this week. Energy and real estate are also respectively down 3.43% and 3.07% thus far. $SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$

1

Real money investors are continuing to buy Treasuries on market dips, which is expected to maintain a strong demand for bonds and push 10-year yields back towards 4% in the coming days.

Dealing desks have observed significant demand from real money accounts in the middle of the Treasury futures curve for the second consecutive day, with fast money using earlier flattening to load up on steepeners, particularly in the 2s10s spread. $S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$ $Nasdaq Composite Index (.IXIC.US)$

Dealing desks have observed significant demand from real money accounts in the middle of the Treasury futures curve for the second consecutive day, with fast money using earlier flattening to load up on steepeners, particularly in the 2s10s spread. $S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$ $Nasdaq Composite Index (.IXIC.US)$

2

1. Inflation rise above 9% for the first time in 40 years

2. Second and third largest bank collapses in US history

3. Oil prices go from -$40 to $100+ in a matter of months

4. Fastest Fed interest rate hike cycle of all time

5. Least affordable housing market in history

6. Over $8 trillion in US Federal debt borrowed

7. Mortgage demand at its lowest since 1995

8. Total US credit card debt hit a record $1 trillion

Yet, all three market indices are entering all time high te...

2. Second and third largest bank collapses in US history

3. Oil prices go from -$40 to $100+ in a matter of months

4. Fastest Fed interest rate hike cycle of all time

5. Least affordable housing market in history

6. Over $8 trillion in US Federal debt borrowed

7. Mortgage demand at its lowest since 1995

8. Total US credit card debt hit a record $1 trillion

Yet, all three market indices are entering all time high te...

3

5

Money market funds just saw $182 billion of inflows in the first 2 weeks of 2024.

This is the biggest 2-week inflow ever recorded to start a year.

This brings the total assets held by money market funds up to a record $6 trillion.

Since the Fed began raising rates in March 2022, over $1.5 trillion has gone into money market funds.

Now for the trillion dollar question.

Where does all this capital go once the Fed starts cutting rates?

$SPDR S&P 500 ETF (SPY.US)$ $S&P 500 Index (.SPX.US)$

This is the biggest 2-week inflow ever recorded to start a year.

This brings the total assets held by money market funds up to a record $6 trillion.

Since the Fed began raising rates in March 2022, over $1.5 trillion has gone into money market funds.

Now for the trillion dollar question.

Where does all this capital go once the Fed starts cutting rates?

$SPDR S&P 500 ETF (SPY.US)$ $S&P 500 Index (.SPX.US)$

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)