Milkin The Cash Moo

voted

Spoiler:

At the end of this post, there is a chance for you to win points!

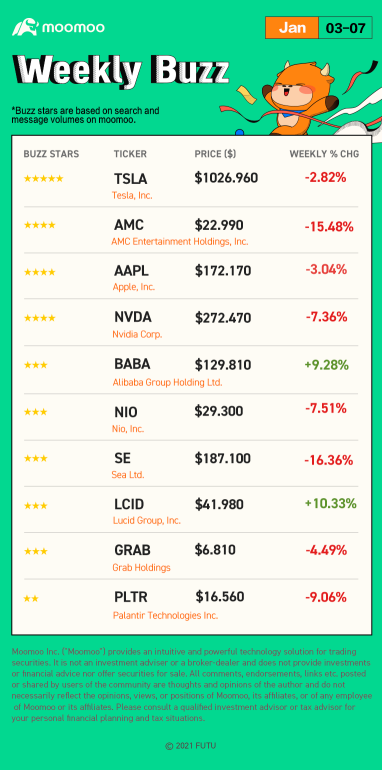

Happy Monday mooers! Welcome back to our first Weekly Buzz in 2022, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Part Ⅰ: Make Your Choices

Part Ⅱ: Buzzing Stocks List & Mooers Comments

Every major index moved downward, ...

At the end of this post, there is a chance for you to win points!

Happy Monday mooers! Welcome back to our first Weekly Buzz in 2022, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Part Ⅰ: Make Your Choices

Part Ⅱ: Buzzing Stocks List & Mooers Comments

Every major index moved downward, ...

+11

65

79

Milkin The Cash Moo

liked

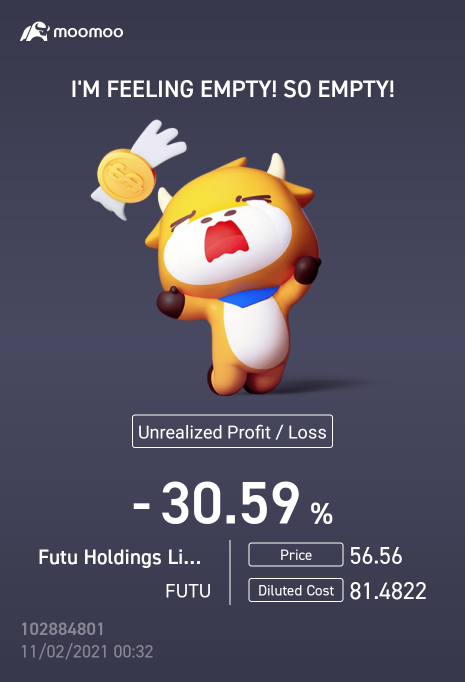

$Futu Holdings Ltd (FUTU.US)$ Is it my eyes playing tricks on me??? Up by 10%???

Translated

1

1

Milkin The Cash Moo

liked

I stick to long term investment because I believe in looking for companies with good fundamental and growth potential. the approach is to look for good entry price when there are weaknesses and to revaluate from time to time if its fundamental is still sound.

$Futu Holdings Ltd (FUTU.US)$

$Futu Holdings Ltd (FUTU.US)$

13

Milkin The Cash Moo

liked

Milkin The Cash Moo

liked

As investors, we have a variety of investment choices.Dividend stocks are usually well-established companies with a good history of distributing earnings back to shareholders.Dividend investing is a popularway toinvestin Singapore.

What is dividend investing?

Dividend investing is the practice of purchasing dividend-paying stocks to receive a consistent income stream from your investment. A dividend is theproportion of the profita company pays when itearns a profit or surplus.A vast majority of Singapore companies pay dividends to issue the payout quarterly. For instance, REIT is a well-known type of company that pays out dividends.

What are REITs?

REITs(real estate investment trusts)are among the most popular choices for investors who aim at a steady income stream. A REIT is a business that owns, operates, or funds income-producing real estate, which can provide investment opportunities to invest in a pool of professionally managed real estate assets and is listed and traded on a stock exchange.

Singapore is a large real estate investment trust center in Asia.So far, there are currently 43 real estate investment trusts and real estate business trusts listed on the Singapore Exchange, with a total market value exceeding $110 billion, accounting for approximately 12% of the total in Singapore. The following figures show that REITs are booming in Singapore from different dimensions.

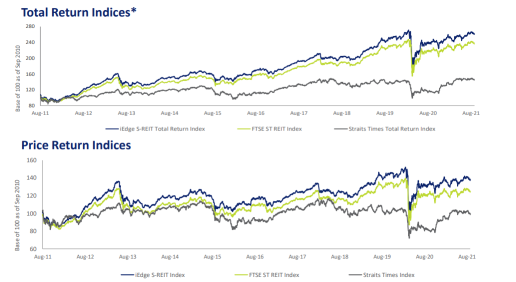

Looking from the historical pattern, the returns of REITs are growing steadily, with a growth rate tripled from 2011 to 2021, as shown in Figure 1.

Figure 1: Three Year Average Annualized Total Return of 13.4%

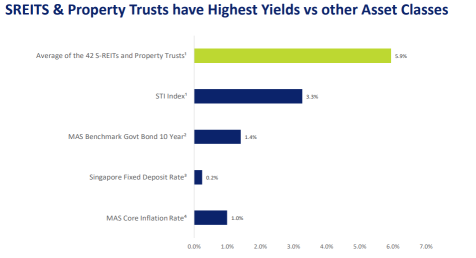

Figure 2 shows that the average return of S-REITS & Property Trusts was 5.9%in 2021, which is higher than other assets classes.

Figure 2: S-REITS & Property Trusts vs Other Asset Classes

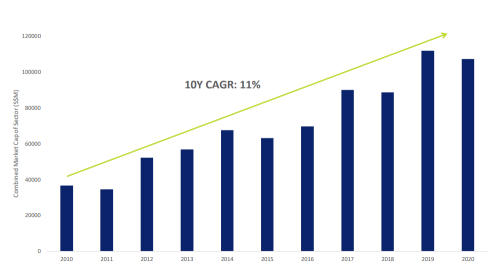

Since 2010, SGX's SREITs & Property Trusts has had a considerable 10-year compound annual growth rate of 11%, as shown in Figure 3.

Figure 3: SGX’s SREITs & Property Trusts: a CAGR Growth of 11% Across Ten Years

How to evaluate dividend stocks?

As mentioned before, dividend stocksare usually well-established companies with a good earning history. The following three parameters could help you differentiate between stocks.

Dividend yield

Dividend yieldis the dividenda company pays out annually and is related to the stock price.Real estate investment trusts (REITs) usually pay higher than average dividends.Thehigherthedividend yield is, thebetter.In addition, the dividend's growth should be in line with the company's long-term earnings.

Payout ratio

Payout ratio refers to the dividends paid out as a percentage of a company's total earnings.A high payout ratio, notably exceeding 100%, could lead to questions regarding the long-term sustainability of a stock. In contrast, a low payout ratio could indicate that a company is reinvesting most of its earnings to expand its businesses. In other words, investors should treat the payout ratio critically, whether it's high or low.

Dividend history

The corporations with the best long-term dividend payment records typically have had consistent payout ratios for many years. Is the company's dividend distribution continually increasing? And how long has the corporation paid a dividend to its stockholders?

How to conduct dividend investing?

(1)Aim for a high dividend yield

Investors with a short-term horizon can focus on slow-growing, established companies with a large cash flow that could pay substantial dividends.

(2) Choose high dividend growth

Long-term investors should concentrate on buying stocks of firms that are proliferating but pay lower-than-average dividends. The returns might look small shortly, but the dividend yield should steadily increase as a company expands.

To evaluate the potential of a specific stock, investors can look at its past performance from reports that contain various charts. The following bar chart of WLMIY (Wilmar International Limited) forecasts dividend growth based on itshistory. Assuming that the annual dividend growth rate of $Wilmar Intl (F34.SG)$ is 15.73%, Wilmar's dividends double every 4.7 years.

Several notes on dividend investing

Dividends of any company are not fixed and can be adjusted at any time.

Mature and large companies usually provide dividends with modest growth rates.

Suppose investors focus on companies with substantial dividends only. In that case, they may miss out on fast-growing companies that have not started paying dividends or are paying a small amount of dividends.

Futu limited-time event

If investors make a minimum subscription of 4,000 SGD of UOB APAC Green REIT ETF during the subscription period from November 5th, 2021 to November 16th, 2021 (both dates inclusive) and have not withdrawn the subscription before the subscription deadline will get an 18.8 SGD worth of Cash Coupons for trading on moomoo.

Enter Now>>

Disclaimer:

Moomoo is a trading platform offered by Moomoo Inc. In Singapore, capital markets products and services on moomoo are offered by Futu Singapore Pte. Ltd. regulated by the Monetary Authority of Singapore (MAS).

The content is provided for educational & informational use only. The information and data used are for purposes of illustration only. No content herein shall be considered an offer, solicitation or recommendation for the purchase or sale of securities, futures, or other investment products. It does not take into account your investment objectives, financial situation or particular needs. All information and data, if any, are for reference only and past performance should not be viewed as an indicator of future results. It is not a guarantee for future results. Investments in stocks, options, ETFs, and other instruments are subject to risks, including possible loss of the amount invested. The value of investments may fluctuate and as a result, clients may lose the value of their investment. When trading in a margin account, a client may lose more than their original investment. Please consult your financial adviser as to the suitability of any investment.

What is dividend investing?

Dividend investing is the practice of purchasing dividend-paying stocks to receive a consistent income stream from your investment. A dividend is theproportion of the profita company pays when itearns a profit or surplus.A vast majority of Singapore companies pay dividends to issue the payout quarterly. For instance, REIT is a well-known type of company that pays out dividends.

What are REITs?

REITs(real estate investment trusts)are among the most popular choices for investors who aim at a steady income stream. A REIT is a business that owns, operates, or funds income-producing real estate, which can provide investment opportunities to invest in a pool of professionally managed real estate assets and is listed and traded on a stock exchange.

Singapore is a large real estate investment trust center in Asia.So far, there are currently 43 real estate investment trusts and real estate business trusts listed on the Singapore Exchange, with a total market value exceeding $110 billion, accounting for approximately 12% of the total in Singapore. The following figures show that REITs are booming in Singapore from different dimensions.

Looking from the historical pattern, the returns of REITs are growing steadily, with a growth rate tripled from 2011 to 2021, as shown in Figure 1.

Figure 1: Three Year Average Annualized Total Return of 13.4%

Figure 2 shows that the average return of S-REITS & Property Trusts was 5.9%in 2021, which is higher than other assets classes.

Figure 2: S-REITS & Property Trusts vs Other Asset Classes

Since 2010, SGX's SREITs & Property Trusts has had a considerable 10-year compound annual growth rate of 11%, as shown in Figure 3.

Figure 3: SGX’s SREITs & Property Trusts: a CAGR Growth of 11% Across Ten Years

How to evaluate dividend stocks?

As mentioned before, dividend stocksare usually well-established companies with a good earning history. The following three parameters could help you differentiate between stocks.

Dividend yield

Dividend yieldis the dividenda company pays out annually and is related to the stock price.Real estate investment trusts (REITs) usually pay higher than average dividends.Thehigherthedividend yield is, thebetter.In addition, the dividend's growth should be in line with the company's long-term earnings.

Payout ratio

Payout ratio refers to the dividends paid out as a percentage of a company's total earnings.A high payout ratio, notably exceeding 100%, could lead to questions regarding the long-term sustainability of a stock. In contrast, a low payout ratio could indicate that a company is reinvesting most of its earnings to expand its businesses. In other words, investors should treat the payout ratio critically, whether it's high or low.

Dividend history

The corporations with the best long-term dividend payment records typically have had consistent payout ratios for many years. Is the company's dividend distribution continually increasing? And how long has the corporation paid a dividend to its stockholders?

How to conduct dividend investing?

(1)Aim for a high dividend yield

Investors with a short-term horizon can focus on slow-growing, established companies with a large cash flow that could pay substantial dividends.

(2) Choose high dividend growth

Long-term investors should concentrate on buying stocks of firms that are proliferating but pay lower-than-average dividends. The returns might look small shortly, but the dividend yield should steadily increase as a company expands.

To evaluate the potential of a specific stock, investors can look at its past performance from reports that contain various charts. The following bar chart of WLMIY (Wilmar International Limited) forecasts dividend growth based on itshistory. Assuming that the annual dividend growth rate of $Wilmar Intl (F34.SG)$ is 15.73%, Wilmar's dividends double every 4.7 years.

Several notes on dividend investing

Dividends of any company are not fixed and can be adjusted at any time.

Mature and large companies usually provide dividends with modest growth rates.

Suppose investors focus on companies with substantial dividends only. In that case, they may miss out on fast-growing companies that have not started paying dividends or are paying a small amount of dividends.

Futu limited-time event

If investors make a minimum subscription of 4,000 SGD of UOB APAC Green REIT ETF during the subscription period from November 5th, 2021 to November 16th, 2021 (both dates inclusive) and have not withdrawn the subscription before the subscription deadline will get an 18.8 SGD worth of Cash Coupons for trading on moomoo.

Enter Now>>

Disclaimer:

Moomoo is a trading platform offered by Moomoo Inc. In Singapore, capital markets products and services on moomoo are offered by Futu Singapore Pte. Ltd. regulated by the Monetary Authority of Singapore (MAS).

The content is provided for educational & informational use only. The information and data used are for purposes of illustration only. No content herein shall be considered an offer, solicitation or recommendation for the purchase or sale of securities, futures, or other investment products. It does not take into account your investment objectives, financial situation or particular needs. All information and data, if any, are for reference only and past performance should not be viewed as an indicator of future results. It is not a guarantee for future results. Investments in stocks, options, ETFs, and other instruments are subject to risks, including possible loss of the amount invested. The value of investments may fluctuate and as a result, clients may lose the value of their investment. When trading in a margin account, a client may lose more than their original investment. Please consult your financial adviser as to the suitability of any investment.

+1

167

8

Milkin The Cash Moo

reacted to

$Futu Holdings Ltd (FUTU.US)$

i have earned a few times with futu. it was one of the first stocks i bought when i first started joining and at that time, 105 was a low price. I have bought and sold a few times and i believed that it will always rise back after each drop. but it dropped to the 80s. then 70s. then now 50s. i'm not sure whether i have the faith to continue averaging down....

i have earned a few times with futu. it was one of the first stocks i bought when i first started joining and at that time, 105 was a low price. I have bought and sold a few times and i believed that it will always rise back after each drop. but it dropped to the 80s. then 70s. then now 50s. i'm not sure whether i have the faith to continue averaging down....

12

10

Milkin The Cash Moo

liked

$Futu Holdings Ltd (FUTU.US)$ Three types of people here. those who are scare and keep asking about the bottom. just wait after 1 Nov. No points keep asking where is the bottom and when can I enter. wait till 1Nov see got problem or not then enter. The other is those who is in and wanted to average down when the price is right because they have trust in the company. the third is no trust in the company, just sell together with the shortlist and go invest on those stock that you have confident in.

4

7

Milkin The Cash Moo

liked

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)