MJL21

reacted to

Dear mooers,

Happy Chinese New Year!

Regardless of who you are with and where you are, moomoo wishes you a new year full of luck, happiness, achievement, and prosperity.

moomoo thank you for your continuous company. We hope to accompany you further in your investing journey!

Once again, we wish you and your family a lucky, happy, healthy, and prosperous lunar new year!

Team moomoo

Happy Chinese New Year!

Regardless of who you are with and where you are, moomoo wishes you a new year full of luck, happiness, achievement, and prosperity.

moomoo thank you for your continuous company. We hope to accompany you further in your investing journey!

Once again, we wish you and your family a lucky, happy, healthy, and prosperous lunar new year!

Team moomoo

131

51

MJL21

commented on

MJL21

liked

What is ESG?

For the uninitiated, ESG stands for environmental, social and governance. Increasingly, a company’s impact on the environment and whether its business model contributes to sustainable development matter to its stakeholders and investors. The ESG criteria include how the company manages its waste, the kind of energy sources it uses, the kind of suppliers it works with, how it handles pollution, its attitude to climate change, transparency in accounting and their choice of board members.

Why Should We Care About ESG?

Recently, my powerbank made by a well-known company in China became faulty. When I returned to the authorised distributor to enquire whether they had a recycling program for their old powerbanks, I was told they did not. This is sad as while many people are aware that recycling is important, they do not practise it as they find it costly or inconvenient. The inconvenience factor can be overcome if companies do their part to provide collection points, especially if it is their own products.

If society values ESG and supports companies that have high ESG ratings, then more companies will be incentivised to prioritise sustainable practices alongside profit generation. Our combined efforts can help to keep our planet sustainable for ourselves and future generations.

Never has this been more apparent than the haze that used to be an annual affair for Southeast Asia, triggering respiratory problems, forcing residents to stay indoors and keep their windows shut and causing tourists to cancel or defer their trips; the health and economic costs ran to billions of dollars. The situation only turned around when it was exposed which companies and products were linked to the slash and burn practices. The public backlash was enormous and consumers started boycotting said companies’ products. That in turn put pressure on the regulators.

Having Our Cake And Eating It

Fortunately, being profitable and meeting high ESG criteria are not mutually exclusive. Companies with high ESG ratings are often industry leaders that generate greater returns than their peers as they have better reputation, enjoy stronger customer loyalty and have more streamlined operations that reduce waste. $Microsoft (MSFT.US)$ , $Accenture (ACN.US)$ , $Linde (LIN.US)$ , $Adobe (ADBE.US)$ , $Xylem (XYL.US)$ , $Qualcomm (QCOM.US)$ , $Oracle (ORCL.US)$ , $Nike (NKE.US)$ , $Texas Instruments (TXN.US)$ , $NVIDIA (NVDA.US)$ , $Salesforce (CRM.US)$ , $Advanced Micro Devices (AMD.US)$, $CityDev (C09.SG)$ , $CapLand IntCom T (C38U.SG)$ and $DBS Group Holdings (D05.SG)$ . Hence, it is possible to have our cake and eat it too.

Future Prospects

With the renewed focus on cleaner energy and cutting carbon emissions around the world, ESG investing is the new trend with a “tsunami of money” pouring in, in the words of Piyush Gupta, group chief executive of DBS. Even if the fundamental asset value were to remain unchanged, the increased demand will cause the price of the asset to rise.

Besides buying the stocks of companies with good ESG ratings, there are various ESG funds to choose from like $Ishares Msci Usa Esg Select Etf (SUSA.US)$ $iShares Global Clean Energy ETF (ICLN.US)$ and the upcoming $UOB AP GRN REIT US$ (GRE.SG)$ . The current challenge is there is no unified standard and different methodologies used by different providers can result in different ESG ratings for the same company. For example, $Tesla (TSLA.US)$ is average among 40 companies in the automobile industry according to MSCI, 20 out of 100 according to SPDJI and in the 61st percentile (high) for ESG risk according to Sustainalytics..

If you enjoy the read, please click![]() and/or drop a comment below before you go. Thank you.

and/or drop a comment below before you go. Thank you.

Disclaimer: The above is my personal opinion. It is not financial advice or a recommendation to invest. Please consult a financial advisor before making any investment decision.

Check out Some Pointers for Day Trading https://www.moomoo.com/community/feed/107439079489542?lang_code=2

For the uninitiated, ESG stands for environmental, social and governance. Increasingly, a company’s impact on the environment and whether its business model contributes to sustainable development matter to its stakeholders and investors. The ESG criteria include how the company manages its waste, the kind of energy sources it uses, the kind of suppliers it works with, how it handles pollution, its attitude to climate change, transparency in accounting and their choice of board members.

Why Should We Care About ESG?

Recently, my powerbank made by a well-known company in China became faulty. When I returned to the authorised distributor to enquire whether they had a recycling program for their old powerbanks, I was told they did not. This is sad as while many people are aware that recycling is important, they do not practise it as they find it costly or inconvenient. The inconvenience factor can be overcome if companies do their part to provide collection points, especially if it is their own products.

If society values ESG and supports companies that have high ESG ratings, then more companies will be incentivised to prioritise sustainable practices alongside profit generation. Our combined efforts can help to keep our planet sustainable for ourselves and future generations.

Never has this been more apparent than the haze that used to be an annual affair for Southeast Asia, triggering respiratory problems, forcing residents to stay indoors and keep their windows shut and causing tourists to cancel or defer their trips; the health and economic costs ran to billions of dollars. The situation only turned around when it was exposed which companies and products were linked to the slash and burn practices. The public backlash was enormous and consumers started boycotting said companies’ products. That in turn put pressure on the regulators.

Having Our Cake And Eating It

Fortunately, being profitable and meeting high ESG criteria are not mutually exclusive. Companies with high ESG ratings are often industry leaders that generate greater returns than their peers as they have better reputation, enjoy stronger customer loyalty and have more streamlined operations that reduce waste. $Microsoft (MSFT.US)$ , $Accenture (ACN.US)$ , $Linde (LIN.US)$ , $Adobe (ADBE.US)$ , $Xylem (XYL.US)$ , $Qualcomm (QCOM.US)$ , $Oracle (ORCL.US)$ , $Nike (NKE.US)$ , $Texas Instruments (TXN.US)$ , $NVIDIA (NVDA.US)$ , $Salesforce (CRM.US)$ , $Advanced Micro Devices (AMD.US)$, $CityDev (C09.SG)$ , $CapLand IntCom T (C38U.SG)$ and $DBS Group Holdings (D05.SG)$ . Hence, it is possible to have our cake and eat it too.

Future Prospects

With the renewed focus on cleaner energy and cutting carbon emissions around the world, ESG investing is the new trend with a “tsunami of money” pouring in, in the words of Piyush Gupta, group chief executive of DBS. Even if the fundamental asset value were to remain unchanged, the increased demand will cause the price of the asset to rise.

Besides buying the stocks of companies with good ESG ratings, there are various ESG funds to choose from like $Ishares Msci Usa Esg Select Etf (SUSA.US)$ $iShares Global Clean Energy ETF (ICLN.US)$ and the upcoming $UOB AP GRN REIT US$ (GRE.SG)$ . The current challenge is there is no unified standard and different methodologies used by different providers can result in different ESG ratings for the same company. For example, $Tesla (TSLA.US)$ is average among 40 companies in the automobile industry according to MSCI, 20 out of 100 according to SPDJI and in the 61st percentile (high) for ESG risk according to Sustainalytics..

If you enjoy the read, please click

Disclaimer: The above is my personal opinion. It is not financial advice or a recommendation to invest. Please consult a financial advisor before making any investment decision.

Check out Some Pointers for Day Trading https://www.moomoo.com/community/feed/107439079489542?lang_code=2

67

5

MJL21

liked

Learning to wait is key all the more for trading where the margin for error is so much lesser than investment! Patience to wait for the right price point is key!

Here is my youtube channel:

https://www.youtube.com/channel/UCAPWOEQKCpCWmzKkdo7v-iw

You can find my playlist on financial education for new investors and traders on portfolio management and position sizing.

Below is the very first few youtube videos that I created on youtube on portfolio management:-

https://youtu.be/IwLbVChfV7M

As always, this should not be construed as any investment or trading.

$iShares Hang Seng TECH ETF (03067.HK)$ $TENCENT (00700.HK)$ $KUAISHOU-W (01024.HK)$ $Bilibili (BILI.US)$ $Beyond Meat (BYND.US)$ $Tesla (TSLA.US)$ $NIO Inc (NIO.US)$ $Lemonade (LMND.US)$ $Futu Holdings Ltd (FUTU.US)$ $UP Fintech (TIGR.US)$ $SoFi Technologies (SOFI.US)$ $Palantir (PLTR.US)$ $DouYu (DOYU.US)$ $HUYA Inc (HUYA.US)$ $ZA ONLINE N2507 (40304.HK)$ $AUTOHOME-S (02518.HK)$

Here is my youtube channel:

https://www.youtube.com/channel/UCAPWOEQKCpCWmzKkdo7v-iw

You can find my playlist on financial education for new investors and traders on portfolio management and position sizing.

Below is the very first few youtube videos that I created on youtube on portfolio management:-

https://youtu.be/IwLbVChfV7M

As always, this should not be construed as any investment or trading.

$iShares Hang Seng TECH ETF (03067.HK)$ $TENCENT (00700.HK)$ $KUAISHOU-W (01024.HK)$ $Bilibili (BILI.US)$ $Beyond Meat (BYND.US)$ $Tesla (TSLA.US)$ $NIO Inc (NIO.US)$ $Lemonade (LMND.US)$ $Futu Holdings Ltd (FUTU.US)$ $UP Fintech (TIGR.US)$ $SoFi Technologies (SOFI.US)$ $Palantir (PLTR.US)$ $DouYu (DOYU.US)$ $HUYA Inc (HUYA.US)$ $ZA ONLINE N2507 (40304.HK)$ $AUTOHOME-S (02518.HK)$

67

1

MJL21

liked

$UP Fintech (TIGR.US)$ ok I stop averaging for now and wait for another 10% dip to average down 😃

21

5

MJL21

liked

$UP Fintech (TIGR.US)$ no more panic selling. Volume goes below 4m.

17

2

MJL21

liked

On October 29, 2012, Futu obtained the Type 1 License for Securities Dealing issued by the Securities and Futures Commission of Hong Kong, and has since carried out online brokerage business as a licensed brokerage firm.

Bearing in mind our founding vision of "adhere to fully compliant operation and transform the investing experience with technologies", we determined that October 29th is Futu's birthday.

In the blink of an eye, Futu turns 9 years old.

Every day for 9 years, Futu has been making efforts to make investing easier and not alone.

Every day for 9 years, hundreds of thousands of users from all across the globe gather in Futu's online Community to share trading insights and their ups and downs along the investment journey.

More and more users and investors have joined our Community. Meanwhile, we have made a remarkable progress in "making investment easier and not lonely".

Not long ago, we sent an invitation to our users, hoping that they may share with us their wonderful moments in using our products or services.

During the submission period, we received numerous stories.

Each user has a distinct background and their stories are all unique. They come from different regions and time zones, and have various jobs and hobbies; they are at different stages of life with distinct social roles; and they all have unique life and investment experiences as well as their own understanding of and insights into financial management...

But at the same time, they have a lot in common. They all love life and enjoy challenges; they do not flinch in the face of uncertainties; they are full of curiosity and the courage to explore; and they are good at learning, eager in improving themselves, and passionate about sharing...

On the 9th birthday, we invited 9 users from all over the world to share their Futu stories.![]()

![]() KOL in the Community: Trading can be cold, but Futubull makes it friendly and fun

KOL in the Community: Trading can be cold, but Futubull makes it friendly and fun

![]() The Story of How a University Lecturer Named Benson Earned His First Pot of Gold on Futubull

The Story of How a University Lecturer Named Benson Earned His First Pot of Gold on Futubull

![]() An editor from Singapore: I use my brush to capture moments of love with Futu

An editor from Singapore: I use my brush to capture moments of love with Futu

![]() IT Engineer from Singapore: From Unemployed to Employed & How Investing Became His Alternative Life

IT Engineer from Singapore: From Unemployed to Employed & How Investing Became His Alternative Life

![]() Tina, stay-at-home-mother: grows from an “overconfident” newbie to a “rational” investor

Tina, stay-at-home-mother: grows from an “overconfident” newbie to a “rational” investor

![]() Developer Zhang who's referred Futubull to friends: A good product carries its own magic

Developer Zhang who's referred Futubull to friends: A good product carries its own magic

![]() Hong Kong user Kimberly: Futubull has witnessed all the defining moments of my life

Hong Kong user Kimberly: Futubull has witnessed all the defining moments of my life

![]() Jared: An American physician assistant who gains and passes down investing know-how via moomoo

Jared: An American physician assistant who gains and passes down investing know-how via moomoo

![]() American newbie investor: Starting a business has made me eager to make money "work" for me

American newbie investor: Starting a business has made me eager to make money "work" for me

On the 9th birthday, we have made our birthday wish: to continue accompanying every user on their investment journey.![]()

Bearing in mind our founding vision of "adhere to fully compliant operation and transform the investing experience with technologies", we determined that October 29th is Futu's birthday.

In the blink of an eye, Futu turns 9 years old.

Every day for 9 years, Futu has been making efforts to make investing easier and not alone.

Every day for 9 years, hundreds of thousands of users from all across the globe gather in Futu's online Community to share trading insights and their ups and downs along the investment journey.

More and more users and investors have joined our Community. Meanwhile, we have made a remarkable progress in "making investment easier and not lonely".

Not long ago, we sent an invitation to our users, hoping that they may share with us their wonderful moments in using our products or services.

During the submission period, we received numerous stories.

Each user has a distinct background and their stories are all unique. They come from different regions and time zones, and have various jobs and hobbies; they are at different stages of life with distinct social roles; and they all have unique life and investment experiences as well as their own understanding of and insights into financial management...

But at the same time, they have a lot in common. They all love life and enjoy challenges; they do not flinch in the face of uncertainties; they are full of curiosity and the courage to explore; and they are good at learning, eager in improving themselves, and passionate about sharing...

On the 9th birthday, we invited 9 users from all over the world to share their Futu stories.

On the 9th birthday, we have made our birthday wish: to continue accompanying every user on their investment journey.

122

72

MJL21

reacted to

I shorted AOL during the dotcom boom. I sold at about $70. I covered about two weeks later at $80. Not bad for a failed short ... except there was a 2:1 split in there. Yup, I lost about 120% of my investment in two weeks.

(Numbers from memory. I've long since shredded the records.)

$S&P 500 Index (.SPX.US)$ $NASDAQ 100 Index (.NDX.US)$

(Numbers from memory. I've long since shredded the records.)

$S&P 500 Index (.SPX.US)$ $NASDAQ 100 Index (.NDX.US)$

13

3

MJL21

liked and commented on

History of blockchain Technology in three steps:

- It was initially developed in 1991 as a sort of digital timestamp. Early innovators saw this function almost as a “notary” function. There could be no backdating or tampering with data utilizing the early blockchain technology.

- For almost two decades nobody really cared.

- 2009 “Satoshi Nakamoto” introduces BTC.

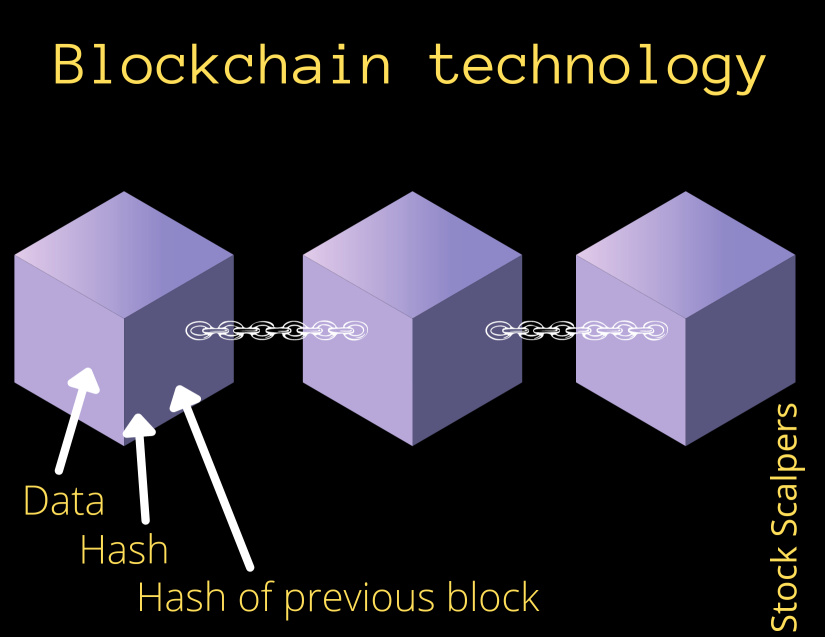

What is blockchain Technology?

Blockchain is a form of “Distributed Ledger.” I’ll break it down with an image so its easier to understand. Each “block” has three basic parts to it. The “data”, the “hash” and the “hash” of the previous “block”.

Data: This differs depending on the function. In something like BTC we have the sender, the receive and how many coins moved.

Hash: Think of the Hash as a unique ID or fingerprint. Changing anything about the block changes the hash.

Hash of Previous Block: That is exactly what it sounds like. A ledger containing the unique ID/fingerprint of the block before it in the chain.

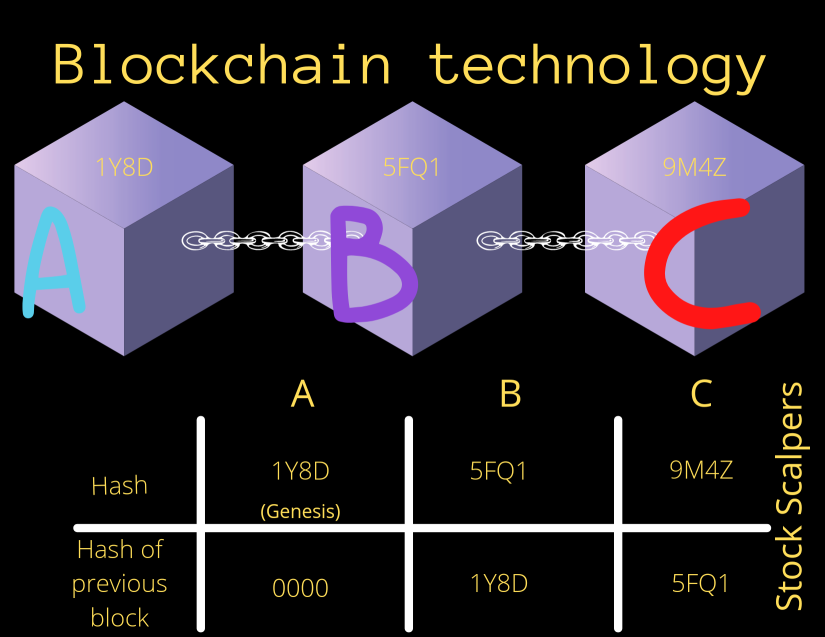

You’ll notice the first block has no previous hash number. That is because it is the first block in the chain. It is known as the “Genesis Block”, the beginning.

Why is Blockchain Technology so difficult to tamper with?

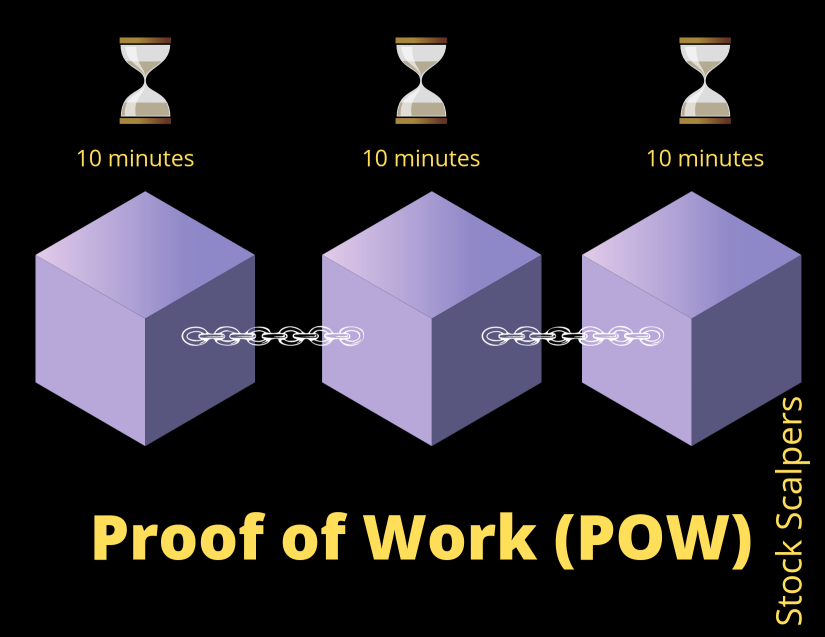

A modern computer could calculate hundreds of thousands of hash/second. In theory it would be easy to tamper with a single block and then change the hash number of the preceding blocks so they would match.

A concept called “proof of work” slows down this process to prevent computing and changing previous hashes. Currently it takes about 10 minutes to generate the hashcash proofs of work to mine BTC. This means that if someone were to TRY and tamper with a block they would need to change EVERY block before that as well to hide the discrepancy and receive P2P validation.

At 10mins/block it simply isn’t possible.

Blockchain technology is built utilizing a peer-to-peer verification process. This means each when a new block is discovered it is sent to everyone on the network and each node will independently verify the correctness of the block. In the simplest terms every node executes a consensus protocol to verify the addition of the block. ALL OF THEM. This also removes the need for centralization. (ie decentralization)

Any block that has been tampered with will be rejected by the nodes.

In order to effectively tamper with the blockchain and be validated on the P2P network someone would have to:

1) Tamper with ALL the blocks on the chain. (Remember the hash of the previous block)

2) Redo all the POW.

3) Somehow take control of greater that 50% of the P2P network.

$Bitcoin (BTC.CC)$ $Ethereum (ETH.CC)$ $MARA Holdings (MARA.US)$ $Hut 8 (HUT.US)$ $Riot Platforms (RIOT.US)$ $BIT Mining (BTCM.US)$

- It was initially developed in 1991 as a sort of digital timestamp. Early innovators saw this function almost as a “notary” function. There could be no backdating or tampering with data utilizing the early blockchain technology.

- For almost two decades nobody really cared.

- 2009 “Satoshi Nakamoto” introduces BTC.

What is blockchain Technology?

Blockchain is a form of “Distributed Ledger.” I’ll break it down with an image so its easier to understand. Each “block” has three basic parts to it. The “data”, the “hash” and the “hash” of the previous “block”.

Data: This differs depending on the function. In something like BTC we have the sender, the receive and how many coins moved.

Hash: Think of the Hash as a unique ID or fingerprint. Changing anything about the block changes the hash.

Hash of Previous Block: That is exactly what it sounds like. A ledger containing the unique ID/fingerprint of the block before it in the chain.

You’ll notice the first block has no previous hash number. That is because it is the first block in the chain. It is known as the “Genesis Block”, the beginning.

Why is Blockchain Technology so difficult to tamper with?

A modern computer could calculate hundreds of thousands of hash/second. In theory it would be easy to tamper with a single block and then change the hash number of the preceding blocks so they would match.

A concept called “proof of work” slows down this process to prevent computing and changing previous hashes. Currently it takes about 10 minutes to generate the hashcash proofs of work to mine BTC. This means that if someone were to TRY and tamper with a block they would need to change EVERY block before that as well to hide the discrepancy and receive P2P validation.

At 10mins/block it simply isn’t possible.

Blockchain technology is built utilizing a peer-to-peer verification process. This means each when a new block is discovered it is sent to everyone on the network and each node will independently verify the correctness of the block. In the simplest terms every node executes a consensus protocol to verify the addition of the block. ALL OF THEM. This also removes the need for centralization. (ie decentralization)

Any block that has been tampered with will be rejected by the nodes.

In order to effectively tamper with the blockchain and be validated on the P2P network someone would have to:

1) Tamper with ALL the blocks on the chain. (Remember the hash of the previous block)

2) Redo all the POW.

3) Somehow take control of greater that 50% of the P2P network.

$Bitcoin (BTC.CC)$ $Ethereum (ETH.CC)$ $MARA Holdings (MARA.US)$ $Hut 8 (HUT.US)$ $Riot Platforms (RIOT.US)$ $BIT Mining (BTCM.US)$

22

5

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)