MoneyBee9288

liked

4

MoneyBee9288

liked

$Serve Robotics (SERV.US)$ should've bought Palantir 🤑🤑

2

2

MoneyBee9288

liked

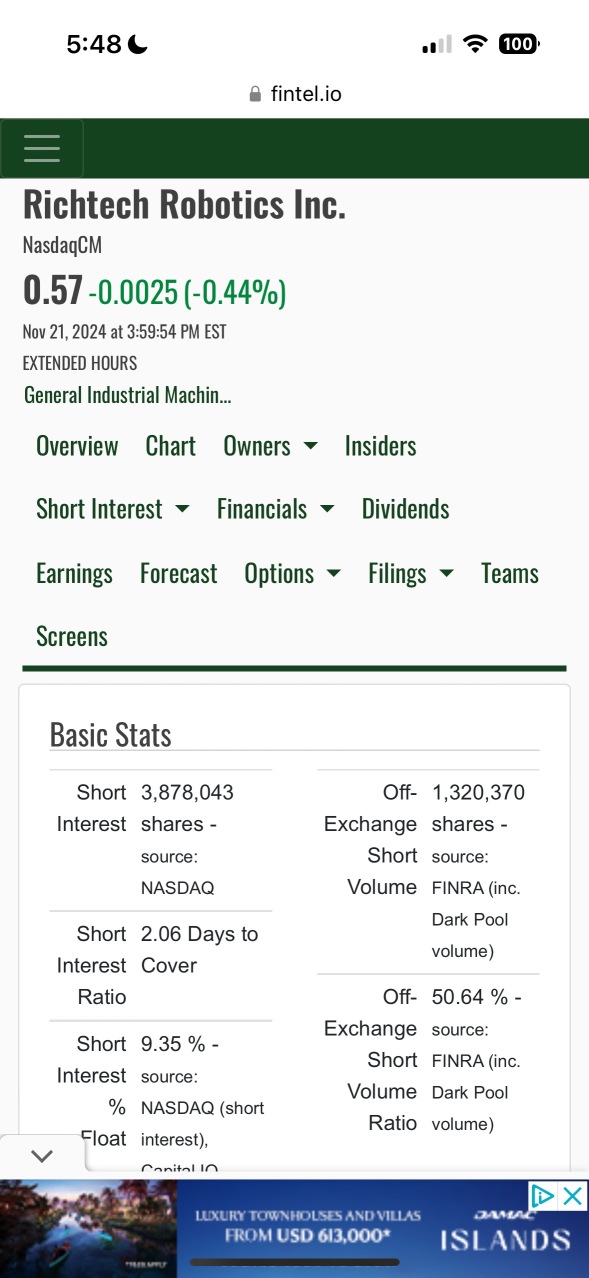

$Richtech Robotics (RR.US)$ Short interest has increased since last time i checked. Its now over 2 day for shorts to cover. If they keep shorting this and driving the price down the risk of a short squeeze increases. I think they are willing to take more risk and keep shorting due to general sentiment being low. (They know there are many people that will sell as soon as they are out of the hole, which helps them cover and kills a short squeeze)

I was reading one post of a self proclaimed shor...

I was reading one post of a self proclaimed shor...

3

6

MoneyBee9288

voted

MoneyBee9288

liked

Translated

1

MoneyBee9288

liked

$Enovix (ENVX.US)$ Better get out. This look like the Mullen scam.

4

6

MoneyBee9288

voted

Columns Operation plan after the general election and during the Chinese concept financial reporting season.

$NASDAQ 100 Index (.NDX.US)$Under the dual stimulus of the settled election and a 25 basis point rate cut, the market rose by 5% this week to reach 21117 points, which is currently a bit high. Last week's rise was mainly driven by bank stocks, small cap stocks, semiconductors, and technology stocks, reaching the upper band of the Bollinger Bands. An expected short-term pullback is anticipated. Next week, the USA's CPI and PPI data will be released, with a high probability of meeting expectations and a low possibility of a market crash. The current prediction is that the current upward trend should continue until the Christmas market, but with Donald Trump's return to the White House in January next year, there may be a significant pullback in January. Therefore, during this period of policy vacuum, the US stocks are likely to experience an oscillating upward trend. In the short term, due to the crazy rise of US stocks last week, a brief pullback is expected this week, presenting a buying opportunity during the dip.

Regarding Chinese concept stocks, due to the potential policy risks since Trump took office, as well as the lackluster effect of the debt-for-equity policy announced on Friday in stimulating the stock market, leading to a 6% decline, many stocks have directly shifted trends to a downward trajectory this week. $TENCENT (00700.HK)$ $JD.com (JD.US)$ $Alibaba (BABA.US)$ $Bilibili (BILI.US)$ $Cisco (CSCO.US)$ $Occidental Petroleum (OXY.US)$ $Sea (SE.US)$As for Chinese concept stocks, due to the potential policy risks since Trump took office, and the issuance of debt conversion policy on Friday did not have the expected stimulating effect on the stock market, resulting in a sharp 6% drop on Friday, many stocks have directly changed trends to a downward trend next week

Regarding Chinese concept stocks, due to the potential policy risks since Trump took office, as well as the lackluster effect of the debt-for-equity policy announced on Friday in stimulating the stock market, leading to a 6% decline, many stocks have directly shifted trends to a downward trajectory this week. $TENCENT (00700.HK)$ $JD.com (JD.US)$ $Alibaba (BABA.US)$ $Bilibili (BILI.US)$ $Cisco (CSCO.US)$ $Occidental Petroleum (OXY.US)$ $Sea (SE.US)$As for Chinese concept stocks, due to the potential policy risks since Trump took office, and the issuance of debt conversion policy on Friday did not have the expected stimulating effect on the stock market, resulting in a sharp 6% drop on Friday, many stocks have directly changed trends to a downward trend next week

Translated

38

4

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)