moo三平

liked

$Nippon Telegraph & Telephone (9432.JP)$

It looks like Toyota's decline has stopped

Where are investors' eyes going?

NTT has already acquired the next generation weapon called IWON

The sales target will be global communication networks and global data centers.

Verizon and AT&T in the United States crashed last year due to a problem with the disposal of communication lines containing lead.

There doesn't seem to be such a problem with IWON...

The industry most affected by this spread is rising in price for some reason...

A crowd of people who can only see their eyes

It's around 150 yen, and the mentality of not being able to buy it back is probably growing

When lightning shines, those not in the market can't benefit from it...

The highlight of IWON is optical technology, and the effect of reducing power consumption...

Lightning is electricity

Let me meet up with something

What do you have in your hands when lightning shines?

It looks like Toyota's decline has stopped

Where are investors' eyes going?

NTT has already acquired the next generation weapon called IWON

The sales target will be global communication networks and global data centers.

Verizon and AT&T in the United States crashed last year due to a problem with the disposal of communication lines containing lead.

There doesn't seem to be such a problem with IWON...

The industry most affected by this spread is rising in price for some reason...

A crowd of people who can only see their eyes

It's around 150 yen, and the mentality of not being able to buy it back is probably growing

When lightning shines, those not in the market can't benefit from it...

The highlight of IWON is optical technology, and the effect of reducing power consumption...

Lightning is electricity

Let me meet up with something

What do you have in your hands when lightning shines?

Translated

11

1

moo三平

liked

● $Nippon Telegraph & Telephone (9432.JP)$(NTT) will announce its financial results for the fiscal year ending March 2024 on May 10, 2024.

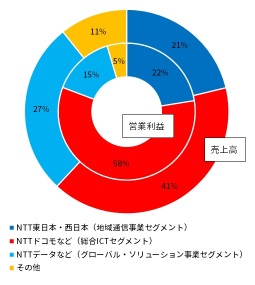

The full-year consolidated performance forecast expects revenue to decrease by 0.6% year-on-year to 13 trillion 60 billion yen, operating profit to increase by 6.6% to 1 trillion 950 billion yen, net profit to increase by 3.5% to 1 trillion 255 billion yen, and EPS to be 14.80 yen.In January of the 24th year, NTT DoCoMo, a subsidiary, has made Monex Securities a consolidated subsidiary, expecting an increase in revenue and profit.。

Considering stock splits.The annual dividend is expected to exceed the previous year by 0.2 yen, planning to increase dividends for the 13th consecutive year.At the time of the earnings announcement.The dividend forecast for the 25th fiscal year (FY 24) will also be disclosed.Outlook.

The amended NTT Law was enacted in April, allowing for changes in company names and the appointment of foreign company executives.

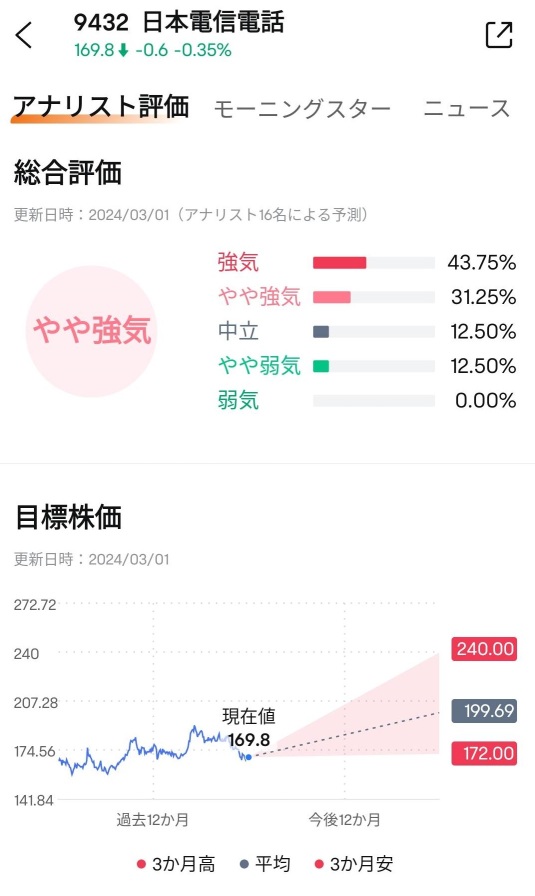

In an evaluation by 16 analysts, 43.75% are bullish, 31.25% are somewhat bullish, 12.50% are neutral, and 12.50% are slightly bearish, resulting in an overall evaluation of 'somewhat bullish'.The average target stock price is 199.69 yen, 17.6% higher than the closing price of 169.8 yen on the 7th day.。

![]() Q4 ...

Q4 ...

The full-year consolidated performance forecast expects revenue to decrease by 0.6% year-on-year to 13 trillion 60 billion yen, operating profit to increase by 6.6% to 1 trillion 950 billion yen, net profit to increase by 3.5% to 1 trillion 255 billion yen, and EPS to be 14.80 yen.In January of the 24th year, NTT DoCoMo, a subsidiary, has made Monex Securities a consolidated subsidiary, expecting an increase in revenue and profit.。

Considering stock splits.The annual dividend is expected to exceed the previous year by 0.2 yen, planning to increase dividends for the 13th consecutive year.At the time of the earnings announcement.The dividend forecast for the 25th fiscal year (FY 24) will also be disclosed.Outlook.

The amended NTT Law was enacted in April, allowing for changes in company names and the appointment of foreign company executives.

In an evaluation by 16 analysts, 43.75% are bullish, 31.25% are somewhat bullish, 12.50% are neutral, and 12.50% are slightly bearish, resulting in an overall evaluation of 'somewhat bullish'.The average target stock price is 199.69 yen, 17.6% higher than the closing price of 169.8 yen on the 7th day.。

Translated

+5

32

1

moo三平

voted

Good morning, moomoo users!![]() Here is the opening situation this morning. Thank you.

Here is the opening situation this morning. Thank you.![]()

Market Overview

In today's Tokyo stock market, the Nikkei average stock price started at 39,056.93 yen, a decrease of 466.62 yen from the previous business day, and the Tokyo Stock Price Index (TOPIX) started at 2,732.29, down by 27.35 points.

Top News

The possibility of a gradual return of yen-denominated bonds by life insurance companies, while being cautious about foreign bond investments, will be announced in the investment plan starting this week.

Following the end of the Bank of Japan's negative interest rate policy, life insurance companies are likely to increase their holdings of Japanese government bonds in the 2024 fiscal year. It is expected that financial policy normalization will proceed cautiously, with investment in ultra-long-term bonds continuing in a rising interest rate environment. On the other hand, there is a possibility of increasing open foreign bonds while managing exchange rate risks.

The yen is in the low 153 yen range against the dollar, exhibiting nervous movements due to uncertainty surrounding the Middle East situation.

In the Tokyo foreign exchange market on the 15th, the yen exchange rate remained in the low 153 yen range per dollar. Following Iran's attack on Israel over the weekend, early trading saw a scene where risk-averse yen buying took the lead. The market is now at a stage of discerning the direction of the Middle East situation...

Market Overview

In today's Tokyo stock market, the Nikkei average stock price started at 39,056.93 yen, a decrease of 466.62 yen from the previous business day, and the Tokyo Stock Price Index (TOPIX) started at 2,732.29, down by 27.35 points.

Top News

The possibility of a gradual return of yen-denominated bonds by life insurance companies, while being cautious about foreign bond investments, will be announced in the investment plan starting this week.

Following the end of the Bank of Japan's negative interest rate policy, life insurance companies are likely to increase their holdings of Japanese government bonds in the 2024 fiscal year. It is expected that financial policy normalization will proceed cautiously, with investment in ultra-long-term bonds continuing in a rising interest rate environment. On the other hand, there is a possibility of increasing open foreign bonds while managing exchange rate risks.

The yen is in the low 153 yen range against the dollar, exhibiting nervous movements due to uncertainty surrounding the Middle East situation.

In the Tokyo foreign exchange market on the 15th, the yen exchange rate remained in the low 153 yen range per dollar. Following Iran's attack on Israel over the weekend, early trading saw a scene where risk-averse yen buying took the lead. The market is now at a stage of discerning the direction of the Middle East situation...

Translated

25

1

moo三平

liked

$Screen Holdings (7735.JP)$ 、 $Disco (6146.JP)$ 、 $Advantest (6857.JP)$ 、 $Zensho Holdings (7550.JP)$ 、 $Renesas Electronics (6723.JP)$ 、 $Kawasaki Kisen Kaisha (9107.JP)$Achieved a year-to-date performance of over 100% until December 19.

$Nippon Sanso Holdings (4091.JP)$ 、 $Tokyo Electron (8035.JP)$ 、 $Toppan Holdings (7911.JP)$has achieved a year-to-date performance of over 90%.

$NEC (6701.JP)$ has achieved year-to-date performance of over 77%.

Source: moomoo

Data time point: 2...

$Nippon Sanso Holdings (4091.JP)$ 、 $Tokyo Electron (8035.JP)$ 、 $Toppan Holdings (7911.JP)$has achieved a year-to-date performance of over 90%.

$NEC (6701.JP)$ has achieved year-to-date performance of over 77%.

Source: moomoo

Data time point: 2...

Translated

![[2023 review] Check out the list of the top 10 Japanese stock appreciation rates!](https://sgsnsimg.moomoo.com/feed_image/181569713/1a0e97b6d5c238318e2a7c3459601ea7.png/thumb)

48

moo三平

liked

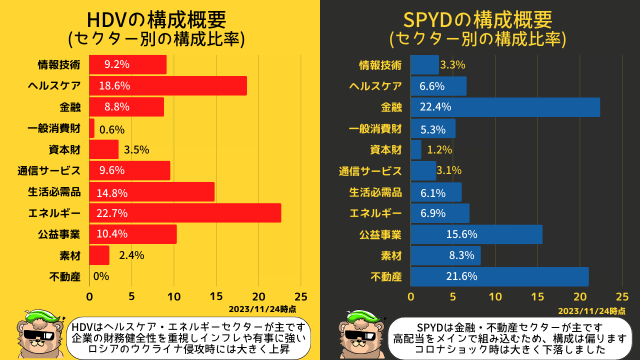

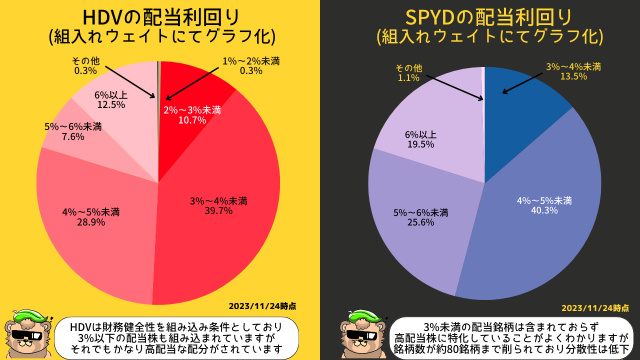

While thinking about asset formation under the new NISA

I want to enter VYM, but the yield is low

HDV and SPYD are also recommended for those who are worried

Each one covers a different sector, so

For example, combine to secure yield while increasing dispersion

It is also possible to use it like that

I hope it will be helpful to everyone.

I want to enter VYM, but the yield is low

HDV and SPYD are also recommended for those who are worried

Each one covers a different sector, so

For example, combine to secure yield while increasing dispersion

It is also possible to use it like that

I hope it will be helpful to everyone.

Translated

+1

54

moo三平

liked

It is a common belief that due to Nvidia's strong growth and high performance in the most recent financial results, the company's stock price typically rises by 10% overnight on the next trading day after the announcement, attracting buying interest. In reality, following the quarterly earnings report, the stock price often experiences a more than 10% increase supported by strong financial results.

It was anticipated that this time there would be better-than-expected financial results, leading many investors to increase their shareholdings before the announcement.

Despite the positive quarterly earnings this time, the stock price did not rise on the next trading day as it has in the past.

While I believe there is no need to be overly concerned about the growth, performance, and profitability, it seems that this time, institutions, along with individual investors, increased their buy positions two weeks before the quarterly earnings, resulting in a surge in stock prices before the announcement, followed by profit-taking and subsequent repurchases amidst the sell-buy fluctuations.

On the contrary, could beginner individual investors who felt uneasy, especially institutions, hoping for a temporary crash despite good performance, aiming to buy more at bargain prices when selling stock prices drop in adjustment phase?

I think it's important to hold onto growth stocks without being swayed by fluctuating emotions, and view market downturns as buying opportunities, keeping cash and available funds.

It was anticipated that this time there would be better-than-expected financial results, leading many investors to increase their shareholdings before the announcement.

Despite the positive quarterly earnings this time, the stock price did not rise on the next trading day as it has in the past.

While I believe there is no need to be overly concerned about the growth, performance, and profitability, it seems that this time, institutions, along with individual investors, increased their buy positions two weeks before the quarterly earnings, resulting in a surge in stock prices before the announcement, followed by profit-taking and subsequent repurchases amidst the sell-buy fluctuations.

On the contrary, could beginner individual investors who felt uneasy, especially institutions, hoping for a temporary crash despite good performance, aiming to buy more at bargain prices when selling stock prices drop in adjustment phase?

I think it's important to hold onto growth stocks without being swayed by fluctuating emotions, and view market downturns as buying opportunities, keeping cash and available funds.

Translated

4

moo三平

liked

$NVIDIA (NVDA.US)$

Despite a movement of +234% since the beginning of the year, $NVDA still looks cheap. The EPS for CY'24 is currently $20 per share (+7% compared to the previous night). NVDA is at $488, with a PER of 24.5 times in 2024, and the earnings growth rate from 2024 to 2027 will be +22 times. This corresponds to PEG 1.1 times, very cheap for a mega-growth stock (while my TSLA in 2024 has a PER of 54 times, the eps growth rate from 2023 to 2027 is +38% = PEG 1.4 times).

Despite a movement of +234% since the beginning of the year, $NVDA still looks cheap. The EPS for CY'24 is currently $20 per share (+7% compared to the previous night). NVDA is at $488, with a PER of 24.5 times in 2024, and the earnings growth rate from 2024 to 2027 will be +22 times. This corresponds to PEG 1.1 times, very cheap for a mega-growth stock (while my TSLA in 2024 has a PER of 54 times, the eps growth rate from 2023 to 2027 is +38% = PEG 1.4 times).

Translated

4

1

moo三平

liked

NVIDIA's third-quarter financial results exceeded Wall Street's predictions, but the stock price fell 1%. The company said there will be a negative impact in the next quarter as export restrictions are affecting sales to organizations in China and other countries.

Colette Kress, who is responsible for finance at NVIDIA, stated in a letter addressed to shareholders, “We expect sales to these regions to drop drastically in the fourth quarter of fiscal 2024, but we believe this decline will be offset by strong growth in other regions.”

In a conference call with analysts, Kress said NVIDIA is working with some customers in the Middle East and China to obtain US government licenses to sell high-performance products. NVIDIA is looking to develop new data center products that are in line with government policies and do not require a license, but Kress said they don't think they will make sense in the fourth quarter.

Below is a comparison with analysts' consensus:

interests: $4.02 per share after adjustment; forecast $3.37

turnover: 181.2 billion dollars Expected: 16.1 billion 8 million dollars...

Colette Kress, who is responsible for finance at NVIDIA, stated in a letter addressed to shareholders, “We expect sales to these regions to drop drastically in the fourth quarter of fiscal 2024, but we believe this decline will be offset by strong growth in other regions.”

In a conference call with analysts, Kress said NVIDIA is working with some customers in the Middle East and China to obtain US government licenses to sell high-performance products. NVIDIA is looking to develop new data center products that are in line with government policies and do not require a license, but Kress said they don't think they will make sense in the fourth quarter.

Below is a comparison with analysts' consensus:

interests: $4.02 per share after adjustment; forecast $3.37

turnover: 181.2 billion dollars Expected: 16.1 billion 8 million dollars...

Translated

4

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)