When investing, determining where to buy and where to sell is very important. However, it is not easy to continuously monitor market movements and place orders at the optimal timing. This is where the following can be utilized, "Stop-Loss Order" and "Trigger Order" By effectively using these orders, it becomes possible to conduct strategic trades while managing risk.

This article explains the features of "Stop-Loss Orders" and "Trigger Orders," and also touches on the various scenarios in which they can be utilized.

What is a Stop-Loss Order?

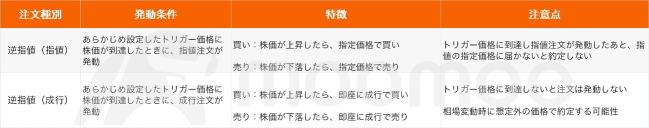

Stop-Loss OrderA Stop-Loss Order automatically places a Limit Order or Market Order when the set price (Trigger Price) is reached.

Scenarios for utilizing Stop-Loss (Limit) Orders

Sell Limit-If-Touched Order

"If the price drops below this, sell for at least $XX."Used to limit losses.

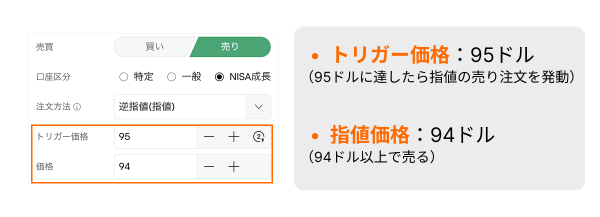

For example, if you want to cut losses at $94 when the stock held at $100 falls below $95, set it up as follows.

A Limit Order to sell at $94 or above will be triggered when the stock price falls below $95.

A Limit-If-Touched Order for selling serves as a means of risk management.ETC.

However, it is essential to decide on the price to sell beforehand...

This article explains the features of "Stop-Loss Orders" and "Trigger Orders," and also touches on the various scenarios in which they can be utilized.

What is a Stop-Loss Order?

Stop-Loss OrderA Stop-Loss Order automatically places a Limit Order or Market Order when the set price (Trigger Price) is reached.

Scenarios for utilizing Stop-Loss (Limit) Orders

Sell Limit-If-Touched Order

"If the price drops below this, sell for at least $XX."Used to limit losses.

For example, if you want to cut losses at $94 when the stock held at $100 falls below $95, set it up as follows.

A Limit Order to sell at $94 or above will be triggered when the stock price falls below $95.

A Limit-If-Touched Order for selling serves as a means of risk management.ETC.

However, it is essential to decide on the price to sell beforehand...

Translated

+15

6

1

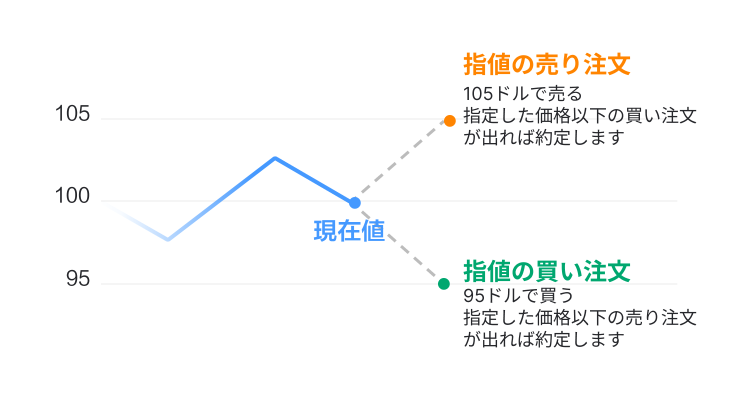

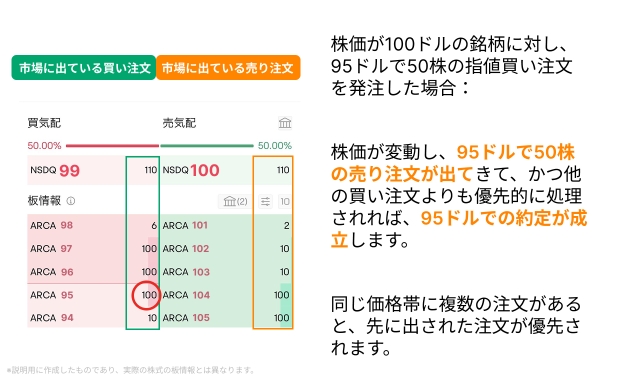

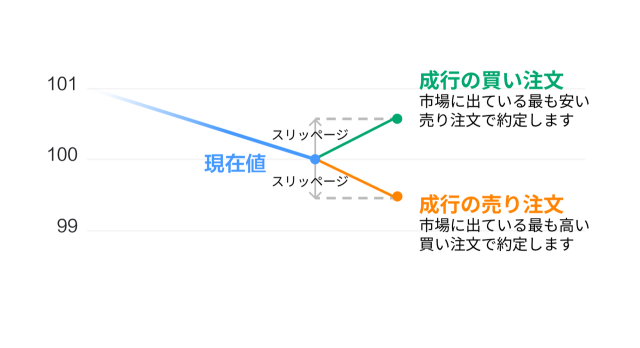

When starting to Trade Stocks, the first thing to understand is "Limit Order」and「Market Order". These are the most basic Order methods,and should be learned as fundamental actions in stock investment.It is important to prepare in advance. This article will explain in detail the mechanisms of each order method and their useful scenarios.Limit Order: An order method that specifies the transaction price.A Limit Order is an order method that specifies the buy/sell transaction price. For example, a limit order to buy is placed at $95 for a stock priced at $100.

It will only be filled at the specified price or a more favorable price. If the stock price does not reach the specified price, it will not be filled.

Even if the specified price is reached, the order may not be executed if the order quantity is insufficient.Scenarios for using a Limit Order include when you want to buy or sell at a desired price.Example: "I want to Buy a stock that is $100 when it drops to $95". It can be good to specify a price based on key points on the Candlestick (e.g., moving averages).When wanting to avoid sudden market fluctuations.Even during sharp rises or falls, it is possible to avoid the risk of being All Filled at an unintended price. Since slippage does not occur like it does with a Market Order, calm trading becomes possible.When dealing with stocks with low liquidity...

It will only be filled at the specified price or a more favorable price. If the stock price does not reach the specified price, it will not be filled.

Even if the specified price is reached, the order may not be executed if the order quantity is insufficient.Scenarios for using a Limit Order include when you want to buy or sell at a desired price.Example: "I want to Buy a stock that is $100 when it drops to $95". It can be good to specify a price based on key points on the Candlestick (e.g., moving averages).When wanting to avoid sudden market fluctuations.Even during sharp rises or falls, it is possible to avoid the risk of being All Filled at an unintended price. Since slippage does not occur like it does with a Market Order, calm trading becomes possible.When dealing with stocks with low liquidity...

Translated

+2

51

8

moomoo 学ぶ

liked

Precision medicine utilizing AIis being provided in the USA. $Tempus AI (TEM.US)$The stock price is rebounding. Tempus has just been listed on the Nasdaq market in June 2024, and it is a stock with high volatility.Former Speaker of the House Nancy Pelosiand"Queen of Tech" Cathy Wood's ARK Invest ManagementIt is attracting attention due to its shareholding. $SoftBank Group (9984.JP)$Also holds 3.23% of the company's shares, approaching ARK's investment ratio of 3.3%.

![]() The Volume MACD is showing a bullish signal.

The Volume MACD is showing a bullish signal.

On March 24, Tempus AI stock in the USA surpassed all short-term, medium-term, and long-term moving averages (5-day to 200-day).It surged by 14.9%.In addition to the price MACD sending a buy signal, the Volume MACD (VMACD) that combines volume and MACD also indicated a bullish signal.A cross indicating a shift to an upward trend is formed.Did.

▼ Volume MACD (VMACD) is

It is a Technical Indicator combining Volume and MACD, which can capture trend reversals through the intersection of two lines and the histogram....

On March 24, Tempus AI stock in the USA surpassed all short-term, medium-term, and long-term moving averages (5-day to 200-day).It surged by 14.9%.In addition to the price MACD sending a buy signal, the Volume MACD (VMACD) that combines volume and MACD also indicated a bullish signal.A cross indicating a shift to an upward trend is formed.Did.

▼ Volume MACD (VMACD) is

It is a Technical Indicator combining Volume and MACD, which can capture trend reversals through the intersection of two lines and the histogram....

Translated

![Pelosi & Cathy's stock, 'Tempus AI,' has rebounded sharply! How high will it rise? Has the lower limit firmed up? [Technical Analysis]](https://sgsnsimg.moomoo.com/sns_client_feed/181000001/20250325/0e3ee4360ae74b40f27f740f30101532.png/thumb?area=105&is_public=true)

![Pelosi & Cathy's stock, 'Tempus AI,' has rebounded sharply! How high will it rise? Has the lower limit firmed up? [Technical Analysis]](https://sgsnsimg.moomoo.com/sns_client_feed/181000001/20250325/32b716a75b3ec019c3804337d8e5ceb2.png/thumb?area=105&is_public=true)

![Pelosi & Cathy's stock, 'Tempus AI,' has rebounded sharply! How high will it rise? Has the lower limit firmed up? [Technical Analysis]](https://sgsnsimg.moomoo.com/sns_client_feed/181000001/20250325/9523991920c5d429fd4f09f9e55ee54c.png/thumb?area=105&is_public=true)

+2

37

2

27

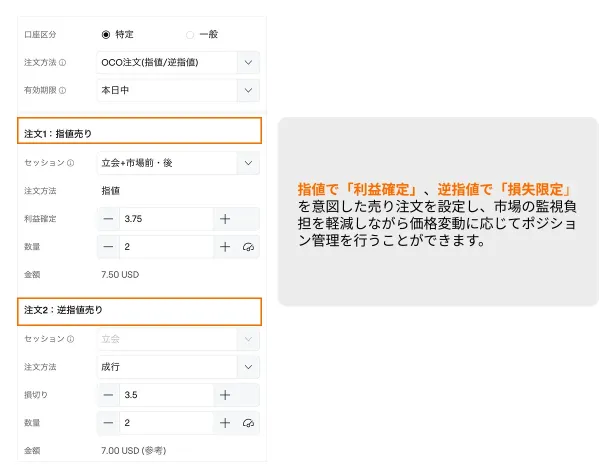

OCO Orders and Algorithm Orders, utilized by Institutions and professional traders, may sound complicated just by their names, but once the mechanism is understood, they become a means to support planned trading without being influenced by emotions. This article explains OCO Orders and Algorithm Orders (TWAP, VWAP, POV).

What is an OCO Order?

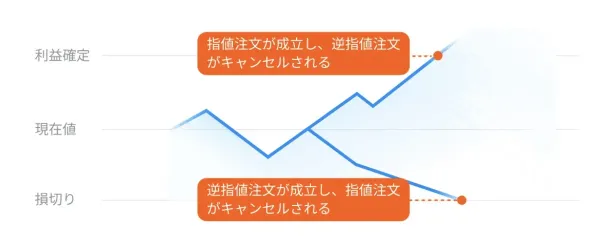

OCOIn an (One-Cancels-Other) Order,A Limit Order and Stop Limit Order are combined and placed simultaneously.When one is All Filled, the other is automatically canceled.

OCO Order is valid only when selling the Stocks that are held.OCO Order refers to.

OCO Order.

The mechanism of OCO Order.

For example, for a stock held at one hundred dollars, you can set the OCO Order as follows.

"Limit sell order to take profit at one hundred ten dollars."

"Stop loss sell order at ninety-five dollars."

If the sale is completed when reaching 110 dollars, the stop-loss order will be automatically canceled.

On the contrary, if it drops to 95 dollars and the stop-loss is executed, the profit-taking limit order will be automatically canceled.

Mechanism of OCO order.

Oh...

What is an OCO Order?

OCOIn an (One-Cancels-Other) Order,A Limit Order and Stop Limit Order are combined and placed simultaneously.When one is All Filled, the other is automatically canceled.

OCO Order is valid only when selling the Stocks that are held.OCO Order refers to.

OCO Order.

The mechanism of OCO Order.

For example, for a stock held at one hundred dollars, you can set the OCO Order as follows.

"Limit sell order to take profit at one hundred ten dollars."

"Stop loss sell order at ninety-five dollars."

If the sale is completed when reaching 110 dollars, the stop-loss order will be automatically canceled.

On the contrary, if it drops to 95 dollars and the stop-loss is executed, the profit-taking limit order will be automatically canceled.

Mechanism of OCO order.

Oh...

Translated

+2

20

6

Interest rates are one of the important factors in investment, and it is essential to deepen understanding of the Bond market before the FOMC meeting that determines the policy interest rate.

In this FOMC meeting, 'holding the policy interest rate steady' is considered likely. Looking back at past cases, in markets where such expectations have already been priced in, there were instances where Bond prices rose (interest rates fell) after the FOMC.

In the current situation where concerns about a recession and expectations for interest rate cuts are affecting market psychology, learning about the factors that influence Bond yields will be useful for future investment strategies.

This content provides a detailed explanation of important points to know about USA Bonds. Check it out now and grab hints to read the market outlook!

▼▼▼

Even for Stocks investors, there are benefits to focusing on Bonds now!

Translated

9

1

moomoo 学ぶ

liked

USA Stocks are struggling to find a bottom.On March 10, the S&P 500 Index fell by 2.7%,falling below the 200-day moving average.The 200-day moving average is often seen as an indicator of long-term trends, garnering strong interest from Institutions. When it falls below this level, there might be short-term buying aimed at a self-rebound,but it raises questions about whether it indicates a breakdown of the long-term trend.After all, at this moment,Concerns about a recession in the USA are growing due to Trump's tariff policy....

While uncertainty surrounding tariffs continues, if Trump's promise of tax cuts is still far off, caution towards further declines may increase.US stocks plummeted due to Trump's tariffs.Comparing the market situation of 2018 with the current situation.Looking for investment hints based on this.Insights from 2018's experiences and the perspective of diversified investment.FromRecession-resistant USA Stock ETFandForeign Stocks (excluding USA) ETF, andIntroducing ETFs other than StocksProvide.

![]() Concerns over Trump's tariffs have led to a significant adjustment in US stocks.

Concerns over Trump's tariffs have led to a significant adjustment in US stocks.

The S&P 500 Index ( $S&P 500 Index (.SPX.US)$ ) has been in a downward trend since hitting the high on February 19, and on March 10 it closed below the 200-day moving average...

While uncertainty surrounding tariffs continues, if Trump's promise of tax cuts is still far off, caution towards further declines may increase.US stocks plummeted due to Trump's tariffs.Comparing the market situation of 2018 with the current situation.Looking for investment hints based on this.Insights from 2018's experiences and the perspective of diversified investment.FromRecession-resistant USA Stock ETFandForeign Stocks (excluding USA) ETF, andIntroducing ETFs other than StocksProvide.

The S&P 500 Index ( $S&P 500 Index (.SPX.US)$ ) has been in a downward trend since hitting the high on February 19, and on March 10 it closed below the 200-day moving average...

Translated

![How much further will USA Stocks fall? A comparison with the "Trump 1.0" crash due to tariffs! Candidate refuge options: [7 ETFs]](https://sgsnsimg.moomoo.com/sns_client_feed/181000001/20250311/web-1741674286810-OFVxtalAmf.png/thumb?area=105&is_public=true)

![How much further will USA Stocks fall? A comparison with the "Trump 1.0" crash due to tariffs! Candidate refuge options: [7 ETFs]](https://sgsnsimg.moomoo.com/sns_client_feed/181000001/20250311/web-1741676497140-YQWGkpZcsL.png/thumb?area=105&is_public=true)

![How much further will USA Stocks fall? A comparison with the "Trump 1.0" crash due to tariffs! Candidate refuge options: [7 ETFs]](https://sgsnsimg.moomoo.com/sns_client_feed/181000001/20250311/web-1741674285603-DTIFl3snIg.png/thumb?area=105&is_public=true)

+14

76

64

Bitcoin rebounded by about 10% over the weekend on Saturday and Sunday.

In fact, on the 28th (Friday), the daily Candlestick Chart of Bitcoin showed thatthe sign of a trend reversal, the "Hammer," appeared.appeared.

Let's take this opportunity to learn together how to identify the "Hammer" in the Candlestick Chart.

How to distinguish hammer (tonkachi) candlesticks.

How to distinguish inverse hammer (tonkachi) candlesticks?

$Coinbase (COIN.US)$ $Strategy (MSTR.US)$ $Bitcoin (BTC.CC)$ $T-Rex 2X Inverse MSTR Daily Target ETF (MSTZ.US)$ $T-Rex 2X Long MSTR Daily Target ETF (MSTU.US)$ $NVIDIA (NVDA.US)$

In fact, on the 28th (Friday), the daily Candlestick Chart of Bitcoin showed thatthe sign of a trend reversal, the "Hammer," appeared.appeared.

Let's take this opportunity to learn together how to identify the "Hammer" in the Candlestick Chart.

How to distinguish hammer (tonkachi) candlesticks.

How to distinguish inverse hammer (tonkachi) candlesticks?

$Coinbase (COIN.US)$ $Strategy (MSTR.US)$ $Bitcoin (BTC.CC)$ $T-Rex 2X Inverse MSTR Daily Target ETF (MSTZ.US)$ $T-Rex 2X Long MSTR Daily Target ETF (MSTU.US)$ $NVIDIA (NVDA.US)$

Translated

34

4

moomoo 学ぶ

voted

To make your US stock investment more accessible, MOOMOO Securities has introduced the "micro US Stocks (Fractional Stocks)" service, which can be traded from 1 US dollar. has been newly introduced!

Even for those new to investing or those hoping to invest small amounts, you can now easily start investing in US stocks.

What are micro cap stocks in the US?

Normally, trading US stocks is based on trading in units of one share, but with micro cap US stocksInvesting is possible with less than one share, starting from one dollar!Order placement includesSpecifying the number of sharesandSpecifying the amountCan be selected.

Specifying the number of shares: Purchase is possible from 0.0001 shares.

For stocks with a price of 1 dollar or more, you can buy from 0.01 shares.You can buy from 0.01 shares.Additionally, concurrent ordering of single unit physical stocks is possible (market and limit orders only).

Specifying the amount:1 DollarCan be purchased from.

Now, receive a 500 yen cash back on your first U.S. stock trade! Check it out now >>

The appeal of micro US stocks (fractional stocks)

With industry-leading* trading fees of 0.132% (including tax), and 0 yen for NISA growth accounts!Even if there is a surplus of the growth investment quota in NISA,Aim for full utilization up to the limit!

Begin with beginner-friendly experiential investmentsStart investing with a smaller amount, and...

Even for those new to investing or those hoping to invest small amounts, you can now easily start investing in US stocks.

What are micro cap stocks in the US?

Normally, trading US stocks is based on trading in units of one share, but with micro cap US stocksInvesting is possible with less than one share, starting from one dollar!Order placement includesSpecifying the number of sharesandSpecifying the amountCan be selected.

Specifying the number of shares: Purchase is possible from 0.0001 shares.

For stocks with a price of 1 dollar or more, you can buy from 0.01 shares.You can buy from 0.01 shares.Additionally, concurrent ordering of single unit physical stocks is possible (market and limit orders only).

Specifying the amount:1 DollarCan be purchased from.

Now, receive a 500 yen cash back on your first U.S. stock trade! Check it out now >>

The appeal of micro US stocks (fractional stocks)

With industry-leading* trading fees of 0.132% (including tax), and 0 yen for NISA growth accounts!Even if there is a surplus of the growth investment quota in NISA,Aim for full utilization up to the limit!

Begin with beginner-friendly experiential investmentsStart investing with a smaller amount, and...

Translated

80

11

15

moomoo 学ぶ

liked

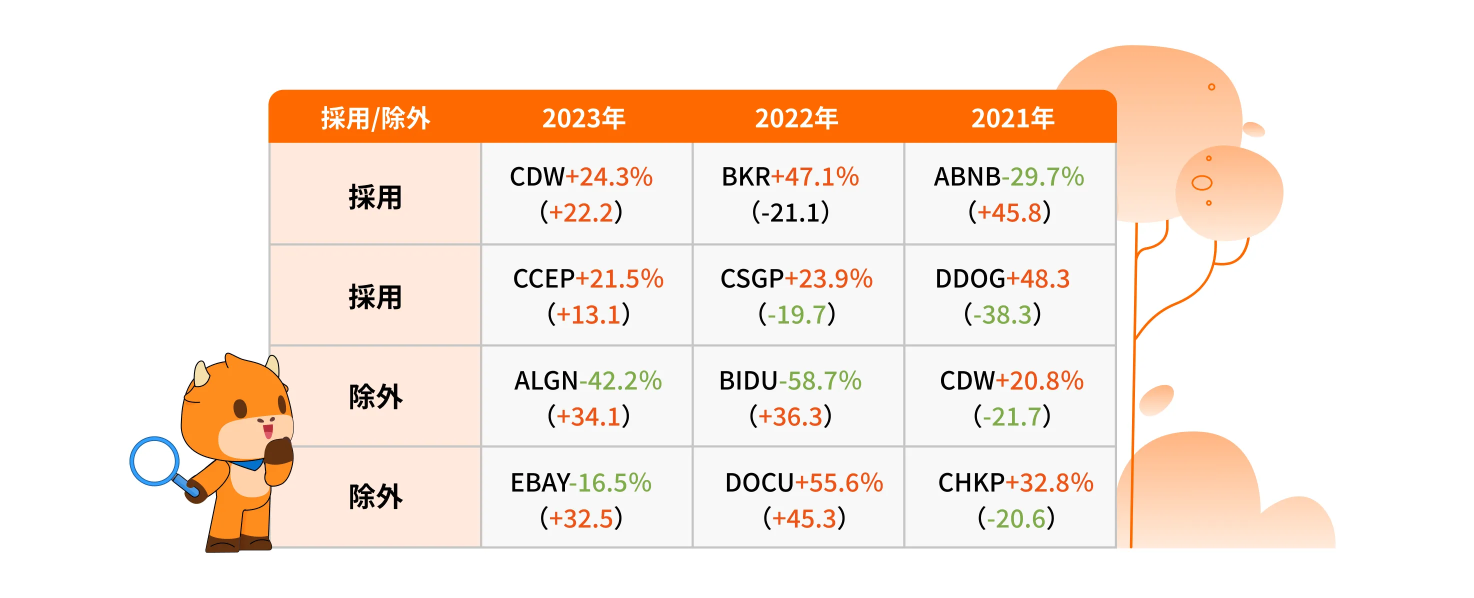

It is often considered positive when the held positions are included in an index. In this case, I will introduce the reasons why inclusion or exclusion from the Nasdaq 100 Index can cause stock price movements.

The Nasdaq 100 Index conducts a regular reconstitution of constituent stocks on the second Friday of December each year.For stocks where inclusion or exclusion from the index is anticipated, certain price fluctuations may be observed. This is because expectations for the "Index Effect" suggest the possibility of price increase or decrease.Index Effectsuggesting the possibility of price increase or decrease due to expectations of the Index Effect.

The index effect refers to the phenomenon where the included components of a stock price index change, causing the adopted components to rise and the excluded components to decline.

Check the performance of past included/excluded stocks.

When looking at the past performance of included/excluded stocks,The index effect is reflected in the stock price before the actual replacement occurs.It can be observed that there is a tendency for expectations towards index inclusion to impact stock prices before the actual change happens. Be aware that if expectations towards index inclusion go too far, there is a possibility that stock prices may drop.

Please check out the detailed explanation from this link below!!! ↓↓↓↓↓

If included in the Nasdaq component, will it rise when selected?

The Nasdaq 100 Index conducts a regular reconstitution of constituent stocks on the second Friday of December each year.For stocks where inclusion or exclusion from the index is anticipated, certain price fluctuations may be observed. This is because expectations for the "Index Effect" suggest the possibility of price increase or decrease.Index Effectsuggesting the possibility of price increase or decrease due to expectations of the Index Effect.

The index effect refers to the phenomenon where the included components of a stock price index change, causing the adopted components to rise and the excluded components to decline.

Check the performance of past included/excluded stocks.

When looking at the past performance of included/excluded stocks,The index effect is reflected in the stock price before the actual replacement occurs.It can be observed that there is a tendency for expectations towards index inclusion to impact stock prices before the actual change happens. Be aware that if expectations towards index inclusion go too far, there is a possibility that stock prices may drop.

Please check out the detailed explanation from this link below!!! ↓↓↓↓↓

If included in the Nasdaq component, will it rise when selected?

Translated

34

2

moomoo 学ぶ

liked and voted

Dear users,

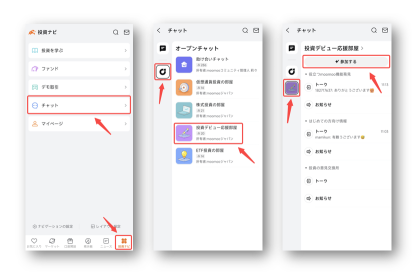

Thank you very much for using the moomoo app as always. This time, in order for everyone to use the app more comfortably, 'Open Chat' will be introduced to you.

What is Open Chat?

By utilizing the open chat function, you can exchange information and opinions in real time with other investors and traders, as well as actively determine.Market TrendsandHot stocksYou can actively participate in discussions about it. Through discussions among participants,fresh investment perspectivesandMarket outlookis being utilized as a place to share and deepen mutual learning.There are opportunities to receive advice and tips from experienced investors, further expanding the range of investment decisions.It is also full of information to widen the scope of investment decisions, as it is utilized as a place to deepen mutual learning.

How to use the open chat function

●How to join an open chat.

Steps: Navigate to 'Investment Navi' > 'Chat' > 'Discover' > Tap on Open Chat > Click on 'Join'.

●Setting up message notifications.

Steps: Tap on the open chat name > Select 'Notification Settings'.

●How to invite other users to an open chat.

Steps: Open Chat > Click on "Invite"

●Open chat, huh...

Thank you very much for using the moomoo app as always. This time, in order for everyone to use the app more comfortably, 'Open Chat' will be introduced to you.

What is Open Chat?

By utilizing the open chat function, you can exchange information and opinions in real time with other investors and traders, as well as actively determine.Market TrendsandHot stocksYou can actively participate in discussions about it. Through discussions among participants,fresh investment perspectivesandMarket outlookis being utilized as a place to share and deepen mutual learning.There are opportunities to receive advice and tips from experienced investors, further expanding the range of investment decisions.It is also full of information to widen the scope of investment decisions, as it is utilized as a place to deepen mutual learning.

How to use the open chat function

●How to join an open chat.

Steps: Navigate to 'Investment Navi' > 'Chat' > 'Discover' > Tap on Open Chat > Click on 'Join'.

●Setting up message notifications.

Steps: Tap on the open chat name > Select 'Notification Settings'.

●How to invite other users to an open chat.

Steps: Open Chat > Click on "Invite"

●Open chat, huh...

Translated

+1

58

6

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)