mutualtrader

Set a live reminder

With the U.S. election over, what ripple effects will the political shifts bring to Malaysia’s market? Join us as we explore the aftermath, adjustments, and opportunities on the horizon. Don’t miss out—tune in on Wednesday, November 13, at 8 p.m. for an exclusive live stream hosted by Nanyang Siang Pau (NYSP) in collaboration with KOLs Zeff Tan and Max Tan Kyzen from Moomoo. We’ll cover the post-election outlook, market reactions, and offer f...

Translated

特朗普重掌白宫,探亚洲马股喜忧

Nov 13 06:00

160

68

mutualtrader

voted

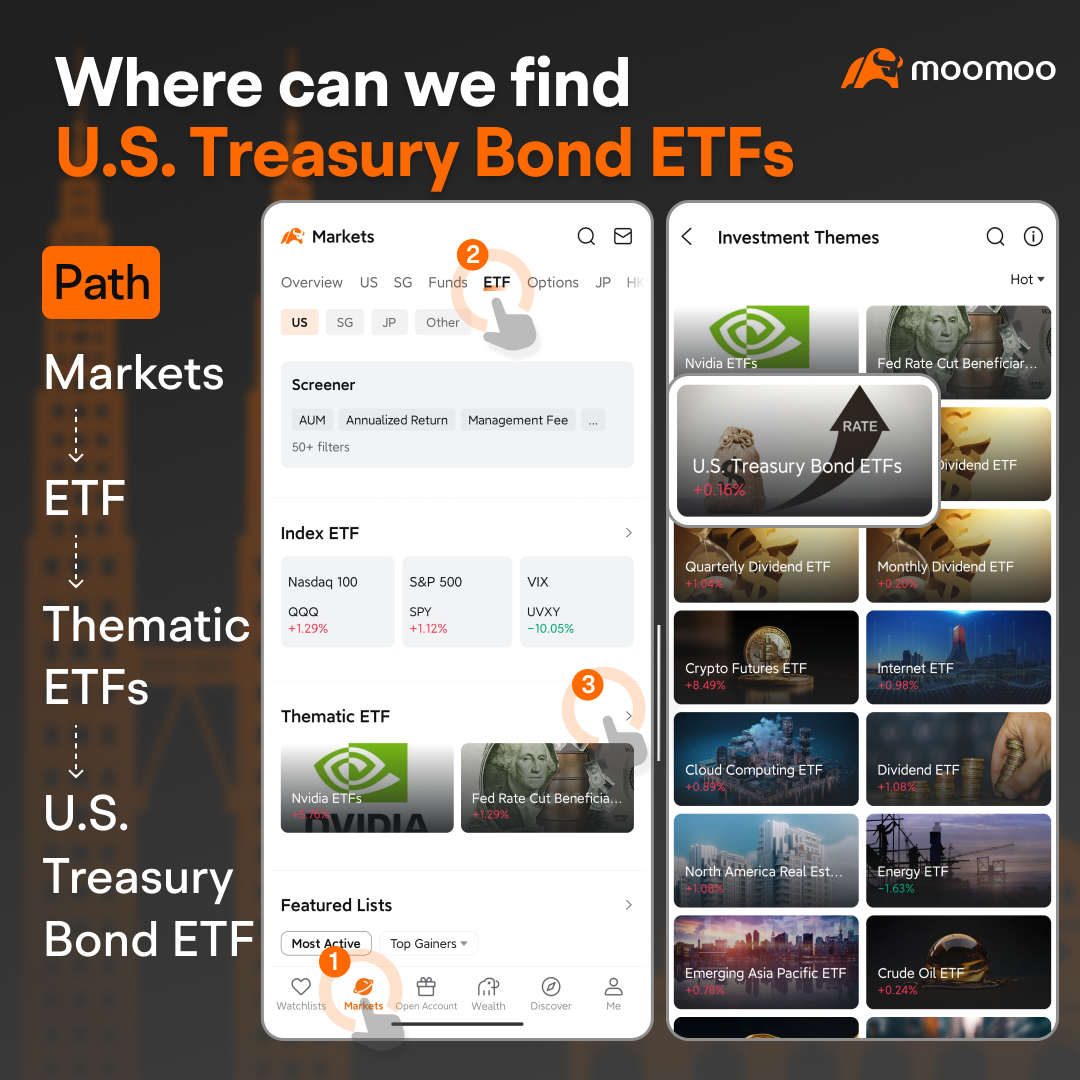

The much-anticipated rate cut decision has finally arrived, with the Federal Reserve announcing a 50 basis point rate cut! At this pivotal moment, investors need to have a deeper understanding of the background and impact of rate cuts.

Since March 2022, in a bid to curb inflation, the Fed has hiked rates 11 times, bringing it to the current range of 5.25%-5.50%. Now that inflation is under control, the calls for a rate cut are growin...

Since March 2022, in a bid to curb inflation, the Fed has hiked rates 11 times, bringing it to the current range of 5.25%-5.50%. Now that inflation is under control, the calls for a rate cut are growin...

+4

401

177

mutualtrader

voted

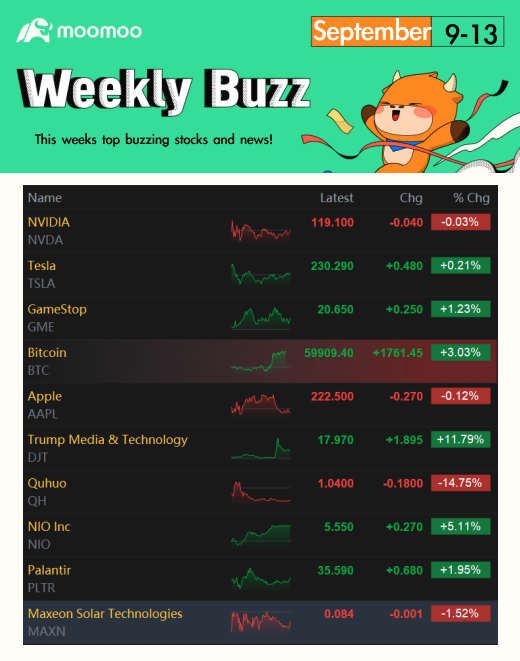

Happy Friday, mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the top ten buzzing stocks on moomoo based on search and message volumes! Comment below to answer the Weekly Topic question for a chance to win an award!

Make Your Choice

Weekly Buzz

Happy Friday, traders. The market climbed this week after a rough start in September. Wednesday, the market decline turned around by the afternoon af...

Make Your Choice

Weekly Buzz

Happy Friday, traders. The market climbed this week after a rough start in September. Wednesday, the market decline turned around by the afternoon af...

+11

34

22

mutualtrader

voted

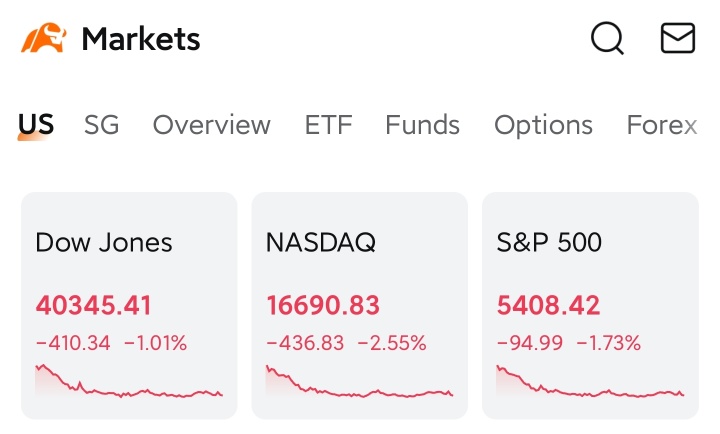

Last week, the U.S. ADP report and non-farm payroll data for August were released, indicating a slowdown in the labor market.

– Private employment: 99k (Actual), 145k (Expected);

– Non farm payrolls: 142k (Actual), 165k (Expected);

– Unemployment rate: 4.2% (2024/8) , 3.7% (2023/8).

Investor concerns about a potential recession in the U.S. have intensified, leading to a collective decline in the three major U.S. stock...

– Private employment: 99k (Actual), 145k (Expected);

– Non farm payrolls: 142k (Actual), 165k (Expected);

– Unemployment rate: 4.2% (2024/8) , 3.7% (2023/8).

Investor concerns about a potential recession in the U.S. have intensified, leading to a collective decline in the three major U.S. stock...

+3

360

184

mutualtrader

commented on

mutualtrader

voted

Timetable of IPO

Figure 1: IPO timetable of SDCG

Source: $SDCG (0321.MY)$ IPO Prospectus

-Will be listed on the ACE Board

Full Video for SDCG IPO (Chinese version) - YouTube

Info of IPO

Enlarged no. of shares upon listing: 423.82246 million

IPO price: RM0.38

Market capitalization: RM161.05 million

Estimated funds to raise from Public Issue: RM45.09 million

PE ratio = 25.36x (based on FY2023)

Business Model

Figure 2: Business model of SDCG

Sour...

Figure 1: IPO timetable of SDCG

Source: $SDCG (0321.MY)$ IPO Prospectus

-Will be listed on the ACE Board

Full Video for SDCG IPO (Chinese version) - YouTube

Info of IPO

Enlarged no. of shares upon listing: 423.82246 million

IPO price: RM0.38

Market capitalization: RM161.05 million

Estimated funds to raise from Public Issue: RM45.09 million

PE ratio = 25.36x (based on FY2023)

Business Model

Figure 2: Business model of SDCG

Sour...

+4

2

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)