My Mleczynski

liked

After the latest Purchasing Managers' Index (PMI) showed an expansion in the manufacturing sector but revealed an increase in the "prices paid" index during December, the major U.S. indices lost ground, with S&P 500 slipped 1.11%. Underperformance in the technology sector dragged on the NASDAQ which fell 1.89%, while the DJIA ended the session 0.42% lower.

The indication of pricing pressure in the final month of 2024 could ...

The indication of pricing pressure in the final month of 2024 could ...

+3

25

2

My Mleczynski

liked

Hey mooers! ![]()

I hope you have enjoyed your holidays well! And a belated Happy New Year to y'all!![]()

A new and improved version of Weekly Syrup is back! Check now!

(Feel free to drop any feedback to us on this column)

On Thursday, January 2, $Tesla (TSLA.US)$ saw a sharp decline in its stock value following its announcement of fourth-quarter deliveries that did not meet anticipated targets. At the start of trading, the stock fell b...

I hope you have enjoyed your holidays well! And a belated Happy New Year to y'all!

A new and improved version of Weekly Syrup is back! Check now!

(Feel free to drop any feedback to us on this column)

On Thursday, January 2, $Tesla (TSLA.US)$ saw a sharp decline in its stock value following its announcement of fourth-quarter deliveries that did not meet anticipated targets. At the start of trading, the stock fell b...

+4

26

5

My Mleczynski

liked

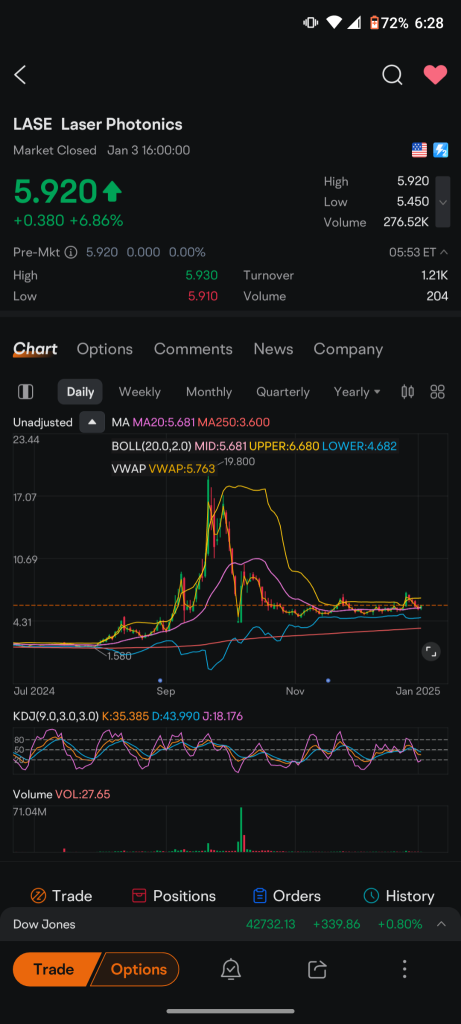

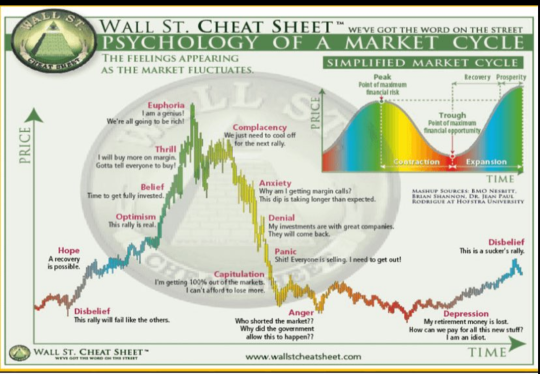

$Laser Photonics (LASE.US)$ you see this chart pattern in many small cap and large cap stocks for that matter where momentum takes over you have this velocity effect that everybody is chasing and stocks get catapulted to astronomical levels.

ultimately it's not sustainable and smart money moves on and the rallies get less and less.

this is the exact chart pattern with this company

the euphoria phase has ended, the omg I fked phase is over.. and now we're in gradual accumulation.

I think the f...

ultimately it's not sustainable and smart money moves on and the rallies get less and less.

this is the exact chart pattern with this company

the euphoria phase has ended, the omg I fked phase is over.. and now we're in gradual accumulation.

I think the f...

10

My Mleczynski

liked

(Kuala Lumpur, 3rd) Analysts pointed out that the stock performance of gambling companies last year lagged behind the FTSE Bursa Malaysia KLCI, but they believe it will gradually rebound in the first half of 2025.

Dahua Jixian pointed out: 'We believe that the industry's profit growth, undervalued financial indicators, and generous dividend yield are very compatible with our potential lagging investment strategy.'

'We expect profits to strengthen seasonally from the fourth quarter of the 2024 fiscal year (4Q24) to the first half of 2025, mainly due to the influx of international tourists and a strong domestic consumption trend.'

This will lead to a gradual recovery of the industry's stock price in the first half of this year, but the momentum is relatively mild.

According to the data from this research institution, the trend of tourism consumption is still in a growth range, with a year-on-year increase of 4.9% in consumer spending in the third quarter of 2024.

"Our channel survey shows that the business volume of two sectors, casinos and numbers forecast operations, remained strong between October and November 2024."

"In the casino sector, multiple related indicators (such as flight capacity and international tourist visitation) have all increased month-on-month. As for the numbers forecast operations, lottery sales have recovered and stabilized at over 90% of the pre-pandemic levels."

The report points out that the valuation of the Gambling industry is currently 1.5 to 2 standard deviations below the average level, very attractive as it is still in the early stages after the pandemic.

"In addition, the industry still offers a lucrative weekly dividend yield of 5.1% to 10.5%, benefiting from the period between 2024 and 2025...

Dahua Jixian pointed out: 'We believe that the industry's profit growth, undervalued financial indicators, and generous dividend yield are very compatible with our potential lagging investment strategy.'

'We expect profits to strengthen seasonally from the fourth quarter of the 2024 fiscal year (4Q24) to the first half of 2025, mainly due to the influx of international tourists and a strong domestic consumption trend.'

This will lead to a gradual recovery of the industry's stock price in the first half of this year, but the momentum is relatively mild.

According to the data from this research institution, the trend of tourism consumption is still in a growth range, with a year-on-year increase of 4.9% in consumer spending in the third quarter of 2024.

"Our channel survey shows that the business volume of two sectors, casinos and numbers forecast operations, remained strong between October and November 2024."

"In the casino sector, multiple related indicators (such as flight capacity and international tourist visitation) have all increased month-on-month. As for the numbers forecast operations, lottery sales have recovered and stabilized at over 90% of the pre-pandemic levels."

The report points out that the valuation of the Gambling industry is currently 1.5 to 2 standard deviations below the average level, very attractive as it is still in the early stages after the pandemic.

"In addition, the industry still offers a lucrative weekly dividend yield of 5.1% to 10.5%, benefiting from the period between 2024 and 2025...

Translated

27

5

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)