MyHeadsAboveTheH2o

liked

Michael Saylor to present to the Microsoft Board next month on buyiong Bitcoin for their corporate treasury

$MicroStrategy (MSTR.US)$ $Coinbase (COIN.US)$ $iShares Bitcoin Trust (IBIT.US)$ $Iris Energy (IREN.US)$ $Microsoft (MSFT.US)$ $Alphabet-C (GOOG.US)$ $Apple (AAPL.US)$ $Advanced Micro Devices (AMD.US)$ $NVIDIA (NVDA.US)$ $Super Micro Computer (SMCI.US)$ $CleanSpark (CLSK.US)$ $Bitcoin (BTC.CC)$ $Vanguard S&P 500 ETF (VOO.US)$ $SPDR S&P 500 ETF (SPY.US)$ $iShares Core S&P 500 ETF (IVV.US)$ $iShares Russell 2000 ETF (IWM.US)$ $ARK 21Shares Bitcoin ETF (ARKB.US)$ $Valkyrie Bitcoin Fund (BRRR.US)$ $VanEck Bitcoin Trust (HODL.US)$

$MicroStrategy (MSTR.US)$ $Coinbase (COIN.US)$ $iShares Bitcoin Trust (IBIT.US)$ $Iris Energy (IREN.US)$ $Microsoft (MSFT.US)$ $Alphabet-C (GOOG.US)$ $Apple (AAPL.US)$ $Advanced Micro Devices (AMD.US)$ $NVIDIA (NVDA.US)$ $Super Micro Computer (SMCI.US)$ $CleanSpark (CLSK.US)$ $Bitcoin (BTC.CC)$ $Vanguard S&P 500 ETF (VOO.US)$ $SPDR S&P 500 ETF (SPY.US)$ $iShares Core S&P 500 ETF (IVV.US)$ $iShares Russell 2000 ETF (IWM.US)$ $ARK 21Shares Bitcoin ETF (ARKB.US)$ $Valkyrie Bitcoin Fund (BRRR.US)$ $VanEck Bitcoin Trust (HODL.US)$

8

1

MyHeadsAboveTheH2o

reacted to

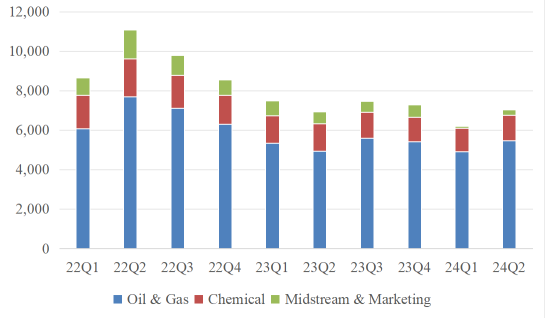

OOXY.US expects to release its third quarter 2024 financial report after the market closes on November 12, 2024, Eastern Time. As a leading global energy company, OXY's performance in the oil and gas industry has been highly anticipated. In 2024, OXY further consolidated its position in the Permian Basin through a series of strategic measures, such as the $12 billion acquisition of CrownRock wi...

17

MyHeadsAboveTheH2o

Set a live reminder

While the election may be over, the implications for your portfolio are likely not. Join our panelists as they discuss the market’s reaction over the past week to the results and what’s in store for the first 100 days of the new administration. This panel will explore the historical relationship between presidential election cycles and market performance as well as the potential impact of the president-elect’s policies on specific sectors and t...

How will the election results affect your portfolio?

Nov 16 10:40

3

MyHeadsAboveTheH2o

Set a live reminder

Listen in as three women in finance share their journeys, strategies, and practical tips for women entering the trading world. This session covers overcoming challenges, debunking myths, and embracing opportunities, with actionable steps to help you start or advance your options trading path.

Helping women reach their financial goals

Nov 16 09:50

14

1

MyHeadsAboveTheH2o

Set a live reminder

Moomoo surveyed its users at the end of the quarter to find out which ones are using options and the resources and tools they are using to do so. Find out which trends are supported in the overall market through data provided by Cboe. Viewers will gain a better understanding of investors’ comfort level with options while getting familiar with the advantages of products such as index options. This session will explore what’s holding investors back f...

Insights on how moomoo users are trading options

Nov 15 13:40

1

MyHeadsAboveTheH2o

Set a live reminder

Moomoo is constantly updating its features, tools and product offerings to provide the best possible trading experience to its users. This session will examine how moomoo is working to meet its customers’ needs. Explore moomoo’s recent product rollouts including a live demo of how they work. Learn about the risk controls moomoo has in place and what the next cutting edge release will be in the coming year.

Next Gen trading: What's new on the moomoo app

Nov 16 09:00

6

MyHeadsAboveTheH2o

Set a live reminder

Event driven risk can come in all different shapes and sizes. Zero days to expiration options (0DTE) are designed to monetize high impact intraday events but it is important to understand the benefits and risks. Different 0DTE strategies can be utilized based on the type and time of a particular catalyst. Learn how to trade around economic releases, earnings releases, FOMC meetings and even surprise events and how to avoid time decay during periods of high expe...

Managing Volatile Markets with 0DTE

Nov 14 09:20

16

MyHeadsAboveTheH2o

Set a live reminder

Want to be able to distinguish fact from fiction when it comes to ETFs? This session will explain how ETFs work and who the key players are in the ecosystem. Viewers will gain understanding of the benefits of ETFs including liquidity, transparency and US tax efficiency. The use of both index and active ETF and their differences will be discussed.

Speaker:

Matt Camuso

Head of Exchange-Traded Fund (ETF) Solutions, BNY Investments

Matt ...

Speaker:

Matt Camuso

Head of Exchange-Traded Fund (ETF) Solutions, BNY Investments

Matt ...

Advantages of ETF portfolios in the current financial market

Nov 14 08:30

9

1

MyHeadsAboveTheH2o

Set a live reminder

With US elections in the rearview mirror investors have begun to set their sights on 2025. This session will recap year that was in markets including the areas investors have been finding success, the hottest investment trends, where valuations stand now and the market’s reaction to the election. Investors will learn how institutional clients are setting up into the year end and what Wellington’s best investment ideas are for 2025 as well as their expe...

Investment Ideas for 2025: Trends and Themes

Nov 14 07:40

7

MyHeadsAboveTheH2o

Set a live reminder

Earnings season is almost over and there are a lot of reports to sift through. Find out which companies and sectors performed better than expected and which did not and why. This session will explore the implications of the second quarter earnings season and companies’ outlooks for the future. Also learn how professional money managers differentiate growth and value stocks and which may be best for your portfolio.

Speaker: ...

Speaker: ...

Earnings season analysis and the truth about growth versus value stocks

Nov 15 12:50

5

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)