nameless1

liked

Link to the third quarter of 2024👉🏻Summary of the third quarter of 2024

Monthly Earnings:

October profits are moderate, November profits significantly increased, December had a slight loss.

Quarterly Trendlines:

The fourth-quarter return is 37.79%, far higher than the SPX's 3.47%, benefiting from opportunistic markets and disciplined trading within the system.

Annual Trendlines:

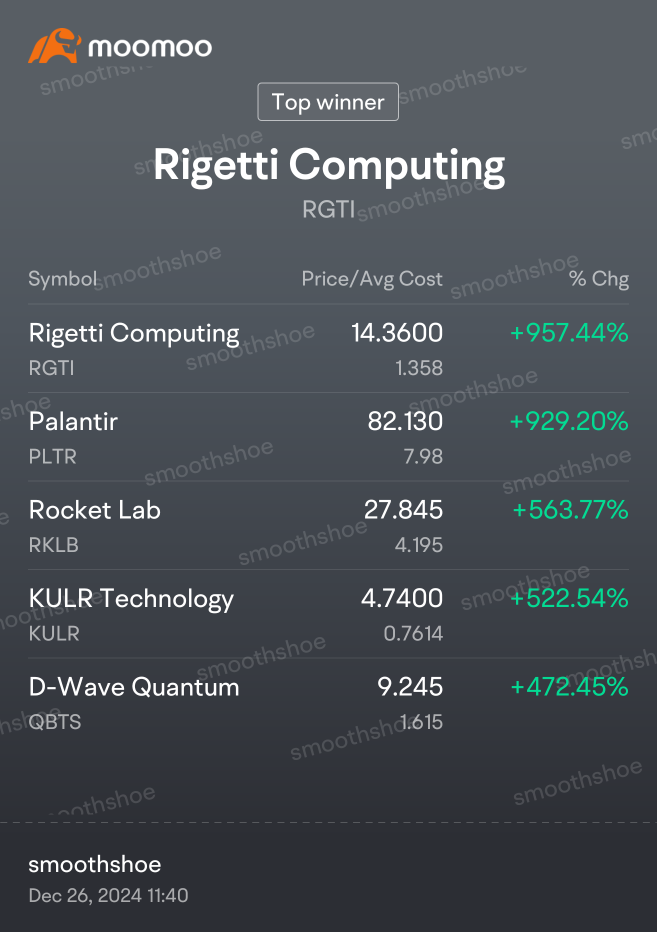

The year-to-date return is 67.74%, higher than the SPX's 23.31%; mainly benefiting from a deep self-correction after being hit hard by the market from mid-July to early August. Since then, 100% discipline has been maintained in the trading system, except for not participating in the final quantum computing theme (multiple opportunities to trade quantum computing names appeared in my screener during that time, each time struggling with too large stop loss percentages and giving up). The rest of the major breakout themes such as BTC miners, AI, and small nuclear power have all been involved; the main three entry setups are VCP, flag consolidation, and buy at the end of an uptrend pullback; some experience has been accumulated for entering flags, but there is still plenty of room for improvement.

Top 5 in profit:

$NuScale Power (SMR.US)$

It was a total of one swing trade, with the entry set at the breakout of the highest point after flag consolidation for buying. Thanks to the tight initial stop-loss, I did not get shaken out and obtained a relatively large starting position. The three sales (1/3, 1/6, 1/2) were also a moderate systematic selling strategy, both in terms of strategy execution and feedback results, I am quite satisfied...

Monthly Earnings:

October profits are moderate, November profits significantly increased, December had a slight loss.

Quarterly Trendlines:

The fourth-quarter return is 37.79%, far higher than the SPX's 3.47%, benefiting from opportunistic markets and disciplined trading within the system.

Annual Trendlines:

The year-to-date return is 67.74%, higher than the SPX's 23.31%; mainly benefiting from a deep self-correction after being hit hard by the market from mid-July to early August. Since then, 100% discipline has been maintained in the trading system, except for not participating in the final quantum computing theme (multiple opportunities to trade quantum computing names appeared in my screener during that time, each time struggling with too large stop loss percentages and giving up). The rest of the major breakout themes such as BTC miners, AI, and small nuclear power have all been involved; the main three entry setups are VCP, flag consolidation, and buy at the end of an uptrend pullback; some experience has been accumulated for entering flags, but there is still plenty of room for improvement.

Top 5 in profit:

$NuScale Power (SMR.US)$

It was a total of one swing trade, with the entry set at the breakout of the highest point after flag consolidation for buying. Thanks to the tight initial stop-loss, I did not get shaken out and obtained a relatively large starting position. The three sales (1/3, 1/6, 1/2) were also a moderate systematic selling strategy, both in terms of strategy execution and feedback results, I am quite satisfied...

Translated

+15

27

1

nameless1

liked

Potentially breaking out from a downward sloping Raff Regression model. I am long $Humacyte (HUMA.US)$ .

11

$KULR Technology (KULR.US)$

mine is broken. it does not want to go up

mine is broken. it does not want to go up

3

nameless1

liked

$KULR Technology (KULR.US)$ 🤔 will it happen again? pre market rise , normal trading hour crash again 😤

4

4

nameless1

commented on

is this just due to year end or something else??$Graphjet Technology (GTI.US)$

2

6

nameless1

reacted to

$Advanced Micro Devices (AMD.US)$ watch closely if spy comes back to 20MA (579) to retest. i think that can buy the dip during 579 spy. first batch. (im applying to desired stocks in your watchlist, not amd haha).

3 occurences this year (except for August rate hike dip). most of them rebound rather quickly. i would of course love the idea if it retraces to 542 during january, that way i can buy more good dips ahead of the year.

3 occurences this year (except for August rate hike dip). most of them rebound rather quickly. i would of course love the idea if it retraces to 542 during january, that way i can buy more good dips ahead of the year.

9

9

$Advanced Micro Devices (AMD.US)$

AMD or: How I Learned to Stop Worrying and Love DCA

AMD or: How I Learned to Stop Worrying and Love DCA

2

nameless1

commented on

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)