natymerej

reacted to

natymerej

liked

Previous Hightlight

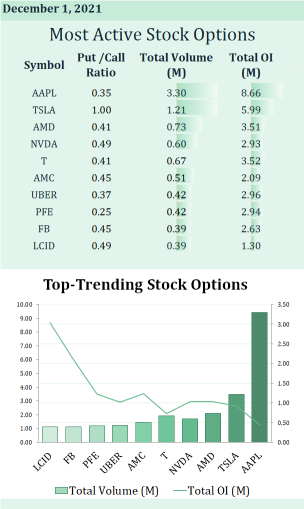

I ain't gonna lie, yesterday's market was quite something. $Apple (AAPL.US)$ and $Tesla (TSLA.US)$ were the only two companies that survived the panic selling. I hope you have got a taste of my column since Apple has been the top one for a while.

AAPL stock is up more than 3% for the day, following the news of the long-awaited iPhone release. MacRumors has reported that the Big Tech innovator is planning on releasing the third-generation iPhone SE within the first quarter of the coming year. There are still plenty of options that are betting the stock will keep surging.

$Pfizer (PFE.US)$ Pfizer Inc.'s top viral vaccine-science executive is leaving the pharmaceutical giant for rival GlaxoSmithKline PLC, a high-profile industry move that comes as Pfizer and other vaccine makers scramble to assess how their shots will stand up to a new variant of the coronavirus that causes Covid-19. $Merck & Co (MRK.US)$ Merck said its believes its COVID-19 antiviral drug will have similar activity against any new coronavirus variant, according to Reuters.Read more at:https://thefly.com/n.php?id=3418515

$Uber Technologies (UBER.US)$ Technology-enabled mobility services provider Uber Technologies recently revealed that it has joined hands with a multi-specialty telehealth platform, Hims & Hers Health, Inc., to deliver its products to customers through Uber Eats app and Postmates, a separate delivery app owned by Uber.

$Lucid Group (LCID.US)$ Lucid presents one of the biggest threats to both legacy automakers and Tesla; we're excited to see how the Lucid Air changes the game, and we're even more excited to see what the company's second effort looks like." said MotorTrend review.

How to read the chart

· The chart shows stocks with the most option activities of the previous trading day.

· Put/Call ratio >0.7 means more the stock attract more bears than bulls.![]()

![]()

![]() Put/Call ratio<0.7 means the stock attract more bulls than bears.

Put/Call ratio<0.7 means the stock attract more bulls than bears.![]()

![]()

![]()

· Option volume indicates the shares of contracts traded for the day.

· Open interest indicates the total number of option contracts that are currently open – that means they are not yet exercised or offset.![]()

![]()

![]()

Quick option tutorial

Options trading for beginners: How to access options function on mm![]()

Explore the world of option trading with: Intro to options.![]()

Improve your option trading knowledge: Key elements on the table![]()

![]()

![]()

![]()

![]() Follow me to keep receiving the latest critical market movement and keep FOMO away.

Follow me to keep receiving the latest critical market movement and keep FOMO away.![]()

![]()

I ain't gonna lie, yesterday's market was quite something. $Apple (AAPL.US)$ and $Tesla (TSLA.US)$ were the only two companies that survived the panic selling. I hope you have got a taste of my column since Apple has been the top one for a while.

AAPL stock is up more than 3% for the day, following the news of the long-awaited iPhone release. MacRumors has reported that the Big Tech innovator is planning on releasing the third-generation iPhone SE within the first quarter of the coming year. There are still plenty of options that are betting the stock will keep surging.

$Pfizer (PFE.US)$ Pfizer Inc.'s top viral vaccine-science executive is leaving the pharmaceutical giant for rival GlaxoSmithKline PLC, a high-profile industry move that comes as Pfizer and other vaccine makers scramble to assess how their shots will stand up to a new variant of the coronavirus that causes Covid-19. $Merck & Co (MRK.US)$ Merck said its believes its COVID-19 antiviral drug will have similar activity against any new coronavirus variant, according to Reuters.Read more at:https://thefly.com/n.php?id=3418515

$Uber Technologies (UBER.US)$ Technology-enabled mobility services provider Uber Technologies recently revealed that it has joined hands with a multi-specialty telehealth platform, Hims & Hers Health, Inc., to deliver its products to customers through Uber Eats app and Postmates, a separate delivery app owned by Uber.

$Lucid Group (LCID.US)$ Lucid presents one of the biggest threats to both legacy automakers and Tesla; we're excited to see how the Lucid Air changes the game, and we're even more excited to see what the company's second effort looks like." said MotorTrend review.

How to read the chart

· The chart shows stocks with the most option activities of the previous trading day.

· Put/Call ratio >0.7 means more the stock attract more bears than bulls.

· Option volume indicates the shares of contracts traded for the day.

· Open interest indicates the total number of option contracts that are currently open – that means they are not yet exercised or offset.

Quick option tutorial

Options trading for beginners: How to access options function on mm

Explore the world of option trading with: Intro to options.

Improve your option trading knowledge: Key elements on the table

48

3

natymerej

liked

Shares of $Moderna (MRNA.US)$, which developed a COVID-19 vaccine, tumbled 22% at intraday lows as investors anticipate lower demand for shots.

The selloff comes on the heels of Moderna's Thursday announcement of lower than expected earnings and a slashed sales forecast.

However, when looking at its insider transactions...![]()

![]()

Red are sales. Green would be buys... if there were any.

The selloff comes on the heels of Moderna's Thursday announcement of lower than expected earnings and a slashed sales forecast.

However, when looking at its insider transactions...

Red are sales. Green would be buys... if there were any.

47

13

natymerej

reacted to

$Moderna (MRNA.US)$ it's like a rhythm, up when market open then drop like a beat to low 340s++ ytd n today

23

1

natymerej

reacted to

You know an uptrend consists of higher highs and lows.This means you can use the swing low to trail your stop loss because if the trend holds, it shouldn’t close below it.Here’s how to do it.

Identify the previous swing lowSet your trailing stop loss below the swing lowIf the price closes below it, exit the tradeAn example…

Pro Tip: The market tends to “hunt” stop losses below Support or swing low.To avoid it, set your stop loss 1 ATR below the market structure.

$Futu Holdings Ltd (FUTU.US)$

$AMC Entertainment (AMC.US)$

$GameStop (GME.US)$

$UP Fintech (TIGR.US)$

$Apple (AAPL.US)$

$Tesla (TSLA.US)$

$Meta Platforms (FB.US)$

$Moderna (MRNA.US)$

$Merck & Co (MRK.US)$

Identify the previous swing lowSet your trailing stop loss below the swing lowIf the price closes below it, exit the tradeAn example…

Pro Tip: The market tends to “hunt” stop losses below Support or swing low.To avoid it, set your stop loss 1 ATR below the market structure.

$Futu Holdings Ltd (FUTU.US)$

$AMC Entertainment (AMC.US)$

$GameStop (GME.US)$

$UP Fintech (TIGR.US)$

$Apple (AAPL.US)$

$Tesla (TSLA.US)$

$Meta Platforms (FB.US)$

$Moderna (MRNA.US)$

$Merck & Co (MRK.US)$

110

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)