nenecota

liked

nenecota

voted

Hello, Moomoo users!![]() Tonight's read on NY stocks.

Tonight's read on NY stocks.![]()

Market Overview

US market starts with the Dow Jones Industrial Average, composed of high-quality stocks, opening at 39,139.59, down 30.65 points, while the tech-heavy Nasdaq Composite Index starts at 16,178.80, down 61.65 points. The S&P 500 Average, which consists of 500 large-cap US stocks, opens at 5,194.37, down 11.44 points.

$Dow Jones Industrial Average (.DJI.US)$

$Nasdaq Composite Index (.IXIC.US)$

$S&P 500 Index (.SPX.US)$

Top news of individual stocks

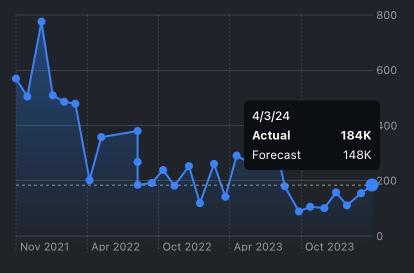

【Indicator Flash Report】U.S. ADP non-farm payroll employment increased by 0.184 million in March, significantly exceeding expectations.

The corporate payroll calculation service provided by Automatic Data Processing (ADP) has announced theMarch National Employment ReportAccording toNon-farm payroll employmentisAn increase of 0.184 million people.、Market expectations are for an increase of 0.148 million people.Contrary to expectations of a slowdown in growth since February, it experienced the largest growth since July last year.Revised upward from 0.14 million people to 0.155 million people compared to the previous period.Overall...

Market Overview

US market starts with the Dow Jones Industrial Average, composed of high-quality stocks, opening at 39,139.59, down 30.65 points, while the tech-heavy Nasdaq Composite Index starts at 16,178.80, down 61.65 points. The S&P 500 Average, which consists of 500 large-cap US stocks, opens at 5,194.37, down 11.44 points.

$Dow Jones Industrial Average (.DJI.US)$

$Nasdaq Composite Index (.IXIC.US)$

$S&P 500 Index (.SPX.US)$

Top news of individual stocks

【Indicator Flash Report】U.S. ADP non-farm payroll employment increased by 0.184 million in March, significantly exceeding expectations.

The corporate payroll calculation service provided by Automatic Data Processing (ADP) has announced theMarch National Employment ReportAccording toNon-farm payroll employmentisAn increase of 0.184 million people.、Market expectations are for an increase of 0.148 million people.Contrary to expectations of a slowdown in growth since February, it experienced the largest growth since July last year.Revised upward from 0.14 million people to 0.155 million people compared to the previous period.Overall...

Translated

+2

25

12

nenecota

reacted to

What is important for holding dividend stocks for a long time is the “buying price” 💰

If you grab it at a high price, the days of seeing unrealized losses continue... so you want to sell it. (Even if you buy it for dividend purposes)

However, if the purchase price is low, unrealized profits can be kept, so you can receive dividends every year while holding with peace of mind ✨

Easier said than done... long-term investing isn't that easy 🌱

Buying price is very important for long-term investments! Waiting until it goes down is also an investment 😉

If you grab it at a high price, the days of seeing unrealized losses continue... so you want to sell it. (Even if you buy it for dividend purposes)

However, if the purchase price is low, unrealized profits can be kept, so you can receive dividends every year while holding with peace of mind ✨

Easier said than done... long-term investing isn't that easy 🌱

Buying price is very important for long-term investments! Waiting until it goes down is also an investment 😉

Translated

6

2

nenecota

liked

$Mitsubishi (8058.JP)$

$ITOCHU (8001.JP)$

$Mitsui (8031.JP)$

Summary of the interim financial results of the top 5 trading companies.

$ITOCHU (8001.JP)$

$Mitsui (8031.JP)$

Summary of the interim financial results of the top 5 trading companies.

Translated

9

1

nenecota

liked

Verizon stock soaring 🤩

Will the telecommunications stocks make a comeback?

Awesome 🥳

Verizon rises on earnings, FCF outlook raised. Mobile phone subscribers also increased more than expected = U.S. individual stocks.

Will the telecommunications stocks make a comeback?

Awesome 🥳

Verizon rises on earnings, FCF outlook raised. Mobile phone subscribers also increased more than expected = U.S. individual stocks.

Translated

6

nenecota

liked

Many people have been saying that they would sell the specific account's held commodities in preparation to buy high-dividend stocks with the new NISA, but I feel like those voices have become less audible in the recent downturn market...

Yes, selling is indeed difficult 💦

I think selling funds also comes with a certain level of stress.

I think reducing mental burden is by gathering high-dividend stocks that do not require selling for investment 🌱

Yes, selling is indeed difficult 💦

I think selling funds also comes with a certain level of stress.

I think reducing mental burden is by gathering high-dividend stocks that do not require selling for investment 🌱

Translated

5

nenecota

reacted to

I'm paying attention to whether gold can break out above the trend line of the downtrend channel

Translated

91

2

1

nenecota

reacted to

Yesterday, there was a significant inflow of funds into safe asset gold. This is the largest increase since the Silicon Valley bank went bankrupt in March, and such events are likely to occur in the future. As for gold, it has been recommended since last year, and the reality is that it provides both value protection and profit compared to holding it in yen. $XAU/USD (XAUUSD.CFD)$ $SPDR Gold ETF (GLD.US)$ $Spdr Gold Minishares Trust (GLDM.US)$

Translated

25

4

nenecota

liked

The recommended product for those starting to invest in high-dividend stocks is “VYM,” which is famous as an excellent US ETF 🌱

The past average dividend yield was 3.1%

The average rate of increase in dividends over the last 10 years is 7.5%

Total return for the last 5 years is 6.7%

Wouldn't it be a good idea to compare these when considering other stocks 😊

※The table below shows past distribution results 💰

The past average dividend yield was 3.1%

The average rate of increase in dividends over the last 10 years is 7.5%

Total return for the last 5 years is 6.7%

Wouldn't it be a good idea to compare these when considering other stocks 😊

※The table below shows past distribution results 💰

Translated

3

nenecota

liked

Real estate stocks fell across the board in response to Governor Ueda's statement “with a view to canceling negative interest rates” 🌱

Sumitomo Real Estate -3.50%

Mitsui Fudosan -4.27%

Mitsubishi Estate -4.07%

Real estate stocks are strong during inflation, but when interest rate rises flickering, they still show a negative reaction 👀

I want to buy real estate stocks with high yields when the decline starts in earnest 🤤

https://www.yomiuri.co.jp/economy/20230908-OYT1T50416/

Sumitomo Real Estate -3.50%

Mitsui Fudosan -4.27%

Mitsubishi Estate -4.07%

Real estate stocks are strong during inflation, but when interest rate rises flickering, they still show a negative reaction 👀

I want to buy real estate stocks with high yields when the decline starts in earnest 🤤

https://www.yomiuri.co.jp/economy/20230908-OYT1T50416/

Translated

5

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)