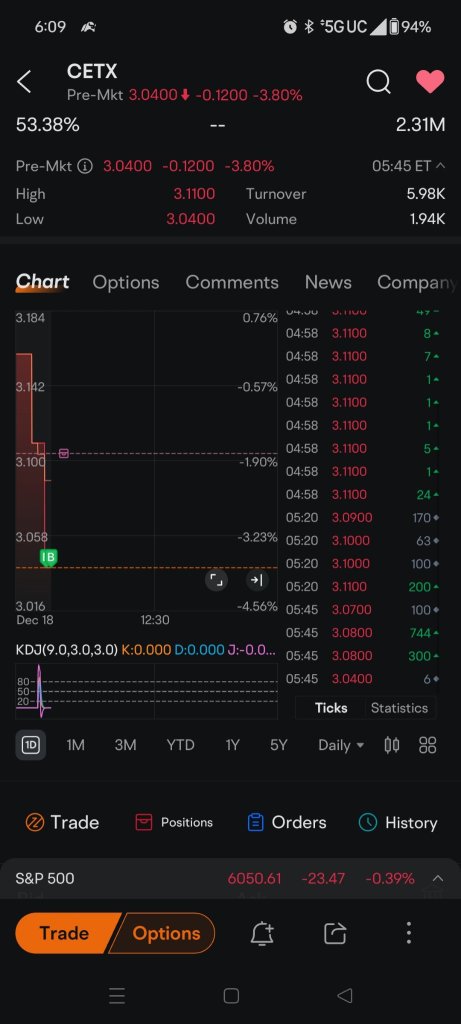

$Cemtrex (CETX.US)$ Im staying!

1

Nicer456

reacted to

2

2

Nicer456

commented on

$Algorhythm (RIME.US)$ I knew something was coming

3

Nicer456

commented on

$Cemtrex (CETX.US)$ no matter the good amount of prs, this is destined to get delisted. short this TRASH

2

Nicer456

liked

$Aptevo Therapeutics (APVO.US)$ its been a while since ive seen a chart so hideous, what a rug pull

1

$Algorhythm (RIME.US)$ Looks like they gonna pull an ookie doke reverse / split

1

Nicer456

liked

4

Nicer456

reacted to

$Cemtrex (CETX.US)$ $4 is the first stepping stone to $5. Just sit back and watch them steps build

3

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)