this is exciting I'm happy to be a part of it.

1

Not the Mama81

voted

As the 95-year copyright protection period for "Mickey Mouse" approaches, Disney may lose the exclusive rights to the company's most iconic cartoon image, according to a report in the UK's "Guardian" on 3 March. According to the US copyright law, Mickey Mouse's copyright protection period is 95 years, which means that from 2024 onwards, Mickey Mouse's image will automatically enter the public domain. ![]()

![]()

...

...

16

13

1

Not the Mama81

voted

Spoiler:

At the end of this post, there is a chance for you to win points!

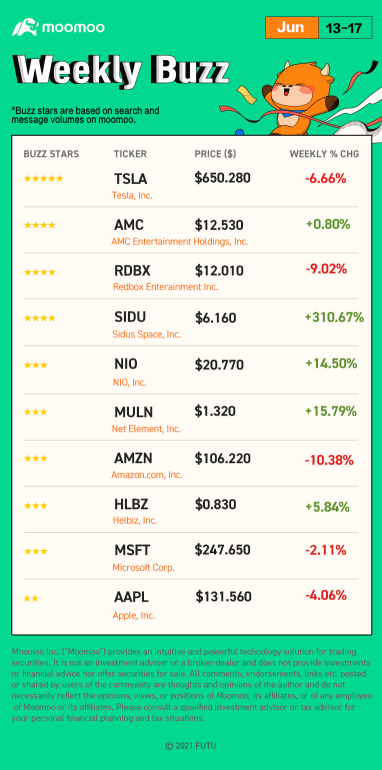

Happy Monday, mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Part Ⅰ: Make Your Choices

Part Ⅱ: Buzzing Stocks List & Mooers Comments

Three major indices moved downward, Russell 2000 Index decreased...

At the end of this post, there is a chance for you to win points!

Happy Monday, mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Part Ⅰ: Make Your Choices

Part Ⅱ: Buzzing Stocks List & Mooers Comments

Three major indices moved downward, Russell 2000 Index decreased...

+3

65

78

20

Not the Mama81

voted

# My Christmas Wishlist for 2022 would be to have over 100 shares of any stock on the Hot List. Futu and Moomoo have been a great addition to my entry into the world of stock trading. I've learned a lot and can't wait to see what next year brings. I'm ready with Moomoo in my corner.

1

Not the Mama81

liked

Stock slide may ease in Asia after tumble in U.S.

The global stock slide may ease Tuesday when markets open in Asia as investors digest the impact of curbs against the omicron virus variant and the outlook for President Joe Biden's stymied economic agenda.

Australian shares fluctuated, and futures for Japan and Hong Kong signaled a steady start. U.S. contracts climbed modestly after the $S&P 500 Index (.SPX.US)$ posted its biggest three-day drop since September. Lower volumes ahead of the Christmas holiday period threaten to exacerbate market moves.

Wall Street money machine booms as 445 ETFs debut in epic year

A corner of Wall Street already enjoying a reputation for explosive growth has gone supernova, with a record 445 new products in 2021 so far, according to data compiled by Bloomberg.

Behind the rapid expansion is a deluge of new cash as investors chase an economic recovery from the coronavirus, while equity mutual funds fall out of favor. About $900 billion has flowed into the ETF market since the start of the year -- also easily a record. Barely any funds are getting shuttered.

Traders sent $30 billion into the dip and this time got bruised

Down hard for a second day Monday, the S&P 500 has now posted back-to-back, 1%-plus swoons twice in the past month. The failure to bounce is rattling those conditioned to anticipate it and comes as a litany of stressors weighs on bulls. Last week, when the S&P 500 fell on all but one day, investors poured $30 billion into exchange-traded funds focusing on U.S. equities, the largest inflow since March.

Amazon slides below support level as big tech weakness continues

Shares of $Amazon (AMZN.US)$ finished under a key technical level for the first time in more than a month. The decline came amid for U.S. equities, and after last week's downturn in high-growth names that was triggered by the Federal Reserve's hawkish pivot. $Apple (AAPL.US)$ lost 0.8%, while $Microsoft (MSFT.US)$ dropped 1.2% and $Meta Platforms (FB.US)$ tumbled 2.5%.

Electric vehicle stocks tumble after Manchin rejects Biden's climate and social plan

Shares of electric vehicle companies tumbled Monday following the apparent failure of President Joe Biden's "Build Back Better" plan that includes significant incentives for the growing sector.

The stocks of EV start-ups such as $Lordstown Motors (RIDE.US)$, $Faraday Future Intelligent Electric Inc. (FFIE.US)$ and $Nikola (NKLA.US)$ all shed more than 7% Monday. The EV incentives under the Build Back Better plan include up to $12,500 per vehicle and are viewed as critical to spur consumer demand.

Oracle to buy medical records company Cerner in its biggest acquisition ever

Enterprise software giant $Oracle (ORCL.US)$ will buy electronic medical records company $Cerner (CERN.US)$ in an all-cash deal for $95 per share, or approximately $28.3 billion in equity value. The massive acquisition is the biggest ever for Oracle.

Oracle shares were down 6% initially after the companies announced the deal.

Elon Musk says he will pay over $11 billion in taxes this year

"For those wondering, I will pay over $11 billion in taxes this year," Elon Musk tweeted Monday.

Stock options Musk was awarded in 2012 are set to expire in August next year. In order to exercise them, he has to pay income tax on the gain. The $Tesla (TSLA.US)$ and SpaceX chief has been sparring with prominent Democrats on Twitter lately over the issue of tax avoidance.

Shopping in stores on the final Saturday before Christmas down 26% from pre-pandemic levels

A lack of foreign tourists opening up their wallets and another wave of coronavirus cases in some major U.S. cities played a role in hindering shopper traffic on the final Saturday before Christmas from returning to pre-pandemic levels.

Visits to retail stores dropped 26.3% on Saturday compared with the Saturday before Christmas in 2019, according to preliminary data from Sensormatic Solutions. Year over year, though, store traffic jumped 19.4%, Sensormatic said.

Source: Bloomberg, CNBC

The global stock slide may ease Tuesday when markets open in Asia as investors digest the impact of curbs against the omicron virus variant and the outlook for President Joe Biden's stymied economic agenda.

Australian shares fluctuated, and futures for Japan and Hong Kong signaled a steady start. U.S. contracts climbed modestly after the $S&P 500 Index (.SPX.US)$ posted its biggest three-day drop since September. Lower volumes ahead of the Christmas holiday period threaten to exacerbate market moves.

Wall Street money machine booms as 445 ETFs debut in epic year

A corner of Wall Street already enjoying a reputation for explosive growth has gone supernova, with a record 445 new products in 2021 so far, according to data compiled by Bloomberg.

Behind the rapid expansion is a deluge of new cash as investors chase an economic recovery from the coronavirus, while equity mutual funds fall out of favor. About $900 billion has flowed into the ETF market since the start of the year -- also easily a record. Barely any funds are getting shuttered.

Traders sent $30 billion into the dip and this time got bruised

Down hard for a second day Monday, the S&P 500 has now posted back-to-back, 1%-plus swoons twice in the past month. The failure to bounce is rattling those conditioned to anticipate it and comes as a litany of stressors weighs on bulls. Last week, when the S&P 500 fell on all but one day, investors poured $30 billion into exchange-traded funds focusing on U.S. equities, the largest inflow since March.

Amazon slides below support level as big tech weakness continues

Shares of $Amazon (AMZN.US)$ finished under a key technical level for the first time in more than a month. The decline came amid for U.S. equities, and after last week's downturn in high-growth names that was triggered by the Federal Reserve's hawkish pivot. $Apple (AAPL.US)$ lost 0.8%, while $Microsoft (MSFT.US)$ dropped 1.2% and $Meta Platforms (FB.US)$ tumbled 2.5%.

Electric vehicle stocks tumble after Manchin rejects Biden's climate and social plan

Shares of electric vehicle companies tumbled Monday following the apparent failure of President Joe Biden's "Build Back Better" plan that includes significant incentives for the growing sector.

The stocks of EV start-ups such as $Lordstown Motors (RIDE.US)$, $Faraday Future Intelligent Electric Inc. (FFIE.US)$ and $Nikola (NKLA.US)$ all shed more than 7% Monday. The EV incentives under the Build Back Better plan include up to $12,500 per vehicle and are viewed as critical to spur consumer demand.

Oracle to buy medical records company Cerner in its biggest acquisition ever

Enterprise software giant $Oracle (ORCL.US)$ will buy electronic medical records company $Cerner (CERN.US)$ in an all-cash deal for $95 per share, or approximately $28.3 billion in equity value. The massive acquisition is the biggest ever for Oracle.

Oracle shares were down 6% initially after the companies announced the deal.

Elon Musk says he will pay over $11 billion in taxes this year

"For those wondering, I will pay over $11 billion in taxes this year," Elon Musk tweeted Monday.

Stock options Musk was awarded in 2012 are set to expire in August next year. In order to exercise them, he has to pay income tax on the gain. The $Tesla (TSLA.US)$ and SpaceX chief has been sparring with prominent Democrats on Twitter lately over the issue of tax avoidance.

Shopping in stores on the final Saturday before Christmas down 26% from pre-pandemic levels

A lack of foreign tourists opening up their wallets and another wave of coronavirus cases in some major U.S. cities played a role in hindering shopper traffic on the final Saturday before Christmas from returning to pre-pandemic levels.

Visits to retail stores dropped 26.3% on Saturday compared with the Saturday before Christmas in 2019, according to preliminary data from Sensormatic Solutions. Year over year, though, store traffic jumped 19.4%, Sensormatic said.

Source: Bloomberg, CNBC

64

5

8

Not the Mama81

liked and commented on

The survey shows a third of U.S. respondents plan to give the gift of cash![]()

![]() or clothing items

or clothing items![]()

![]() like socks or ties.

like socks or ties.![]() What do you want for Christmas?

What do you want for Christmas?![]()

Expand

Expand 206

169

14

Not the Mama81

liked

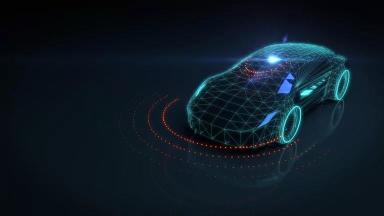

$Apple (AAPL.US)$ is back front and center of the talk in the electric vehicle sector with Bloomberg reporting the tech giant is targeting a launch of a self-driving car in four years. Apple's progress in developing a chip made up primarily of neural processors that can handle the artificial intelligence needed for autonomous driving is the driving force in pushing the Apple Car project ahead again. Previous reports indicated that $Taiwan Semiconductor (TSM.US)$ would likely make the autonomous chip for Apple. The company has also held discussions on battery options with Contemporary Amperex Technology Co and $BYD Co. (BYDDF.US)$.

The general consensus on the initiative is that Apple will seek out a manufacturing partner. But who? Wedbush Securities thinks Apple is very likely to announce a strategic partnership next year that lays out the groundwork needed to enter the autonomous vehicle space. In his update, analyst Dan Ives mentions H $HYUNDAI MOTOR CO GDR EACH REP 1/2 PFD N/VTG(REG'S')(CIT) (HYMTF.US)$, $Tesla (TSLA.US)$, $General Motors (GM.US)$, $Ford Motor (F.US)$ and $VOLKSWAGEN AG (VLKAF.US)$ as potential partners, while noting a partnership in China could include $XPeng (XPEV.US)$ or $NIO Inc (NIO.US)$. Other companies being bandied around Wall Street as potential AAPL partners include $Magna International (MGA.US)$, $Stellantis NV (STLA.US)$ and Foxconn.

The Apple autonomous car news sent shares of many auto stocks a bit lower after they were already in negative territory. Notable decliners include $Lucid Group (LCID.US)$, $Rivian Automotive (RIVN.US)$, $Mullen Automotive (MULN.US)$, $Canoo (GOEV.US)$, $AYRO Inc (AYRO.US)$, $Electrameccanica Vehicles (SOLO.US)$, $Fisker (FSR.US)$, $GreenPower Motor (GP.US)$, $Workhorse (WKHS.US)$, $Nikola (NKLA.US)$, $Arrival (ARVL.US)$, $Faraday Future Intelligent Electric Inc. (FFIE.US)$ and $Proterra (PTRA.US)$.

The general consensus on the initiative is that Apple will seek out a manufacturing partner. But who? Wedbush Securities thinks Apple is very likely to announce a strategic partnership next year that lays out the groundwork needed to enter the autonomous vehicle space. In his update, analyst Dan Ives mentions H $HYUNDAI MOTOR CO GDR EACH REP 1/2 PFD N/VTG(REG'S')(CIT) (HYMTF.US)$, $Tesla (TSLA.US)$, $General Motors (GM.US)$, $Ford Motor (F.US)$ and $VOLKSWAGEN AG (VLKAF.US)$ as potential partners, while noting a partnership in China could include $XPeng (XPEV.US)$ or $NIO Inc (NIO.US)$. Other companies being bandied around Wall Street as potential AAPL partners include $Magna International (MGA.US)$, $Stellantis NV (STLA.US)$ and Foxconn.

The Apple autonomous car news sent shares of many auto stocks a bit lower after they were already in negative territory. Notable decliners include $Lucid Group (LCID.US)$, $Rivian Automotive (RIVN.US)$, $Mullen Automotive (MULN.US)$, $Canoo (GOEV.US)$, $AYRO Inc (AYRO.US)$, $Electrameccanica Vehicles (SOLO.US)$, $Fisker (FSR.US)$, $GreenPower Motor (GP.US)$, $Workhorse (WKHS.US)$, $Nikola (NKLA.US)$, $Arrival (ARVL.US)$, $Faraday Future Intelligent Electric Inc. (FFIE.US)$ and $Proterra (PTRA.US)$.

57

11

3

Not the Mama81

liked

2021 is a year of volatility. ![]()

![]() It has witnessed the rise of meme stocks, starting with $GameStop (GME.US)$ and WallStreeBets early in January and up to the moon $AMC Entertainment (AMC.US)$ in June. After the 2020 pandemic, S&P 500 rallied 100% within 354 trading days*.

It has witnessed the rise of meme stocks, starting with $GameStop (GME.US)$ and WallStreeBets early in January and up to the moon $AMC Entertainment (AMC.US)$ in June. After the 2020 pandemic, S&P 500 rallied 100% within 354 trading days*. ![]()

![]() In times of chip shortage, investors are also watching the tech stocks closely. Not to mention dramas like what caused by Elon Musk and Donald Trump on $Tesla (TSLA.US)$ and $Digital World Acquisition Corp (DWAC.US)$ . What a year!

In times of chip shortage, investors are also watching the tech stocks closely. Not to mention dramas like what caused by Elon Musk and Donald Trump on $Tesla (TSLA.US)$ and $Digital World Acquisition Corp (DWAC.US)$ . What a year!

*Source: CNBC Maekets News

![]()

![]()

![]() Review Your 2021 to Win Free Stocks

Review Your 2021 to Win Free Stocks![]()

![]()

![]()

As 2021 comes to an end, moomoo invites you to write your own review of 2021 trading journey, reflecting on the year that was and looking ahead to 2022.![]() Join the topic discussion "2021 in Review: My Investing Journey Forges Ahead" and get rewards now!

Join the topic discussion "2021 in Review: My Investing Journey Forges Ahead" and get rewards now!

Event Duration: Now to December 31st, 11:59pm ET

Rewards*:

1. Top 40 posts will get FREE stock with a price range from $5 to $30.![]()

2. 9 Growing Stars of the Year* will get FREE stock with a price range from $20 to $50.![]()

3. All relevant posts with no less than 20 words will be rewarded with 88 points.

*Participants before December 22nd stand a chance to become Growing Stars of the Year, which is a title given by moomoo community to reward your effort made in 2021. A badge will be given to Growing Stars on the profile page to acknowledge your progress and achievement. The Growing Star will be rewarded with one random moomoo merchandise and one free stock with a price range from $20 to $50.

*Note: One can only get one out of the three rewards mentioned above.

The above rewards will be issued in 15 working days after the event ends.

Selection criteria:

(applied to both Top 40 posts and Growing Stars)

1. Content quality: a comprehensive review of 2021.

2. Good typesetting with order histories, stock's trend or other helpful charts.

3. User interaction with the post.

4. Relevant tickers added.

![]()

![]() How to join?

How to join?

Click here and join the discussion under the topic, and you stand a chance to win the free stocks! Easy peasy!

![]()

![]() Don't know what to write? Ask yourself the following three questions!

Don't know what to write? Ask yourself the following three questions!

ONE: How did your trades perform?![]()

![]() As we approach the end of 2021, it's time to look back on whether you make money over 2021! Where did you put your money in? Did your stocks bring you good returns? What are your highlights this year in trading?

As we approach the end of 2021, it's time to look back on whether you make money over 2021! Where did you put your money in? Did your stocks bring you good returns? What are your highlights this year in trading?

![]() Reviewing your trading performance is a way to acknowledge successes and drawbacks to improve your trading skills. Let's check out what moomoo features you could adopt to assist the writing of your reviews here.

Reviewing your trading performance is a way to acknowledge successes and drawbacks to improve your trading skills. Let's check out what moomoo features you could adopt to assist the writing of your reviews here.

TWO: What have you learned from trading?![]()

![]() Perhaps you made a profit, learned a new trading skill, developed good trading psychology, broke bad habits, and gained more confidence.

Perhaps you made a profit, learned a new trading skill, developed good trading psychology, broke bad habits, and gained more confidence.

![]() Even if 2021 might not be the best year in trading, time must have rewarded you with something greater than money, and that is AWESOME! What lesson did you learn, and what progress did you make? Write down the trading knowledge you've learned over the year now!

Even if 2021 might not be the best year in trading, time must have rewarded you with something greater than money, and that is AWESOME! What lesson did you learn, and what progress did you make? Write down the trading knowledge you've learned over the year now!

THREE: What cool thins have you done?![]()

![]() 2020 might be the worst year for many people as COVID-19 took away so many innocent lives. Is 2021 getting better with you? What are your stories this year? Did you meet any good fellows during your trading journey?

2020 might be the worst year for many people as COVID-19 took away so many innocent lives. Is 2021 getting better with you? What are your stories this year? Did you meet any good fellows during your trading journey?

![]() We are all ears for your remarkable stories! Please remember, mooers will always be by your side no matter what happens.

We are all ears for your remarkable stories! Please remember, mooers will always be by your side no matter what happens.

Final Words: 2022 Will Be Everything You Want It To Be

Moving forward, it isn't just about learning from what didn't' work in 2021, but also about learning, acknowledging, and genuinely appreciating what did work in the past. You should allow yourself to be happy and truly soak it all in if you want to thrive.![]()

![]()

Happy (almost) 2022, and remember, this year—it's going to be what you want it to be.

Join discussion and get rewards now! Click here: "2021 in Review: My Investing Journey Forges Ahead"

*Write Your Original Ideas: Plagiarism or cheating is not acceptable in any activities on moomoo. Please "Report" the suspicious posts if you find any. Once confirmed, the user committed shall be disqualified from the activities.

moomoo annual ceremony is happening right now! Check it out here: 2021 in Review: Grow Together to the Moon!

*Source: CNBC Maekets News

As 2021 comes to an end, moomoo invites you to write your own review of 2021 trading journey, reflecting on the year that was and looking ahead to 2022.

Event Duration: Now to December 31st, 11:59pm ET

Rewards*:

1. Top 40 posts will get FREE stock with a price range from $5 to $30.

2. 9 Growing Stars of the Year* will get FREE stock with a price range from $20 to $50.

3. All relevant posts with no less than 20 words will be rewarded with 88 points.

*Participants before December 22nd stand a chance to become Growing Stars of the Year, which is a title given by moomoo community to reward your effort made in 2021. A badge will be given to Growing Stars on the profile page to acknowledge your progress and achievement. The Growing Star will be rewarded with one random moomoo merchandise and one free stock with a price range from $20 to $50.

*Note: One can only get one out of the three rewards mentioned above.

The above rewards will be issued in 15 working days after the event ends.

Selection criteria:

(applied to both Top 40 posts and Growing Stars)

1. Content quality: a comprehensive review of 2021.

2. Good typesetting with order histories, stock's trend or other helpful charts.

3. User interaction with the post.

4. Relevant tickers added.

Click here and join the discussion under the topic, and you stand a chance to win the free stocks! Easy peasy!

ONE: How did your trades perform?

TWO: What have you learned from trading?

THREE: What cool thins have you done?

Final Words: 2022 Will Be Everything You Want It To Be

Moving forward, it isn't just about learning from what didn't' work in 2021, but also about learning, acknowledging, and genuinely appreciating what did work in the past. You should allow yourself to be happy and truly soak it all in if you want to thrive.

Happy (almost) 2022, and remember, this year—it's going to be what you want it to be.

Join discussion and get rewards now! Click here: "2021 in Review: My Investing Journey Forges Ahead"

*Write Your Original Ideas: Plagiarism or cheating is not acceptable in any activities on moomoo. Please "Report" the suspicious posts if you find any. Once confirmed, the user committed shall be disqualified from the activities.

moomoo annual ceremony is happening right now! Check it out here: 2021 in Review: Grow Together to the Moon!

393

39

14

Not the Mama81

liked

An ugly day for the stock market was especially rough on $AT&T (T.US)$, which slipped 4.4% on the day to seal its worst month in a year and a half - and reach its lowest point since the Global Financial Crisis, more than a decade ago.

That came as a presentation from Communications chief Jeff McElfresh raised new concerns about user growth in the wireless industry.

Speaking at a Wells Fargo conference, McElfresh worked to highlight momentum in mobility, saying over the past five quarters AT&T has delivered its best subscriber results in a decade (including nearly 4 million postpaid phone net additions, and 1.4 million fiber net adds).

"Total tonnage of EBITDA in the third quarter of '21 was a high-water mark for us," he says, noting Wireless raised its EBITDA by nearly 3.6%.

He added that the company's "three key elements" - simplified plans and targeted sub-segment approach, improved customer experience and network performance - are leading to lower churn and increased customer lifetime value.

He reiterated, though, that the outlook for 2022 and beyond doesn't assume a continuation of the outsized trends in net adds that we've seen.

"There's no doubt that the stimulus programs have put some extra cash in household budgets" this year, he says. "And so we're not expecting that level of activity to continue into 2022 and beyond. In fact, in a three-player market with the integration between Sprint and T-Mobile, we suspect the activity level for postpaid in 2022 is probably going to subside." AT&T does expect to take "more than our fair share," however, and he adds their guidance doesn't depend on outsized postpaid growth.

Expectations that average revenue per user on postpaid phones will stabilize next year means the company expects higher service revenues from the growing base, he says. Fewer than a quarter of gross adds and upgrades in Q3 traded in newer devices for premium promotional offers, and only about 20% of the company's postpaid smartphones are on Unlimited Elite, its highest-ARPU and fastest growing rate plan.

McElfresh's comments about dwindling industry user growth ahead did no favors for AT&T's wireless rivals today. $T-Mobile US (TMUS.US)$fell 4.1% (again, also amid a marketwide sell-off), and $Verizon (VZ.US)$fell 2.7%. $Dish Network (DISH.US)$, set to become the fourth national player in wireless over time, tumbled 5.7% today.

That came as a presentation from Communications chief Jeff McElfresh raised new concerns about user growth in the wireless industry.

Speaking at a Wells Fargo conference, McElfresh worked to highlight momentum in mobility, saying over the past five quarters AT&T has delivered its best subscriber results in a decade (including nearly 4 million postpaid phone net additions, and 1.4 million fiber net adds).

"Total tonnage of EBITDA in the third quarter of '21 was a high-water mark for us," he says, noting Wireless raised its EBITDA by nearly 3.6%.

He added that the company's "three key elements" - simplified plans and targeted sub-segment approach, improved customer experience and network performance - are leading to lower churn and increased customer lifetime value.

He reiterated, though, that the outlook for 2022 and beyond doesn't assume a continuation of the outsized trends in net adds that we've seen.

"There's no doubt that the stimulus programs have put some extra cash in household budgets" this year, he says. "And so we're not expecting that level of activity to continue into 2022 and beyond. In fact, in a three-player market with the integration between Sprint and T-Mobile, we suspect the activity level for postpaid in 2022 is probably going to subside." AT&T does expect to take "more than our fair share," however, and he adds their guidance doesn't depend on outsized postpaid growth.

Expectations that average revenue per user on postpaid phones will stabilize next year means the company expects higher service revenues from the growing base, he says. Fewer than a quarter of gross adds and upgrades in Q3 traded in newer devices for premium promotional offers, and only about 20% of the company's postpaid smartphones are on Unlimited Elite, its highest-ARPU and fastest growing rate plan.

McElfresh's comments about dwindling industry user growth ahead did no favors for AT&T's wireless rivals today. $T-Mobile US (TMUS.US)$fell 4.1% (again, also amid a marketwide sell-off), and $Verizon (VZ.US)$fell 2.7%. $Dish Network (DISH.US)$, set to become the fourth national player in wireless over time, tumbled 5.7% today.

24

10

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)