I keep reminding myself that BHP usually has a " good " November ( historically )

After their failed 49 billion bid for Anglo American, BHP has shifted gears and is now looking for growth elsewhere. They've struck a C$4.5 billion deal with Lundin Mining to expand their copper holdings in South America. Despite some investors pushing for tougher climate goals, a whopping 91.77% of shareholders backed BHP's climate plan, which aims for net-zero operational emissions by 2050. CEO Mike Henry even de...

After their failed 49 billion bid for Anglo American, BHP has shifted gears and is now looking for growth elsewhere. They've struck a C$4.5 billion deal with Lundin Mining to expand their copper holdings in South America. Despite some investors pushing for tougher climate goals, a whopping 91.77% of shareholders backed BHP's climate plan, which aims for net-zero operational emissions by 2050. CEO Mike Henry even de...

Iron ore ⚒️ spreads continue to look disappointing. 📉

According to UK laws, BHP must wait six months (until the end of October) before it can launch another takeover bid for Anglo 😜

$BHP Group Ltd (BHP.AU)$

According to UK laws, BHP must wait six months (until the end of October) before it can launch another takeover bid for Anglo 😜

$BHP Group Ltd (BHP.AU)$

I hold $BHP Group Ltd (BHP.AU)$ as a Long Term hold, a hedge and also as a U308 stock. For years Olympic dam which is one of the biggest u308 resources in the world has seen little if any mention by BHP. Today's BHP report has 9 mentions! One says they expect/assume USD$80lbs and another states ".Uranium and silver grades are currently considered to be sub-economic and are therefore not reported as part of the Mineral Resource."

BHPs statement is gold in my view! IF BHP is for real then the incen...

BHPs statement is gold in my view! IF BHP is for real then the incen...

9

question

can it be worth much more than $100

with a 4% return on $4 a year div at $100

can it be worth much more

are people happy with a lower % return at prices higher than $100

would some

sort of share buy back buy cba be on the cards?

how does the shareholder benefit from here forward? hold and collect? $CommBank (CBA.AU)$

can it be worth much more than $100

with a 4% return on $4 a year div at $100

can it be worth much more

are people happy with a lower % return at prices higher than $100

would some

sort of share buy back buy cba be on the cards?

how does the shareholder benefit from here forward? hold and collect? $CommBank (CBA.AU)$

1

They will not cut rates at all 2024 nor 2025. They were saying about pivoting in 2022, they said halt at 1.5-1.8percent but they exceeded 3percent in 2023.

2

I have never been on a forum where just about every person agrees the stock is overvalued... it's weird to see such a strong consensus.

The media love reporting on the fact CBA is now the world's most expensive bank based on fundamentals.

Yet... here it is over 140...

Then there are the analysts who have fair value as low as the 80s.

Seemingly it doesn't matter how many people keep saying it's grossly overvalued - it keeps going higher. $CommBank (CBA.AU)$

The media love reporting on the fact CBA is now the world's most expensive bank based on fundamentals.

Yet... here it is over 140...

Then there are the analysts who have fair value as low as the 80s.

Seemingly it doesn't matter how many people keep saying it's grossly overvalued - it keeps going higher. $CommBank (CBA.AU)$

1

I hope to buy late this year Tradinator.

BHP Average iron ore realised price FY2024 H1 US$103.70

BHP Average iron ore realised price FY2024 H2 US$98.30

For a FY2024 Average realised US$101.04

So H2 realised price approx 5% lower than H1

That's why upcoming dividend might be slightly lower than expectations?

Might be wrong - just a bit of guestimate fun!! $BHP Group Ltd (BHP.AU)$

BHP Average iron ore realised price FY2024 H1 US$103.70

BHP Average iron ore realised price FY2024 H2 US$98.30

For a FY2024 Average realised US$101.04

So H2 realised price approx 5% lower than H1

That's why upcoming dividend might be slightly lower than expectations?

Might be wrong - just a bit of guestimate fun!! $BHP Group Ltd (BHP.AU)$

5

Australia is becoming a much higher risk destination for mining investment….In the past few days, 2 potential mines owned by Regis ( $Regis Resources Ltd (RRL.AU)$ ) and Silver Mines ( $Silver Mines Ltd (SVL.AU)$ ) have suffered major setbacks in the approval process.

1

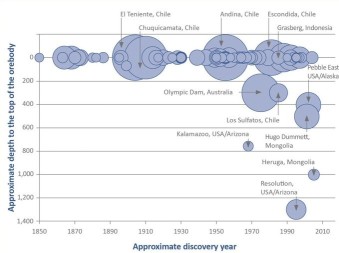

Deeper deposits mean more expensive mines to build, and higher operation costs.

What comes to mind when you look at this chart?

$BHP Group Ltd (BHP.AU)$ $Rio Tinto Ltd (RIO.AU)$

What comes to mind when you look at this chart?

$BHP Group Ltd (BHP.AU)$ $Rio Tinto Ltd (RIO.AU)$

I don't think RBA is going to be increasing the cash rate anytime soon. That will cause a massive uproar. Everyone's struggling enough as it is, with how high the interest rates are in comparison to the last few years.

The RBA wants inflation to get between 2 to 3 per cent before it considers rate cuts but the bank projects that will come in the second half of 2025.

Considering inflation remains well above that target, it's unclear whether the central bank will hike rates to force that number ...

The RBA wants inflation to get between 2 to 3 per cent before it considers rate cuts but the bank projects that will come in the second half of 2025.

Considering inflation remains well above that target, it's unclear whether the central bank will hike rates to force that number ...

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)