onedayberich

voted

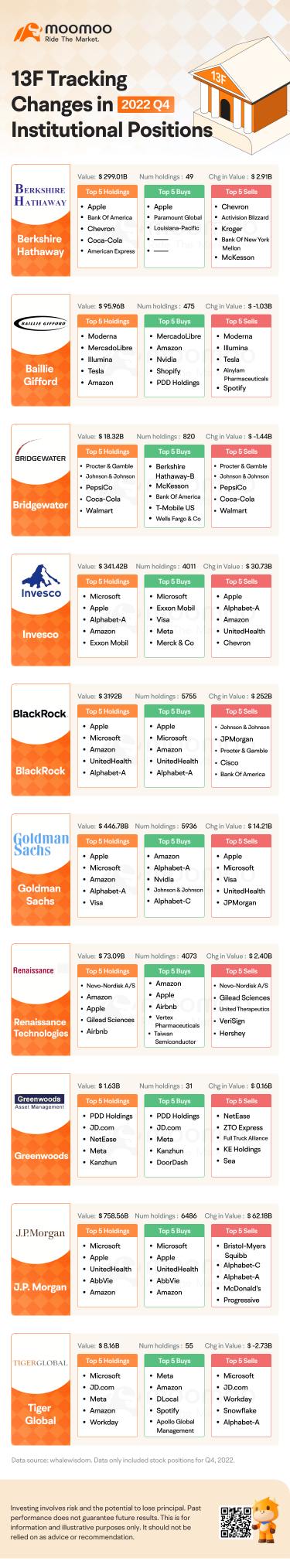

Recently, major institutions filed 13F reports with the U.S. Securities and Exchange Commission (SEC), disclosing their holdings and the size of their positions in U.S. stocks during the fourth quarter.

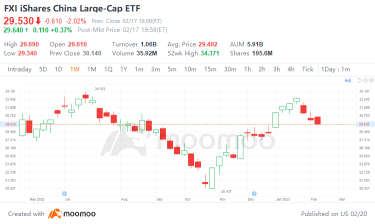

It is worth noting that large Wall Street private equity funds are buying Chinese stocks on a large scale, and the allocation strategy for Chinese stocks has gradually shifted from [underweight] to [Neutral]!![]()

Michae...

It is worth noting that large Wall Street private equity funds are buying Chinese stocks on a large scale, and the allocation strategy for Chinese stocks has gradually shifted from [underweight] to [Neutral]!

Michae...

39

17

21

onedayberich

commented on

$Meta Platforms (META.US)$ so everytime meta announce layoffs their shar price will fly. so if they sack all but the ceo, i assume it will hit 500?

2

onedayberich

liked

Q&A is a session under a company's earnings conference that institutional and retail investors ask some most-concerned questions to the management. On this page, you may discover info that might affect the stock price in the following weeks.

Key Takeaways:

Attitudes: management feel good about where demand is right now, but the constraints will be larger than the $6 billion that experienced in Q4.

Goals: the company expects to achieve very solid year-over-year revenue growth and to set a new revenue record during the next quarter.

For services, Apple expects growth rate to decelerate from the September quarter but to remain strong.

Tim, can you talk a bit more about specific supply chain issues you saw and how you've seen improvements, I think, during the current quarter? And, you know, how we should think about what products you expect to see most impacted going forward?

Sure. If you look at Q4 for a moment, we had about $6 billion in supply constraints and it affected the iPhone the iPad and the Mac. There were two causes of them for Q4. One was the chip shortages that you've heard a lot about from many different companies through the industry. And the second was COVID-related manufacturing disruptions in Southeast Asia. But from a demand point of view, demand is very robust. And so, part of this is that demand also is very strong. But we believe that by the time we finish the quarter that the constraints will be larger than the $6 billion that we experienced in Q4.

Do you feel comfortable that the supply chain bottlenecks sort of peaks in December and alleviates from there? Or what does that trajectory look like for improvement?

It is difficult to predict COVID, and so I'm not going to predict where it goes. But I can just tell you that as of today, we're in a materially better position than we were in September and in the first several weeks of October. In terms of the chip shortage, that chip shortage is happening on legacy nodes, primarily with bottom supply. And it's difficult to forecast when those things will balance because you'd have to know how how the economy is going to be in 2022 and the accuracy of everyone else's demand projections. But I do feel very comfortable with our operational team.

Given the supply chain is blurring the demand picture for iPhone 13, what data points can you share that help investors understand whether demand is tracking to a product cycle that is flat, growing, or down from the very strong iPhone 12.

The channel inventory, as you would expect in a constrained environment, the iPhone channel inventory ended below the targeted range and is currently below it. In terms of the blurring of demand, we look at a number of different data points. We look at demand across our online store, demand in retail. We look through to backorders on the carrier channels, the ones that do take backorders there. We look at channel orders as well. And so, we have a number of different data points that we use to conclude how strong demand is and we feel very very good about where demand is right now.

We've recently surveyed 4,000 consumers in the US and China. And the feedback is most of them don't want to pay for apps or services direct to the developer, they value the security privacy ease of transactions of the App Store. So, how do you think about balancing the regulators push for more choice with a customer base that's happy with the existing experience?

The main thing that we're focused on on the App Store is to keep our focus on privacy and security. Everything else is a distant second. And so, what we're doing is working to explain the decisions that we've made that are key to keeping the privacy and security there, which is to not have sideloading and not have alternate ways on the iPhone where it opens up the iPhone to unreviewed apps and also gets by the privacy restrictions that we've put on the App Store. And so, we're very focused in discussing the privacy and security elements of the App Store with the regulators and legislators.

On the services revenue, much better than expected. Can you give us some details about what drove that?

On services, the 26 percent growth rate that we had was better than what we were expecting at the beginning of the quarter. And it was really across the board. It's difficult to single out the specific area because we set all-time records on cloud, we set, you know, all-time records across the board. Apple Care, music, video, advertising, payments services. The App Store was a September quarter record. So, it was strong across the board. We sell a lot of different services and our customers seem to really enjoy the experience that they have on the platform.

This year, Apple launched the iPhone 13 at a slightly lower price than where the 12 was launched last year in China. Can you maybe help us think through what are some of the things that you look at in deciding that?

We look at a variety of things, including our cost, including competition, including local conditions, and exchange rates, and, you know, a number of different things. And so, there's no formula for determining it. It's done by a level of judgment, looking at a number of different data points. And we do that region by region. $Apple (AAPL.US)$

This article is a script from the Q&A session of Apple's earnings call on Oct 28. In order to facilitate reading, we have made appropriate cuts. If you want to know more details, you can click here to re-watch the earnings call.

Key Takeaways:

Attitudes: management feel good about where demand is right now, but the constraints will be larger than the $6 billion that experienced in Q4.

Goals: the company expects to achieve very solid year-over-year revenue growth and to set a new revenue record during the next quarter.

For services, Apple expects growth rate to decelerate from the September quarter but to remain strong.

Tim, can you talk a bit more about specific supply chain issues you saw and how you've seen improvements, I think, during the current quarter? And, you know, how we should think about what products you expect to see most impacted going forward?

Sure. If you look at Q4 for a moment, we had about $6 billion in supply constraints and it affected the iPhone the iPad and the Mac. There were two causes of them for Q4. One was the chip shortages that you've heard a lot about from many different companies through the industry. And the second was COVID-related manufacturing disruptions in Southeast Asia. But from a demand point of view, demand is very robust. And so, part of this is that demand also is very strong. But we believe that by the time we finish the quarter that the constraints will be larger than the $6 billion that we experienced in Q4.

Do you feel comfortable that the supply chain bottlenecks sort of peaks in December and alleviates from there? Or what does that trajectory look like for improvement?

It is difficult to predict COVID, and so I'm not going to predict where it goes. But I can just tell you that as of today, we're in a materially better position than we were in September and in the first several weeks of October. In terms of the chip shortage, that chip shortage is happening on legacy nodes, primarily with bottom supply. And it's difficult to forecast when those things will balance because you'd have to know how how the economy is going to be in 2022 and the accuracy of everyone else's demand projections. But I do feel very comfortable with our operational team.

Given the supply chain is blurring the demand picture for iPhone 13, what data points can you share that help investors understand whether demand is tracking to a product cycle that is flat, growing, or down from the very strong iPhone 12.

The channel inventory, as you would expect in a constrained environment, the iPhone channel inventory ended below the targeted range and is currently below it. In terms of the blurring of demand, we look at a number of different data points. We look at demand across our online store, demand in retail. We look through to backorders on the carrier channels, the ones that do take backorders there. We look at channel orders as well. And so, we have a number of different data points that we use to conclude how strong demand is and we feel very very good about where demand is right now.

We've recently surveyed 4,000 consumers in the US and China. And the feedback is most of them don't want to pay for apps or services direct to the developer, they value the security privacy ease of transactions of the App Store. So, how do you think about balancing the regulators push for more choice with a customer base that's happy with the existing experience?

The main thing that we're focused on on the App Store is to keep our focus on privacy and security. Everything else is a distant second. And so, what we're doing is working to explain the decisions that we've made that are key to keeping the privacy and security there, which is to not have sideloading and not have alternate ways on the iPhone where it opens up the iPhone to unreviewed apps and also gets by the privacy restrictions that we've put on the App Store. And so, we're very focused in discussing the privacy and security elements of the App Store with the regulators and legislators.

On the services revenue, much better than expected. Can you give us some details about what drove that?

On services, the 26 percent growth rate that we had was better than what we were expecting at the beginning of the quarter. And it was really across the board. It's difficult to single out the specific area because we set all-time records on cloud, we set, you know, all-time records across the board. Apple Care, music, video, advertising, payments services. The App Store was a September quarter record. So, it was strong across the board. We sell a lot of different services and our customers seem to really enjoy the experience that they have on the platform.

This year, Apple launched the iPhone 13 at a slightly lower price than where the 12 was launched last year in China. Can you maybe help us think through what are some of the things that you look at in deciding that?

We look at a variety of things, including our cost, including competition, including local conditions, and exchange rates, and, you know, a number of different things. And so, there's no formula for determining it. It's done by a level of judgment, looking at a number of different data points. And we do that region by region. $Apple (AAPL.US)$

This article is a script from the Q&A session of Apple's earnings call on Oct 28. In order to facilitate reading, we have made appropriate cuts. If you want to know more details, you can click here to re-watch the earnings call.

82

8

11

onedayberich

reacted to

Moomoo is so convenient, one software for trading in Singapore, USA, and domestically, and the trading fees are affordable. No need to switch between different trading systems anymore!

Translated

739

553

243

onedayberich

reacted to

Stock trading, Forex trading, or any other form of securities trading is extremely high risk. The information provided here is for informational purposes only. It should not be considered legal or financial advice. No one should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence.

59

14

67

onedayberich

liked

$DBS (D05.SG)$ 29.54 Is time to buy in?

4

2

onedayberich

commented on

For beginners, placing an order sometimes can be a difficult task.

In this video, we will guide you on how to place a market/limit order.

Follow us for more tutorials.

For more guides, please refer to moomoo courses at https://live.moomoo.com/college

![]() Have fun with your financial journey on moomoo!

Have fun with your financial journey on moomoo!

$AMC Entertainment (AMC.US)$ $Tesla (TSLA.US)$ $S&P 500 Index (.SPX.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Nasdaq Composite Index (.IXIC.US)$

In this video, we will guide you on how to place a market/limit order.

Follow us for more tutorials.

For more guides, please refer to moomoo courses at https://live.moomoo.com/college

$AMC Entertainment (AMC.US)$ $Tesla (TSLA.US)$ $S&P 500 Index (.SPX.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Nasdaq Composite Index (.IXIC.US)$

![[Video Tutorial] How to place an order on moomoo?](https://ussnsimg.moomoo.com/202106170000078178e2dd5e936.jpg/thumb)

6131

6909

1070

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)