$Apple (AAPL.US)$ $Tesla (TSLA.US)$ $Alibaba (BABA.US)$ The current stock market continues to decline, and good companies are not being bought. The main reason is lack of liquidity, and no one has any cash positions.

From a macro perspective, the US is raising interest rates, capital flows back, and the US dollar appreciates. This situation is the opposite of the global capital generated by the US when it printed banknotes before, and credit expansion was rampant.

There was a flood of capital over the previous year, and stocks were easy to rise. Now that capital is scarce, stocks can easily fall. The trading volume of Hong Kong stocks is getting lower and lower, and stock prices are getting lower and lower.

If investors now have full positions, that is, lying flat, it's OK. If they finance stocks and trade stocks, then this wave may have to be recovered by the market.

The better situation is that investors have had a habit of maintaining cash positions before, so it's OK to handle it.

A better situation is that the shares held on hand have sufficient dividends, which can also supplement liquidity.

The best case scenario is holding shares on hand. The company itself has a lot of liquidity and low debt, so it is possible that such stocks will also rebound first in the future.

The main thing is to check liquidity. When cash becomes scarce, the less pressure, the more opportunities there are, whether for investors, companies, or stocks. However, this liquidity investor must plan well in advance; the enterprise must have sufficient earning power and not rely on excessive debt to make money; stocks must also have a long history of dividends. These tests can also make up for some of the survival of the big bear market...

From a macro perspective, the US is raising interest rates, capital flows back, and the US dollar appreciates. This situation is the opposite of the global capital generated by the US when it printed banknotes before, and credit expansion was rampant.

There was a flood of capital over the previous year, and stocks were easy to rise. Now that capital is scarce, stocks can easily fall. The trading volume of Hong Kong stocks is getting lower and lower, and stock prices are getting lower and lower.

If investors now have full positions, that is, lying flat, it's OK. If they finance stocks and trade stocks, then this wave may have to be recovered by the market.

The better situation is that investors have had a habit of maintaining cash positions before, so it's OK to handle it.

A better situation is that the shares held on hand have sufficient dividends, which can also supplement liquidity.

The best case scenario is holding shares on hand. The company itself has a lot of liquidity and low debt, so it is possible that such stocks will also rebound first in the future.

The main thing is to check liquidity. When cash becomes scarce, the less pressure, the more opportunities there are, whether for investors, companies, or stocks. However, this liquidity investor must plan well in advance; the enterprise must have sufficient earning power and not rely on excessive debt to make money; stocks must also have a long history of dividends. These tests can also make up for some of the survival of the big bear market...

Translated

$Tesla (TSLA.US)$ The current stock market continues to decline, and good companies are not being bought. The main reason is lack of liquidity, and no one has any cash positions.

From a macro perspective, the US is raising interest rates, capital flows back, and the US dollar appreciates. This situation is the opposite of the global capital generated by the US when it printed banknotes before, and credit expansion was rampant.

There was a flood of capital over the previous year, and stocks were easy to rise. Now that capital is scarce, stocks can easily fall. The trading volume of Hong Kong stocks is getting lower and lower, and stock prices are getting lower and lower.

If investors now have full positions, that is, lying flat, it's OK. If they finance stocks and trade stocks, then this wave may have to be recovered by the market.

The better situation is that investors have had a habit of maintaining cash positions before, so it's OK to handle it.

A better situation is that the shares held on hand have sufficient dividends, which can also supplement liquidity.

The best case scenario is holding shares on hand. The company itself has a lot of liquidity and low debt, so it is possible that such stocks will also rebound first in the future.

The main thing is to check liquidity. When cash becomes scarce, the less pressure, the more opportunities there are, whether for investors, companies, or stocks. However, this liquidity investor must plan well in advance; the enterprise must have sufficient earning power and not rely on excessive debt to make money; stocks must also have a long history of dividends. These current tests can also make up for some of the big bear market's viability. Companies with high leverage and companies with high foreign debt, even if stock prices drop a lot now, it's best not to rush to buy

If you have questions...

From a macro perspective, the US is raising interest rates, capital flows back, and the US dollar appreciates. This situation is the opposite of the global capital generated by the US when it printed banknotes before, and credit expansion was rampant.

There was a flood of capital over the previous year, and stocks were easy to rise. Now that capital is scarce, stocks can easily fall. The trading volume of Hong Kong stocks is getting lower and lower, and stock prices are getting lower and lower.

If investors now have full positions, that is, lying flat, it's OK. If they finance stocks and trade stocks, then this wave may have to be recovered by the market.

The better situation is that investors have had a habit of maintaining cash positions before, so it's OK to handle it.

A better situation is that the shares held on hand have sufficient dividends, which can also supplement liquidity.

The best case scenario is holding shares on hand. The company itself has a lot of liquidity and low debt, so it is possible that such stocks will also rebound first in the future.

The main thing is to check liquidity. When cash becomes scarce, the less pressure, the more opportunities there are, whether for investors, companies, or stocks. However, this liquidity investor must plan well in advance; the enterprise must have sufficient earning power and not rely on excessive debt to make money; stocks must also have a long history of dividends. These current tests can also make up for some of the big bear market's viability. Companies with high leverage and companies with high foreign debt, even if stock prices drop a lot now, it's best not to rush to buy

If you have questions...

Translated

os and

liked

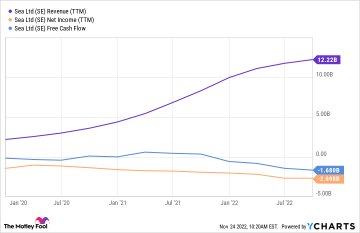

$Sea (SE.US)$ $S&P 500 Index (.SPX.US)$

During the market bull run that followed the COVID-19 crash of early 2020, Sea caught investors' attention with its regular triple-digit revenue growth, which helped drive the parabolic share appreciation.

However, at the same time, Sea was unprofitable and mostly free-cash-flow negative. While this is not uncommon for businesses that are in growth mode, the market began to sour on Sea once the revenue growth slowed.

What's inte...

During the market bull run that followed the COVID-19 crash of early 2020, Sea caught investors' attention with its regular triple-digit revenue growth, which helped drive the parabolic share appreciation.

However, at the same time, Sea was unprofitable and mostly free-cash-flow negative. While this is not uncommon for businesses that are in growth mode, the market began to sour on Sea once the revenue growth slowed.

What's inte...

1

1

os and

reacted to and commented on

Thanks for the moomoo app that made me aware of stocks![]() I'm still a rookie now, but I'll do my best to cheer~

I'm still a rookie now, but I'll do my best to cheer~![]()

Translated

3

1

os and

liked and commented on

$Tesla (TSLA.US)$

$Apple (AAPL.US)$

$Amazon (AMZN.US)$

The main character is SBF, the “explosive head” of the coin industry. It is known as Bombhead because he is indeed a bomber, and SBF is an acronym for his full name Sam Bankman-Fried.

This dude is a celebrity in the cryptocurrency industry. He resigned from the famous hedge fund Jane Street in 2017. All in the coin industry, initially did arbitrage trading between the Bitcoin markets in the US and Japan, and later founded the quantitative cryptocurrency fund Alameda Research, which is mainly engaged in cryptocurrency market making and venture capital for cryptocurrencies.

In addition to FTX's own financing, FTX US, a subsidiary of the company, which provides services to US investors, also announced in January 2022 that it will complete Series A financing of 400 million US dollars at a valuation of 8 billion US dollars. Institutions such as Paladin, SoftBank Vision Fund Phase II, and Temasek participated in this round of financing.

As a result, by the age of 30, SBF had assets of 17 billion US dollars and was on the Forbes list. Together with Ethereum founder Vitalik, Binance founder Zhao Changpeng CZ, and Wavefield founder Sun Yuchen, JustinSun, the founder of Wave Field, it was named the four kings of the coin industry.

FTT is FTX's token, and Alameda is an FTX market maker. It enjoys fully discounted transaction rates, earns more referral commissions, and the money earned is used to continue to buy back FTT, which is quite equivalent...

$Apple (AAPL.US)$

$Amazon (AMZN.US)$

The main character is SBF, the “explosive head” of the coin industry. It is known as Bombhead because he is indeed a bomber, and SBF is an acronym for his full name Sam Bankman-Fried.

This dude is a celebrity in the cryptocurrency industry. He resigned from the famous hedge fund Jane Street in 2017. All in the coin industry, initially did arbitrage trading between the Bitcoin markets in the US and Japan, and later founded the quantitative cryptocurrency fund Alameda Research, which is mainly engaged in cryptocurrency market making and venture capital for cryptocurrencies.

In addition to FTX's own financing, FTX US, a subsidiary of the company, which provides services to US investors, also announced in January 2022 that it will complete Series A financing of 400 million US dollars at a valuation of 8 billion US dollars. Institutions such as Paladin, SoftBank Vision Fund Phase II, and Temasek participated in this round of financing.

As a result, by the age of 30, SBF had assets of 17 billion US dollars and was on the Forbes list. Together with Ethereum founder Vitalik, Binance founder Zhao Changpeng CZ, and Wavefield founder Sun Yuchen, JustinSun, the founder of Wave Field, it was named the four kings of the coin industry.

FTT is FTX's token, and Alameda is an FTX market maker. It enjoys fully discounted transaction rates, earns more referral commissions, and the money earned is used to continue to buy back FTT, which is quite equivalent...

Translated

4

3

os and

commented on

$Tesla (TSLA.US)$

Nv reply me... I wont when will be the 170... Can short next month but not now ba.

Nv reply me... I wont when will be the 170... Can short next month but not now ba.

10

os and

liked and commented on

$Sea (SE.US)$ sub $50 buy later today

3

2

os and

liked

Stocks had ended last week with their biggest gains in months, with lighter inflation data sparking hopes among investors that a monetary policy shift is near. The S&P 500 rose nearly 6%, while the Nasdaq added around 8% for the week.

Are happy days here again for investors?![]() Let's take a look at the performance of stocks picked by Moomoo high net worth clients and find potential investment opportunities!

Let's take a look at the performance of stocks picked by Moomoo high net worth clients and find potential investment opportunities!

Are happy days here again for investors?

3

os and

liked

Spoiler:

At the end of this post, there is a chance for you to win points!

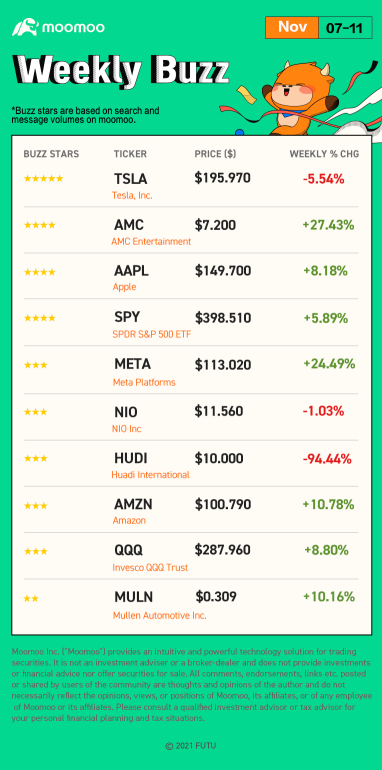

Happy Monday, mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Make Your Choices

Buzzing Stocks List & Mooers Comments

Every cloud has a silver lining. The S&P 500 posted its best week since June, adding...

At the end of this post, there is a chance for you to win points!

Happy Monday, mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Make Your Choices

Buzzing Stocks List & Mooers Comments

Every cloud has a silver lining. The S&P 500 posted its best week since June, adding...

+1

55

53

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)