OscarTrader

liked

Last week's review 👉🏻Market review + Holdings (11/11-15/11 2024)

Market review this week:

$NASDAQ 100 Index (.NDX.US)$ And $S&P 500 Index (.SPX.US)$ Thursday's absorption of funds;

$Russell 2000 Index (.RUT.US)$ Absorbing funds on Thursday and Friday.

rut>spx>ndx.

NDX has not yet completed the gap fill at the top, the current price is still below the 10MA. SPX has completed the gap fill at the top and is above the 10MA. RUT has completed the previous consolidation platform test and continues to move upward with strength. The biggest surprise after NVDA's financial report is that the price feedback has hardly changed, continue to pay attention to the feedback on the future of the semiconductor industry. Biotechnology experienced an oversold rebound this week, BTC approached 100,000. Overall, the recent market has provided a very favorable environment for traders, offering many breakout opportunities, with the vast majority of feedback being positive. At the same time, the indices have hardly changed, you can't ask for more than this...

Weekly Charts:

The uptrend is currently still healthy.

Breadth:

Continuing to stay green, gradually gaining strength after the phased bottom trading days of 15, 18, 19, 20.

Weekly Notes:

Only the RS of NVDA in the internal trading list of the system is slightly downgraded.

Market Sentiment:

Bullish sentiment in AAII...

Market review this week:

$NASDAQ 100 Index (.NDX.US)$ And $S&P 500 Index (.SPX.US)$ Thursday's absorption of funds;

$Russell 2000 Index (.RUT.US)$ Absorbing funds on Thursday and Friday.

rut>spx>ndx.

NDX has not yet completed the gap fill at the top, the current price is still below the 10MA. SPX has completed the gap fill at the top and is above the 10MA. RUT has completed the previous consolidation platform test and continues to move upward with strength. The biggest surprise after NVDA's financial report is that the price feedback has hardly changed, continue to pay attention to the feedback on the future of the semiconductor industry. Biotechnology experienced an oversold rebound this week, BTC approached 100,000. Overall, the recent market has provided a very favorable environment for traders, offering many breakout opportunities, with the vast majority of feedback being positive. At the same time, the indices have hardly changed, you can't ask for more than this...

Weekly Charts:

The uptrend is currently still healthy.

Breadth:

Continuing to stay green, gradually gaining strength after the phased bottom trading days of 15, 18, 19, 20.

Weekly Notes:

Only the RS of NVDA in the internal trading list of the system is slightly downgraded.

Market Sentiment:

Bullish sentiment in AAII...

Translated

+22

32

2

OscarTrader

liked

I have read this book three times, to be honest, I still only partially understand it, it's all a bit foggy.

I accidentally saw this female trader's interpretation of the book on X, which ignited a strong desire for my fourth reading.

X Address:x.com

I accidentally saw this female trader's interpretation of the book on X, which ignited a strong desire for my fourth reading.

X Address:x.com

Translated

9

OscarTrader

voted

Hi, mooers!

This week, $SUNWAY (5211.MY)$ and $IJM (3336.MY)$ are said to report their quarterly earnings.

Both core businesses include property development and construction, which company will satisfy the market more? Make your prediction to grab point rewards!![]()

Rewards

● An equal share of 5,000 points: For mooers who correctly guessed the winner who makes the biggest % gains in intraday trading this week (e.g., If 50 mooers make a corr...

This week, $SUNWAY (5211.MY)$ and $IJM (3336.MY)$ are said to report their quarterly earnings.

Both core businesses include property development and construction, which company will satisfy the market more? Make your prediction to grab point rewards!

Rewards

● An equal share of 5,000 points: For mooers who correctly guessed the winner who makes the biggest % gains in intraday trading this week (e.g., If 50 mooers make a corr...

7

6

1

OscarTrader

voted

Hi mooers! Are you ready for the Malaysian earnings season?![]()

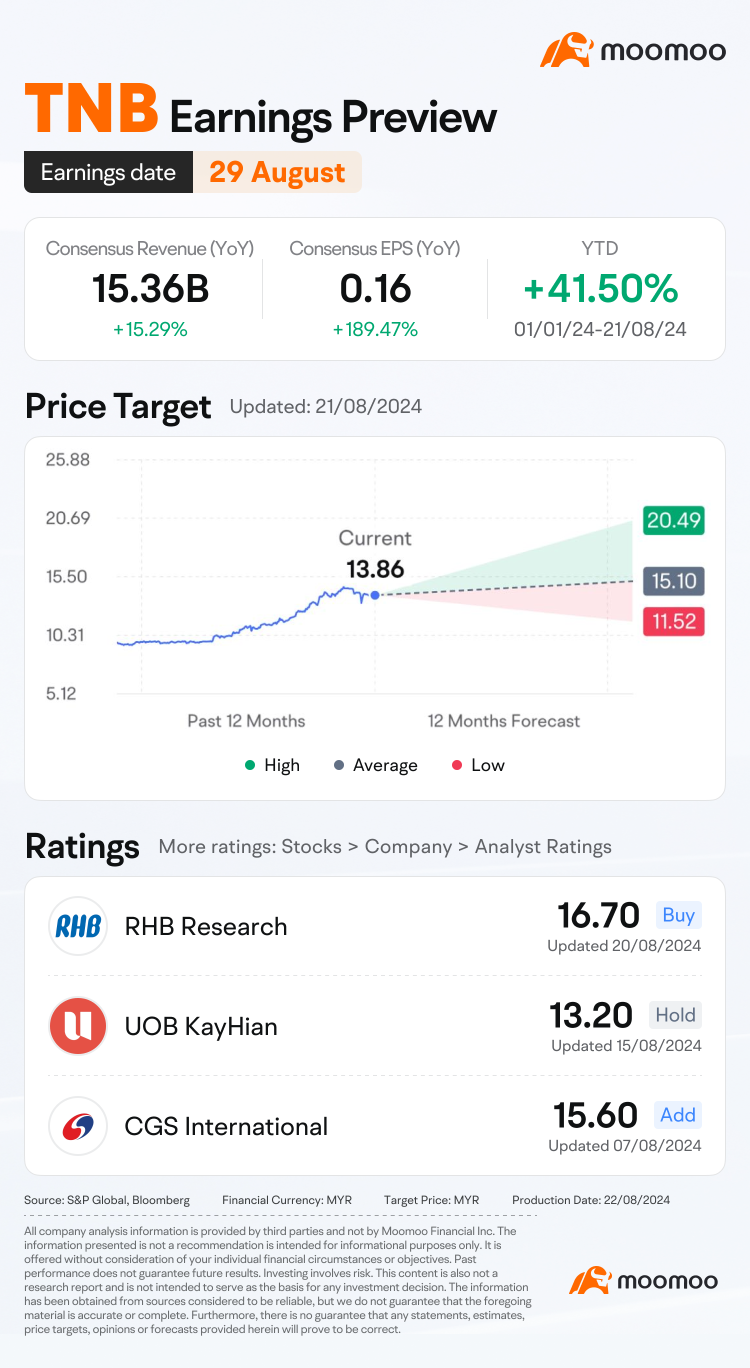

This week, $INARI (0166.MY)$ and $TENAGA (5347.MY)$ are said to report their quarterly earnings.

Who will surprise the market more, the semiconductor giant or the electricity monopoly? Make your prediction to grab point rewards!![]()

Rewards

● An equal share of 5,000 points: For mooers who correctly guessed the winner who makes the biggest % gains in intraday trading this week (e.g., ...

This week, $INARI (0166.MY)$ and $TENAGA (5347.MY)$ are said to report their quarterly earnings.

Who will surprise the market more, the semiconductor giant or the electricity monopoly? Make your prediction to grab point rewards!

Rewards

● An equal share of 5,000 points: For mooers who correctly guessed the winner who makes the biggest % gains in intraday trading this week (e.g., ...

36

28

9

OscarTrader

voted

Hi, mooers! ![]()

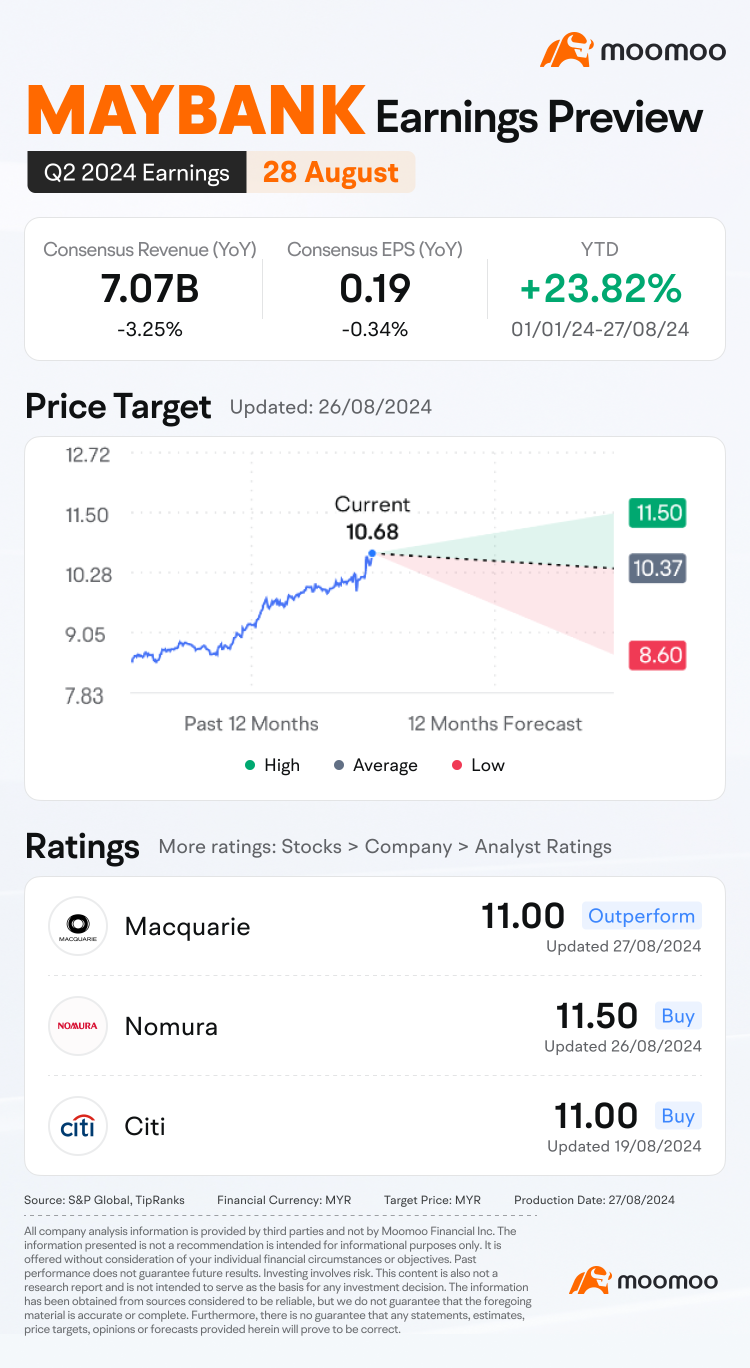

Malayan Banking Bhd $MAYBANK (1155.MY)$ is expected to release its quarterly earnings on August 28*. How will the market react to the company's results? Vote your answer to participate!

*The exact release date depends on the company's announcement.

🎁 Rewards

![]() An equal share of 5,000 points: For mooers who correctly guess the price range of $MAYBANK (1155.MY)$'s closing price on 29 August!

An equal share of 5,000 points: For mooers who correctly guess the price range of $MAYBANK (1155.MY)$'s closing price on 29 August!

(Vote will close a...

Malayan Banking Bhd $MAYBANK (1155.MY)$ is expected to release its quarterly earnings on August 28*. How will the market react to the company's results? Vote your answer to participate!

*The exact release date depends on the company's announcement.

🎁 Rewards

(Vote will close a...

77

142

23

OscarTrader

voted

Hi, mooers!

Join the Q2 Earnings Challenge and share 30,000 points! Tap to learn more!

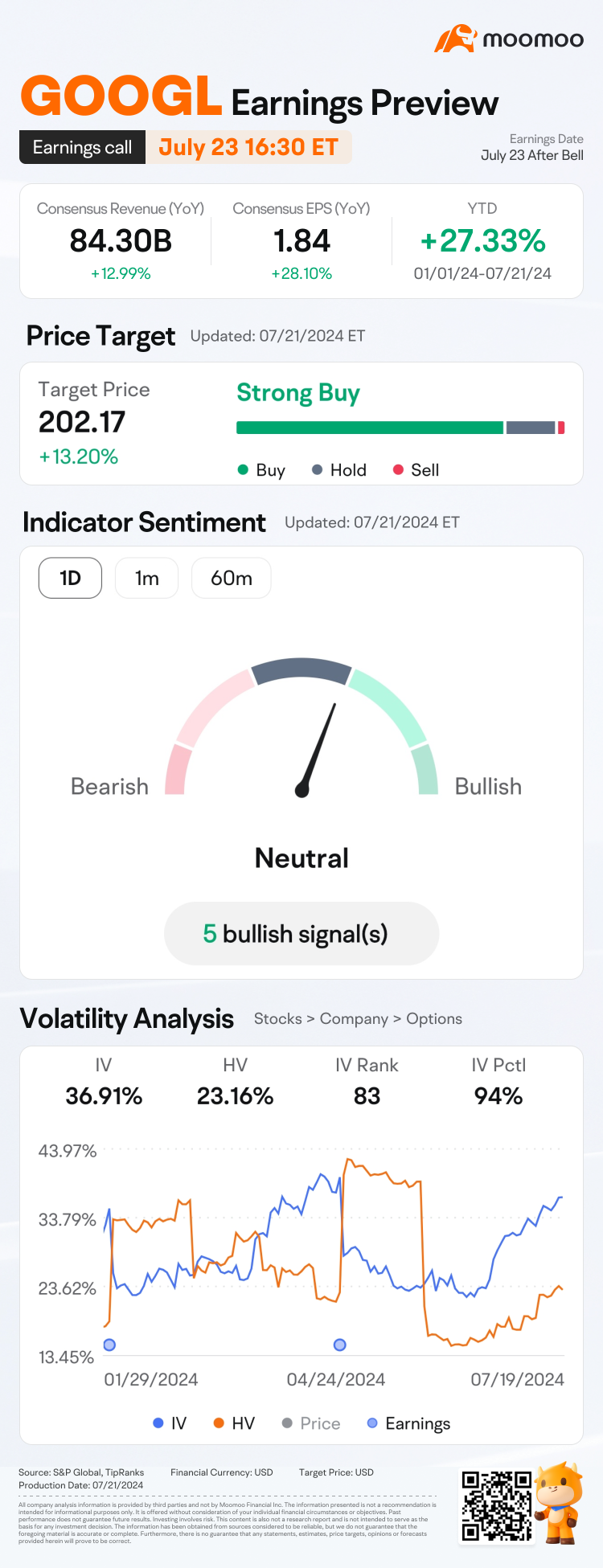

$Alphabet-A (GOOGL.US)$ is releasing its Q2 earnings on July 23 after the bell. Unlock insights with GOOGL Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q1 earnings release, shares of $Alphabet-A (GOOGL.US)$ have seen an increase of 11.77%.![]() How will the market react to the upcoming resul...

How will the market react to the upcoming resul...

Join the Q2 Earnings Challenge and share 30,000 points! Tap to learn more!

$Alphabet-A (GOOGL.US)$ is releasing its Q2 earnings on July 23 after the bell. Unlock insights with GOOGL Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q1 earnings release, shares of $Alphabet-A (GOOGL.US)$ have seen an increase of 11.77%.

Expand

Expand 79

153

17

OscarTrader

liked

Link for the first quarter👉🏻Summary and thoughts for the first quarter of 2024👇

Monthly profit and loss chart for the second quarter:

Small losses in April and June, small profits in May; overall trading results are struggling.

Rate of return curve for the second quarter:

Total loss of 0.51%, lagging behind the overall market (SPX+4.13%)

YTD yield curve:

Continues to outperform the market YTD, with the margin closing.

TOP 5 winners in the second quarter:

$ProShares Ultra Bloomberg Natural Gas (BOIL.US)$ (+4.2%After 2 months of operation, it experienced an upward trend, with the core position accounting for approximately 3.X% and bringing 4.2% profit to the account. Currently, there are no hold positions. Once again, a small position makes a big contribution, but overall operation is very demanding for part-time traders.

$NVIDIA (NVDA.US)$ (+2.47%) Using approximately 8% of the position, riding a rising trend for about 3 weeks, contributed 2.47% profit to the account. Currently no positions are held, and I continue to be bullish on it in the future, patiently waiting for the next opportunity to set up.

$Royal Caribbean (RCL.US)$ (+0.95%) As of now, it has brought 0.95% profit to the account, and there are still 1/2 positions being held.

$Netflix (NFLX.US)$ (+0.72%) Currently brings 0.72% to the account...

Monthly profit and loss chart for the second quarter:

Small losses in April and June, small profits in May; overall trading results are struggling.

Rate of return curve for the second quarter:

Total loss of 0.51%, lagging behind the overall market (SPX+4.13%)

YTD yield curve:

Continues to outperform the market YTD, with the margin closing.

TOP 5 winners in the second quarter:

$ProShares Ultra Bloomberg Natural Gas (BOIL.US)$ (+4.2%After 2 months of operation, it experienced an upward trend, with the core position accounting for approximately 3.X% and bringing 4.2% profit to the account. Currently, there are no hold positions. Once again, a small position makes a big contribution, but overall operation is very demanding for part-time traders.

$NVIDIA (NVDA.US)$ (+2.47%) Using approximately 8% of the position, riding a rising trend for about 3 weeks, contributed 2.47% profit to the account. Currently no positions are held, and I continue to be bullish on it in the future, patiently waiting for the next opportunity to set up.

$Royal Caribbean (RCL.US)$ (+0.95%) As of now, it has brought 0.95% profit to the account, and there are still 1/2 positions being held.

$Netflix (NFLX.US)$ (+0.72%) Currently brings 0.72% to the account...

Translated

+14

20

OscarTrader

Set a live reminder

[Synopsis]

With the global market transitions since the start of 2024, how can an active investor possibly capture these pivotal turns and evolutions for their investment strategy? With the final live webinar for our mid-year funds series, learn how investors like yourselves can potentially leverage on Income strategies to navigate the changes on a global scale with our experts from PIMCO and Moomoo Singapore. Join us and you may be rewarded with qu...

With the global market transitions since the start of 2024, how can an active investor possibly capture these pivotal turns and evolutions for their investment strategy? With the final live webinar for our mid-year funds series, learn how investors like yourselves can potentially leverage on Income strategies to navigate the changes on a global scale with our experts from PIMCO and Moomoo Singapore. Join us and you may be rewarded with qu...

A Pivotal Year: Strategies for Capturing Income

Jun 28 04:00

24

3

OscarTrader

liked

Last week review👉🏻Market Review + Position Analysis (03/06-07/06 2024)

"Over the years, the most important discipline I have developed is never to let my opinions interfere with the ability and willingness to make breakthroughs in good setups. I always let stocks determine the flow of my capital, no matter what my intuition says. Sometimes my intuition is right, sometimes it is wrong... but stocks can never be wrong, because I am the guard and the market is the engine. My strategy is what I follow, not my personal opinions. This requires discipline and willingness. Strive to do this!" - Mark Minervini

Quick review of the market this week:

$NASDAQ 100 Index (.NDX.US)$ Accumulate funds on Monday and Wednesday;

$S&P 500 Index (.SPX.US)$ Accumulate funds on Monday and Wednesday;

$Dow Jones Industrial Average (.DJI.US)$ Distribute on Tuesday, divergence on Wednesday.

NDX>SPX>DJI.

In the recent two weeks, the market has been led by giant technology stocks and large semiconductor stocks. Currently, these big players are somewhat stretched, and the overall breadth of the market has deteriorated. In the short term, rotation is needed to maintain the healthy development of the market; beneath the surface of the market's climb, the reality of stock trading is still struggling. Let's see how the market will develop in the second half of this month, with trading activities primarily guided by the feedback of the stocks themselves.

Weekly charts of NDX and SPX:

Short-term slowing down...

"Over the years, the most important discipline I have developed is never to let my opinions interfere with the ability and willingness to make breakthroughs in good setups. I always let stocks determine the flow of my capital, no matter what my intuition says. Sometimes my intuition is right, sometimes it is wrong... but stocks can never be wrong, because I am the guard and the market is the engine. My strategy is what I follow, not my personal opinions. This requires discipline and willingness. Strive to do this!" - Mark Minervini

Quick review of the market this week:

$NASDAQ 100 Index (.NDX.US)$ Accumulate funds on Monday and Wednesday;

$S&P 500 Index (.SPX.US)$ Accumulate funds on Monday and Wednesday;

$Dow Jones Industrial Average (.DJI.US)$ Distribute on Tuesday, divergence on Wednesday.

NDX>SPX>DJI.

In the recent two weeks, the market has been led by giant technology stocks and large semiconductor stocks. Currently, these big players are somewhat stretched, and the overall breadth of the market has deteriorated. In the short term, rotation is needed to maintain the healthy development of the market; beneath the surface of the market's climb, the reality of stock trading is still struggling. Let's see how the market will develop in the second half of this month, with trading activities primarily guided by the feedback of the stocks themselves.

Weekly charts of NDX and SPX:

Short-term slowing down...

Translated

+15

14

OscarTrader

liked

Last week review👉🏻Market Review + Position Analysis (28/05-31/05 2024)

"If you listen to what others say instead of paying attention to what the stocks are telling you, you may be very confused." - Mark Minervini

Quick review of the market this week:

$NASDAQ 100 Index (.NDX.US)$ Sucking in money on Wednesday;

$S&P 500 Index (.SPX.US)$ Sucking in money on Wednesday;

$Dow Jones Industrial Average (.DJI.US)$ The funds will be raised on Wednesday and distributed on Friday.

NDX>SPX>DJI.

As analyzed last week, it won't be long before the market reaches a new high. However, in terms of stocks, except for a few strong names, most are in a volatile state. Many stocks have been reassessed over the weekend, and some names have been put on the potential cut/clear list, while some new names have entered the watch list.

Weekly charts of NDX and SPX:

The medium to long-term upward trend is still in the early to middle stage, and there are currently no signs of any potential issues.

In terms of market sentiment:

The proportion of AAII bearishness suddenly reached a recent high on Wednesday. The last similar emotional leap was on April 17th.

The Fear & Greed Index is still below 50, indicating that the real uptrend has not yet begun, and many potential opportunities have not yet surfaced...

"If you listen to what others say instead of paying attention to what the stocks are telling you, you may be very confused." - Mark Minervini

Quick review of the market this week:

$NASDAQ 100 Index (.NDX.US)$ Sucking in money on Wednesday;

$S&P 500 Index (.SPX.US)$ Sucking in money on Wednesday;

$Dow Jones Industrial Average (.DJI.US)$ The funds will be raised on Wednesday and distributed on Friday.

NDX>SPX>DJI.

As analyzed last week, it won't be long before the market reaches a new high. However, in terms of stocks, except for a few strong names, most are in a volatile state. Many stocks have been reassessed over the weekend, and some names have been put on the potential cut/clear list, while some new names have entered the watch list.

Weekly charts of NDX and SPX:

The medium to long-term upward trend is still in the early to middle stage, and there are currently no signs of any potential issues.

In terms of market sentiment:

The proportion of AAII bearishness suddenly reached a recent high on Wednesday. The last similar emotional leap was on April 17th.

The Fear & Greed Index is still below 50, indicating that the real uptrend has not yet begun, and many potential opportunities have not yet surfaced...

Translated

+25

19

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)