PalmettoMoo

voted

Morning mooers! It's Thursday, May 30th. The market indexes are in decline, and GDP numbers were revised lower, but overall, there is more green than red out there. My name is Kevin Travers, here are stories heard on Wall Street today:

If most equities were green, you would not believe it based on recent earnings reactions.

$UiPath (PATH.US)$ fell 34% at open after the firm lowered its full year guidance during its earnings release, ...

If most equities were green, you would not believe it based on recent earnings reactions.

$UiPath (PATH.US)$ fell 34% at open after the firm lowered its full year guidance during its earnings release, ...

38

4

PalmettoMoo

commented on

$ProShares Ultra Bloomberg Natural Gas (BOIL.US)$ going once,twice and gone!

2

PalmettoMoo

voted

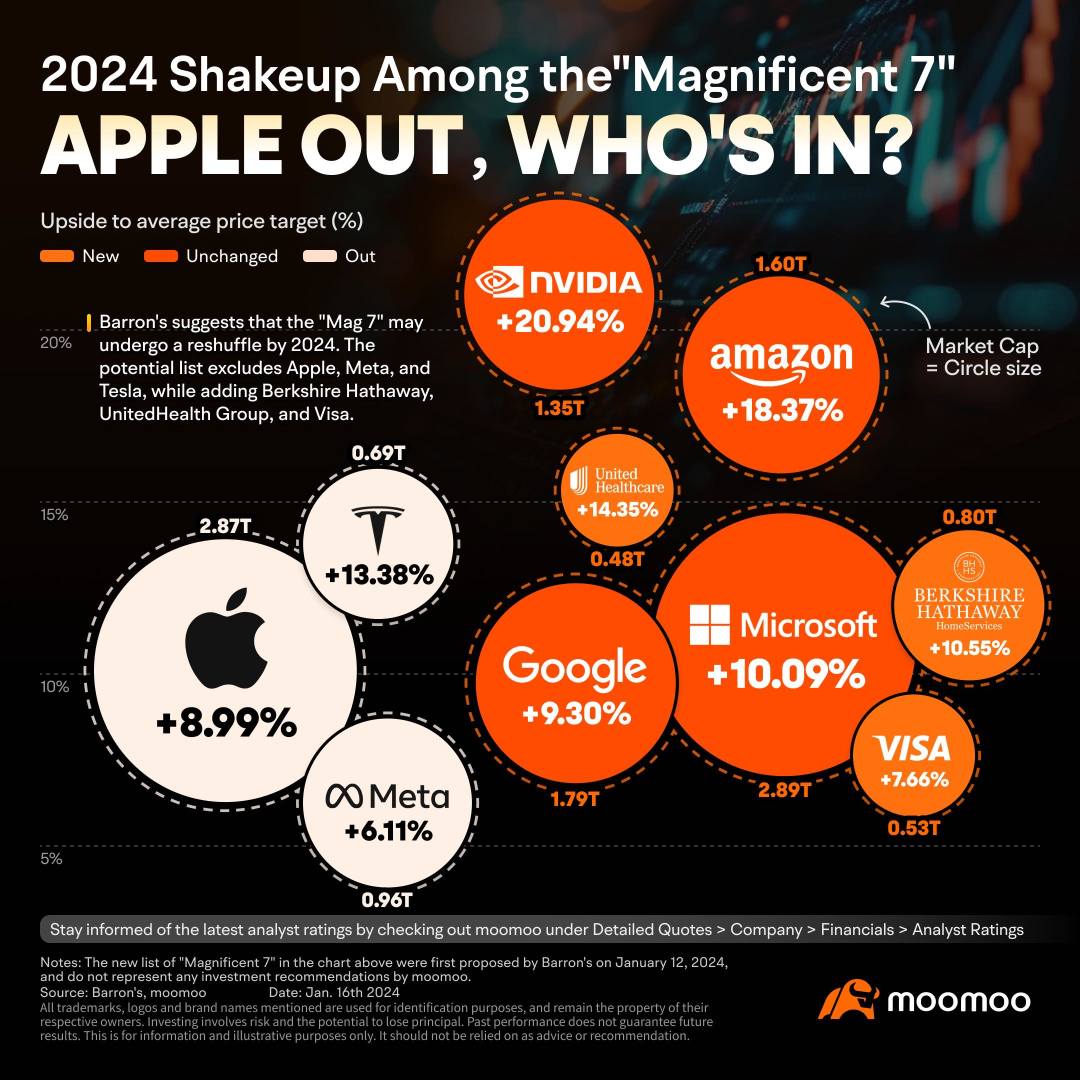

The "Magnificent 7" made an impressive showing in 2023. However, as 2024 begins, there has been a significant divergence in the fundamentals, analyst opinions, and stock performance of the seven companies.The increasing sentiment is that a shakeup is needed in the "Magnificent 7" this year to include companies with greater potential. Barron's senior writer and member of the stock-picking team, Nicholas Jasinski, ...

35

8

PalmettoMoo

voted

Fixed Income Investing

If you want guaranteed returns on a low risk investment, then look towards fixed income investing. US treasuries are some of the least risky investments in the fixed income space.

$Vanguard Total Bond Market ETF (BND.US)$ $iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB.US)$ $Short-Treasury Bond Ishares (SHV.US)$ $SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (BIL.US)$ $iShares 1-3 Year Treasury Bond ETF (SHY.US)$ $iShares 3-7 Year Treasury Bond ETF (IEI.US)$ $iShares 7-10 Year Treasury Bond ETF (IEF.US)$ $Ishares Trust 10-20 Year Treasury Bd Etf (TLH.US)$ $iShares 20+ Year Treasury Bond ETF (TLT.US)$

���������...

If you want guaranteed returns on a low risk investment, then look towards fixed income investing. US treasuries are some of the least risky investments in the fixed income space.

$Vanguard Total Bond Market ETF (BND.US)$ $iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB.US)$ $Short-Treasury Bond Ishares (SHV.US)$ $SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (BIL.US)$ $iShares 1-3 Year Treasury Bond ETF (SHY.US)$ $iShares 3-7 Year Treasury Bond ETF (IEI.US)$ $iShares 7-10 Year Treasury Bond ETF (IEF.US)$ $Ishares Trust 10-20 Year Treasury Bd Etf (TLH.US)$ $iShares 20+ Year Treasury Bond ETF (TLT.US)$

���������...

+1

20

8

PalmettoMoo

commented on

Elon Musk isn't pleased after $Tesla (TSLA.US)$ was dropped from an equity index that tracks environmental, social and governance principles (ESG).

ESG is a scam. It has been weaponized by phony social justice warriors.

—— Mr.Musk said.

Musk lamented that $Exxon Mobil (XOM.US)$, one of the world's largest oil and gas companies, remained in the index.

The S&P Dow Jones Indices recently removed Tesla and several other companies from its E...

ESG is a scam. It has been weaponized by phony social justice warriors.

—— Mr.Musk said.

Musk lamented that $Exxon Mobil (XOM.US)$, one of the world's largest oil and gas companies, remained in the index.

The S&P Dow Jones Indices recently removed Tesla and several other companies from its E...

36

58

PalmettoMoo

commented on

tesla market cap is less than 1T. how can tesla be less than Apple. this is a joke?

3

9

PalmettoMoo

liked

$ProShares UltraPro QQQ ETF (TQQQ.US)$ I saw a post earlier that justifying 100% portfolio in TQQQ. TQQQ has been back tested for Dot com bubble. It would have taken 2 decades to get your original investment back if you bought at the peak of Dot com bubble.

Leveraged ETS work when there is Euphoria, but it can literally wipe you out if you don't understand its Risk and don't have a proper Risk management plan in place.

Leveraged ETS work when there is Euphoria, but it can literally wipe you out if you don't understand its Risk and don't have a proper Risk management plan in place.

15

2

PalmettoMoo

liked

$Tesla (TSLA.US)$ Sure go buy a new car when you are struggling with higher gas and food prices. Buttigieg is such an elitist moron.

22

6

PalmettoMoo

liked

A friend chatted with me an interesting question: "Many young people ask me, what is the best investment now, stocks, futures or funds?" I always answer him: ‘The best investment is to invest in yourself! '"Time will tell you that the best investment is to invest in yourself. Our lifelong pursuit is to meet a better self, to meet a better life, to have more freedom, and to live a more comfortable life. And all of this is inseparable from your own hard work and creation, and inseparable from your own “investment.” When you feel that you are confused about the future, please invest in yourself. Perhaps, when it is, the role of this investment is not obvious But, time will tell you what a wise choice you have made now. You did not live up to the time.

$Tesla (TSLA.US)$ $Netflix (NFLX.US)$ $Disney (DIS.US)$ $NIO Inc (NIO.US)$ $Longeveron (LGVN.US)$

$Tesla (TSLA.US)$ $Netflix (NFLX.US)$ $Disney (DIS.US)$ $NIO Inc (NIO.US)$ $Longeveron (LGVN.US)$

48

4

PalmettoMoo

liked

GO Nvidia - My Investment Objective has always been Growth - Nvidia fits the bill - my adjusted cost basis is less than $4 per share. $NVIDIA (NVDA.US)$

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)