Pandamonium_6924

voted

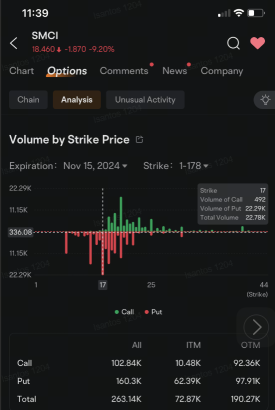

$Super Micro Computer (SMCI.US)$ attracted heavier options volume as the stock price slumped to the lowest since May 2023 after the developer of server solutions said it's unable to file its financial report for the quarter ended Sept. 30. That compounded concerns that the company could be delisted.

The company still hasn't hired a new auditor. Ernst & Young resigned in October, noting that it's "unwilling to be associated with...

The company still hasn't hired a new auditor. Ernst & Young resigned in October, noting that it's "unwilling to be associated with...

31

11

17

Pandamonium_6924

voted

Hello Mooers! ![]()

In today's discussion, I would like to try helping one of my![]() cutest $Futu Holdings Ltd (FUTU.US)$ MooMoo supporters, @soyabean89 , to answer his question, that is, which REIT types have better chances to

cutest $Futu Holdings Ltd (FUTU.US)$ MooMoo supporters, @soyabean89 , to answer his question, that is, which REIT types have better chances to ![]() Huat Big Big, which he posted as a comment in one of my posts. Mooers can access that post by clicking the link below.

Huat Big Big, which he posted as a comment in one of my posts. Mooers can access that post by clicking the link below.

To answer that question, I took some efforts![]() by finding all the REITs listed on the Singapore Stock Exchange. In ...

by finding all the REITs listed on the Singapore Stock Exchange. In ...

In today's discussion, I would like to try helping one of my

To answer that question, I took some efforts

42

23

20

Pandamonium_6924

voted

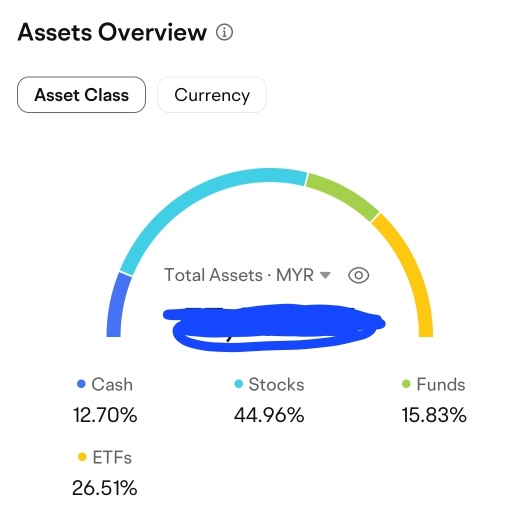

I feel that this rate cut against an uncertain recessionary and un/under-employment backdrop, on top other bad govermental policies = volatility. To add to this, there is too much hot money in the market, not just from US investors/ traders, but from all over the world, further contributing to the chaos.

My current strategy is defensive.

1) 50% of my portfolio is high dividend stock such as:

$Stellantis NV (STLA.US)$

$GlaxoSmithKline (GSK.US)$

$Ecopetrol (EC.US)$

���������...

My current strategy is defensive.

1) 50% of my portfolio is high dividend stock such as:

$Stellantis NV (STLA.US)$

$GlaxoSmithKline (GSK.US)$

$Ecopetrol (EC.US)$

���������...

12

2

Pandamonium_6924

voted

Hey, mooers!

The global financial community is gearing up for the Jackson Hole Symposium taking place from August 22-24. Attention is focused on Powell's speech at 10:00 a.m. ET on August 23 (tap here to reserve your spot for the live stream), which typically offers insights into the Federal Reserve's monetary policy outlook. This year's gathering is themed "Reevaluating the Effectiveness and Transmission Mechanisms of Monetary Policy."...

The global financial community is gearing up for the Jackson Hole Symposium taking place from August 22-24. Attention is focused on Powell's speech at 10:00 a.m. ET on August 23 (tap here to reserve your spot for the live stream), which typically offers insights into the Federal Reserve's monetary policy outlook. This year's gathering is themed "Reevaluating the Effectiveness and Transmission Mechanisms of Monetary Policy."...

96

71

9

Pandamonium_6924

voted

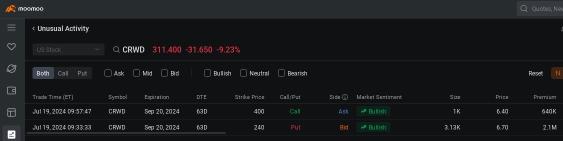

Columns CrowdStrike Sees Big Money Jump Into Options Amid Rising Demand for Hedge Against Price Slump

Big money is jumping into $CrowdStrike (CRWD.US)$ put options amid increasing demand for protection against deepening losses as the stock slumps more than 8%.

CrowdStrike's stock fell to $314.56 Friday morning after CEO George Kutz posted on LinkedIn that the company's customers were impacted by a defect found in a content update for Microsoft Windows hosts. The event caused a global outage, forcing airli...

CrowdStrike's stock fell to $314.56 Friday morning after CEO George Kutz posted on LinkedIn that the company's customers were impacted by a defect found in a content update for Microsoft Windows hosts. The event caused a global outage, forcing airli...

+1

45

2

20

Pandamonium_6924

voted

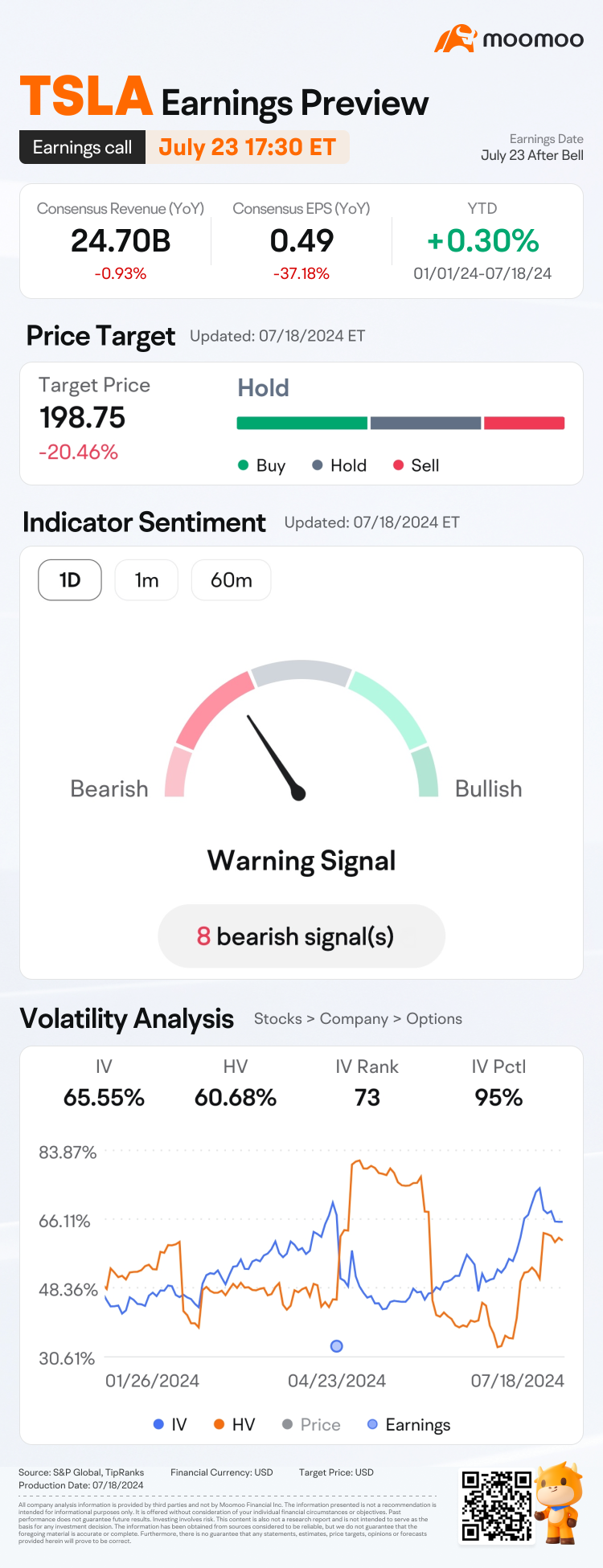

$Tesla (TSLA.US)$ is releasing its Q2 earnings on July 23 after the bell. Unlock insights with TSLA Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q1 earnings release, shares of $Tesla (TSLA.US)$ have seen an increase of 72.26%!![]() How will the market react to the upcoming results? Make your guess now!

How will the market react to the upcoming results? Make your guess now! ![]()

Rewards

● An equal share of 10,000 points: For mooers who correctly guess th...

For the details of indicator sentiment, please tap the link and check.

Since its Q1 earnings release, shares of $Tesla (TSLA.US)$ have seen an increase of 72.26%!

Rewards

● An equal share of 10,000 points: For mooers who correctly guess th...

Expand

Expand 128

250

25

Pandamonium_6924

voted

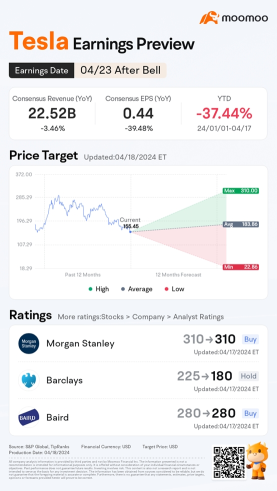

Tesla is releasing its Q1 2024 earnings after the market closes on April 23.

Since its Q4 earnings release, shares of $Tesla (TSLA.US)$ have seen a decrease of 29%.![]() Overall earnings estimates have been revised lower since the company's last earnings release. How will the market react to the upcoming results? Make your guess now!

Overall earnings estimates have been revised lower since the company's last earnings release. How will the market react to the upcoming results? Make your guess now! ![]()

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the price range ...

Since its Q4 earnings release, shares of $Tesla (TSLA.US)$ have seen a decrease of 29%.

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the price range ...

144

371

34

Pandamonium_6924

voted

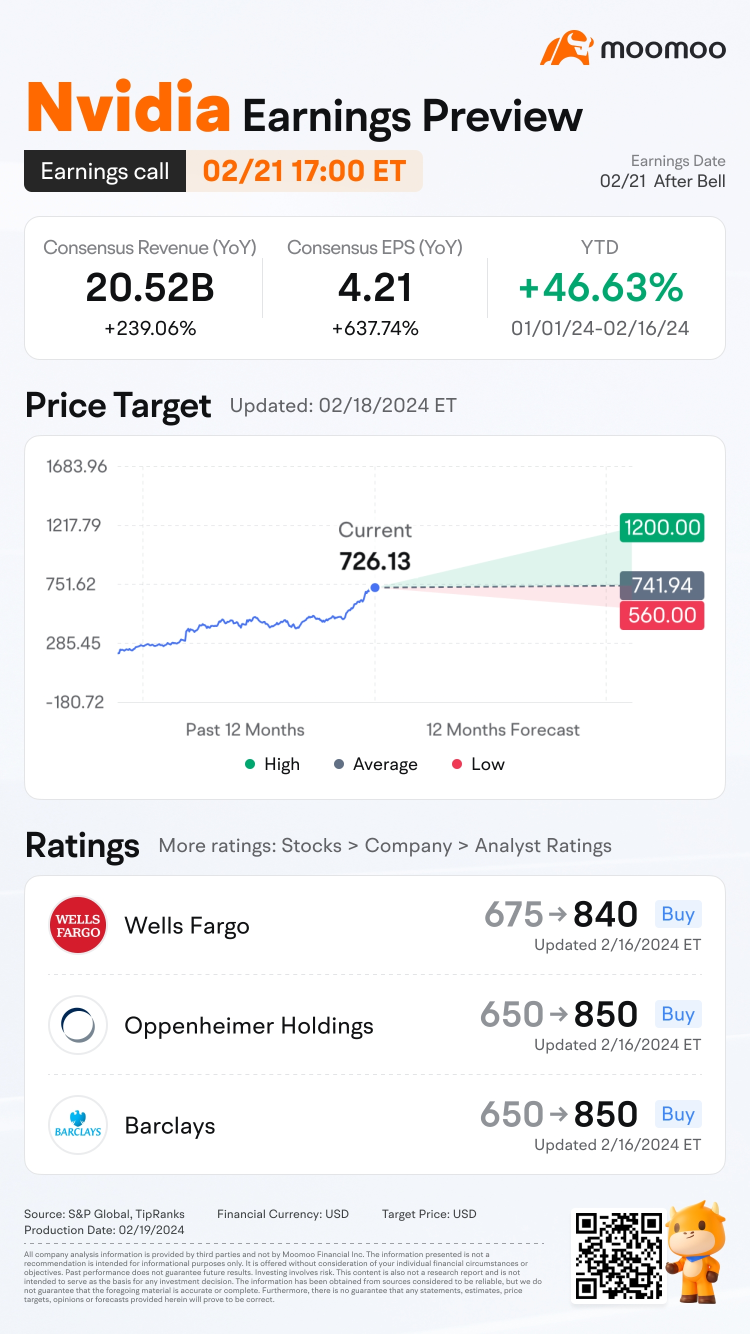

$NVIDIA (NVDA.US)$ is releasing its Q4 FY24 earnings on Feburary 21, after the U.S. stock market close. How will the market react to the company's quarterly results? Vote your answer to participate!

Rewards

● An equal share of 10,000 points: For mooers who correctly guess the price range of $NVIDIA (NVDA.US)$'s opening price at 9:30 AM ET Feb 22 (e.g., If 50 mooers make a correct guess, each of them will get 200 points!...

Rewards

● An equal share of 10,000 points: For mooers who correctly guess the price range of $NVIDIA (NVDA.US)$'s opening price at 9:30 AM ET Feb 22 (e.g., If 50 mooers make a correct guess, each of them will get 200 points!...

152

111

18

Pandamonium_6924

voted

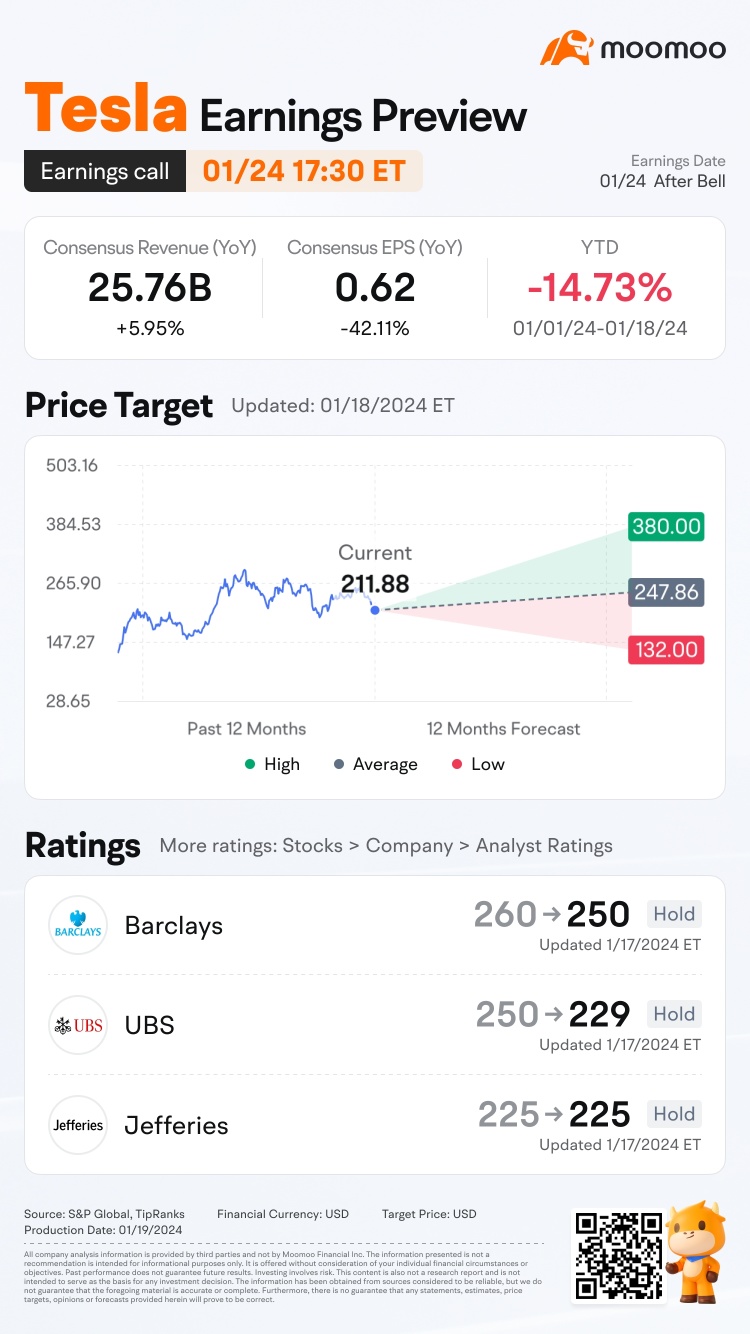

Tesla is releasing its Q4 2023 earnings on January 24, after the U.S. stock market close. How will the market react to the company's quarterly results? Vote your answer to participate!

Rewards

● An equal share of 1,000 points: For mooers who correctly guess the price range of $Tesla (TSLA.US)$'s opening price at 9:30 AM ET Jan 25 (e.g., If 50 mooers make a correct guess, each of them will get 20 points.)

(Vote will ...

Rewards

● An equal share of 1,000 points: For mooers who correctly guess the price range of $Tesla (TSLA.US)$'s opening price at 9:30 AM ET Jan 25 (e.g., If 50 mooers make a correct guess, each of them will get 20 points.)

(Vote will ...

106

130

11

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)