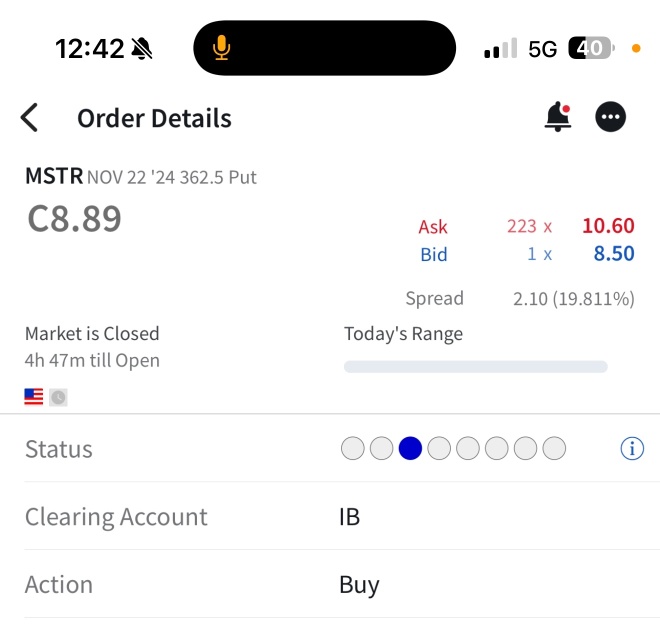

$MicroStrategy (MSTR.US)$ CITRON DECLARED WAR

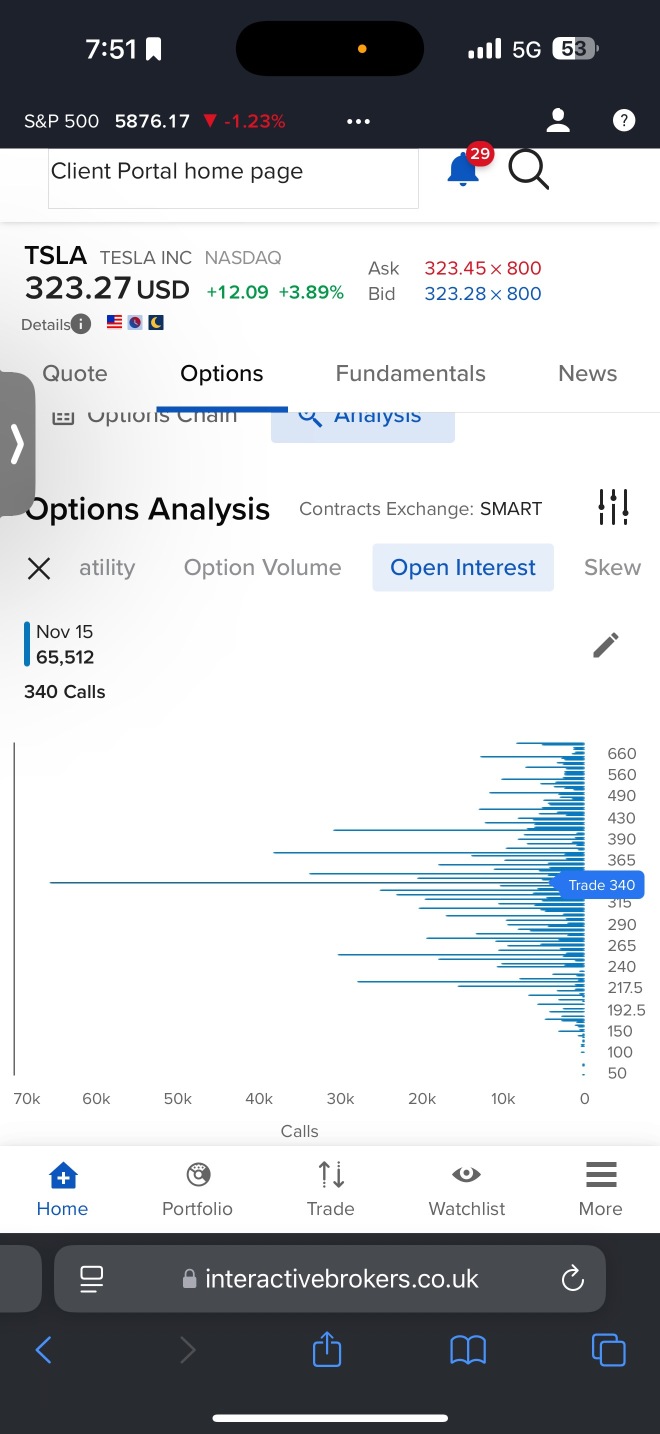

$Tesla (TSLA.US)$https://news.futunn.com/en/post/50057179?ns_stock_id=201335&report_type=stock&hk_cid=232964417&report_id=47556052&main_broker=WwogIDEwMDEKXQ==&skintype=3&src=2&futusource=news_stock_stockpagenews&client_hour_clock=24&level=1&global_content=%7B%22promote_content%22%3A%22nn%3Apost%3A50057179%22%2C%22invite%22%3A232964417%7D&data_ticket=3a7f565fe149756abf1e51e5a866ede2&utm_medium=futu_niuniu_share&utm_content=web_share&utm_campaign=news&utm_term=50057179

2

$NVIDIA (NVDA.US)$ The top call option for **NVIDIA (NVDA)** with 0 days to expiration as of October 25, 2024, based on open interest is:

[Stock Symbol: NVDA]

- **Signal**: Buy

- **Option Strategy**: Long Call

- **Strike Price**: US$150.00

- **Expiry Date**: 25-Oct-2024

- **Current Price**: US$142.12

- **Buy/Sell**: Buy

- **Call/Put**: Call

- **Premium**: US$0.02

- **Stop loss**: US$0.01

- **Take profit**: US$0.02

- **Open Interest**: 149,743

- **Implied Volatility**: 58%

- **Rationale**: The te...

[Stock Symbol: NVDA]

- **Signal**: Buy

- **Option Strategy**: Long Call

- **Strike Price**: US$150.00

- **Expiry Date**: 25-Oct-2024

- **Current Price**: US$142.12

- **Buy/Sell**: Buy

- **Call/Put**: Call

- **Premium**: US$0.02

- **Stop loss**: US$0.01

- **Take profit**: US$0.02

- **Open Interest**: 149,743

- **Implied Volatility**: 58%

- **Rationale**: The te...

7

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)