Patylc

voted

I will start with my positions in $NVIDIA (NVDA.US)$ . Other than $NVIDIA (NVDA.US)$ I have the leveraged ETF $GraniteShares 2x Long NVDA Daily ETF (NVDL.US)$ which is currently losing ![]() . I also have the short puts options which I wish to close by this week

. I also have the short puts options which I wish to close by this week ![]() .

.

So how do I feel about Nvidia? I would say that it has been more volatile than I anticipated despite of its good earnings, the stock has not been performing as well. With the upcoming Nvidia GTC ...

So how do I feel about Nvidia? I would say that it has been more volatile than I anticipated despite of its good earnings, the stock has not been performing as well. With the upcoming Nvidia GTC ...

+3

64

25

11

Patylc

voted

The $NVIDIA (NVDA.US)$GTC (GPU Technology Conference)is one of the most anticipated events in the tech industry, often serving as a catalyst for momentum in AI, semiconductor, and quantum computing stocks.

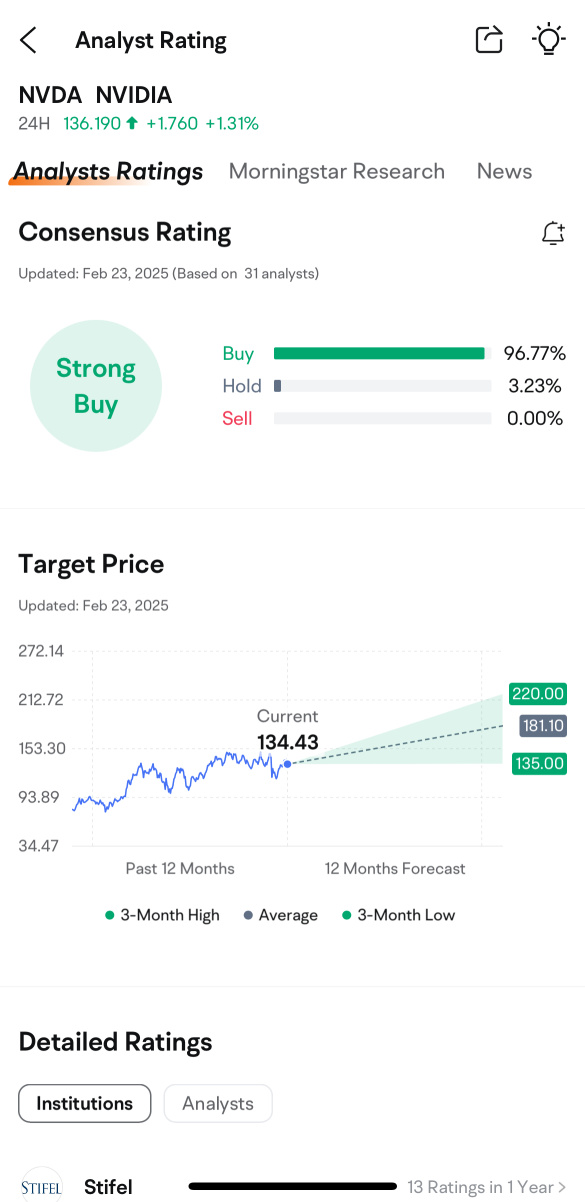

I am a long term holder of Nvidia (NVDA) stocks as I believe that they have a lot more to offer as we navigate the AI and Quantum space, things will move very quickly.

While past performance is not a guarantee, NVIDIA’s announcements at...

I am a long term holder of Nvidia (NVDA) stocks as I believe that they have a lot more to offer as we navigate the AI and Quantum space, things will move very quickly.

While past performance is not a guarantee, NVIDIA’s announcements at...

+1

30

9

8

Patylc

voted

💡 Is Nvidia about to spark another AI stock explosion? GTC 2025 is here, and the stakes have never been higher! Lock in your Calendar 📆 17 - 21 March.

🔥 What’s Coming at GTC 2025?

🔹 GeForce RTX 50 Series Expansion 🚀

📌 Expect new RTX 5070 Ti & 5070 GPUs, powered by Blackwell architecture—rumored to deliver next-gen AI & gaming performance. Could this redefine GPU dominance?

🔹 Project DIGITS AI Supercomputer 🤯

📌 1 peta...

🔥 What’s Coming at GTC 2025?

🔹 GeForce RTX 50 Series Expansion 🚀

📌 Expect new RTX 5070 Ti & 5070 GPUs, powered by Blackwell architecture—rumored to deliver next-gen AI & gaming performance. Could this redefine GPU dominance?

🔹 Project DIGITS AI Supercomputer 🤯

📌 1 peta...

+8

38

10

1

Patylc

voted

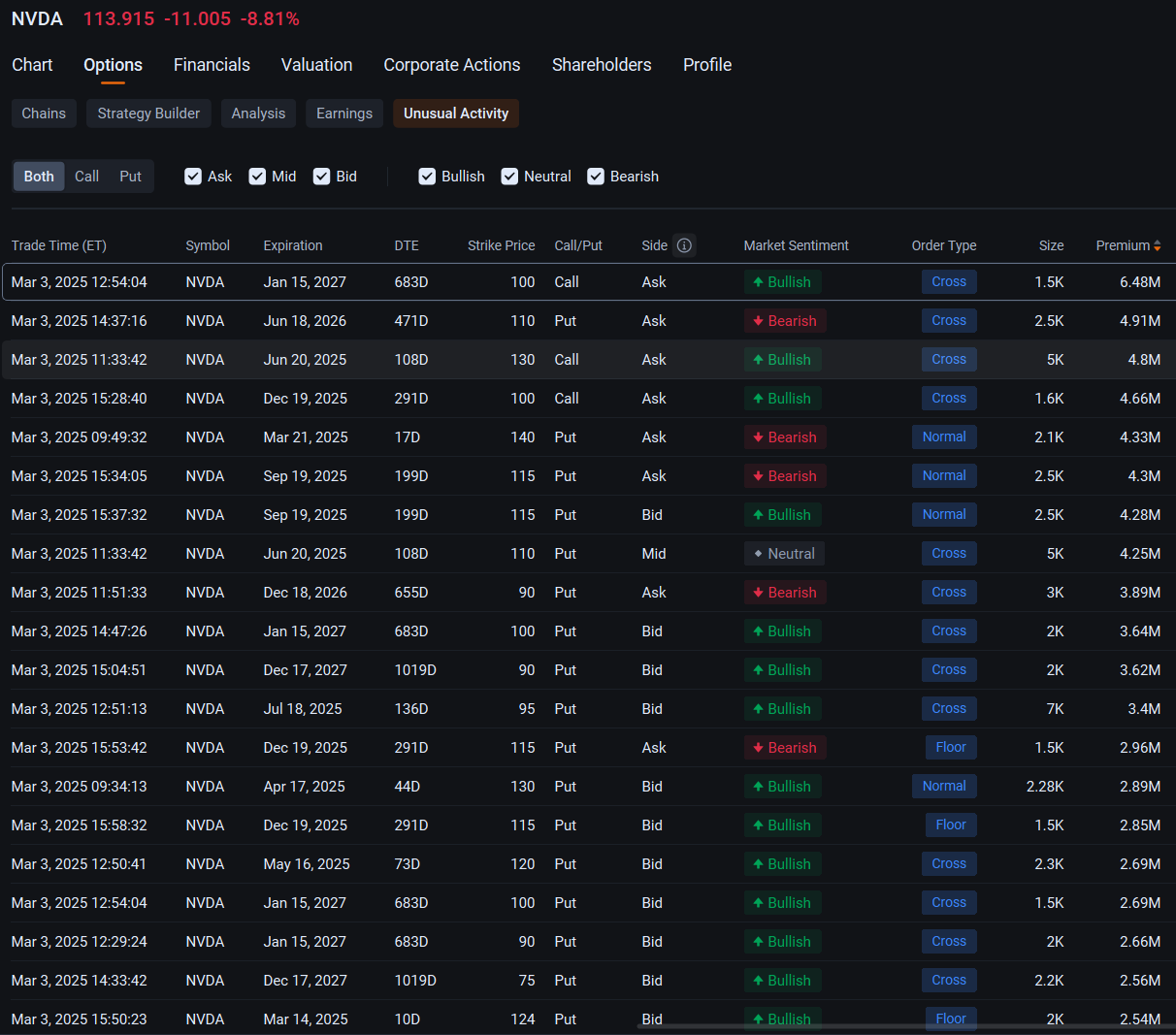

$NVIDIA (NVDA.US)$ bulls piled onto bullish block trades of options Monday, undeterred by the stock slump that sent the chip giant’s market capital to its lowest level in almost six months.

Shares of Nvidia tumbled 8.8% to close at $113.92 in New York, taking its market capital to $2.78 trillion, the lowest level since September. The slump came amid concerns that escalating trade tensions could trigger a downturn for the...

Shares of Nvidia tumbled 8.8% to close at $113.92 in New York, taking its market capital to $2.78 trillion, the lowest level since September. The slump came amid concerns that escalating trade tensions could trigger a downturn for the...

40

2

28

Patylc

voted

Hi, mooers! 👋

The AI world holds its breath! $NVIDIA (NVDA.US)$ will release its Q4 FY2025 earnings on February 26, just before the market opens. As the AI kingpin faces heightened scrutiny amid market volatility, will it defy expectations again? This is your chance to earn rewards and gain insights by predicting the opening price. Let’s get into it! 🎉

Stay Ahead of the Game

Subscribe to @Moo Live for real-time updates, expert analysis, and t...

The AI world holds its breath! $NVIDIA (NVDA.US)$ will release its Q4 FY2025 earnings on February 26, just before the market opens. As the AI kingpin faces heightened scrutiny amid market volatility, will it defy expectations again? This is your chance to earn rewards and gain insights by predicting the opening price. Let’s get into it! 🎉

Stay Ahead of the Game

Subscribe to @Moo Live for real-time updates, expert analysis, and t...

645

1022

40

Patylc

reacted to

Recently, as expected, the Federal Reserve cut interest rates by 25 basis points, meeting market expectations. However, why is there a slowdown in rate cuts next year? First of all, let me clarify that I will not provide direct answers. For those who are willing to learn, I will provide hints. Please go find the answers and think independently. Interest rate cuts and hikes have different effects. Hikes mainly suppress inflation, while rate cuts mainly have three effects. What are these three effects, you can go do some research. ![]()

Why is the market reacting so strongly to Powell's slowdown in rate cuts? Because of concerns about inflation rebounding. Why? Due to Trump's tariff policies (here you can go ask "orthopedics" to learn how they are formed). If in the future inflation leads the Federal Reserve back to a rate hike path, what impact will this have on the stock market? I know this may be a bit challenging for those without financial knowledge, so I'll give the answer directly. In a situation where the U.S. economy is already in a soft landing, rather than a hard landing or face landing, combined with U.S. tech stocks, especially visible applications of AI starting up recently, as long as the rate of return on tech stocks grows higher than the Fed's rate hikes, tech stocks may show no fear of rate hikes and soar (but the premise is, as I already hinted in the narrative, remember to pay attention to the key points).

Let's briefly discuss the direction of the large cap. Based on observation and celestial calculations, the technology stocks representing Nasdaq have not met the satisfaction level of increase. Funds will need to be rotated in the future, while individual stock Indicators have been hovering near oversold levels for several days. If you think it's about to fail, I can only hope... $NVIDIA (NVDA.US)$ Indicators have been hovering near oversold levels for a few days. If you think it's about to fail, I can only hope...

Why is the market reacting so strongly to Powell's slowdown in rate cuts? Because of concerns about inflation rebounding. Why? Due to Trump's tariff policies (here you can go ask "orthopedics" to learn how they are formed). If in the future inflation leads the Federal Reserve back to a rate hike path, what impact will this have on the stock market? I know this may be a bit challenging for those without financial knowledge, so I'll give the answer directly. In a situation where the U.S. economy is already in a soft landing, rather than a hard landing or face landing, combined with U.S. tech stocks, especially visible applications of AI starting up recently, as long as the rate of return on tech stocks grows higher than the Fed's rate hikes, tech stocks may show no fear of rate hikes and soar (but the premise is, as I already hinted in the narrative, remember to pay attention to the key points).

Let's briefly discuss the direction of the large cap. Based on observation and celestial calculations, the technology stocks representing Nasdaq have not met the satisfaction level of increase. Funds will need to be rotated in the future, while individual stock Indicators have been hovering near oversold levels for several days. If you think it's about to fail, I can only hope... $NVIDIA (NVDA.US)$ Indicators have been hovering near oversold levels for a few days. If you think it's about to fail, I can only hope...

Translated

78

37

10

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)