PayPayPAY

voted

This week, on the 29th $Alphabet-A (GOOGL.US)$ on the 30th $Meta Platforms (META.US)$ 、 $Microsoft (MSFT.US)$ on the 31st $Amazon (AMZN.US)$ 4 companies each on Earnings reports will be announced quarterly.I am planning to do so.

Ahead of the earnings reports, please vote on the stock price volatility of these four companies.Predict the stock price volatility after the earnings reports of these four companies and vote.

【Compensation】![]()

● Distribute 10,000 points equally

Until 10:00 PM on October 30th (Japan time)Each of the 4 companiesThe closing price on the day following the earnings report.Make financial estimates and choose最も株価変動率(上昇または下落)が大きい銘柄Please choose the correct estimates. Points will be equally distributed among users who made accurate estimates (for example, if 50 users made accurate estimates, they will each receive 400 points).

【Exclusive 1,000 yen worth of Amazon gift card】![]()

Amazon gift card contest...

Ahead of the earnings reports, please vote on the stock price volatility of these four companies.Predict the stock price volatility after the earnings reports of these four companies and vote.

【Compensation】

● Distribute 10,000 points equally

Until 10:00 PM on October 30th (Japan time)Each of the 4 companiesThe closing price on the day following the earnings report.Make financial estimates and choose最も株価変動率(上昇または下落)が大きい銘柄Please choose the correct estimates. Points will be equally distributed among users who made accurate estimates (for example, if 50 users made accurate estimates, they will each receive 400 points).

【Exclusive 1,000 yen worth of Amazon gift card】

Amazon gift card contest...

Translated

68

201

PayPayPAY

voted

PayPayPAY

voted

$USD/JPY (USDJPY.FX)$

Which way do you think it will go in the end?

Please let me know your financial estimates. 🙇♂️

Which way do you think it will go in the end?

Please let me know your financial estimates. 🙇♂️

Translated

5

2

PayPayPAY

commented on and voted

$NVIDIA (NVDA.US)$ is,August 28thAfter the U.S. stock market closes on August 28th (morning of August 29th Japan time),The earnings for the second quarter of fiscal year 2025are scheduled to be announced. While maintaining a leading position in semiconductors for artificial intelligence (ai),the focus is on whether nvidia can exceed market expectations with its growth and strong performance.Please predict nvidia's closing price on the day after the earnings announcement and vote!

【Compensation】

●Distribute 10,000 points equally

Until 10 p.m. on August 29th (Japan time).Closing price of Nvidia on August 29th (5 a.m. on August 30th Japan time)Please make your financial estimates and choose from the price ranges below. If the actual closing price matches the chosen price range, points will be evenly distributed to all users who voted in that price range (e.g. If 50 users hit the mark, each will receive 200 points!).

【Special Challenge! Win 500 yen Amazon gift voucher】

Guess the closing price of Nvidia accurately and get a chance to win additional benefits!

Until 10:00 PM on August 29 (Japan time)On August 29thWith...

【Compensation】

●Distribute 10,000 points equally

Until 10 p.m. on August 29th (Japan time).Closing price of Nvidia on August 29th (5 a.m. on August 30th Japan time)Please make your financial estimates and choose from the price ranges below. If the actual closing price matches the chosen price range, points will be evenly distributed to all users who voted in that price range (e.g. If 50 users hit the mark, each will receive 200 points!).

【Special Challenge! Win 500 yen Amazon gift voucher】

Guess the closing price of Nvidia accurately and get a chance to win additional benefits!

Until 10:00 PM on August 29 (Japan time)On August 29thWith...

Translated

172

748

PayPayPAY

voted

I bought at $106 and sold at $110. Then I bought again at $112 and sold at $114... I don't want to be fooled anymore by these experts recommending short selling.![]() I paid for two UFO onigiri in fees!

I paid for two UFO onigiri in fees!![]()

$NVIDIA (NVDA.US)$

$NVIDIA (NVDA.US)$

Translated

13

PayPayPAY

liked

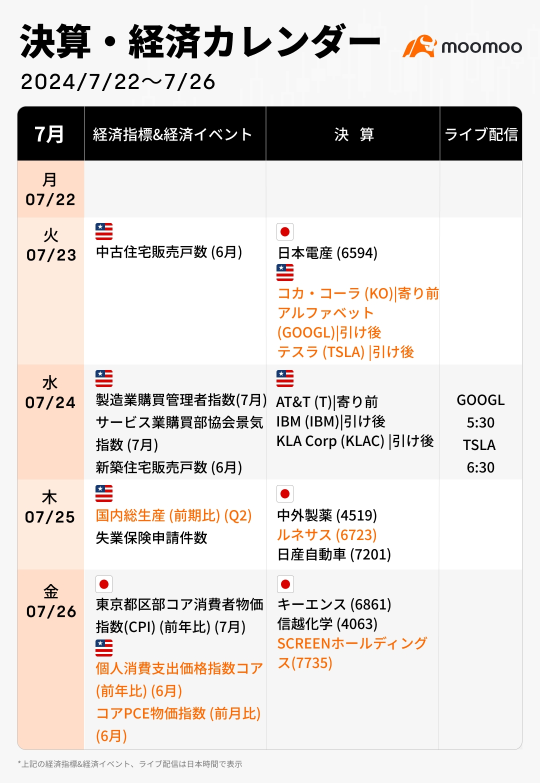

A solid development is expected for Japanese stocks this week. The Nikkei average is likely to see a rebound as a result of the over ¥1,000 decline last week.Buyers aiming for autonomous reboundare likely to enter. On the other hand, earnings of major companies at home and abroad will be announced, and individual stocks will be searched based on performance trends.Following the recent declines,stock picking is likely to continue.Buy on dips.However, the following week will see the monetary policy decision meetings of the FOMC and the Bank of Japan, among other things, which could act as support for the market. $Microsoft (MSFT.US)$It is unlikely that there will be a significant increase as major US tech companies, such as earnings reports, are looming. On the other hand, if the exchange rate shifts further towards yen appreciation, selling pressure may emerge mainly in export-related stocks, warranting caution.

In Japan, $Nidec (6594.JP)$focus is on earnings reports. According to Bloomberg Intelligence, there is a possibility of a rapid recovery from the January-March period, driven by strong demand for AI servers, among other factors.Shinkei Asset Management fund manager Naoki Fujiwara pointed out that if orders continue to show signs of improvement, even without upward revisions, uncertainties about the future are likely to dissipate.Moreover, with the exchange rate trending towards further appreciation of the yen, there's a likelihood of increased selling pressure on export-related stocks, warranting caution.

Translated

89

1

PayPayPAY

liked

$Ishares Msci South Africa Index Fund (EZA.US)$

According to moomoo's analysis, the probability of increase from now on is 95%.

However, there is information that the ruling party in South Africa did not win a majority in the election, so I have doubts about the 95%.

How much trust can we place in moomoo's analysis?

According to moomoo's analysis, the probability of increase from now on is 95%.

However, there is information that the ruling party in South Africa did not win a majority in the election, so I have doubts about the 95%.

How much trust can we place in moomoo's analysis?

Translated

3

PayPayPAY

liked

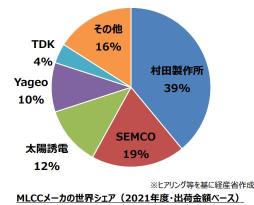

While the sharp rise in semiconductor-related stocks showed calm, it was lateShopping for electronic component brandsis spreading. What is attracting particular attention is that Japan is proud of its competitiveness.”MLCC (Multilayer Ceramic Capacitors)It's”. Integrate AI functions into PCs and smartphone devicesIncreased demand due to “edge AI”and ceramic capacitors according to recent trade statisticsSignificant increase in average export pricesThe fact that it can be seen is in the background. About 800 to 1000 MLCCs are used per smartphone, and they are also often used in computers, EVs (electric vehicles), servers, etc.Rice in the electronics industryAlso called.MLCC is a “passive component”It plays a role such as storing electricity and stabilizing voltage,Semiconductor devices that are “active components”It is essential for proper operation. In other words,As AI evolves, demand for MLCCs will similarly expand along with semiconductorsIt is seen as. The electronic component brands being searched were confirmed, including brands that handle MLCC materials.

![]() The Japanese team is holding on to the MLCC global market share!

The Japanese team is holding on to the MLCC global market share!

Domestic MLCC manufacturers have in-house manufacturing equipment, etc., and technology...

Domestic MLCC manufacturers have in-house manufacturing equipment, etc., and technology...

Translated

+9

151

14

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)