Pila

liked

$Tesla(TSLA.US$ $Lucid Group(LCID.US$ $Rivian Automotive(RIVN.US$ $Lordstown Motors(RIDE.US$

Shares of US-listed electric vehicle companies plummeted across the board on Monday after US President Biden’s “Build Back Better” bill was met with resistance, which included major incentives for the growing electric vehicle industry.

As of Monday's close, Lordstown Motors was down 8.15%, Faraday Future was down 9.5%, Nicolas was down 7.31%, and Lucid was down 5.15%. Rivian Automotive, which went public last month, fell 7.9% to close at $89.98. Chinese concept stock Weilai Auto fell 6.13%.

Shares of other automakers such as Tesla and General Motors also fell. Although the two automakers are no longer eligible for the federal electric vehicle tax credit, they will be eligible under the Build Back Better program. .

According to the plan, electric vehicles can enjoy incentives of up to USD 12,500 per vehicle, which is regarded as a key factor in stimulating consumer demand for electric vehicles, because the current price of electric vehicles is still much higher than that of traditional internal combustion engine models.

Article excerpted from the US Stock Research Agency

Shares of US-listed electric vehicle companies plummeted across the board on Monday after US President Biden’s “Build Back Better” bill was met with resistance, which included major incentives for the growing electric vehicle industry.

As of Monday's close, Lordstown Motors was down 8.15%, Faraday Future was down 9.5%, Nicolas was down 7.31%, and Lucid was down 5.15%. Rivian Automotive, which went public last month, fell 7.9% to close at $89.98. Chinese concept stock Weilai Auto fell 6.13%.

Shares of other automakers such as Tesla and General Motors also fell. Although the two automakers are no longer eligible for the federal electric vehicle tax credit, they will be eligible under the Build Back Better program. .

According to the plan, electric vehicles can enjoy incentives of up to USD 12,500 per vehicle, which is regarded as a key factor in stimulating consumer demand for electric vehicles, because the current price of electric vehicles is still much higher than that of traditional internal combustion engine models.

Article excerpted from the US Stock Research Agency

19

1

Pila

liked

2021 is a year of recovery. In Jan 2021, the world is promised with an effective vaccine for Covid and the reopening of economy. Fast forward to Dec 2021, we have battled the Delta variant and now battling the Omicron.

With the Covid as backdrop, the world has been kept busy. Some of the key events in the market include:

* Reddit trying to take on Wall Street. This marks the beginning of meme stocks in a big way. $GameStop(GME.US$ $AMC Entertainment(AMC.US$

* China and her common prosperity policies which have impacted the Chinese listed companies, especially Chinese Tech. $BABA-SW(09988.HK$ $TENCENT(00700.HK$

* $Bitcoin(BTC.CC$ hit all time high of ~$67K and the growing popularity of NFT.

* $Meta Platforms(FB.US$ changed its name to Meta and the entire metaverse ecosystem.

* The sell off of growth stock in Dec (probably still ongoing now). We have seen some of the growth stocks came down more than 50% from its all time high. $Sea(SE.US$ $Zoom Video Communications(ZM.US$

At a personal level, 2021 has been a year of learning. I shifted my focus from Singapore dividend stocks such as $DBS Group Holdings(D05.SG$ to US growth stocks. The learning curve is steep but satisfying. My take away from my investing journey this year:

1. Build strong conviction

Conviction is build after you have done your research. Having a strong conviction about the companies you owned helps you through volatility and prevent panic selling. For example, $Pinterest(PINS.US$ has not done well recently. I went through my checklist and the thesis still looks intact. So despite the draw down, I have decided to hold.

2. Be Patient

Companies need time to execute and that will be reflected in their share price if they execute well. Very often this does not happen overnight. Sometimes the share price may not go up in a straight line, you may have to endure some drawdown before it is up again. It is therefore important to have patience.

By being patient, it help us to find the next 100 baggers.

$Apple(AAPL.US$

$Amazon(AMZN.US$

3. Be humble and keep learning

The more I learn, the more I know that I do not know. Sometimes I thought I have it all covered and Mr Market threw me a curveball.

I am grateful for the great community that @Investing with moomoo @Meta Moo @moomoo Singapore have built, allow us to exchange ideas and learn from one another. We may not agree with all the points, but having an open mind and exchanging ideas will make you a better investor.

@HopeAlways @Mcsnacks H Tupack @GratefulPanda @Dadacai @NANA123 @Mars Mooo

4. Do not FOMO and hindsight is always 20/20

Fear of Missing Out (FOMO) can wipe you out if you tried to chase any of the stocks. I resisted very hard to not jump into $GameStop(GME.US$.

Hindsight is a common feeling when we invest. Sometimes I did not buy a stock and it rocket and vice versa. I tell myself that hindsight is 20/20 and I can’t catch all the winners. Looking forward is better than regretting what have happened.

5. Have a journal

It can be an old fashioned notebook, Microsoft word, video or a post in Moomoo.

Have a journal and record my investing journey helps to crystallize my thoughts. I wrote down my reason of starting or exiting a position, my target and my thoughts.

With the virus living among us, 2021 has not been easy. We have certainly grown in resilient and hope that the resilience can be also shown in our investing journey.

Wish that 2022 will be a better year for all of us.

Cheers![]()

![]()

![]()

With the Covid as backdrop, the world has been kept busy. Some of the key events in the market include:

* Reddit trying to take on Wall Street. This marks the beginning of meme stocks in a big way. $GameStop(GME.US$ $AMC Entertainment(AMC.US$

* China and her common prosperity policies which have impacted the Chinese listed companies, especially Chinese Tech. $BABA-SW(09988.HK$ $TENCENT(00700.HK$

* $Bitcoin(BTC.CC$ hit all time high of ~$67K and the growing popularity of NFT.

* $Meta Platforms(FB.US$ changed its name to Meta and the entire metaverse ecosystem.

* The sell off of growth stock in Dec (probably still ongoing now). We have seen some of the growth stocks came down more than 50% from its all time high. $Sea(SE.US$ $Zoom Video Communications(ZM.US$

At a personal level, 2021 has been a year of learning. I shifted my focus from Singapore dividend stocks such as $DBS Group Holdings(D05.SG$ to US growth stocks. The learning curve is steep but satisfying. My take away from my investing journey this year:

1. Build strong conviction

Conviction is build after you have done your research. Having a strong conviction about the companies you owned helps you through volatility and prevent panic selling. For example, $Pinterest(PINS.US$ has not done well recently. I went through my checklist and the thesis still looks intact. So despite the draw down, I have decided to hold.

2. Be Patient

Companies need time to execute and that will be reflected in their share price if they execute well. Very often this does not happen overnight. Sometimes the share price may not go up in a straight line, you may have to endure some drawdown before it is up again. It is therefore important to have patience.

By being patient, it help us to find the next 100 baggers.

$Apple(AAPL.US$

$Amazon(AMZN.US$

3. Be humble and keep learning

The more I learn, the more I know that I do not know. Sometimes I thought I have it all covered and Mr Market threw me a curveball.

I am grateful for the great community that @Investing with moomoo @Meta Moo @moomoo Singapore have built, allow us to exchange ideas and learn from one another. We may not agree with all the points, but having an open mind and exchanging ideas will make you a better investor.

@HopeAlways @Mcsnacks H Tupack @GratefulPanda @Dadacai @NANA123 @Mars Mooo

4. Do not FOMO and hindsight is always 20/20

Fear of Missing Out (FOMO) can wipe you out if you tried to chase any of the stocks. I resisted very hard to not jump into $GameStop(GME.US$.

Hindsight is a common feeling when we invest. Sometimes I did not buy a stock and it rocket and vice versa. I tell myself that hindsight is 20/20 and I can’t catch all the winners. Looking forward is better than regretting what have happened.

5. Have a journal

It can be an old fashioned notebook, Microsoft word, video or a post in Moomoo.

Have a journal and record my investing journey helps to crystallize my thoughts. I wrote down my reason of starting or exiting a position, my target and my thoughts.

With the virus living among us, 2021 has not been easy. We have certainly grown in resilient and hope that the resilience can be also shown in our investing journey.

Wish that 2022 will be a better year for all of us.

Cheers

191

13

Pila

liked

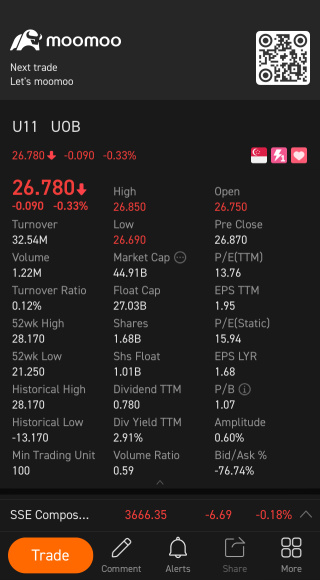

$UOB(U11.SG$ wait for dip to enter again

32

1

Pila

liked

$UOB(U11.SG$ why dropped suddenly?

11

2

Pila

liked

2021 is awesome because I started my investment journey... I selected Moo Moo as my desired investment platform due to several reasons, 1) Moo Moo offers user friendly interface, 2) lots of news, short quick articles and videos to level up my investment knowledge, 3) low charge fees for trading, and 4) offers free stocks! The journey so far using Moo Moo has been exceptionally pleasant.

For my investment portfolio, I diversify on several fronts.

I actively invest in Bank stocks including $OCBC Bank(O39.SG$, $DBS Group Holdings(D05.SG$, $UOB(U11.SG$, which provide for great gains and dividends.

For Reits, I would recommend $CapLand IntCom T(C38U.SG$, $CapLand Ascendas REIT(A17U.SG$, $Suntec Reit(T82U.SG$ and $Keppel DC Reit(AJBU.SG$. Good source of high dividends.

Other SG stocks include $ST Engineering(S63.SG$ and $SGX(S68.SG$ are worth considering.

For US stocks, $Apple(AAPL.US$ is definitely a good stock to invest in. I would expect the stock to rise further with the excitement over the release of the Apple Car in the near future. In the upcoming hype of the electric cars, stocks such as $NIO Inc(NIO.US$, $Lucid Group(LCID.US$ would probably gain traction over time. I previously bought NIO with the believe that the stock would soar in time.

For the HK market, $BABA-SW(09988.HK$ and $ICBC(01398.HK$ are my targets. Alibaba is currently very much undervalued, thus expecting it to increase soon after recovery from its nosedive for a period.

All of the above stocks, I am adopting the long term investment mentality to gradually increase the volume for high dividend returns.

Patience and diligence is what I learnt through the process as I spent many days observing the stock trends to determine when would be the best time to enter the market.

With uncertainty over news of the Omicron variant, stocks seem to be bearish during this time, I see it as an opportunity to buy more during the dip. So far, I am happy with the performance of all my investment, laying the foundation for growth as the economy gradually recovers.

One cool thing I did was to sell the Twitter stock and use whatever funds to buy a biotech stock, $Longeveron(LGVN.US$. This was the only one off instance that I traded based on luck with the strike lottery mindset. As in times of covid, biotech stocks tend to be rocketing high dynamically within a day. I made a decent profit out of it when the stock shot up. This was quite an experience.

Hope for all to invest well and into a Great 2022 ahead!

For my investment portfolio, I diversify on several fronts.

I actively invest in Bank stocks including $OCBC Bank(O39.SG$, $DBS Group Holdings(D05.SG$, $UOB(U11.SG$, which provide for great gains and dividends.

For Reits, I would recommend $CapLand IntCom T(C38U.SG$, $CapLand Ascendas REIT(A17U.SG$, $Suntec Reit(T82U.SG$ and $Keppel DC Reit(AJBU.SG$. Good source of high dividends.

Other SG stocks include $ST Engineering(S63.SG$ and $SGX(S68.SG$ are worth considering.

For US stocks, $Apple(AAPL.US$ is definitely a good stock to invest in. I would expect the stock to rise further with the excitement over the release of the Apple Car in the near future. In the upcoming hype of the electric cars, stocks such as $NIO Inc(NIO.US$, $Lucid Group(LCID.US$ would probably gain traction over time. I previously bought NIO with the believe that the stock would soar in time.

For the HK market, $BABA-SW(09988.HK$ and $ICBC(01398.HK$ are my targets. Alibaba is currently very much undervalued, thus expecting it to increase soon after recovery from its nosedive for a period.

All of the above stocks, I am adopting the long term investment mentality to gradually increase the volume for high dividend returns.

Patience and diligence is what I learnt through the process as I spent many days observing the stock trends to determine when would be the best time to enter the market.

With uncertainty over news of the Omicron variant, stocks seem to be bearish during this time, I see it as an opportunity to buy more during the dip. So far, I am happy with the performance of all my investment, laying the foundation for growth as the economy gradually recovers.

One cool thing I did was to sell the Twitter stock and use whatever funds to buy a biotech stock, $Longeveron(LGVN.US$. This was the only one off instance that I traded based on luck with the strike lottery mindset. As in times of covid, biotech stocks tend to be rocketing high dynamically within a day. I made a decent profit out of it when the stock shot up. This was quite an experience.

Hope for all to invest well and into a Great 2022 ahead!

238

11

Pila

liked

$UOB(U11.SG$ is there any article that tells us what happen to the current market? See many reds

9

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)