pingggg

Set a live reminder

Kucingko Berhad ("Kucingko") $KUCINGKO(0315.MY$is targeting to debut on the Bursa ace market on 7/26/2024. The IPO subscription takes place from 6/28/2024 to 7/12/2024!

To provide investors with a better understanding of the company's development and future plans,Moomoo Malaysia has the opportunity to conduct a live session with the senior management of Kucingko on 7/10/2024 Wed 14:30 - 15:30 MYT.

Executive Director of Kucingko See Chin...

To provide investors with a better understanding of the company's development and future plans,Moomoo Malaysia has the opportunity to conduct a live session with the senior management of Kucingko on 7/10/2024 Wed 14:30 - 15:30 MYT.

Executive Director of Kucingko See Chin...

222

104

pingggg

liked

Malaysian stocks look forward to victory in the second half of the year

Special Report: Yang Huiping @pingggg

Driven by the AI-driven data center boom, Malaysian stocks performed quite well in the first half of the year. The FTSE Composite Index rose 9.31% in half a year, making investors laugh hehe.

And in a rapidly changing market, how can investors seize opportunities in the second half of the year? Are Malaysian stocks in the second half of the year still driven by data center concepts? What other topics and areas can stand out?

To this end, “Nanyang Commercial Daily” read the investment outlook reports of major investment banks for the second half of the year, sorted out the six major investment themes, and let's take a look at where the investment opportunities for the second half of the year fall.

After years of sluggishness and favorable factors, Malaysian stocks are expected to prosper until next year

Looking back at the first half of the year, with the recovery of the industrial industry, the boom in artificial intelligence (AI) and data centers, healthy domestic economic growth, and stable corporate profits, Malaysian stocks reversed years of sluggishness and achieved a strong rebound.

As of the end of June this year, $FTSE Bursa Malaysia KLCI Index(.KLSE.MY$The FTSE Composite Index rose by about 9.3% and performed quite well in the region.

Now, in the second half of the year, whether Malaysian stocks can continue to rise has become what investors are most concerned about.

Research analysts at Dahua Jixian believe that the gains in the first half of the year were due to strong domestic liquidity, because the composite index also rose 7.0% after the first 5 months of continuous foreign capital withdrawal.

Next, given the Federal Reserve's shift to a dovish attitude in the second half of the year...

Special Report: Yang Huiping @pingggg

Driven by the AI-driven data center boom, Malaysian stocks performed quite well in the first half of the year. The FTSE Composite Index rose 9.31% in half a year, making investors laugh hehe.

And in a rapidly changing market, how can investors seize opportunities in the second half of the year? Are Malaysian stocks in the second half of the year still driven by data center concepts? What other topics and areas can stand out?

To this end, “Nanyang Commercial Daily” read the investment outlook reports of major investment banks for the second half of the year, sorted out the six major investment themes, and let's take a look at where the investment opportunities for the second half of the year fall.

After years of sluggishness and favorable factors, Malaysian stocks are expected to prosper until next year

Looking back at the first half of the year, with the recovery of the industrial industry, the boom in artificial intelligence (AI) and data centers, healthy domestic economic growth, and stable corporate profits, Malaysian stocks reversed years of sluggishness and achieved a strong rebound.

As of the end of June this year, $FTSE Bursa Malaysia KLCI Index(.KLSE.MY$The FTSE Composite Index rose by about 9.3% and performed quite well in the region.

Now, in the second half of the year, whether Malaysian stocks can continue to rise has become what investors are most concerned about.

Research analysts at Dahua Jixian believe that the gains in the first half of the year were due to strong domestic liquidity, because the composite index also rose 7.0% after the first 5 months of continuous foreign capital withdrawal.

Next, given the Federal Reserve's shift to a dovish attitude in the second half of the year...

Translated

+5

45

pingggg

commented on and voted

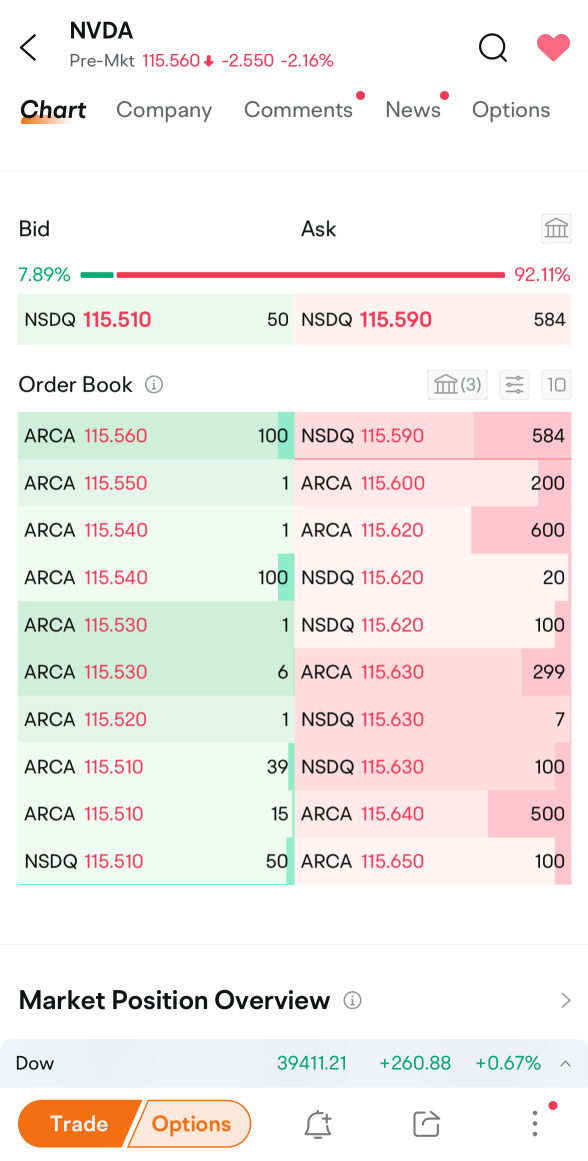

On June 26 at 9:00 a.m. PT, $NVIDIA(NVDA.US$ will host its annual meeting. In a May message, CEO Huang called 2024 a 'watershed moment' for the company, and the momentum is evident. Nvidia's market cap soared to $3.3 trillion, overtaking Microsoft as the most valuable public company a few days ago. Nvidia remained in the spotlight this week as its shares continued falling from the record high reached and entered correctio...

79

165

pingggg

liked

$SIMEPROP(5288.MY$

Data centers have become a hot spot in the market, and Morinami Industries (SIMEPROP, 5288, main board industry stock) has also shared a share of the pie, becoming the latest industrial giant in China to announce the construction of data centers.

After holding an online briefing for the first quarter of fiscal year 2024 today, the company announced a joint development of a hyperscale data center with Pearl Computing Malaysia Private Co., Ltd.

According to the statement, the above data center covers an area of about 49 acres and is located in the 1,500-acre Elmina (Elmina) Industrial Park in Selangor, the largest industrial cluster under Senami.

The data center is scheduled to be launched in the second quarter of 2024 and is expected to be completed in 2026; the two parties signed a 20-year lease totaling RM2 billion, and each 5-year lease can be added twice.

Dato' Azmi Maliken, managing director of Morinami Industries, said at the online briefing this afternoon: “Just like other businesses, this (data center) is a long-term business, so we have to bear the brunt of it, depending on who we cooperate with. After all, this kind of cooperation is long-term.”

“Furthermore, we also need to pay attention to our own infrastructure to ensure that the company has sufficient capacity to meet the needs of the market.”

Currently cooperating with Pearl Computing, the company believes this will broaden its investment and asset management portfolio, meet the SHIFT25 strategy to generate recurring revenue, and boost the Emena Industrial Park...

Data centers have become a hot spot in the market, and Morinami Industries (SIMEPROP, 5288, main board industry stock) has also shared a share of the pie, becoming the latest industrial giant in China to announce the construction of data centers.

After holding an online briefing for the first quarter of fiscal year 2024 today, the company announced a joint development of a hyperscale data center with Pearl Computing Malaysia Private Co., Ltd.

According to the statement, the above data center covers an area of about 49 acres and is located in the 1,500-acre Elmina (Elmina) Industrial Park in Selangor, the largest industrial cluster under Senami.

The data center is scheduled to be launched in the second quarter of 2024 and is expected to be completed in 2026; the two parties signed a 20-year lease totaling RM2 billion, and each 5-year lease can be added twice.

Dato' Azmi Maliken, managing director of Morinami Industries, said at the online briefing this afternoon: “Just like other businesses, this (data center) is a long-term business, so we have to bear the brunt of it, depending on who we cooperate with. After all, this kind of cooperation is long-term.”

“Furthermore, we also need to pay attention to our own infrastructure to ensure that the company has sufficient capacity to meet the needs of the market.”

Currently cooperating with Pearl Computing, the company believes this will broaden its investment and asset management portfolio, meet the SHIFT25 strategy to generate recurring revenue, and boost the Emena Industrial Park...

Translated

15

pingggg

liked and voted

Although investors believe that the Federal Reserve will maintain high interest rates for a longer period of time, the strong corporate earnings season supported the market, and the three major Wall Street stock market indices all closed higher today.

$Dow Jones Industrial Average(.DJI.US$Up 146.43 points, or 0.38%, to close 38386.09 points.

$S&P 500 Index(.SPX.US$Up 16.21 points, or 0.32%, to close 5116.17 points.

$NASDAQ(NASDAQ.US$Up 55.18 points, or 0.35%, to close at 15983.08 points.

As optimism rises, I wonder if it will continue to drive Malaysian stocks to continue to rise?

$FTSE Bursa Malaysia KLCI Index(.KLSE.MY$

$Dow Jones Industrial Average(.DJI.US$Up 146.43 points, or 0.38%, to close 38386.09 points.

$S&P 500 Index(.SPX.US$Up 16.21 points, or 0.32%, to close 5116.17 points.

$NASDAQ(NASDAQ.US$Up 55.18 points, or 0.35%, to close at 15983.08 points.

As optimism rises, I wonder if it will continue to drive Malaysian stocks to continue to rise?

$FTSE Bursa Malaysia KLCI Index(.KLSE.MY$

Translated

27

pingggg

liked

AI stocks are booming, and Yang Zhongli and both hit new highs

Yang Zhongli continued to perform well, and the stock price not only soared to a new high, but also boosted $FTSE Bursa Malaysia KLCI Index(.KLSE.MY$It climbed to the level of 1,580 points.

Today, Yang Zhongli's agency $YTL(4677.MY$ With its subsidiary Yang Zhongli Electric Power $YTLPOWR(6742.MY$ They all went higher, and the increase reached 6% to 8%.

Yang Zhongli's stock price is booming, mainly because the overall trend is favorable to the market. Coupled with the strong performance of US technology stocks, investors are more optimistic that the net profit of AI and other stocks will continue to grow.

Overnight, US stocks strengthened last Friday, among which $Alphabet-A(GOOGL.US$surged 10%, $NVIDIA(NVDA.US$up to 6%, and $Microsoft(MSFT.US$Up 2%.

Looking back at Yang Zhongli Shuang Xiong, Yang Zhongli's three major businesses, namely utilities, mainly Yang Zhongli Electric Power, as well as construction and ash, are all important drivers of its strong profit potential.

In particular, Yang Zhongli Electric Power, Yang Zhongli's agency will rely heavily on this subsidiary holding 55.6% of the shares to achieve outstanding results.

In addition to cooperating with Nvidia to build an artificial intelligence data center of about 100 megawatts, the company is also looking at its green data center park, which can contribute to the end of this year.

Yang Zhongli's institutional stock price performance...

Yang Zhongli continued to perform well, and the stock price not only soared to a new high, but also boosted $FTSE Bursa Malaysia KLCI Index(.KLSE.MY$It climbed to the level of 1,580 points.

Today, Yang Zhongli's agency $YTL(4677.MY$ With its subsidiary Yang Zhongli Electric Power $YTLPOWR(6742.MY$ They all went higher, and the increase reached 6% to 8%.

Yang Zhongli's stock price is booming, mainly because the overall trend is favorable to the market. Coupled with the strong performance of US technology stocks, investors are more optimistic that the net profit of AI and other stocks will continue to grow.

Overnight, US stocks strengthened last Friday, among which $Alphabet-A(GOOGL.US$surged 10%, $NVIDIA(NVDA.US$up to 6%, and $Microsoft(MSFT.US$Up 2%.

Looking back at Yang Zhongli Shuang Xiong, Yang Zhongli's three major businesses, namely utilities, mainly Yang Zhongli Electric Power, as well as construction and ash, are all important drivers of its strong profit potential.

In particular, Yang Zhongli Electric Power, Yang Zhongli's agency will rely heavily on this subsidiary holding 55.6% of the shares to achieve outstanding results.

In addition to cooperating with Nvidia to build an artificial intelligence data center of about 100 megawatts, the company is also looking at its green data center park, which can contribute to the end of this year.

Yang Zhongli's institutional stock price performance...

Translated

8

pingggg

liked

The Capital A (Capital A) restructuring plan has 4 key points!

1) The sale of Yibi Investment Group and the acquisition of AirAsia Group will be paid in the form of shares and debt settlement, with a total value of RM6.8 billion.

2) Shareholders' equity will be corrected for the first time in 14 quarters after the divestment, and AirAsia Long Range's shareholders' equity will also be strengthened after the transaction.

3) AirAsia Group (AirAsia Group) will consolidate its position as Asia's largest low-cost airline with a win-win “single airline” strategy, thereby transforming the face of global low-cost travel.

4) The AirAsia Group's ultimate vision is to create a company based on a strong narrow-body fleet to improve operational efficiency and reduce costs by expanding range capabilities.

CEO Tan Sri Tony Fernandes said:

The restructuring is beneficial to shareholders' rights and is just around the corner from PN17

$CAPITALA(5099.MY$

$AAX(5238.MY$

1) The sale of Yibi Investment Group and the acquisition of AirAsia Group will be paid in the form of shares and debt settlement, with a total value of RM6.8 billion.

2) Shareholders' equity will be corrected for the first time in 14 quarters after the divestment, and AirAsia Long Range's shareholders' equity will also be strengthened after the transaction.

3) AirAsia Group (AirAsia Group) will consolidate its position as Asia's largest low-cost airline with a win-win “single airline” strategy, thereby transforming the face of global low-cost travel.

4) The AirAsia Group's ultimate vision is to create a company based on a strong narrow-body fleet to improve operational efficiency and reduce costs by expanding range capabilities.

CEO Tan Sri Tony Fernandes said:

The restructuring is beneficial to shareholders' rights and is just around the corner from PN17

$CAPITALA(5099.MY$

$AAX(5238.MY$

Translated

From YouTube

6

pingggg

liked

Forest City is rumored to have built a casino, and the agency called the alarm to check the “source”

In response to the rumor that a casino will be built in the forest city of Johor, $BJCORP(3395.MY$The case has been reported to the police to thoroughly investigate the so-called “unnamed sources”.

According to the latest statement, Chenggong Agency indicated that the company's legal representative reported the case to the police on April 26 to allow the police to launch an investigation.

“In particular, in order to identify and identify the so-called 'unnamed source', the source disseminated completely untrue and false claims.

“We trust that the police will take the necessary action to investigate this matter, and we solemnly encourage any publication to carefully verify the content before reporting.”

On the 26th of this month, Bloomberg (Bloomberg) and The Edge Singapore quoted sources as reporting that successful institutions may open a second casino in Forest City (Forest City), Johor

Bloomberg's report revealed that Prime Minister Anwar and China's two business tycoons last week, namely Tan Sri Chen Zhiyuan, founder of successful institutions, and $GENTING(3182.MY$Chairman Tan Sri Lam Cathay had lunch, and the head of state, His Majesty Sultan Ibrahim, also sent a representative to attend.

On the same day, the successful agency issued a statement denying this, while urging Bloomberg and The Edge Singapore to remove related reports.

The next day, $GENM(4715.MY$They also denied participating in discussions on the construction of a casino in Forest City, and asked the media to remove the false reports.

Become...

In response to the rumor that a casino will be built in the forest city of Johor, $BJCORP(3395.MY$The case has been reported to the police to thoroughly investigate the so-called “unnamed sources”.

According to the latest statement, Chenggong Agency indicated that the company's legal representative reported the case to the police on April 26 to allow the police to launch an investigation.

“In particular, in order to identify and identify the so-called 'unnamed source', the source disseminated completely untrue and false claims.

“We trust that the police will take the necessary action to investigate this matter, and we solemnly encourage any publication to carefully verify the content before reporting.”

On the 26th of this month, Bloomberg (Bloomberg) and The Edge Singapore quoted sources as reporting that successful institutions may open a second casino in Forest City (Forest City), Johor

Bloomberg's report revealed that Prime Minister Anwar and China's two business tycoons last week, namely Tan Sri Chen Zhiyuan, founder of successful institutions, and $GENTING(3182.MY$Chairman Tan Sri Lam Cathay had lunch, and the head of state, His Majesty Sultan Ibrahim, also sent a representative to attend.

On the same day, the successful agency issued a statement denying this, while urging Bloomberg and The Edge Singapore to remove related reports.

The next day, $GENM(4715.MY$They also denied participating in discussions on the construction of a casino in Forest City, and asked the media to remove the false reports.

Become...

Translated

From YouTube

17

pingggg

liked

Which Malaysian stocks were favored last week after 8 weeks of net outflows of foreign capital?

Foreign investors bought Malaysian stocks net of RM292.2 million last week, ending an eight-week net outflow trend.

According to the capital flow report released by MIDF Research on Monday, the continued conflict in the Middle East may cause oil prices to rise, but the World Bank still maintains Malaysia's 4.3% economic growth forecast in 2024 and predicts that Malaysia's gross domestic product (GDP) this year will be driven by private consumption.

Last week, the sectors most favored by foreign investors were utilities (RM285.8 million), financial services (RM153 million), and communications and media (RM103 million).

The sectors that have been sold off by foreign investors are consumer goods and services (RM223.2 million), farming (-68.5 million ringgit), and energy (RM31.6 million).

Meanwhile, local institutions acted as buyers for 9 consecutive weeks, buying a net RM143.3 million shares last week.

In addition, retail investors were net selling Malaysian stocks for the 7th week in a row, totaling RM405.5 million.

In terms of participation, the average daily turnover of retail investors and foreign investors declined by 10.9% and 15.5%, respectively; local institutions increased slightly by 0.2%.

Top 10 stocks with net inflows of foreign capital last week

$MAYBANK(1155.MY$ RM1,661 million

$YTL(4677.MY$ RM1.171 billion

$TENAGA(5347.MY$ RM99.2 million

$MYEG(0138.MY$ RM81.8 million...

Foreign investors bought Malaysian stocks net of RM292.2 million last week, ending an eight-week net outflow trend.

According to the capital flow report released by MIDF Research on Monday, the continued conflict in the Middle East may cause oil prices to rise, but the World Bank still maintains Malaysia's 4.3% economic growth forecast in 2024 and predicts that Malaysia's gross domestic product (GDP) this year will be driven by private consumption.

Last week, the sectors most favored by foreign investors were utilities (RM285.8 million), financial services (RM153 million), and communications and media (RM103 million).

The sectors that have been sold off by foreign investors are consumer goods and services (RM223.2 million), farming (-68.5 million ringgit), and energy (RM31.6 million).

Meanwhile, local institutions acted as buyers for 9 consecutive weeks, buying a net RM143.3 million shares last week.

In addition, retail investors were net selling Malaysian stocks for the 7th week in a row, totaling RM405.5 million.

In terms of participation, the average daily turnover of retail investors and foreign investors declined by 10.9% and 15.5%, respectively; local institutions increased slightly by 0.2%.

Top 10 stocks with net inflows of foreign capital last week

$MAYBANK(1155.MY$ RM1,661 million

$YTL(4677.MY$ RM1.171 billion

$TENAGA(5347.MY$ RM99.2 million

$MYEG(0138.MY$ RM81.8 million...

Translated

10

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)