Poppyloli

voted

Previously I asked fellow MooMooers what level of trading are you interested in. And the results are Majority 65% are looking at Basic Level. (Link to previous polls attached at the end of this post)

I started with the same mindset and most would agree for SAFE & SIMPLE. At the start, we are looking towards SAFE levels of investment to beat peanuts 🥜 interests from our 🏦 savings account. We are adverse to any dip in our principle going for 100% safe capital protecti...

I started with the same mindset and most would agree for SAFE & SIMPLE. At the start, we are looking towards SAFE levels of investment to beat peanuts 🥜 interests from our 🏦 savings account. We are adverse to any dip in our principle going for 100% safe capital protecti...

From YouTube

47

6

Poppyloli

voted

I always remind myself to review my trades and strategies each quarter. ![]()

It helps me to be disciplined, to check my positions and make adjustments timely.![]()

Securities Position: Looking good with gradual profits![]()

Asset Distribution:

For me my Golden Ratio (Stocks/Funds) was previously 20/80. Seems like I’ve moved towards 50/50 with my bullishness on $NVIDIA (NVDA.US)$ .![]()

Currency Exposure:

40/60 is sufficient for my golden ratio for trading in US market.![]()

YTD Return:

56% So ...

It helps me to be disciplined, to check my positions and make adjustments timely.

Securities Position: Looking good with gradual profits

Asset Distribution:

For me my Golden Ratio (Stocks/Funds) was previously 20/80. Seems like I’ve moved towards 50/50 with my bullishness on $NVIDIA (NVDA.US)$ .

Currency Exposure:

40/60 is sufficient for my golden ratio for trading in US market.

YTD Return:

56% So ...

+3

38

13

Poppyloli

voted

1. Increase Factors:

- Positive Sentiment:

Strong fundamentals and steady earnings.

- Favorable Global News:

Any positive economic developments (e.g., inflation control) could boost stock prices.

2. Decrease Factors:

- Interest Rate Concerns:

Rising rates may pressure financial stocks.

- Profit-Taking:

Short-term investors may sell, causing a dip.

Recommendation:

Hold for long-term gains, but watch for market news if trading short-term.

- Positive Sentiment:

Strong fundamentals and steady earnings.

- Favorable Global News:

Any positive economic developments (e.g., inflation control) could boost stock prices.

2. Decrease Factors:

- Interest Rate Concerns:

Rising rates may pressure financial stocks.

- Profit-Taking:

Short-term investors may sell, causing a dip.

Recommendation:

Hold for long-term gains, but watch for market news if trading short-term.

6

Poppyloli

voted

September - the notoriously volatile month see the market sell-off since the 1st trading day of the month. The CPI data released yesterday shows that inflation eases to 3-year low. Notwithstanding, the core inflation is still stubbornly above the FED's inflation goal of 2%. Hence, market is now expecting a rate cut of 25 bps instead of a larger rate cut in September.

I started to build my dividend portfolio in August 2024 with the view that a rate cut, albeit small or big, wi...

I started to build my dividend portfolio in August 2024 with the view that a rate cut, albeit small or big, wi...

+1

43

11

Poppyloli

voted

Hello Mooers! ![]()

![]()

In today's discussion, I will be sharing 3 important aspects that may show that the cost of living in Singapore will go even higher next year, 2025.

Without further ado, let's begin.![]()

Back in September 2023, I shared with mooers the prices of many items that will increase in the next few years. Mooers can access the post by clicking the link below.![]()

Since then, almost one year had passed, but inflation continued t...

In today's discussion, I will be sharing 3 important aspects that may show that the cost of living in Singapore will go even higher next year, 2025.

Without further ado, let's begin.

Back in September 2023, I shared with mooers the prices of many items that will increase in the next few years. Mooers can access the post by clicking the link below.

Since then, almost one year had passed, but inflation continued t...

25

14

Poppyloli

voted

It has been an amazing 2 years since I have joined moomoo platform! And I must say so far I have been very impressed by the returns generated by $Fullerton SGD Cash Fund (SG9999005961.MF)$!![]()

In the past few months I have been adding fresh funds into cash plus whenever there are new events or promotions organized by moomoo![]()

But lately I have noticed the yield of money market funds have been declining and so I have look into other funds with high...

In the past few months I have been adding fresh funds into cash plus whenever there are new events or promotions organized by moomoo

But lately I have noticed the yield of money market funds have been declining and so I have look into other funds with high...

+1

33

4

Poppyloli

voted

If you've ever wondered how to navigate the world of dividend investing, our recent live session with Steven "Sarge" Guilfoyle could be helpful! 🌟 If you missed it, here’s a recap that could enhance your investment strategy, whether you're planning for retirement or looking to diversify your portfolio. 💡

Follow Stephen “Sarge” Guilfoyle on moomoo

🔍 Why Do Dividends Matter?

Dividends are a share of a company's profits paid out to share...

60

17

Poppyloli

voted

Good morning, traders. Happy Tuesday, September 3rd. The market is pulling back after a holiday weekend, after the month of August ended with all indexes in the positive, despite starting with a pullback. From near all time highs Semiconductor stocks are leading stocks lower.

My name is Kevin Travers; here are stories moving on the U.S. stock market today.

$Boeing (BA.US)$ shares slumped 8.33% Tuesday, the lowest ...

My name is Kevin Travers; here are stories moving on the U.S. stock market today.

$Boeing (BA.US)$ shares slumped 8.33% Tuesday, the lowest ...

36

8

Poppyloli

voted

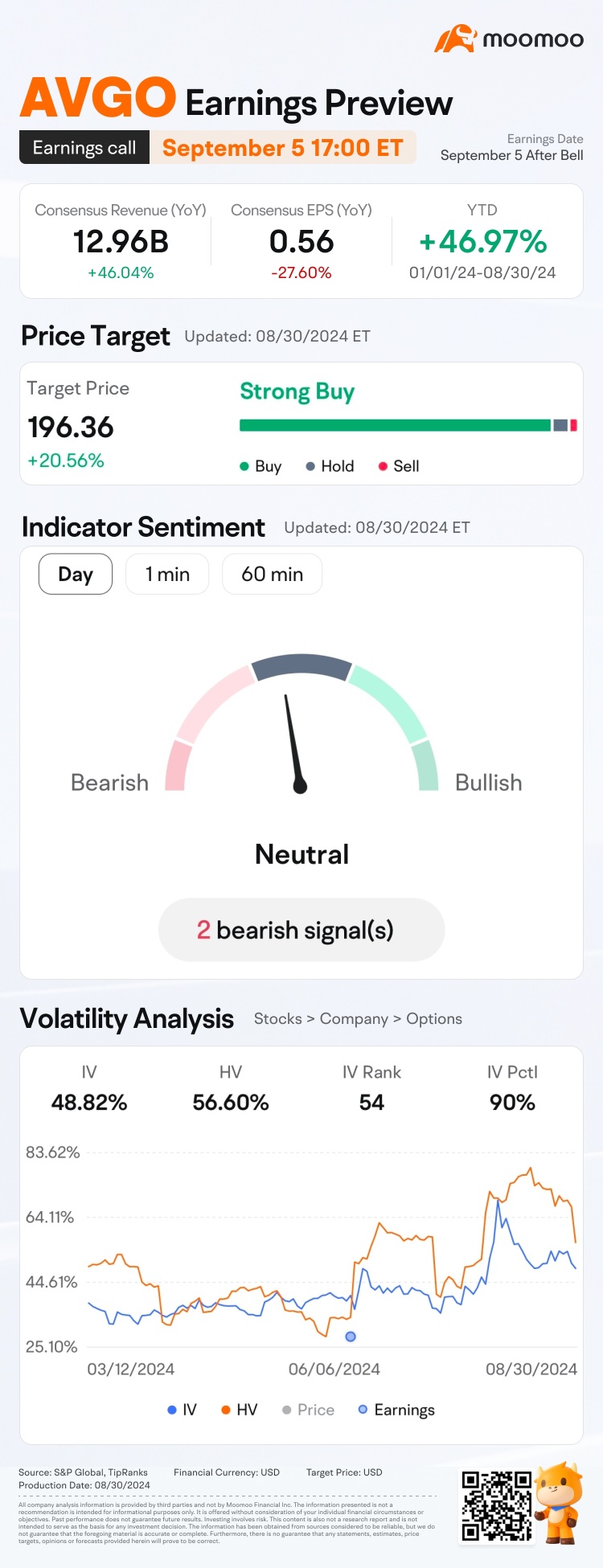

Hi, mooers!

$Broadcom (AVGO.US)$ is releasing its Q3 earnings on September 5 after the bell. Unlock insights with AVGO Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q2 earnings release, shares of $Broadcom (AVGO.US)$ have seen an increase of 9.22%. How will the market react to the upcoming results? Make your guess now!

Rewards

● An equal share of 5,000 points: For mooers who corr...

$Broadcom (AVGO.US)$ is releasing its Q3 earnings on September 5 after the bell. Unlock insights with AVGO Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q2 earnings release, shares of $Broadcom (AVGO.US)$ have seen an increase of 9.22%. How will the market react to the upcoming results? Make your guess now!

Rewards

● An equal share of 5,000 points: For mooers who corr...

Expand

Expand 80

114

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)