Exxon and Cnooc challenge $Chevron (CVX.US)$ 's $53 billion Hess acquisition over rights in Guyana's oil-rich Stabroek Block.

Key Takeaway

Exxon and Cnooc initiate arbitration against Chevron's $53 billion acquisition of Hess, citing a right of first refusal on Hess's 30% stake in Guyana's Stabroek Block.

The dispute, to be decided by the International Chamber of Commerce in Paris, underscores the competitive and strategic signif...

Key Takeaway

Exxon and Cnooc initiate arbitration against Chevron's $53 billion acquisition of Hess, citing a right of first refusal on Hess's 30% stake in Guyana's Stabroek Block.

The dispute, to be decided by the International Chamber of Commerce in Paris, underscores the competitive and strategic signif...

3

The price of crude oil is trading up $1.41 or 1.73% today at $82.77. With 1Q quarter end approaching, the price is up a solid 15.53%. The price at the end of the year closed at $71.65. The gain is the largest since Q3 in 2023 when the price surged 28.52% only to then decline by -21.08% in Q4 2023 in up and down trading. If the pattern continues, we should expect a decline in Q2.

What might limit the upside in Q2 is the technical resistance currently being teste...

What might limit the upside in Q2 is the technical resistance currently being teste...

1

1

$SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$ | JPMorgan says crowded stocks sow the risk of an 'out-of-the-blue' shock.

Dubravko Lakos-Bujas, JPMorgan's strategist, cautioned clients they could be “stuck on the wrong side” of the momentum trade when it eventually falters, advising to diversify holdings and implementing risk management.

He repeated concerns over market volatility, saying, "It just might come one day out of the blue. This has happened in the past, we've had flash crashes...

Dubravko Lakos-Bujas, JPMorgan's strategist, cautioned clients they could be “stuck on the wrong side” of the momentum trade when it eventually falters, advising to diversify holdings and implementing risk management.

He repeated concerns over market volatility, saying, "It just might come one day out of the blue. This has happened in the past, we've had flash crashes...

2

The late collapse in the S&P 500 on Tuesday was primarily driven by Nvidia, with a quarter of the declines attributed to the AI giant, which now represents 5% of the S&P 500 and over 17% of the information technology sector.

Nvidia's significant weighting in the index has more than doubled in the past year, leading to increased vulnerability to sudden shifts as traders reshuffle their positions.

With Nvidia's shares surging 87% in the first qua...

Nvidia's significant weighting in the index has more than doubled in the past year, leading to increased vulnerability to sudden shifts as traders reshuffle their positions.

With Nvidia's shares surging 87% in the first qua...

2

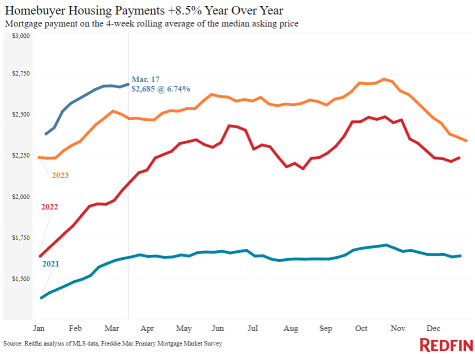

Monthly mortgage payment needed to buy the median priced home for sale in the US...

March 2020: $1,500

March 2021: $1,700

March 2022: $2,200

March 2023: $2,500

March 2024: $2,700

That's an 80% increase over the last 4 years.

March 2020: $1,500

March 2021: $1,700

March 2022: $2,200

March 2023: $2,500

March 2024: $2,700

That's an 80% increase over the last 4 years.

2

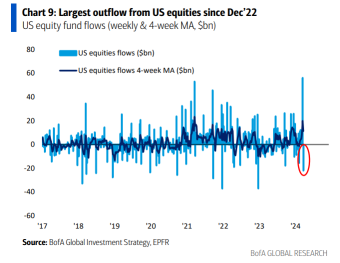

U.S. stocks had their Largest Weekly OUTFLOWS since December 2022, totaling $22 billion.

However, energy sector $XLE funds bucked the trend, receiving their largest inflow since October at $500 million.

Source: BofA

$S&P 500 Index (.SPX.US)$ $Nasdaq Composite Index (.IXIC.US)$

However, energy sector $XLE funds bucked the trend, receiving their largest inflow since October at $500 million.

Source: BofA

$S&P 500 Index (.SPX.US)$ $Nasdaq Composite Index (.IXIC.US)$

2

1

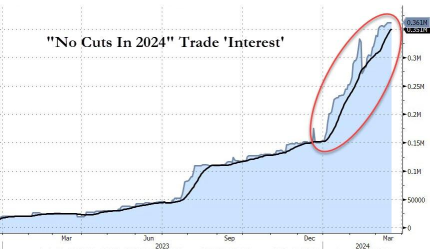

Since January 1st, trade interest for no cuts in 2024 has risen by a whopping 140%, according to Zerohedge.

As we kicked off 2024, markets were beginning to price-in a case with EIGHT rate cuts in 2024.

Rate cut expectations have moved in a straight line lower since then with less than 3 cuts now expected this year.

It's unlikely we see any rate cuts before June 2024 at this point.

Talk about a turn of events.

$SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$ $S&P 500 Index (.SPX.US)$ $Nasdaq Composite Index (.IXIC.US)$ $Dow Jones Industrial Average (.DJI.US)$

As we kicked off 2024, markets were beginning to price-in a case with EIGHT rate cuts in 2024.

Rate cut expectations have moved in a straight line lower since then with less than 3 cuts now expected this year.

It's unlikely we see any rate cuts before June 2024 at this point.

Talk about a turn of events.

$SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$ $S&P 500 Index (.SPX.US)$ $Nasdaq Composite Index (.IXIC.US)$ $Dow Jones Industrial Average (.DJI.US)$

2

WTI and Brent crude prices rose after a significant US stockpile draw and Fed's signal of upcoming rate cuts, boosting market risk appetite.

US crude inventories fell for the second consecutive week, with gasoline also seeing a large draw.

A weaker US dollar following Fed's steady interest rate stance enhanced commodities' appeal, influencing oil price gains. $Occidental Petroleum (OXY.US)$ $Chevron (CVX.US)$ $Exxon Mobil (XOM.US)$

US crude inventories fell for the second consecutive week, with gasoline also seeing a large draw.

A weaker US dollar following Fed's steady interest rate stance enhanced commodities' appeal, influencing oil price gains. $Occidental Petroleum (OXY.US)$ $Chevron (CVX.US)$ $Exxon Mobil (XOM.US)$

4

2

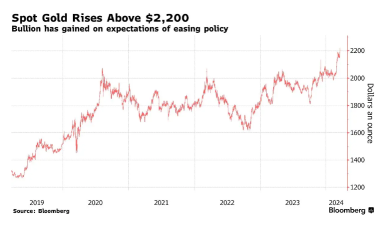

Gold hits record $2,200 as Fed signals three rate cuts, boosting appeal amid inflation uptick and geopolitical tensions.

Key Takeaway

Gold surpasses $2,200 an ounce for the first time, fueled by Fed's rate cut outlook and a softer monetary policy anticipation.

Traders increased net long positions on gold significantly, hinting at strong market optimism towards the precious metal.

Central bank purchases and geopolitical risks further bolster gold's sta...

Key Takeaway

Gold surpasses $2,200 an ounce for the first time, fueled by Fed's rate cut outlook and a softer monetary policy anticipation.

Traders increased net long positions on gold significantly, hinting at strong market optimism towards the precious metal.

Central bank purchases and geopolitical risks further bolster gold's sta...

4

Closer look into 2024 FOMC Dot Plot 👇

2-officials see NO cuts (unchanged)

2-officials see ONE cut (one more than in December)

5-officials see TWO cuts (unchanged)

9-officials see THREE cuts (up from six in December)

1-official sees FOUR cuts (down from five who saw 4 or more cuts in December)

But now for 2025 and 2026 they are seeing FEWER Rate cuts. $Dow Jones Industrial Average (.DJI.US)$ $Nasdaq Composite Index (.IXIC.US)$ $S&P 500 Index (.SPX.US)$

2-officials see NO cuts (unchanged)

2-officials see ONE cut (one more than in December)

5-officials see TWO cuts (unchanged)

9-officials see THREE cuts (up from six in December)

1-official sees FOUR cuts (down from five who saw 4 or more cuts in December)

But now for 2025 and 2026 they are seeing FEWER Rate cuts. $Dow Jones Industrial Average (.DJI.US)$ $Nasdaq Composite Index (.IXIC.US)$ $S&P 500 Index (.SPX.US)$

5

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)