I’m pretty interested in the session on November 15, about portfolio building. As individual investors, we don’t have as much money as financial institutions. So I think it’s crucial to distibute our limited liquidity on the right place, in the meantime adjusting the portifolio accroding our own trading style.

For me personally, I really want to learn about how to build portifolios with limited money. as a economics student, I know a lot theories, but...

For me personally, I really want to learn about how to build portifolios with limited money. as a economics student, I know a lot theories, but...

1

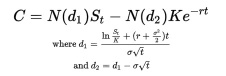

I believe the most important factor in options trading is Implied Volatility. Implied Volatility, or IV, represents investors' opinions on the future volatility of the underlying asset.

Implied volatility can be calculated by solving the famous Black-Scholes Model, given the current stock price, call/put price and strike price. It's a very complicated calculating process, I've tried a few times in courses with finance and derivatieves, in s...

Implied volatility can be calculated by solving the famous Black-Scholes Model, given the current stock price, call/put price and strike price. It's a very complicated calculating process, I've tried a few times in courses with finance and derivatieves, in s...

5

Judging by Wells Fargo's case last week, the interest rate cuts have significant impact on bank's net interest income.

my guess is that bank giants have to find other revenue engines to offset the gap. In Wells Fargo's case, it's investment banking revenue. For other banks, it may be credit card spending.

Wait and see the earnings report from gs, bac and citigroup on Oct. 18th.

my guess is that bank giants have to find other revenue engines to offset the gap. In Wells Fargo's case, it's investment banking revenue. For other banks, it may be credit card spending.

Wait and see the earnings report from gs, bac and citigroup on Oct. 18th.

5

1

Liquidity is good right now. My guess is that banks would benefit a lot from booming economic activities and financial transactions. the impact of low interest rate on lending business can be ignored.

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)