RealSlimLazy

liked

$Rivian Automotive (RIVN.US)$ I shorted this stock at 178. I got greedy and lost it all. don't get greedy! don't chase the stock! hold your ground.

10

12

RealSlimLazy

liked

In part, that’s because environmental, social and governance (ESG) pressures are stifling investment in oil and gas.

Investment in oil, gas and coal has been subdued for several years (Display, below). Companies are under pressure to return cash to shareholders and invest in energy transition businesses rather than fossil fuels. What’s more, hydrocarbon energy investments have a long lead time and capex has been insufficient to maintain medium-term production, further complicating transition planning efforts.

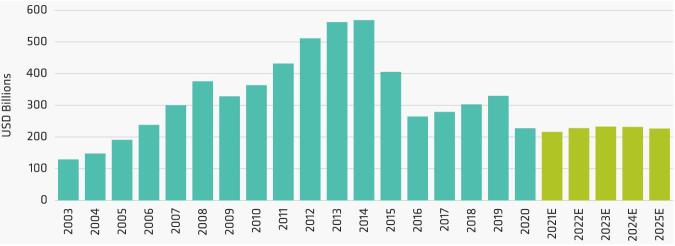

Global Investment in Exploration and Production Capex to Remain Subdued

Capex peaked in 2014, bottomed in 2016, but then fell further in 2020 and is expected to be flat over the next five years.

Effectively the world is living off major investment decisions in oil and gas that were made before the oil price fall in 2015. If nothing changes, hydrocarbons markets could tighten even more, triggering even higher-than-expected price hikes.

Investors have been deterred from the energy sector for two reasons. First, perceived ESG concerns may lead to further derating. In fact, deteriorating support for the sector has pushed oil stocks to extremely low valuations with a price/free cashflow ratio near 25-year lows (Display, below). Second, a collapse in demand for hydrocarbons may leave unused reserves “stranded” and effectively worthless.

In our view, stranded asset fears are misplaced. We think energy stock prices are predominantly valued on a discounted cash flow analysis based on existing projects; that means no value is placed on fields that aren’t yet producing or will produce soon. Most oil and gas companies have about a 10-year reserve life - a period in which fossil fuels will be critical for a smooth energy transition and short enough for investors in select oil and gas stocks to receive satisfactory returns. And if investor aversion continues to act as an additional brake on investment, energy prices will remain high, buoying cash returns to shareholders.

$Dow Jones Industrial Average (.DJI.US)$ $S&P 500 Index (.SPX.US)$

Investment in oil, gas and coal has been subdued for several years (Display, below). Companies are under pressure to return cash to shareholders and invest in energy transition businesses rather than fossil fuels. What’s more, hydrocarbon energy investments have a long lead time and capex has been insufficient to maintain medium-term production, further complicating transition planning efforts.

Global Investment in Exploration and Production Capex to Remain Subdued

Capex peaked in 2014, bottomed in 2016, but then fell further in 2020 and is expected to be flat over the next five years.

Effectively the world is living off major investment decisions in oil and gas that were made before the oil price fall in 2015. If nothing changes, hydrocarbons markets could tighten even more, triggering even higher-than-expected price hikes.

Investors have been deterred from the energy sector for two reasons. First, perceived ESG concerns may lead to further derating. In fact, deteriorating support for the sector has pushed oil stocks to extremely low valuations with a price/free cashflow ratio near 25-year lows (Display, below). Second, a collapse in demand for hydrocarbons may leave unused reserves “stranded” and effectively worthless.

In our view, stranded asset fears are misplaced. We think energy stock prices are predominantly valued on a discounted cash flow analysis based on existing projects; that means no value is placed on fields that aren’t yet producing or will produce soon. Most oil and gas companies have about a 10-year reserve life - a period in which fossil fuels will be critical for a smooth energy transition and short enough for investors in select oil and gas stocks to receive satisfactory returns. And if investor aversion continues to act as an additional brake on investment, energy prices will remain high, buoying cash returns to shareholders.

$Dow Jones Industrial Average (.DJI.US)$ $S&P 500 Index (.SPX.US)$

15

4

RealSlimLazy

voted

Spoiler:

At the end of this post, there is a chance for you to win points!

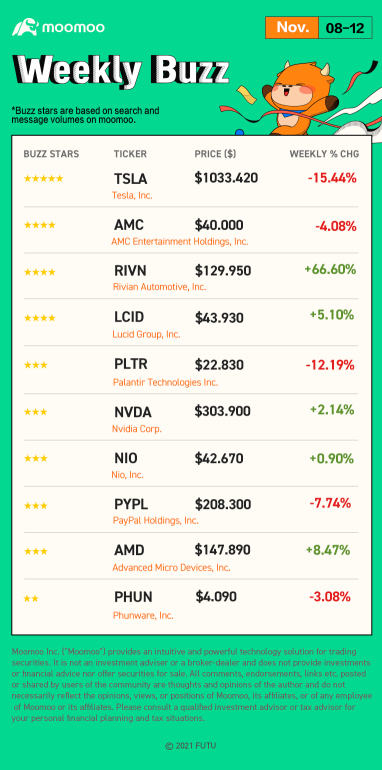

Happy Monday mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Part Ⅰ: Make Your Choices

Part Ⅱ: Buzzing Stocks List & Mooers Comments

Every major index moved lower last week. Here is the weekly buzzing stock list of last week:

1. TSLA - Buzzing Stars: ⭐⭐⭐⭐⭐

Tesla CEO Elon Musk’s trust sold about $1.2 billion in Tesla stock, Tesla stock declined 15.4% for the week, marking the company’s worst one-week performance in 20 months.

● Mooers comment

@Daniel Acret:

There's a New Kid in Town

Everybody's talking

'bout the New Kid in town

They will never forget TSLA

till Rivian comes around

Everybody's talking

'bout the new coin in town

they won't forget BitCoin

till Ethereum comes along.

@DayleyTrades: ⭐⭐⭐⭐

2. AMC - Buzzing Stars: ⭐⭐⭐⭐

With the CEO of AMC selling more than a million shares, AMC's stock price closed at $40.000 with a weekly decrease of 4.08%. The good news is that AMC theaters have joined the crypto bandwagon and the company’s customers can do the online payment via them.

● Mooers comment

@Smoke-A-Shotgun: $AMC Entertainment (AMC.US)$

@Coffee Drip: $AMC Entertainment (AMC.US)$ if you are freaking out over this drop.. You haven't been here long. Lol take a break go eat some toast and watch Netflix or go get some fresh air and calm down. This is not that bad. I've been in amc since like the 2.00 days and even before that. I watched covid almost take out AMC and held on and bought more. Stocks go up and down.

3. RIVN - Buzzing Stars: ⭐⭐⭐⭐

Rivian Automotive has made a strong start in the market, trading at more than 30% above its IPO price and with a market cap of about $100 billion. Its stock price closed at $129.950, with a weekly rise of 66.60%.

● Mooers comment

@GetMeABeerDude: how I feel about this stock right now

$Rivian Automotive (RIVN.US)$

@Palmyra: Rivian IPO: 5 things to know about the Amazon-backed electric-vehicle maker

$Rivian Automotive (RIVN.US)$ Losses have mounted as the business grows. Perhaps not surprisingly, Rivian has never made money, and doesn’t expect to turn a profit in the “foreseeable future” as it invests in its business. Read more...

4. LCID - Buzzing Stars: ⭐⭐⭐⭐

LCID stock closed at $43.930 last Friday with a weekly rise of 5.10%, despite almost doubling in selling price over the past month.

● Mooers comment

@101505797

$Lucid Group (LCID.US)$

5. PLTR - Buzzing Stars: ⭐⭐⭐

RBC Capital has downgraded Palantir's stock from sector performance to underperform and lowered its share price projection from $25 to $19. The shares of PLTR lost 12.19% last week and finally closed at $22.830.

● Mooers comment

@FiveHundredCents: Cathie Wood Rushes To Load Up $36M In Palantir As Its Stock Crashes 9%

Cathie Wood’s money managing firm Ark Invest on Tuesday bought 1.48 million shares— estimated to be worth $35.98 million— in $Palantir (PLTR.US)$ on the dip and after months of booking profit in the stock.Shares of the Peter Thiel-backed company closed 9.35% lower at $24.25 a share on Tuesday. Read more...

6. NVDA - Buzzing Stars: ⭐⭐⭐

Analysts from four different institutions have raised their estimations of Nvidia's intrinsic value, ranging from $340 to $360 per share. Its stock price closed at $303.900, with a weekly rise of 2.14%.

● Mooers comment

@efficentupup: The Biggest Beneficiary Of The Meta Universe?

On November 9th, NVIDIA announced at the 2021 GPU Technology Conference (GTC 2021) that it would upgrade its product route to a "three-core" strategy of "GPU+CPU+DPU". "(Omniverse) platform is positioned as "engineer's meta-universe". Read more...

7. NIO - Buzzing Stars: ⭐⭐⭐

In China, demand for electric vehicles continues strong, with Nio reporting record bookings in October. NIO stock was up 0.90% to $42.670 last week.

● Mooers comment

@Sourav Pan: Nio rallies after Citi boosts price target on positive view of market share $NIO Inc (NIO.US)$ is up 3.25% in early trading to cut into the post-earnings decline. Citi boosts its price target on Nio to $87 from $70 on its expectation that the Chinese EV player will nab more market share. Read more...

8. PYPL - Buzzing Stars: ⭐⭐⭐

PYPL stock price close at $208.300 with a weekly decrease of 7.74%. PayPal Holdings' stock plummeted a day after the company released third-quarter results and predictions that fell short of Wall Street expectations on several fronts.

● Mooers comment

@Deezy_McCheezy

$PayPal (PYPL.US)$

It’s really quite simple.

Buy the dip.

If it does dip more buy some more.

Hold for a minimum of 12-18 months and double your money.

9. AMD - Buzzing Stars: ⭐⭐⭐

AMD stock increased 8.47% to $147.890 over the past week. Meta Platforms has announced a major push into data centers as part of its mission to build a metaverse.

● Mooers comment

@Handy_:

Advanced Micro Devices $Advanced Micro Devices (AMD.US)$ is about to enter the metaverse.

The chip giant said its EPYC chips were selected by Meta (formerly known as Facebook) to help power its data centers at its virtual Accelerated Data Center Premiere event Monday. Read more...

10. PHUN - Buzzing Stars: ⭐⭐

PHUN shares were down 3.08% to $4.090 last week with the extreme volatility of the PHUN stock in October, investors have decided that the asset's fundamental value is far less essential than the observable demand increase.

● Mooers comment

@勇者无惧的亚希伯恩:

$Phunware (PHUN.US)$

Phunware is scheduled to announce Q3 earnings results on Thursday, November 11th, after market close.The consensus EPS Estimate is -$0.04(+78.9% Y/Y) and the consensus Revenue Estimate is $2.27M (-27.5% Y/Y).Over the last 3 months, EPS estimates have seen 2 upward revisions and 2 downward. Read more...

![]() Thanks for your reading!

Thanks for your reading!

![]() Awarding Moment

Awarding Moment

Before moving on to part three, congrats to the following mooers whose comments were selected as the top comments last week!

@GratefulPanda @makankaki @Jia Yung @Syuee @HopeAlways @Dadacai

We really appreciate your great insights! Read the top comments last week!

Notice: Reward will be sent to you this week. Please feel free to contact us if there is any problem.

Part Ⅲ: Weekly Topic

Time to be rewarded for your great insights and knowledge!

This week, we'd like to invite you to comment below and share your idea on:

"Does deciding to invest mean taking a gamble?"

We will select 20 TOP COMMENTS by next Monday.

Winners will get 200 points by next week, with which you can exchange gifts at Reward Club.

*Comments within this week will be counted.

Top Comment Technique:

● Fundamental / Technical / Capital Analyses

● Personal Trading Experience

● Any bright insights or knowledge

Previous of WeeklyBuzz

Weekly Buzz: "My first investment in the stock market."

Weekly Buzz: "What is Metaverse?"

Weekly Buzz: "Have some PHUN."

Disclaimer: Comments below are made available for informational purposes only. Before investing, please consult a licensed professional.

At the end of this post, there is a chance for you to win points!

Happy Monday mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Part Ⅰ: Make Your Choices

Part Ⅱ: Buzzing Stocks List & Mooers Comments

Every major index moved lower last week. Here is the weekly buzzing stock list of last week:

1. TSLA - Buzzing Stars: ⭐⭐⭐⭐⭐

Tesla CEO Elon Musk’s trust sold about $1.2 billion in Tesla stock, Tesla stock declined 15.4% for the week, marking the company’s worst one-week performance in 20 months.

● Mooers comment

@Daniel Acret:

There's a New Kid in Town

Everybody's talking

'bout the New Kid in town

They will never forget TSLA

till Rivian comes around

Everybody's talking

'bout the new coin in town

they won't forget BitCoin

till Ethereum comes along.

@DayleyTrades: ⭐⭐⭐⭐

2. AMC - Buzzing Stars: ⭐⭐⭐⭐

With the CEO of AMC selling more than a million shares, AMC's stock price closed at $40.000 with a weekly decrease of 4.08%. The good news is that AMC theaters have joined the crypto bandwagon and the company’s customers can do the online payment via them.

● Mooers comment

@Smoke-A-Shotgun: $AMC Entertainment (AMC.US)$

@Coffee Drip: $AMC Entertainment (AMC.US)$ if you are freaking out over this drop.. You haven't been here long. Lol take a break go eat some toast and watch Netflix or go get some fresh air and calm down. This is not that bad. I've been in amc since like the 2.00 days and even before that. I watched covid almost take out AMC and held on and bought more. Stocks go up and down.

3. RIVN - Buzzing Stars: ⭐⭐⭐⭐

Rivian Automotive has made a strong start in the market, trading at more than 30% above its IPO price and with a market cap of about $100 billion. Its stock price closed at $129.950, with a weekly rise of 66.60%.

● Mooers comment

@GetMeABeerDude: how I feel about this stock right now

$Rivian Automotive (RIVN.US)$

@Palmyra: Rivian IPO: 5 things to know about the Amazon-backed electric-vehicle maker

$Rivian Automotive (RIVN.US)$ Losses have mounted as the business grows. Perhaps not surprisingly, Rivian has never made money, and doesn’t expect to turn a profit in the “foreseeable future” as it invests in its business. Read more...

4. LCID - Buzzing Stars: ⭐⭐⭐⭐

LCID stock closed at $43.930 last Friday with a weekly rise of 5.10%, despite almost doubling in selling price over the past month.

● Mooers comment

@101505797

$Lucid Group (LCID.US)$

5. PLTR - Buzzing Stars: ⭐⭐⭐

RBC Capital has downgraded Palantir's stock from sector performance to underperform and lowered its share price projection from $25 to $19. The shares of PLTR lost 12.19% last week and finally closed at $22.830.

● Mooers comment

@FiveHundredCents: Cathie Wood Rushes To Load Up $36M In Palantir As Its Stock Crashes 9%

Cathie Wood’s money managing firm Ark Invest on Tuesday bought 1.48 million shares— estimated to be worth $35.98 million— in $Palantir (PLTR.US)$ on the dip and after months of booking profit in the stock.Shares of the Peter Thiel-backed company closed 9.35% lower at $24.25 a share on Tuesday. Read more...

6. NVDA - Buzzing Stars: ⭐⭐⭐

Analysts from four different institutions have raised their estimations of Nvidia's intrinsic value, ranging from $340 to $360 per share. Its stock price closed at $303.900, with a weekly rise of 2.14%.

● Mooers comment

@efficentupup: The Biggest Beneficiary Of The Meta Universe?

On November 9th, NVIDIA announced at the 2021 GPU Technology Conference (GTC 2021) that it would upgrade its product route to a "three-core" strategy of "GPU+CPU+DPU". "(Omniverse) platform is positioned as "engineer's meta-universe". Read more...

7. NIO - Buzzing Stars: ⭐⭐⭐

In China, demand for electric vehicles continues strong, with Nio reporting record bookings in October. NIO stock was up 0.90% to $42.670 last week.

● Mooers comment

@Sourav Pan: Nio rallies after Citi boosts price target on positive view of market share $NIO Inc (NIO.US)$ is up 3.25% in early trading to cut into the post-earnings decline. Citi boosts its price target on Nio to $87 from $70 on its expectation that the Chinese EV player will nab more market share. Read more...

8. PYPL - Buzzing Stars: ⭐⭐⭐

PYPL stock price close at $208.300 with a weekly decrease of 7.74%. PayPal Holdings' stock plummeted a day after the company released third-quarter results and predictions that fell short of Wall Street expectations on several fronts.

● Mooers comment

@Deezy_McCheezy

$PayPal (PYPL.US)$

It’s really quite simple.

Buy the dip.

If it does dip more buy some more.

Hold for a minimum of 12-18 months and double your money.

9. AMD - Buzzing Stars: ⭐⭐⭐

AMD stock increased 8.47% to $147.890 over the past week. Meta Platforms has announced a major push into data centers as part of its mission to build a metaverse.

● Mooers comment

@Handy_:

Advanced Micro Devices $Advanced Micro Devices (AMD.US)$ is about to enter the metaverse.

The chip giant said its EPYC chips were selected by Meta (formerly known as Facebook) to help power its data centers at its virtual Accelerated Data Center Premiere event Monday. Read more...

10. PHUN - Buzzing Stars: ⭐⭐

PHUN shares were down 3.08% to $4.090 last week with the extreme volatility of the PHUN stock in October, investors have decided that the asset's fundamental value is far less essential than the observable demand increase.

● Mooers comment

@勇者无惧的亚希伯恩:

$Phunware (PHUN.US)$

Phunware is scheduled to announce Q3 earnings results on Thursday, November 11th, after market close.The consensus EPS Estimate is -$0.04(+78.9% Y/Y) and the consensus Revenue Estimate is $2.27M (-27.5% Y/Y).Over the last 3 months, EPS estimates have seen 2 upward revisions and 2 downward. Read more...

Before moving on to part three, congrats to the following mooers whose comments were selected as the top comments last week!

@GratefulPanda @makankaki @Jia Yung @Syuee @HopeAlways @Dadacai

We really appreciate your great insights! Read the top comments last week!

Notice: Reward will be sent to you this week. Please feel free to contact us if there is any problem.

Part Ⅲ: Weekly Topic

Time to be rewarded for your great insights and knowledge!

This week, we'd like to invite you to comment below and share your idea on:

"Does deciding to invest mean taking a gamble?"

We will select 20 TOP COMMENTS by next Monday.

Winners will get 200 points by next week, with which you can exchange gifts at Reward Club.

*Comments within this week will be counted.

Top Comment Technique:

● Fundamental / Technical / Capital Analyses

● Personal Trading Experience

● Any bright insights or knowledge

Previous of WeeklyBuzz

Weekly Buzz: "My first investment in the stock market."

Weekly Buzz: "What is Metaverse?"

Weekly Buzz: "Have some PHUN."

Disclaimer: Comments below are made available for informational purposes only. Before investing, please consult a licensed professional.

+5

97

57

RealSlimLazy

commented on

$Mapletree Ind Tr (ME8U.SG)$ omg drop again

3

4

RealSlimLazy

liked

How to choose stocks when funds are insufficient

👉Holding a heavy position to buy a few stocks can lead to higher profits, but also greater losses when incurring losses. It's not possible to find stocks that will definitely rise 100% of the time. If you're lucky enough to buy the right stocks, it's great, but if you pick the wrong ones, your funds may be trapped.![]()

👉Diversify your investments by making small purchases of stocks to reduce risk. However, because you're buying small amounts of multiple stocks, the profits from each stock become small after deducting handling fees and commissions, resulting in even less actual profit. Managing multiple stocks with small investments also takes a lot of time and effort.

I personally prefer diversified investments.

Due to limited funds, it is rare to buy stocks with a high stock price, usually blue chip stocks, although they have potential, the prices are quite expensive (several hundred or even several thousand yuan), while buying a small amount of low-priced stocks, it is tiring and the profit earned is minimal.

Small gains, big gains. For now, don't worry about how much money you've made, but how much you've earned in percentage of your total investment capital. As long as you earn a higher rate than the interest on a bank deposit, that's already pretty good.

Greed is a common problem for people, everyone wants to make big money. But greed often leads people to become opportunistic, and being opportunistic turns investments into gambling. Before investing, one must have a concept, a correct idea, and mindset.

With insufficient funds, one should be cautious in investing, avoid being hasty, consider small gains as part of learning, slowly accumulate experience, learn from losses, and draw lessons from failures. When you have enough capital and accumulated sufficient experience and knowledge, then investing becomes easier and reduces the risk of losses.

$Nasdaq Composite Index (.IXIC.US)$ $S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$

👉Holding a heavy position to buy a few stocks can lead to higher profits, but also greater losses when incurring losses. It's not possible to find stocks that will definitely rise 100% of the time. If you're lucky enough to buy the right stocks, it's great, but if you pick the wrong ones, your funds may be trapped.

👉Diversify your investments by making small purchases of stocks to reduce risk. However, because you're buying small amounts of multiple stocks, the profits from each stock become small after deducting handling fees and commissions, resulting in even less actual profit. Managing multiple stocks with small investments also takes a lot of time and effort.

I personally prefer diversified investments.

Due to limited funds, it is rare to buy stocks with a high stock price, usually blue chip stocks, although they have potential, the prices are quite expensive (several hundred or even several thousand yuan), while buying a small amount of low-priced stocks, it is tiring and the profit earned is minimal.

Small gains, big gains. For now, don't worry about how much money you've made, but how much you've earned in percentage of your total investment capital. As long as you earn a higher rate than the interest on a bank deposit, that's already pretty good.

Greed is a common problem for people, everyone wants to make big money. But greed often leads people to become opportunistic, and being opportunistic turns investments into gambling. Before investing, one must have a concept, a correct idea, and mindset.

With insufficient funds, one should be cautious in investing, avoid being hasty, consider small gains as part of learning, slowly accumulate experience, learn from losses, and draw lessons from failures. When you have enough capital and accumulated sufficient experience and knowledge, then investing becomes easier and reduces the risk of losses.

$Nasdaq Composite Index (.IXIC.US)$ $S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$

Translated

9

1

RealSlimLazy

liked

First, I would like to take this opportunity to thank all Mooers, who have liked my posts, and $Futu Holdings Ltd (FUTU.US)$ and @moomoo Academyfor recognising my work. ![]()

Secondly, I would like to thank all my supporters for voting me for the "Mentor Moo" title via the link below.![]()

Lastly, I want to thank the following for their continuous support in many of my posts. They are:

![]() MooMoo Apes fan club ( Yes, BANGS! To the Moon!

MooMoo Apes fan club ( Yes, BANGS! To the Moon! ![]() $BlackBerry (BB.US)$ , $AMC Entertainment (AMC.US)$ , $Cenntro Electric (NAKD.US)$ , $GameStop (GME.US)$ , $SNDL Inc (SNDL.US)$ )

$BlackBerry (BB.US)$ , $AMC Entertainment (AMC.US)$ , $Cenntro Electric (NAKD.US)$ , $GameStop (GME.US)$ , $SNDL Inc (SNDL.US)$ )

![]() FAANG fan club ( $Meta Platforms (FB.US)$ , $Amazon (AMZN.US)$ , $Apple (AAPL.US)$ , $Netflix (NFLX.US)$ , $Alphabet-C (GOOG.US)$ )

FAANG fan club ( $Meta Platforms (FB.US)$ , $Amazon (AMZN.US)$ , $Apple (AAPL.US)$ , $Netflix (NFLX.US)$ , $Alphabet-C (GOOG.US)$ )

![]() MAGAT fan club ( $Microsoft (MSFT.US)$ , $Apple (AAPL.US)$ , $Alphabet-C (GOOG.US)$ , $Amazon (AMZN.US)$ , $Tesla (TSLA.US)$ )

MAGAT fan club ( $Microsoft (MSFT.US)$ , $Apple (AAPL.US)$ , $Alphabet-C (GOOG.US)$ , $Amazon (AMZN.US)$ , $Tesla (TSLA.US)$ )

![]() ARK fan club ( $ARK Innovation ETF (ARKK.US)$ , $ARK Fintech Innovation ETF (ARKF.US)$ , $ARK Next Generation Internet ETF (ARKW.US)$ , $ARK Space Exploration & Innovation ETF (ARKX.US)$ )

ARK fan club ( $ARK Innovation ETF (ARKK.US)$ , $ARK Fintech Innovation ETF (ARKF.US)$ , $ARK Next Generation Internet ETF (ARKW.US)$ , $ARK Space Exploration & Innovation ETF (ARKX.US)$ )

![]() Crypto fan club ( $Bitcoin (BTC.CC)$ , $Ethereum (ETH.CC)$ , $Dogecoin (DOGE.CC)$ , $Zilliqa (ZIL.CC)$ )

Crypto fan club ( $Bitcoin (BTC.CC)$ , $Ethereum (ETH.CC)$ , $Dogecoin (DOGE.CC)$ , $Zilliqa (ZIL.CC)$ )

![]() Trump concept fan club ( $Digital World Acquisition Corp (DWAC.US)$ , $Phunware (PHUN.US)$ )

Trump concept fan club ( $Digital World Acquisition Corp (DWAC.US)$ , $Phunware (PHUN.US)$ )

Once again, thank you so much and hope to see you all in my next post.![]()

Secondly, I would like to thank all my supporters for voting me for the "Mentor Moo" title via the link below.

Lastly, I want to thank the following for their continuous support in many of my posts. They are:

Once again, thank you so much and hope to see you all in my next post.

128

12

RealSlimLazy

liked

$FTSE Singapore Straits Time Index (.STI.SG)$

New joiner here. starting with a 3 fund lazy portfolio. how much percentage should STI be? 10%?

New joiner here. starting with a 3 fund lazy portfolio. how much percentage should STI be? 10%?

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)