4

1

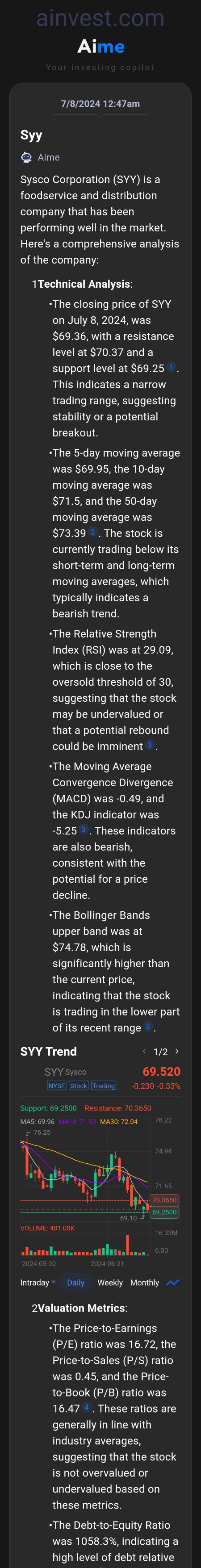

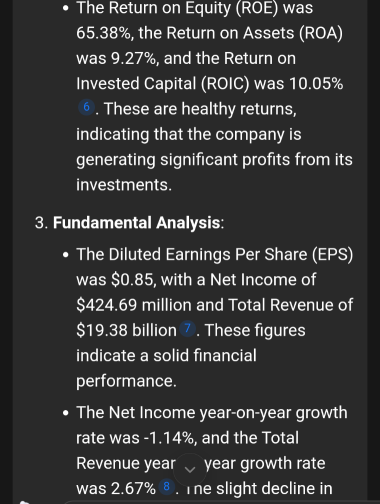

$Sysco Corp (SYY.US)$ This is what an AI bot says, for what it's worth. I'm not quite ready to trust AI for trading, although it does generate a pretty good analysis with no indication of bias...

+2

1

1

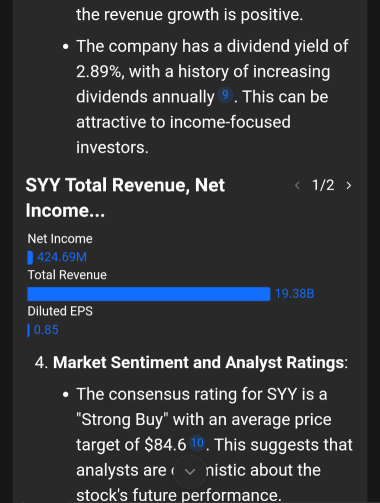

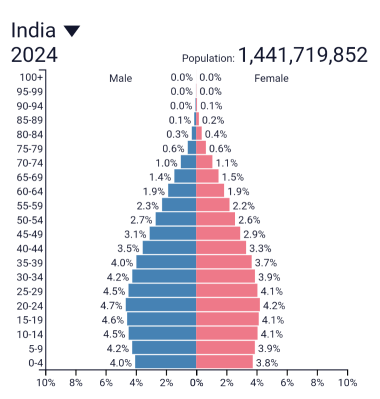

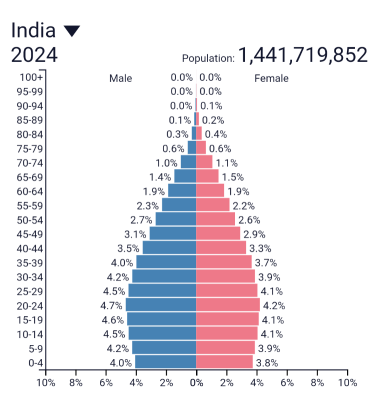

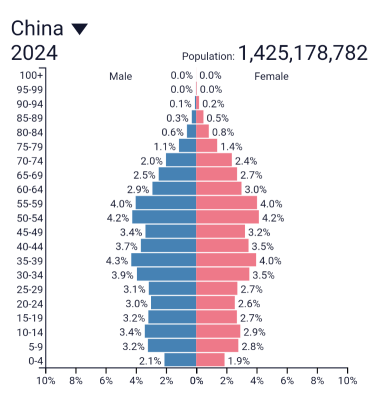

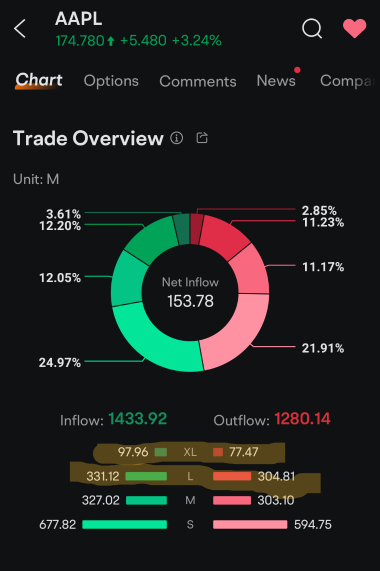

$Apple (AAPL.US)$ You've probably seen a lot of anxiety about China sales slipping. But China is not a growing consumer market for any product. In fact it's dying - literally. China's population is aging out and their decades-long "one child per family" mandate has decimated their population replacement rate. India, on the other hand, is just the opposite - young and growing population. Both populations are approximately the same size, about 1.4 billion ppl. Ba...

3

1

$Apple (AAPL.US)$ Just when you (and stock analysts) think AAPL is done growing, AAPL always has an Ace card they haven't shown yet. I've seen it time and time again over two decades of owning the stock. The announcement of AI is big, but what's bigger and hiding in plain sight, is manufacturing and consumer market is shifting from China to India. Same size mega-population, yet India is young and growing. China is literally aging out. Compare the two population pyramids below. ...

9

3

1

This article has a bunch of interesting takes on Election Year market insights (Congress more important than POTUS, Hmmm), AI, AAPL and more

What Do US Elections Mean For The Stock Market? - Simply Wall St

What Do US Elections Mean For The Stock Market? - Simply Wall St

$Global Partners (GLP.US)$ My first share lot buy of GLP was during the COVID market crash, about $9 per share. I found this little known company while searching for oversold oil and gas companies particularly mid-stream. However, this is not a mid-stream company it's a 75 year-old family owned partnership that is rather unique in the oil/fuel industry. They own and operate a chain of retail gasoline stations, large commercial fuel terminals, and st...

Watch out for the "September Effect" which sometimes starts in late August. Profit taking, temporary fall in stock prices. September Effect: Definition, Stock Market History, Theories

2

Why can't you have both in your portfolio? I have diversity in mine. Numerous multi-year holdings in large caps that are profitable and aren't going away. Then I have some short term stocks that are poised for upside, and ready to take a gain when opportunity strikes. I typically dollar cost average on the way in and on the way out on these.

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)