# This post was published on 17 Oct 2021 on REIT-TIREMENT.

Previously I've blog about Which Singapore REIT had the Most Frequent Equity Fundraising?Besides EFR, there is another way to raise funds without increasing gearing, which is through perpetual securities. Perpetual securities are also known as perps, perpetual bonds or perpetual notes and the interest rate is higher. In fact, with perps, the existing gearing could even be reduced.

For perps, there is no maturity date, therefore perps are treated as equity instead of debt. The coupon payment (interest or dividend in other terms) could be stopped/deferred at any time without the holders' consent. Though there might be a call schedule, it is up to the issuer's decision whether to redeem it or not. If you would like to read for more detail about perpetual securities, check out the following:

1) Understanding perpetual securities by Money Sense

2) Perpetual Bonds and REITs by Investment Moat

3) This is What You Should Know About Perpetual Bonds by Zuu Online

4) Perpetual Bond by Investopedia

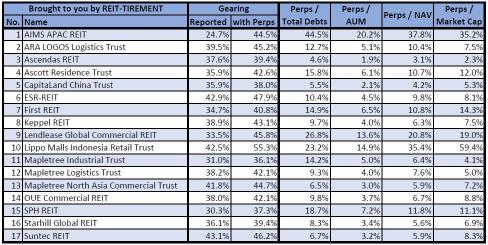

So how many Singapore REITs (and BizTrusts that operate similar to REITs) are having perpetual securities in their balance sheet rights now? The number is 17 out of 40, which is more than 40% of counters and the list is increasing. Refer below for the existing list of REITs:

* Total debts = perps + total borrowings

There are various metrics for investors to compare the perps with. Personally, I would prefer the perps / total debts to gauge whether REITs having a higher proportion of perps. Nonetheless, let's see which are the top 5 REITs with the highest % according to each metric:

From the above, AIMS APAC REIT scores the top for 3 comparisons while LMIRT has the highest perps to market cap ratio. Look closely, you would notice that the top 3 would always be the same 3 counters: AIMS APAC REIT, Lendlease Global Commercial REIT and Lippo Malls Indonesia Retail Trust.

To date, there is no mandatory requirement from MAS to include perpetual securities into the calculation of gearing ratio and cost of debt. The interest coverage ratio, on the other hand, is required to include perps into the calculation (known as adjusted interest coverage ratio) should a REIT exceed 45% gearing ratio after 1 Jan 2022. Refer below for the extra from Code on Collective Investment Schemes by MAS, revised on 1 Jul 2021:

Hopefully, in the near terms, MAS would require all REITs to include perpetual securities into the cost of debt, interest coverage ratio (even below 45% gearing) and gearing ratio. This could provide better information transparency to investors. Besides, hopefully, the formula/criteria for REVPAU for the hospitality sector and rent reversion could be standardized as well.

Join REIT-TIREMENT Patreon for patron-exclusive posts that cover REITs valuation and more detail on fundamental analysis. You could also refer below for more information:

SREITs Dashboard - Detailed information on individual Singapore REIT

SREITs Data - Overview and Detail of Singapore REIT

REIT Analysis - List of previous REIT analysis posts

REIT-TIREMENT Telegram Channel - Join to receive updates on new post

REIT-TIREMENT Facebook Page - Support by liking my Facebook Page

REIT Investing Community - Facebook Group where members share and discuss REIT topic

*Disclaimer: Materials in this blog are based on my research and opinion which I don't guarantee accuracy, completeness, and reliability. It should not be taken as financial advice or a statement of fact. I shall not be held liable for errors, omissions and loss or damage as a result of the use of the material in this blog. Under no circumstances does the information presented on this blog represent a buy, sell, or hold recommendation on any security, please always do your own due diligence before any decision is made.

$AIMS APAC Reit (O5RU.SG)$

$ARA LOGOS Log Tr (K2LU.SG)$

$Acro HTrust USD (XZL.SG)$

$CapLand India T (CY6U.SG)$

$CapLand Ascendas REIT (A17U.SG)$

$CapLand Ascott T (HMN.SG)$

$BHG Retail Reit (BMGU.SG)$

$CapLand China T (AU8U.SG)$

$CapLand IntCom T (C38U.SG)$

$CDL HTrust (J85.SG)$

$Cromwell Reit EUR (CWBU.SG)$

$Cromwell Reit SGD (CWCU.SG)$

$Dasin Retail Tr (CEDU.SG)$

$EC World Reit (BWCU.SG)$

$EliteUKREIT GBP (MXNU.SG)$

$ESR-REIT (J91U.SG)$

$Far East HTrust (Q5T.SG)$

$First Reit (AW9U.SG)$

$Frasers Cpt Tr (J69U.SG)$

$Frasers HTrust (ACV.SG)$

$Frasers L&C Tr (BUOU.SG)$

$IREIT Global EUR (8U7U.SG)$

$IREIT Global SGD (UD1U.SG)$

$Keppel DC Reit (AJBU.SG)$

$KepPacOakReitUSD (CMOU.SG)$

$Keppel Reit (K71U.SG)$

$Lendlease Reit (JYEU.SG)$

$Lippo Malls Tr (D5IU.SG)$

$ManulifeReit USD (BTOU.SG)$

$Mapletree PanAsia Com Tr (N2IU.SG)$

$Mapletree Ind Tr (ME8U.SG)$

$Mapletree Log Tr (M44U.SG)$

$Mapletree NAC Tr (RW0U.SG)$

$OUEREIT (TS0U.SG)$

$ParkwayLife Reit (C2PU.SG)$

$PARAGONREIT (SK6U.SG)$

$StarhillGbl Reit (P40U.SG)$

$Suntec Reit (T82U.SG)$

$UtdHampshReitUSD (ODBU.SG)$

Previously I've blog about Which Singapore REIT had the Most Frequent Equity Fundraising?Besides EFR, there is another way to raise funds without increasing gearing, which is through perpetual securities. Perpetual securities are also known as perps, perpetual bonds or perpetual notes and the interest rate is higher. In fact, with perps, the existing gearing could even be reduced.

For perps, there is no maturity date, therefore perps are treated as equity instead of debt. The coupon payment (interest or dividend in other terms) could be stopped/deferred at any time without the holders' consent. Though there might be a call schedule, it is up to the issuer's decision whether to redeem it or not. If you would like to read for more detail about perpetual securities, check out the following:

1) Understanding perpetual securities by Money Sense

2) Perpetual Bonds and REITs by Investment Moat

3) This is What You Should Know About Perpetual Bonds by Zuu Online

4) Perpetual Bond by Investopedia

So how many Singapore REITs (and BizTrusts that operate similar to REITs) are having perpetual securities in their balance sheet rights now? The number is 17 out of 40, which is more than 40% of counters and the list is increasing. Refer below for the existing list of REITs:

* Total debts = perps + total borrowings

There are various metrics for investors to compare the perps with. Personally, I would prefer the perps / total debts to gauge whether REITs having a higher proportion of perps. Nonetheless, let's see which are the top 5 REITs with the highest % according to each metric:

From the above, AIMS APAC REIT scores the top for 3 comparisons while LMIRT has the highest perps to market cap ratio. Look closely, you would notice that the top 3 would always be the same 3 counters: AIMS APAC REIT, Lendlease Global Commercial REIT and Lippo Malls Indonesia Retail Trust.

To date, there is no mandatory requirement from MAS to include perpetual securities into the calculation of gearing ratio and cost of debt. The interest coverage ratio, on the other hand, is required to include perps into the calculation (known as adjusted interest coverage ratio) should a REIT exceed 45% gearing ratio after 1 Jan 2022. Refer below for the extra from Code on Collective Investment Schemes by MAS, revised on 1 Jul 2021:

Hopefully, in the near terms, MAS would require all REITs to include perpetual securities into the cost of debt, interest coverage ratio (even below 45% gearing) and gearing ratio. This could provide better information transparency to investors. Besides, hopefully, the formula/criteria for REVPAU for the hospitality sector and rent reversion could be standardized as well.

Join REIT-TIREMENT Patreon for patron-exclusive posts that cover REITs valuation and more detail on fundamental analysis. You could also refer below for more information:

SREITs Dashboard - Detailed information on individual Singapore REIT

SREITs Data - Overview and Detail of Singapore REIT

REIT Analysis - List of previous REIT analysis posts

REIT-TIREMENT Telegram Channel - Join to receive updates on new post

REIT-TIREMENT Facebook Page - Support by liking my Facebook Page

REIT Investing Community - Facebook Group where members share and discuss REIT topic

*Disclaimer: Materials in this blog are based on my research and opinion which I don't guarantee accuracy, completeness, and reliability. It should not be taken as financial advice or a statement of fact. I shall not be held liable for errors, omissions and loss or damage as a result of the use of the material in this blog. Under no circumstances does the information presented on this blog represent a buy, sell, or hold recommendation on any security, please always do your own due diligence before any decision is made.

$AIMS APAC Reit (O5RU.SG)$

$ARA LOGOS Log Tr (K2LU.SG)$

$Acro HTrust USD (XZL.SG)$

$CapLand India T (CY6U.SG)$

$CapLand Ascendas REIT (A17U.SG)$

$CapLand Ascott T (HMN.SG)$

$BHG Retail Reit (BMGU.SG)$

$CapLand China T (AU8U.SG)$

$CapLand IntCom T (C38U.SG)$

$CDL HTrust (J85.SG)$

$Cromwell Reit EUR (CWBU.SG)$

$Cromwell Reit SGD (CWCU.SG)$

$Dasin Retail Tr (CEDU.SG)$

$EC World Reit (BWCU.SG)$

$EliteUKREIT GBP (MXNU.SG)$

$ESR-REIT (J91U.SG)$

$Far East HTrust (Q5T.SG)$

$First Reit (AW9U.SG)$

$Frasers Cpt Tr (J69U.SG)$

$Frasers HTrust (ACV.SG)$

$Frasers L&C Tr (BUOU.SG)$

$IREIT Global EUR (8U7U.SG)$

$IREIT Global SGD (UD1U.SG)$

$Keppel DC Reit (AJBU.SG)$

$KepPacOakReitUSD (CMOU.SG)$

$Keppel Reit (K71U.SG)$

$Lendlease Reit (JYEU.SG)$

$Lippo Malls Tr (D5IU.SG)$

$ManulifeReit USD (BTOU.SG)$

$Mapletree PanAsia Com Tr (N2IU.SG)$

$Mapletree Ind Tr (ME8U.SG)$

$Mapletree Log Tr (M44U.SG)$

$Mapletree NAC Tr (RW0U.SG)$

$OUEREIT (TS0U.SG)$

$ParkwayLife Reit (C2PU.SG)$

$PARAGONREIT (SK6U.SG)$

$StarhillGbl Reit (P40U.SG)$

$Suntec Reit (T82U.SG)$

$UtdHampshReitUSD (ODBU.SG)$

+1

4

1

# This post was published on 10 Oct 2021 on REIT-TIREMENT.

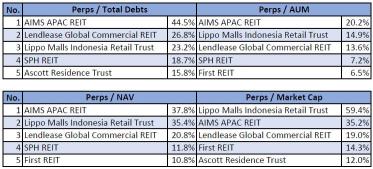

Equity fundraising is a common practice for a REIT to raise funds mainly for property acquisition or strengthen its balance sheets. Equity fundraising (EFR) refers to the process of raising capital through the issuance of new shares. There are 5 types of equity fundraising that employed by Singapore REITs throughout the years:

1) Private Placement

- Offer to institutional or selected investors.

2) Preferential Offering

- Non-renounceable offer to the retail investor, the entitlement is not tradeable nor transferable.

3) Rights Issue

- Renouceable offer to the retail investor, the entitlement is tradeable during the rights trading period. investors can sell the entitlement (nil-paid rights) if they are not intended to take up the offer.

4) Consideration Units

- Issuance of new units to the vendor for acquisition payment.

5) ATM Offering

- Offer new units to the public, similar to IPO, this is not common nowadays.

EFR History

There are 6 REITs which never had EFR since listing:

1) ARA US Hospitality Trust, listed in May 2019

2) BHG Retail REIT, listed in Dec 2015

3) EC World REIT, listed in Jul 2016

4) Lendlease Global Commercial REIT, listed in Oct 2019

5) Parkway Life REIT, listed in Aug 2007

6) Sasseur REIT, listed in Mar 2018

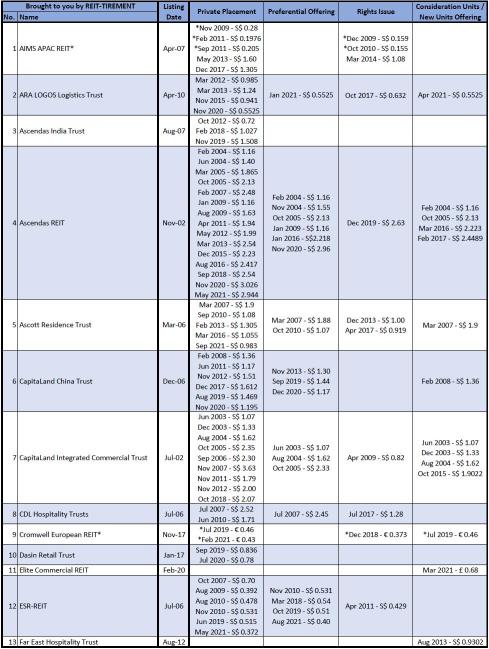

As for the rest, below is the record of individual EFR:

* Pre-consolidation prices

Out of 202 EFR exercises, 27 were preferential offerings and 35 were rights issues, in which both provided opportunities for unitholders (who held until ex-date) to subscribe for new units. Well, sometimes, existing unitholders are kind of forced to subscribe, or else their absolute distribution would get diluted. As for non-existing unitholders, preferential offering and rights issues provide an opportunity to buy the shares at a discounted price. However, there are quite some occurrences that the share prices drop below the preferential offering price in short term. The same applies to the rights issue, albeit may take a longer time due to the higher discount rate.

EFR Frequency

Sometimes, REIT exercises multiple types of EFR at the same time, e.g. Frasers Centrepoint Trust exercised both private placement and preferential offering in Sep/Oct 2020 for the acquisition of the remaining 63.11% stake in AsiaRetail Fund. Regardless, I would consider each as an individual event for frequency computation below:

Out of the 34 counters, 12 counters have an increasing EFR frequency trend while 10 counters have a decreasing EFR frequency trend. Below is the list:

Next, let's find out which REIT has the most frequent EFR throughout different periods:

* Multiple REITs are having the same average frequency for 2nd and 3rd places in the past 10 years, 5 years and 3 years.

For all-time and the past 10 years, Ascendas REIT is the champion. While for the past 5 years and the past 3 years, Mapletree Logistics Trust and Mapletree Industrial Trust get the crown respectively.

Preferential Offering & Rights Issue Frequency

Next, how about we filter out those cash call events only. Below are the 25 REITs that exercised preferential offering or rights issue:

Below is the summary:

1) For all-time, the top 3 REITs with the most frequent cash calls are Manulife US REIT, IREIT Global and Ascendas REIT.

2) For the past 10 years, 5 REITs had 3 cash calls: Ascendas REIT, CapitaLand China Trust, ESR-REIT, IREIT Global and Manulife US REIT.

3) For the past 5 years, 2 REITs had 3 cash calls: ESR-REIT and Manulife US REIT.

4) For the past 3 years, 5 REITs had 2 cash calls: Ascendas REIT, CapitaLand China Trust, ESR-REIT, Frasers Centrepoint Trust and IREIT Global.

Though the trend might not continue in the future, you may want to consider keeping some warchest if you are vested with the counters that have a history of higher cash calls frequency. For those who are new to rights issue or preferential offering, you could refer to my previous post - Key Dates and Figures to Note for Rights Issue and Preferential Offer which I've shared about what are the key dates to take note of and also provided a spreadsheet to calculate the fund required if you are would like to subscribe for the EFR.

Join REIT-TIREMENT Patreon for patron-exclusive posts that cover REITs valuation and more detail on fundamental analysis. You could also refer below for more information:

SREITs Dashboard - Detailed information on individual Singapore REIT

SREITs Data - Overview and Detail of Singapore REIT

REIT Analysis - List of previous REIT analysis posts

REIT-TIREMENT Telegram Channel - Join to receive updates on new post

REIT-TIREMENT Facebook Page - Support by liking my Facebook Page

REIT Investing Community - Facebook Group where members share and discuss REIT topic

*Disclaimer: Materials in this blog are based on my research and opinion which I don't guarantee accuracy, completeness, and reliability. It should not be taken as financial advice or a statement of fact. I shall not be held liable for errors, omissions and loss or damage as a result of the use of the material in this blog. Under no circumstances does the information presented on this blog represent a buy, sell, or hold recommendation on any security, please always do your own due diligence before any decision is made.

$AIMS APAC Reit (O5RU.SG)$

$ARA LOGOS Log Tr (K2LU.SG)$

$Acro HTrust USD (XZL.SG)$

$CapLand India T (CY6U.SG)$

$CapLand Ascendas REIT (A17U.SG)$

$CapLand Ascott T (HMN.SG)$

$BHG Retail Reit (BMGU.SG)$

$CapLand China T (AU8U.SG)$

$CapLand IntCom T (C38U.SG)$

$CDL HTrust (J85.SG)$

$Cromwell Reit EUR (CWBU.SG)$

$Cromwell Reit SGD (CWCU.SG)$

$Dasin Retail Tr (CEDU.SG)$

$EC World Reit (BWCU.SG)$

$EliteUKREIT GBP (MXNU.SG)$

$ESR-REIT (J91U.SG)$

$Far East HTrust (Q5T.SG)$

$First Reit (AW9U.SG)$

$Frasers Cpt Tr (J69U.SG)$

$Frasers HTrust (ACV.SG)$

$Frasers L&C Tr (BUOU.SG)$

$IREIT Global EUR (8U7U.SG)$

$IREIT Global SGD (UD1U.SG)$

$Keppel DC Reit (AJBU.SG)$

$KepPacOakReitUSD (CMOU.SG)$

$Keppel Reit (K71U.SG)$

$Lendlease Reit (JYEU.SG)$

$Lippo Malls Tr (D5IU.SG)$

$ManulifeReit USD (BTOU.SG)$

$Mapletree PanAsia Com Tr (N2IU.SG)$

$Mapletree Ind Tr (ME8U.SG)$

$Mapletree Log Tr (M44U.SG)$

$Mapletree NAC Tr (RW0U.SG)$

$OUEREIT (TS0U.SG)$

$ParkwayLife Reit (C2PU.SG)$

$PARAGONREIT (SK6U.SG)$

$StarhillGbl Reit (P40U.SG)$

$Suntec Reit (T82U.SG)$

$UtdHampshReitUSD (ODBU.SG)$

Equity fundraising is a common practice for a REIT to raise funds mainly for property acquisition or strengthen its balance sheets. Equity fundraising (EFR) refers to the process of raising capital through the issuance of new shares. There are 5 types of equity fundraising that employed by Singapore REITs throughout the years:

1) Private Placement

- Offer to institutional or selected investors.

2) Preferential Offering

- Non-renounceable offer to the retail investor, the entitlement is not tradeable nor transferable.

3) Rights Issue

- Renouceable offer to the retail investor, the entitlement is tradeable during the rights trading period. investors can sell the entitlement (nil-paid rights) if they are not intended to take up the offer.

4) Consideration Units

- Issuance of new units to the vendor for acquisition payment.

5) ATM Offering

- Offer new units to the public, similar to IPO, this is not common nowadays.

EFR History

There are 6 REITs which never had EFR since listing:

1) ARA US Hospitality Trust, listed in May 2019

2) BHG Retail REIT, listed in Dec 2015

3) EC World REIT, listed in Jul 2016

4) Lendlease Global Commercial REIT, listed in Oct 2019

5) Parkway Life REIT, listed in Aug 2007

6) Sasseur REIT, listed in Mar 2018

As for the rest, below is the record of individual EFR:

* Pre-consolidation prices

Out of 202 EFR exercises, 27 were preferential offerings and 35 were rights issues, in which both provided opportunities for unitholders (who held until ex-date) to subscribe for new units. Well, sometimes, existing unitholders are kind of forced to subscribe, or else their absolute distribution would get diluted. As for non-existing unitholders, preferential offering and rights issues provide an opportunity to buy the shares at a discounted price. However, there are quite some occurrences that the share prices drop below the preferential offering price in short term. The same applies to the rights issue, albeit may take a longer time due to the higher discount rate.

EFR Frequency

Sometimes, REIT exercises multiple types of EFR at the same time, e.g. Frasers Centrepoint Trust exercised both private placement and preferential offering in Sep/Oct 2020 for the acquisition of the remaining 63.11% stake in AsiaRetail Fund. Regardless, I would consider each as an individual event for frequency computation below:

Out of the 34 counters, 12 counters have an increasing EFR frequency trend while 10 counters have a decreasing EFR frequency trend. Below is the list:

Next, let's find out which REIT has the most frequent EFR throughout different periods:

* Multiple REITs are having the same average frequency for 2nd and 3rd places in the past 10 years, 5 years and 3 years.

For all-time and the past 10 years, Ascendas REIT is the champion. While for the past 5 years and the past 3 years, Mapletree Logistics Trust and Mapletree Industrial Trust get the crown respectively.

Preferential Offering & Rights Issue Frequency

Next, how about we filter out those cash call events only. Below are the 25 REITs that exercised preferential offering or rights issue:

Below is the summary:

1) For all-time, the top 3 REITs with the most frequent cash calls are Manulife US REIT, IREIT Global and Ascendas REIT.

2) For the past 10 years, 5 REITs had 3 cash calls: Ascendas REIT, CapitaLand China Trust, ESR-REIT, IREIT Global and Manulife US REIT.

3) For the past 5 years, 2 REITs had 3 cash calls: ESR-REIT and Manulife US REIT.

4) For the past 3 years, 5 REITs had 2 cash calls: Ascendas REIT, CapitaLand China Trust, ESR-REIT, Frasers Centrepoint Trust and IREIT Global.

Though the trend might not continue in the future, you may want to consider keeping some warchest if you are vested with the counters that have a history of higher cash calls frequency. For those who are new to rights issue or preferential offering, you could refer to my previous post - Key Dates and Figures to Note for Rights Issue and Preferential Offer which I've shared about what are the key dates to take note of and also provided a spreadsheet to calculate the fund required if you are would like to subscribe for the EFR.

Join REIT-TIREMENT Patreon for patron-exclusive posts that cover REITs valuation and more detail on fundamental analysis. You could also refer below for more information:

SREITs Dashboard - Detailed information on individual Singapore REIT

SREITs Data - Overview and Detail of Singapore REIT

REIT Analysis - List of previous REIT analysis posts

REIT-TIREMENT Telegram Channel - Join to receive updates on new post

REIT-TIREMENT Facebook Page - Support by liking my Facebook Page

REIT Investing Community - Facebook Group where members share and discuss REIT topic

*Disclaimer: Materials in this blog are based on my research and opinion which I don't guarantee accuracy, completeness, and reliability. It should not be taken as financial advice or a statement of fact. I shall not be held liable for errors, omissions and loss or damage as a result of the use of the material in this blog. Under no circumstances does the information presented on this blog represent a buy, sell, or hold recommendation on any security, please always do your own due diligence before any decision is made.

$AIMS APAC Reit (O5RU.SG)$

$ARA LOGOS Log Tr (K2LU.SG)$

$Acro HTrust USD (XZL.SG)$

$CapLand India T (CY6U.SG)$

$CapLand Ascendas REIT (A17U.SG)$

$CapLand Ascott T (HMN.SG)$

$BHG Retail Reit (BMGU.SG)$

$CapLand China T (AU8U.SG)$

$CapLand IntCom T (C38U.SG)$

$CDL HTrust (J85.SG)$

$Cromwell Reit EUR (CWBU.SG)$

$Cromwell Reit SGD (CWCU.SG)$

$Dasin Retail Tr (CEDU.SG)$

$EC World Reit (BWCU.SG)$

$EliteUKREIT GBP (MXNU.SG)$

$ESR-REIT (J91U.SG)$

$Far East HTrust (Q5T.SG)$

$First Reit (AW9U.SG)$

$Frasers Cpt Tr (J69U.SG)$

$Frasers HTrust (ACV.SG)$

$Frasers L&C Tr (BUOU.SG)$

$IREIT Global EUR (8U7U.SG)$

$IREIT Global SGD (UD1U.SG)$

$Keppel DC Reit (AJBU.SG)$

$KepPacOakReitUSD (CMOU.SG)$

$Keppel Reit (K71U.SG)$

$Lendlease Reit (JYEU.SG)$

$Lippo Malls Tr (D5IU.SG)$

$ManulifeReit USD (BTOU.SG)$

$Mapletree PanAsia Com Tr (N2IU.SG)$

$Mapletree Ind Tr (ME8U.SG)$

$Mapletree Log Tr (M44U.SG)$

$Mapletree NAC Tr (RW0U.SG)$

$OUEREIT (TS0U.SG)$

$ParkwayLife Reit (C2PU.SG)$

$PARAGONREIT (SK6U.SG)$

$StarhillGbl Reit (P40U.SG)$

$Suntec Reit (T82U.SG)$

$UtdHampshReitUSD (ODBU.SG)$

+4

23

1

# This post was published on 3 Oct 2021 on REIT-TIREMENT.

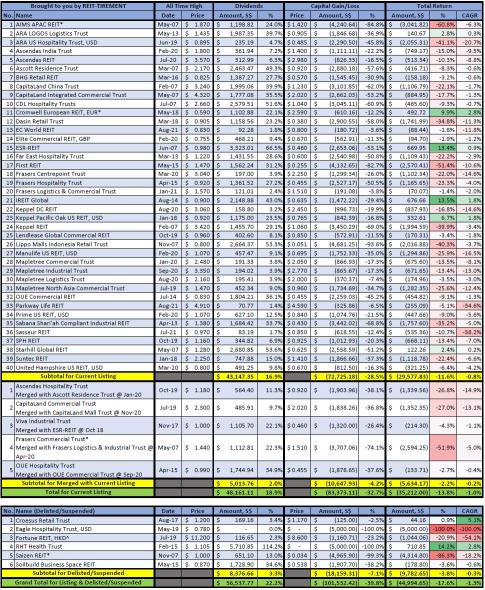

Previously I've posted How Much would You've Gained if You had Invested All Singapore REITs since Their IPOs, which compute the returns for all REITs since their IPOs. The overall return is positive for the protagonist-Ah Nuah after 19+ years of REIT investing journey. Today, I would like to view it from another angle, what happened if you bought at all-time high and hold until now?

This time, let's follow the story of another REIT investor named Gao Suay. His attitude towards investing is totally the same as Ah Nuah from the previous IPO post. Gao Suay invested S$ 5,000 to each and every REIT and BizTrust (which operates similarly to REITs) without doing any research on them. He doesn't follow any news after purchase, never participated in any preferential offer or rights issue, never sold his nil-paid rights for profit nor consideration units after any mergers.

Familiar? Yes, both of them are doing everything the same way, with one exception where Gao Suay is very suay (bad luck) that he always bought REITs at their all-time high. The first REIT he bought was CapitaRetail China Trust (now known as CapitaLand China Trust) in February 2007. Now, let's look at his performance after 14+ years of REIT investing:

Source: Combination of Stock Cafe, Tiger Broker and SGinvestors.io

* Return is adjusted for 5 to 1 units consolidation, however, all-time high price is not adjusted

^ Sold on last day of trading

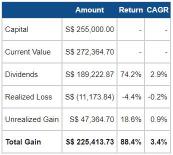

From the above table, Gao Suay has invested in 51 counters, which amount to S$ 255,000 capital. To date, he has received S$ 56,537.77 worth of dividends, equivalent to 22.2% of his capital. Due to delisted and suspended counters (which amount to S$ 30,000 of his capital), he has a realized capital loss of S$ 18,159.31. His current portfolio value is at S$ 143,531.35, with an unrealized loss of S$ 81,468.65. Below is a quick summary:

I am feeling an "Ouch" by just looking at the performance above. Let's explore which REIT provided the highest and lowest CAGR. Note that there are 4 counters where all-time high fall in 2021: EC World REIT, Frasers Logistics and Commercial Trust, Parkway Life REIT and Sasseur REIT. Thus, their CAGR might not be a good gauge as it would vary much with short terms price movement.

From the table above, there are only 8 counters with positive returns, the rest of 43 counters are having negative returns. There is only 1 from MACFK - Keppel Pacific Oak US REIT provided a positive return and 3 MACFK related REITs are within the top 10 lowest CAGR. Nonetheless, let's checkout MACFK (Mapletree, Ascendas, CapitaLand, Frasers & Keppel) performance:

*Frasers Commercial Trust is excluded as it was listed as Allco Commercial REIT initially, without Frasers involvement.

** Lippo Mall Indonesia Retail Trust is included as it was listed as Lippo-Mapletree Indonesia Retail Trust where Mapletree Capital (a wholly-owned subsidiary of Mapletree Investments Pte Ltd) owned 40% of the manager - Lippo-Mapletree Indonesia Retail Trust Management Ltd. In mid-2011, Lippo Karawaci Tbk acquired the entire 40% shareholding from Mapletree.

*** PRIME US REIT is included due to the 30% interest in REIT manager by Keppel Capital Two Pte. Ltd., a wholly-owned subsidiary of Keppel Capital Management Pte Ltd and in turn, wholly-owned by Keppel Capital Holdings Pte. Ltd. which is the asset management arm of Keppel Corporation Limited.

Even if Gao Suay only invested in MACFK related counters, his return is not much better. His capital would be S$ 95,000 and his total return would be -S$ 16,469.94. The dividends he received are S$ 16,754.45 and his unrealized loss is S$ 33,224.39. Refer below for a quick summary:

In reality, I doubt this would really happen which one keeps buying stocks at their all-time high price. Nonetheless, this "extreme" case study should be a good example to point out that, every stock has its value and the value changing with time, be it a MACFK or not. Here, I would like to quote what I have mentioned in my previous post:

"If one enters a REIT at a high price, even if its fundamental is very good, or be it MACFK related counters, it might take quite some time to have a decent return due to its compressed dividend yield. It becomes worse if the share price slides down due to lower-than-expected results, market sentiment, or more often than not, simply drops for no reason."

So, next time, when someone tells you to invest in a fundamentally strong REIT at "any" price, think again. Similarly, a REIT with a less renowned sponsor does not equate to a lower return to investors. After all, your return depends a lot on the price you paid and sold. Always do your own due diligence instead of relying on others. And yes, "others" is applicable to the material on this blog.

If you are passionate to learn more about REIT investing, you could refer to the FREE resources on the following pages on my blog:

1) Personal Finance where I've shared some basic relevant topics like what to prepare before start investing and how to come out with a simple dividend investment plan.

2) REITs Investing where I've shared my idea and experience on REITs investment. If you find pure wording is boring, then you could start with the comic strip (links at bottom of the page) that I believe you would enjoy reading.

3) REITs Analysis where I've shared my review on individual REITs, REITs comparison within the same sector as well as monthly SREITs fundamental review.

4) SREITs Dashboard where you could find the detailed information on individual REIT and REIT ETF, which is the source of my review post as well.

5) SREITs Data where you could find an overview of SREITs and REIT ETFs, including consolidated tables for SREITS metrics and average dividend yield & P/NAV

If you find my blog useful, you could support me by:

1) Join REIT-TIREMENT Telegram Channel to get latest updated post

2) Like REIT-TIREMENT Facebook Page

3) Join REIT Investing Community Facebook group and share/discuss your ideas

4) Join REIT-TIREMENT Patreon for patron-exclusive posts that cover REITs valuation and more detail on fundamental analysis. You could download SREITs Dashboard PDF and SREITs Data Excel as well, subject to membership tier.

*Disclaimer: Materials in this blog are based on my research and opinion which I don't guarantee accuracy, completeness, and reliability. It should not be taken as financial advice or a statement of fact. I shall not be held liable for errors, omissions and loss or damage as a result of the use of the material in this blog. Under no circumstances does the information presented on this blog represent a buy, sell, or hold recommendation on any security, please always do your own due diligence before any decision is made.

$AIMS APAC Reit (O5RU.SG)$

$ARA LOGOS Log Tr (K2LU.SG)$

$Acro HTrust USD (XZL.SG)$

$CapLand India T (CY6U.SG)$

$CapLand Ascendas REIT (A17U.SG)$

$CapLand Ascott T (HMN.SG)$

$BHG Retail Reit (BMGU.SG)$

$CapLand China T (AU8U.SG)$

$CapLand IntCom T (C38U.SG)$

$CDL HTrust (J85.SG)$

$Cromwell Reit EUR (CWBU.SG)$

$Cromwell Reit SGD (CWCU.SG)$

$Dasin Retail Tr (CEDU.SG)$

$EC World Reit (BWCU.SG)$

$EliteUKREIT GBP (MXNU.SG)$

$ESR-REIT (J91U.SG)$

$Far East HTrust (Q5T.SG)$

$First Reit (AW9U.SG)$

$Frasers Cpt Tr (J69U.SG)$

$Frasers HTrust (ACV.SG)$

$Frasers L&C Tr (BUOU.SG)$

$IREIT Global EUR (8U7U.SG)$

$IREIT Global SGD (UD1U.SG)$

$Keppel DC Reit (AJBU.SG)$

$KepPacOakReitUSD (CMOU.SG)$

$Keppel Reit (K71U.SG)$

$Lendlease Reit (JYEU.SG)$

$Lippo Malls Tr (D5IU.SG)$

$ManulifeReit USD (BTOU.SG)$

$Mapletree PanAsia Com Tr (N2IU.SG)$

$Mapletree Ind Tr (ME8U.SG)$

$Mapletree Log Tr (M44U.SG)$

$Mapletree NAC Tr (RW0U.SG)$

$OUEREIT (TS0U.SG)$

$ParkwayLife Reit (C2PU.SG)$

$PARAGONREIT (SK6U.SG)$

$StarhillGbl Reit (P40U.SG)$

$Suntec Reit (T82U.SG)$

$UtdHampshReitUSD (ODBU.SG)$

Previously I've posted How Much would You've Gained if You had Invested All Singapore REITs since Their IPOs, which compute the returns for all REITs since their IPOs. The overall return is positive for the protagonist-Ah Nuah after 19+ years of REIT investing journey. Today, I would like to view it from another angle, what happened if you bought at all-time high and hold until now?

This time, let's follow the story of another REIT investor named Gao Suay. His attitude towards investing is totally the same as Ah Nuah from the previous IPO post. Gao Suay invested S$ 5,000 to each and every REIT and BizTrust (which operates similarly to REITs) without doing any research on them. He doesn't follow any news after purchase, never participated in any preferential offer or rights issue, never sold his nil-paid rights for profit nor consideration units after any mergers.

Familiar? Yes, both of them are doing everything the same way, with one exception where Gao Suay is very suay (bad luck) that he always bought REITs at their all-time high. The first REIT he bought was CapitaRetail China Trust (now known as CapitaLand China Trust) in February 2007. Now, let's look at his performance after 14+ years of REIT investing:

Source: Combination of Stock Cafe, Tiger Broker and SGinvestors.io

* Return is adjusted for 5 to 1 units consolidation, however, all-time high price is not adjusted

^ Sold on last day of trading

From the above table, Gao Suay has invested in 51 counters, which amount to S$ 255,000 capital. To date, he has received S$ 56,537.77 worth of dividends, equivalent to 22.2% of his capital. Due to delisted and suspended counters (which amount to S$ 30,000 of his capital), he has a realized capital loss of S$ 18,159.31. His current portfolio value is at S$ 143,531.35, with an unrealized loss of S$ 81,468.65. Below is a quick summary:

I am feeling an "Ouch" by just looking at the performance above. Let's explore which REIT provided the highest and lowest CAGR. Note that there are 4 counters where all-time high fall in 2021: EC World REIT, Frasers Logistics and Commercial Trust, Parkway Life REIT and Sasseur REIT. Thus, their CAGR might not be a good gauge as it would vary much with short terms price movement.

From the table above, there are only 8 counters with positive returns, the rest of 43 counters are having negative returns. There is only 1 from MACFK - Keppel Pacific Oak US REIT provided a positive return and 3 MACFK related REITs are within the top 10 lowest CAGR. Nonetheless, let's checkout MACFK (Mapletree, Ascendas, CapitaLand, Frasers & Keppel) performance:

*Frasers Commercial Trust is excluded as it was listed as Allco Commercial REIT initially, without Frasers involvement.

** Lippo Mall Indonesia Retail Trust is included as it was listed as Lippo-Mapletree Indonesia Retail Trust where Mapletree Capital (a wholly-owned subsidiary of Mapletree Investments Pte Ltd) owned 40% of the manager - Lippo-Mapletree Indonesia Retail Trust Management Ltd. In mid-2011, Lippo Karawaci Tbk acquired the entire 40% shareholding from Mapletree.

*** PRIME US REIT is included due to the 30% interest in REIT manager by Keppel Capital Two Pte. Ltd., a wholly-owned subsidiary of Keppel Capital Management Pte Ltd and in turn, wholly-owned by Keppel Capital Holdings Pte. Ltd. which is the asset management arm of Keppel Corporation Limited.

Even if Gao Suay only invested in MACFK related counters, his return is not much better. His capital would be S$ 95,000 and his total return would be -S$ 16,469.94. The dividends he received are S$ 16,754.45 and his unrealized loss is S$ 33,224.39. Refer below for a quick summary:

In reality, I doubt this would really happen which one keeps buying stocks at their all-time high price. Nonetheless, this "extreme" case study should be a good example to point out that, every stock has its value and the value changing with time, be it a MACFK or not. Here, I would like to quote what I have mentioned in my previous post:

"If one enters a REIT at a high price, even if its fundamental is very good, or be it MACFK related counters, it might take quite some time to have a decent return due to its compressed dividend yield. It becomes worse if the share price slides down due to lower-than-expected results, market sentiment, or more often than not, simply drops for no reason."

So, next time, when someone tells you to invest in a fundamentally strong REIT at "any" price, think again. Similarly, a REIT with a less renowned sponsor does not equate to a lower return to investors. After all, your return depends a lot on the price you paid and sold. Always do your own due diligence instead of relying on others. And yes, "others" is applicable to the material on this blog.

If you are passionate to learn more about REIT investing, you could refer to the FREE resources on the following pages on my blog:

1) Personal Finance where I've shared some basic relevant topics like what to prepare before start investing and how to come out with a simple dividend investment plan.

2) REITs Investing where I've shared my idea and experience on REITs investment. If you find pure wording is boring, then you could start with the comic strip (links at bottom of the page) that I believe you would enjoy reading.

3) REITs Analysis where I've shared my review on individual REITs, REITs comparison within the same sector as well as monthly SREITs fundamental review.

4) SREITs Dashboard where you could find the detailed information on individual REIT and REIT ETF, which is the source of my review post as well.

5) SREITs Data where you could find an overview of SREITs and REIT ETFs, including consolidated tables for SREITS metrics and average dividend yield & P/NAV

If you find my blog useful, you could support me by:

1) Join REIT-TIREMENT Telegram Channel to get latest updated post

2) Like REIT-TIREMENT Facebook Page

3) Join REIT Investing Community Facebook group and share/discuss your ideas

4) Join REIT-TIREMENT Patreon for patron-exclusive posts that cover REITs valuation and more detail on fundamental analysis. You could download SREITs Dashboard PDF and SREITs Data Excel as well, subject to membership tier.

*Disclaimer: Materials in this blog are based on my research and opinion which I don't guarantee accuracy, completeness, and reliability. It should not be taken as financial advice or a statement of fact. I shall not be held liable for errors, omissions and loss or damage as a result of the use of the material in this blog. Under no circumstances does the information presented on this blog represent a buy, sell, or hold recommendation on any security, please always do your own due diligence before any decision is made.

$AIMS APAC Reit (O5RU.SG)$

$ARA LOGOS Log Tr (K2LU.SG)$

$Acro HTrust USD (XZL.SG)$

$CapLand India T (CY6U.SG)$

$CapLand Ascendas REIT (A17U.SG)$

$CapLand Ascott T (HMN.SG)$

$BHG Retail Reit (BMGU.SG)$

$CapLand China T (AU8U.SG)$

$CapLand IntCom T (C38U.SG)$

$CDL HTrust (J85.SG)$

$Cromwell Reit EUR (CWBU.SG)$

$Cromwell Reit SGD (CWCU.SG)$

$Dasin Retail Tr (CEDU.SG)$

$EC World Reit (BWCU.SG)$

$EliteUKREIT GBP (MXNU.SG)$

$ESR-REIT (J91U.SG)$

$Far East HTrust (Q5T.SG)$

$First Reit (AW9U.SG)$

$Frasers Cpt Tr (J69U.SG)$

$Frasers HTrust (ACV.SG)$

$Frasers L&C Tr (BUOU.SG)$

$IREIT Global EUR (8U7U.SG)$

$IREIT Global SGD (UD1U.SG)$

$Keppel DC Reit (AJBU.SG)$

$KepPacOakReitUSD (CMOU.SG)$

$Keppel Reit (K71U.SG)$

$Lendlease Reit (JYEU.SG)$

$Lippo Malls Tr (D5IU.SG)$

$ManulifeReit USD (BTOU.SG)$

$Mapletree PanAsia Com Tr (N2IU.SG)$

$Mapletree Ind Tr (ME8U.SG)$

$Mapletree Log Tr (M44U.SG)$

$Mapletree NAC Tr (RW0U.SG)$

$OUEREIT (TS0U.SG)$

$ParkwayLife Reit (C2PU.SG)$

$PARAGONREIT (SK6U.SG)$

$StarhillGbl Reit (P40U.SG)$

$Suntec Reit (T82U.SG)$

$UtdHampshReitUSD (ODBU.SG)$

+4

46

4

2

# This post was published on 19 Sep 2021 on REIT-TIREMENT.

Once, a friend of mine told me: "It is not worth investing in REIT because the dividend you get will only be used to cover your loss of share price, end up you wouldn't earn much in long run." His belief is in Malaysia's residential properties where his property doubles in value within 5 years, during the property boom time. Well, in today's post, let's look at whether the above statement of my friend is true.

Let's go through a quick history for SREITs: the first REIT listed is CapitaMall Trust was listed 19 years ago in July 2002 on Singapore Exchange. Subsequently, Ascendas REIT was listed in November 2002, followed by Fortune REIT listed in August 2003. Throughout these years, there are 5 mergers between REITs and 6 REITs/BizTrusts delisted or suspended. Fast forwarded to today, there are 38 REITs and 2 BizTrusts which operate similar to REITs.

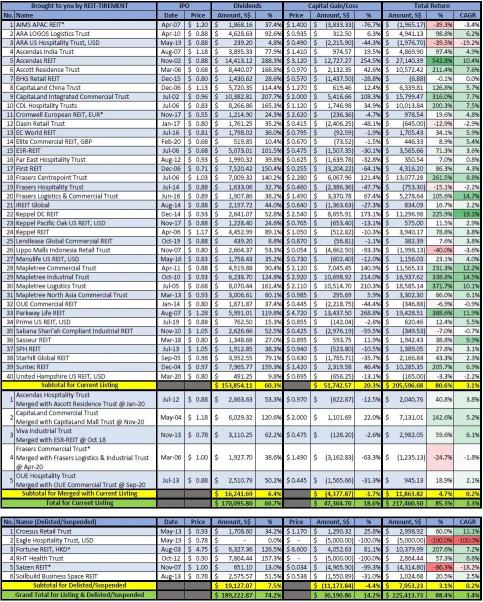

Let's say there is a REIT investor named Ah Nuah who subscribes S$ 5,000 to each and every IPO of REITs and BizTrust (which operates similar to REITs) without doing any research on them. He is lucky enough to get his full allotment every time. Like his name, he is a lazy person who doesn't follow any news after IPO, therefore, he never participated in any preferential offer or rights issue. Also, he never sold his nil-paid rights for profit nor consideration units after any mergers. All he cares about is the dividends coming to his bank account. Let's look at how Ah Nuah's portfolio performance after all these years:

* Return is adjusted for 5 to 1 units consolidation, however, IPO price is not adjusted

^ Sold at last day of trading

From the above, Ah Nuah has invested in 51 counters, which amount to S$ 255,000 capital. To date, he has received S$ 189,222.87 worth of dividends, equivalent to 74.2% of his capital. Due to delisted and suspended counters(which amount to S$ 30,000 of his capital), he has a realized capital loss of S$ 11,173.84. His current portfolio value is at S$ 272,364.70, with an unrealized gain of S$ 47,364.70. Below is a quick summary:

The portfolio CAGR is based on the period from 17 July 2002 when Ah Nuah gets his first REIT - CapitaMall Trust until today @ 19 Sep 2021. It is just an approximate gauge as Ah Nuah injected capital and received dividends throughout different periods.

Next, let's take a look at Ah Nuah's portfolio in terms of CAGR ranking (from the listing date until 19 Sep 2021) for individual counters:

From the above table, you can see KDC gives the highest CAGR to Ah Nuah, followed by FLCT and MIT. However, Ah Nuah has lost 100% of the fund in EHT, followed by CAGR of -19.2% from ARAHT and CAGR of -18.2% from Saizen. Coinincidencely, the top 3 best CAGR is from the industrial sector and the top 3 worst CAGR is from the hospitality sector.

How about we look at the number of counters according to individual CAGR range:

There are 12 counters having negative returns where 2 are delisted/suspended. In another word, the are still chances for the remaining 10 to turn around to a positive return in the future. There are 24 counters that provided more than 5% CAGR to Ah Nuah. If 5% CAGR isn't impressive, there are 8 counters provided CAGR 10% and above. Considering 12 counters with negative returns and 5 counters with less than 2.5% CAGR, my friend is not "entirely" wrong on his theory, as 1/3 (17 over 51 counters) are having less than 2.5% CAGR.

To MACFK (Mapletree, Ascendas, CapitaLand, Frasers & Keppel) lovers, below is the summary to satisfy your curiosity:

*Frasers Commercial Trust is excluded as it was listed as Allco Commercial REIT initially, without Frasers involvement.

** Lippo Mall Indonesia Retail Trust is included as it was listed as Lippo-Mapletree Indonesia Retail Trust where Mapletree Capital (a wholly-owned subsidiary of Mapletree Investments Pte Ltd) owned 40% of the manager - Lippo-Mapletree Indonesia Retail Trust Management Ltd. In mid-2011, Lippo Karawaci Tbk acquired the entire 40% shareholding from Mapletree.

*** PRIME US REIT is included due to the 30% interest in REIT manager by Keppel Capital Two Pte. Ltd., a wholly-owned subsidiary of Keppel Capital Management Pte Ltd and in turn, wholly-owned by Keppel Capital Holdings Pte. Ltd. which is the asset management arm of Keppel Corporation Limited.

If Ah Nuah solely invested in MACFK related counters, his capital would be S$ 95,000 and his total return would be a whopping 164.5% with a CAGR of 5.2%. Just the dividends alone, his return is already at 100.7%, slightly more than his capital. Coupled with a 63.8% unrealized gain, his total return is 86% more as compared to simply buying all the SREITs/Biztrusts.

Obviously, same as stock investing, REIT investing requires research as well to achieve a better return. Now, how can Ah Nuah further increase his return? First, he would have to start following REITs updates. Of course, he can still choose not to subscribe to any preferential offers and rights issues. However, he should sell his nil-paid rights for gain provided it is enough to cover his commission. Besides, Ah Nuah could also:

1) Learn about fundamental analysis

2) Have a systematic way to value REITs

3) Learn about technical analysis

4) Take profit when the share price is higher than the intrinsic value (at target %)

5) Cut loss when fundamental shift causing intrinsic value drops below the share price

If one enters a REIT at a high price, even if its fundamental is very good, or be it MACFK related counters, it might take quite some time to have a decent return due to its compressed dividend yield. It becomes worse if the share price slides down due to lower-than-expected results, market sentiment, or more often than not, simply drops for no reason. Maybe later I could work on the gain/loss if one bought at all-time high prices.

As a side note, it seems SREITs like to list with the number of 8; there are 32 counters listed with the number 8 in their IPO price in which 11 counters listed with 88 cents, 6 counters listed with 80 cents, 4 counters listed with 68 cents and 3 counters listed with 78 cents. There are also 5 counters listed with 93 cents, I could understand the reason for 8 as it is pronounced similar to wealth, but 93? Hmm, I do not get this. There are also 4 SREITs that exercised unit consolidation in which all are having the same ratio of 5 to 1.

Do note that past performance is no guarantee of future results. If you are passionate to learn more about REIT investing, you could refer to the FREE resources on the following pages on my blog:

1) Personal Finance where I've shared some basic relevant topics like what to prepare before start investing and how to come out with a simple dividend investment plan.

2) REITs Investing where I've shared my idea and experience on REITs investment. If you find pure wording is boring, then you could start with the comic strip (links at bottom of the page) that I believe you would enjoy reading.

3) REITs Analysis where I've shared my review on individual REITs, REITs comparison within the same sector as well as monthly SREITs fundamental review.

4) SREITs Dashboard where you could find the detailed information on individual REIT and REIT ETF, which is the source of my review post as well.

5) SREITs Data where you could find an overview of SREITs and REIT ETFs, including consolidated tables for SREITS metrics and average dividend yield & P/NAV

If you find my blog useful, you could support me by:

1) Join REIT-TIREMENT Telegram Channel to get latest updated post

2) Like REIT-TIREMENT Facebook Page

3) Join REIT Investing Community Facebook group and share/discuss your ideas

4) Join REIT-TIREMENT Patreon for patron-exclusive posts that cover REITs valuation and more detail on fundamental analysis. You could download SREITs Dashboard PDF and SREITs Data Excel as well, subject to membership tier.

*Disclaimer: Materials in this blog are based on my research and opinion which I don't guarantee accuracy, completeness, and reliability. It should not be taken as financial advice or a statement of fact. I shall not be held liable for errors, omissions and loss or damage as a result of the use of the material in this blog. Under no circumstances does the information presented on this blog represent a buy, sell, or hold recommendation on any security, please always do your own due diligence before any decision is made.

$AIMS APAC Reit (O5RU.SG)$

$ARA LOGOS Log Tr (K2LU.SG)$

$Acro HTrust USD (XZL.SG)$

$CapLand India T (CY6U.SG)$

$CapLand Ascendas REIT (A17U.SG)$

$CapLand Ascott T (HMN.SG)$

$BHG Retail Reit (BMGU.SG)$

$CapLand China T (AU8U.SG)$

$CapLand IntCom T (C38U.SG)$

$CDL HTrust (J85.SG)$

$Cromwell Reit EUR (CWBU.SG)$

$Cromwell Reit SGD (CWCU.SG)$

$Dasin Retail Tr (CEDU.SG)$

$EC World Reit (BWCU.SG)$

$EliteUKREIT GBP (MXNU.SG)$

$ESR-REIT (J91U.SG)$

$Far East HTrust (Q5T.SG)$

$First Reit (AW9U.SG)$

$Frasers Cpt Tr (J69U.SG)$

$Frasers HTrust (ACV.SG)$

$Frasers L&C Tr (BUOU.SG)$

$IREIT Global EUR (8U7U.SG)$

$IREIT Global SGD (UD1U.SG)$

$Keppel DC Reit (AJBU.SG)$

$KepPacOakReitUSD (CMOU.SG)$

$Keppel Reit (K71U.SG)$

$Lendlease Reit (JYEU.SG)$

$Lippo Malls Tr (D5IU.SG)$

$ManulifeReit USD (BTOU.SG)$

$Mapletree PanAsia Com Tr (N2IU.SG)$

$Mapletree Ind Tr (ME8U.SG)$

$Mapletree Log Tr (M44U.SG)$

$Mapletree NAC Tr (RW0U.SG)$

$OUEREIT (TS0U.SG)$

$ParkwayLife Reit (C2PU.SG)$

$PARAGONREIT (SK6U.SG)$

$StarhillGbl Reit (P40U.SG)$

$Suntec Reit (T82U.SG)$

$UtdHampshReitUSD (ODBU.SG)$

Once, a friend of mine told me: "It is not worth investing in REIT because the dividend you get will only be used to cover your loss of share price, end up you wouldn't earn much in long run." His belief is in Malaysia's residential properties where his property doubles in value within 5 years, during the property boom time. Well, in today's post, let's look at whether the above statement of my friend is true.

Let's go through a quick history for SREITs: the first REIT listed is CapitaMall Trust was listed 19 years ago in July 2002 on Singapore Exchange. Subsequently, Ascendas REIT was listed in November 2002, followed by Fortune REIT listed in August 2003. Throughout these years, there are 5 mergers between REITs and 6 REITs/BizTrusts delisted or suspended. Fast forwarded to today, there are 38 REITs and 2 BizTrusts which operate similar to REITs.

Let's say there is a REIT investor named Ah Nuah who subscribes S$ 5,000 to each and every IPO of REITs and BizTrust (which operates similar to REITs) without doing any research on them. He is lucky enough to get his full allotment every time. Like his name, he is a lazy person who doesn't follow any news after IPO, therefore, he never participated in any preferential offer or rights issue. Also, he never sold his nil-paid rights for profit nor consideration units after any mergers. All he cares about is the dividends coming to his bank account. Let's look at how Ah Nuah's portfolio performance after all these years:

* Return is adjusted for 5 to 1 units consolidation, however, IPO price is not adjusted

^ Sold at last day of trading

From the above, Ah Nuah has invested in 51 counters, which amount to S$ 255,000 capital. To date, he has received S$ 189,222.87 worth of dividends, equivalent to 74.2% of his capital. Due to delisted and suspended counters(which amount to S$ 30,000 of his capital), he has a realized capital loss of S$ 11,173.84. His current portfolio value is at S$ 272,364.70, with an unrealized gain of S$ 47,364.70. Below is a quick summary:

The portfolio CAGR is based on the period from 17 July 2002 when Ah Nuah gets his first REIT - CapitaMall Trust until today @ 19 Sep 2021. It is just an approximate gauge as Ah Nuah injected capital and received dividends throughout different periods.

Next, let's take a look at Ah Nuah's portfolio in terms of CAGR ranking (from the listing date until 19 Sep 2021) for individual counters:

From the above table, you can see KDC gives the highest CAGR to Ah Nuah, followed by FLCT and MIT. However, Ah Nuah has lost 100% of the fund in EHT, followed by CAGR of -19.2% from ARAHT and CAGR of -18.2% from Saizen. Coinincidencely, the top 3 best CAGR is from the industrial sector and the top 3 worst CAGR is from the hospitality sector.

How about we look at the number of counters according to individual CAGR range:

There are 12 counters having negative returns where 2 are delisted/suspended. In another word, the are still chances for the remaining 10 to turn around to a positive return in the future. There are 24 counters that provided more than 5% CAGR to Ah Nuah. If 5% CAGR isn't impressive, there are 8 counters provided CAGR 10% and above. Considering 12 counters with negative returns and 5 counters with less than 2.5% CAGR, my friend is not "entirely" wrong on his theory, as 1/3 (17 over 51 counters) are having less than 2.5% CAGR.

To MACFK (Mapletree, Ascendas, CapitaLand, Frasers & Keppel) lovers, below is the summary to satisfy your curiosity:

*Frasers Commercial Trust is excluded as it was listed as Allco Commercial REIT initially, without Frasers involvement.

** Lippo Mall Indonesia Retail Trust is included as it was listed as Lippo-Mapletree Indonesia Retail Trust where Mapletree Capital (a wholly-owned subsidiary of Mapletree Investments Pte Ltd) owned 40% of the manager - Lippo-Mapletree Indonesia Retail Trust Management Ltd. In mid-2011, Lippo Karawaci Tbk acquired the entire 40% shareholding from Mapletree.

*** PRIME US REIT is included due to the 30% interest in REIT manager by Keppel Capital Two Pte. Ltd., a wholly-owned subsidiary of Keppel Capital Management Pte Ltd and in turn, wholly-owned by Keppel Capital Holdings Pte. Ltd. which is the asset management arm of Keppel Corporation Limited.

If Ah Nuah solely invested in MACFK related counters, his capital would be S$ 95,000 and his total return would be a whopping 164.5% with a CAGR of 5.2%. Just the dividends alone, his return is already at 100.7%, slightly more than his capital. Coupled with a 63.8% unrealized gain, his total return is 86% more as compared to simply buying all the SREITs/Biztrusts.

Obviously, same as stock investing, REIT investing requires research as well to achieve a better return. Now, how can Ah Nuah further increase his return? First, he would have to start following REITs updates. Of course, he can still choose not to subscribe to any preferential offers and rights issues. However, he should sell his nil-paid rights for gain provided it is enough to cover his commission. Besides, Ah Nuah could also:

1) Learn about fundamental analysis

2) Have a systematic way to value REITs

3) Learn about technical analysis

4) Take profit when the share price is higher than the intrinsic value (at target %)

5) Cut loss when fundamental shift causing intrinsic value drops below the share price

If one enters a REIT at a high price, even if its fundamental is very good, or be it MACFK related counters, it might take quite some time to have a decent return due to its compressed dividend yield. It becomes worse if the share price slides down due to lower-than-expected results, market sentiment, or more often than not, simply drops for no reason. Maybe later I could work on the gain/loss if one bought at all-time high prices.

As a side note, it seems SREITs like to list with the number of 8; there are 32 counters listed with the number 8 in their IPO price in which 11 counters listed with 88 cents, 6 counters listed with 80 cents, 4 counters listed with 68 cents and 3 counters listed with 78 cents. There are also 5 counters listed with 93 cents, I could understand the reason for 8 as it is pronounced similar to wealth, but 93? Hmm, I do not get this. There are also 4 SREITs that exercised unit consolidation in which all are having the same ratio of 5 to 1.

Do note that past performance is no guarantee of future results. If you are passionate to learn more about REIT investing, you could refer to the FREE resources on the following pages on my blog:

1) Personal Finance where I've shared some basic relevant topics like what to prepare before start investing and how to come out with a simple dividend investment plan.

2) REITs Investing where I've shared my idea and experience on REITs investment. If you find pure wording is boring, then you could start with the comic strip (links at bottom of the page) that I believe you would enjoy reading.

3) REITs Analysis where I've shared my review on individual REITs, REITs comparison within the same sector as well as monthly SREITs fundamental review.

4) SREITs Dashboard where you could find the detailed information on individual REIT and REIT ETF, which is the source of my review post as well.

5) SREITs Data where you could find an overview of SREITs and REIT ETFs, including consolidated tables for SREITS metrics and average dividend yield & P/NAV

If you find my blog useful, you could support me by:

1) Join REIT-TIREMENT Telegram Channel to get latest updated post

2) Like REIT-TIREMENT Facebook Page

3) Join REIT Investing Community Facebook group and share/discuss your ideas

4) Join REIT-TIREMENT Patreon for patron-exclusive posts that cover REITs valuation and more detail on fundamental analysis. You could download SREITs Dashboard PDF and SREITs Data Excel as well, subject to membership tier.

*Disclaimer: Materials in this blog are based on my research and opinion which I don't guarantee accuracy, completeness, and reliability. It should not be taken as financial advice or a statement of fact. I shall not be held liable for errors, omissions and loss or damage as a result of the use of the material in this blog. Under no circumstances does the information presented on this blog represent a buy, sell, or hold recommendation on any security, please always do your own due diligence before any decision is made.

$AIMS APAC Reit (O5RU.SG)$

$ARA LOGOS Log Tr (K2LU.SG)$

$Acro HTrust USD (XZL.SG)$

$CapLand India T (CY6U.SG)$

$CapLand Ascendas REIT (A17U.SG)$

$CapLand Ascott T (HMN.SG)$

$BHG Retail Reit (BMGU.SG)$

$CapLand China T (AU8U.SG)$

$CapLand IntCom T (C38U.SG)$

$CDL HTrust (J85.SG)$

$Cromwell Reit EUR (CWBU.SG)$

$Cromwell Reit SGD (CWCU.SG)$

$Dasin Retail Tr (CEDU.SG)$

$EC World Reit (BWCU.SG)$

$EliteUKREIT GBP (MXNU.SG)$

$ESR-REIT (J91U.SG)$

$Far East HTrust (Q5T.SG)$

$First Reit (AW9U.SG)$

$Frasers Cpt Tr (J69U.SG)$

$Frasers HTrust (ACV.SG)$

$Frasers L&C Tr (BUOU.SG)$

$IREIT Global EUR (8U7U.SG)$

$IREIT Global SGD (UD1U.SG)$

$Keppel DC Reit (AJBU.SG)$

$KepPacOakReitUSD (CMOU.SG)$

$Keppel Reit (K71U.SG)$

$Lendlease Reit (JYEU.SG)$

$Lippo Malls Tr (D5IU.SG)$

$ManulifeReit USD (BTOU.SG)$

$Mapletree PanAsia Com Tr (N2IU.SG)$

$Mapletree Ind Tr (ME8U.SG)$

$Mapletree Log Tr (M44U.SG)$

$Mapletree NAC Tr (RW0U.SG)$

$OUEREIT (TS0U.SG)$

$ParkwayLife Reit (C2PU.SG)$

$PARAGONREIT (SK6U.SG)$

$StarhillGbl Reit (P40U.SG)$

$Suntec Reit (T82U.SG)$

$UtdHampshReitUSD (ODBU.SG)$

+4

47

3

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)