RM10 ZhapFan

commented on and voted

Morning, mooers! ![]()

This week, $MAYBANK (1155.MY)$ (11/26) and $PBBANK (1295.MY)$ (11/27) are said to report their quarterly earnings. After the recent pullback, investors are focusing on the performance of these two local banking giants. Who will be the winner of earnings week? Make your choice and grab some point rewards!![]()

Rewards

● An equal share of 5,000 points: For mooers who correctly guessed the winner who makes the biggest % gains in...

This week, $MAYBANK (1155.MY)$ (11/26) and $PBBANK (1295.MY)$ (11/27) are said to report their quarterly earnings. After the recent pullback, investors are focusing on the performance of these two local banking giants. Who will be the winner of earnings week? Make your choice and grab some point rewards!

Rewards

● An equal share of 5,000 points: For mooers who correctly guessed the winner who makes the biggest % gains in...

74

67

22

RM10 ZhapFan

liked and commented on

$GameStop (GME.US)$ No idea what this does since this is not in my country , but it looks promising 💎💎💎

3

3

RM10 ZhapFan

voted

Hi, mooers!

Ever wonder how to make your idle money work smarter? Are you looking for ways to boost your idle funds while keeping them readily available?![]()

You might want to get familiar with Cash Plus!![]()

Here's a snapshot of what Cash Plus offers:

1. Daily returns: Enjoy returns of up to 3.5% p.a.*, even on non-trading days.

2. Ultra-low threshold: Dive in with as little as RM0.01 without any cap.

3. Flexible redemption: Cash out for stoc...

Ever wonder how to make your idle money work smarter? Are you looking for ways to boost your idle funds while keeping them readily available?

You might want to get familiar with Cash Plus!

Here's a snapshot of what Cash Plus offers:

1. Daily returns: Enjoy returns of up to 3.5% p.a.*, even on non-trading days.

2. Ultra-low threshold: Dive in with as little as RM0.01 without any cap.

3. Flexible redemption: Cash out for stoc...

226

371

19

RM10 ZhapFan

voted

Hi, mooers!

Join the Q2 Earnings Challenge and share 30,000 points! Tap to learn more!

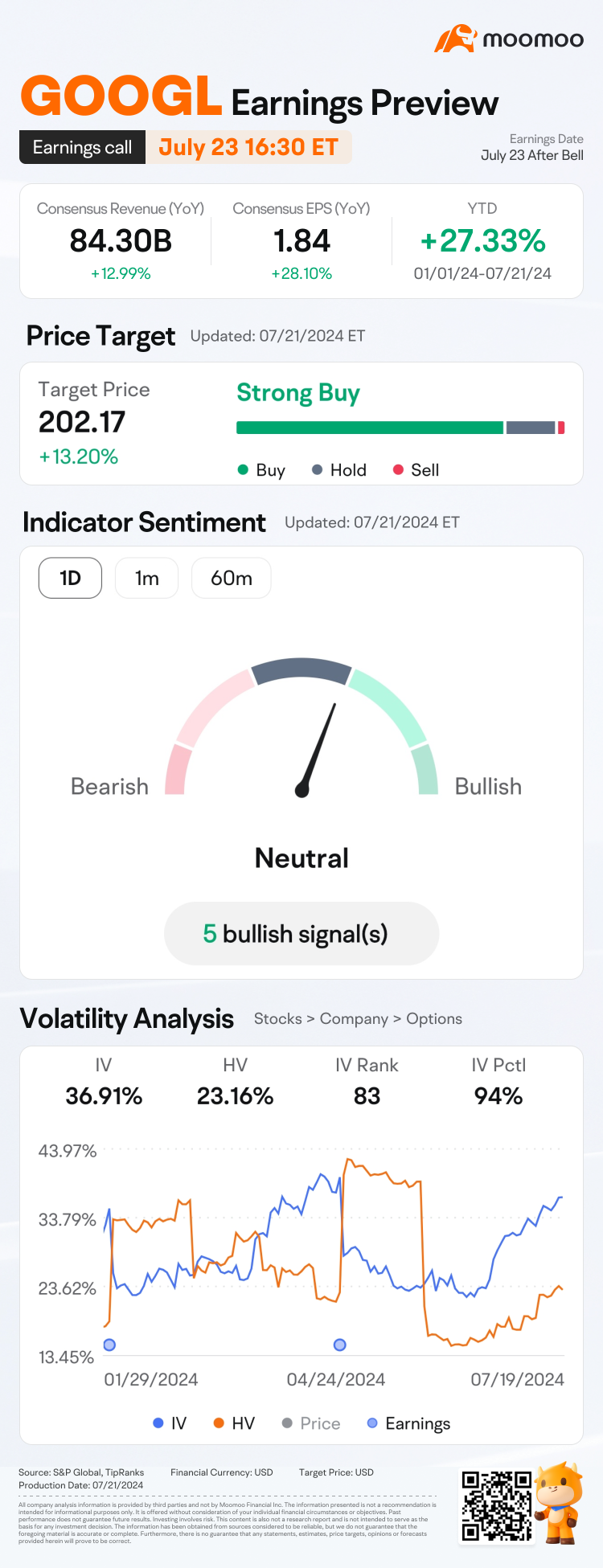

$Alphabet-A (GOOGL.US)$ is releasing its Q2 earnings on July 23 after the bell. Unlock insights with GOOGL Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q1 earnings release, shares of $Alphabet-A (GOOGL.US)$ have seen an increase of 11.77%.![]() How will the market react to the upcoming resul...

How will the market react to the upcoming resul...

Join the Q2 Earnings Challenge and share 30,000 points! Tap to learn more!

$Alphabet-A (GOOGL.US)$ is releasing its Q2 earnings on July 23 after the bell. Unlock insights with GOOGL Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q1 earnings release, shares of $Alphabet-A (GOOGL.US)$ have seen an increase of 11.77%.

Expand

Expand 79

153

17

RM10 ZhapFan

Set a live reminder

[Synopsis]

With the global market transitions since the start of 2024, how can an active investor possibly capture these pivotal turns and evolutions for their investment strategy? With the final live webinar for our mid-year funds series, learn how investors like yourselves can potentially leverage on Income strategies to navigate the changes on a global scale with our experts from PIMCO and Moomoo Singapore. Join us and you may be rewarded with qu...

With the global market transitions since the start of 2024, how can an active investor possibly capture these pivotal turns and evolutions for their investment strategy? With the final live webinar for our mid-year funds series, learn how investors like yourselves can potentially leverage on Income strategies to navigate the changes on a global scale with our experts from PIMCO and Moomoo Singapore. Join us and you may be rewarded with qu...

A Pivotal Year: Strategies for Capturing Income

Jun 28 17:00

24

3

RM10 ZhapFan

Set a live reminder

[Synopsis]

Mid-2024 - where are we for Asia's Fixed Income space? What is the outlook and how can investors utilise the potential window of opportunities in the current global market context? We delve deeper into possible strategies you may leverage on for Fixed Income, so join us to find out more on the analysis as we transition into the second half of the year with our experts from UOB Asset Management. Come learn with us and stand a chance to win some...

Mid-2024 - where are we for Asia's Fixed Income space? What is the outlook and how can investors utilise the potential window of opportunities in the current global market context? We delve deeper into possible strategies you may leverage on for Fixed Income, so join us to find out more on the analysis as we transition into the second half of the year with our experts from UOB Asset Management. Come learn with us and stand a chance to win some...

Asia Fixed Income: A Window of Opportunity

Jun 28 15:00

7

2

RM10 ZhapFan

Set a live reminder

[Synopsis]

With the US interest rate cycle transitions since the start of 2024 - where are we now given there is no rate cutes in 2024 by the Fed? How can investors potentially benefit and what can we expect from the US market going into the second half of the year? Find out more in the latest live webinar with our expert from CSOP Asset Management. Join us and you might be rewarded with some giveaways and quiz questions.@olivehiggo

[Speake...

With the US interest rate cycle transitions since the start of 2024 - where are we now given there is no rate cutes in 2024 by the Fed? How can investors potentially benefit and what can we expect from the US market going into the second half of the year? Find out more in the latest live webinar with our expert from CSOP Asset Management. Join us and you might be rewarded with some giveaways and quiz questions.@olivehiggo

[Speake...

US Interest rate cycle overview by CSOP Asset Management

Jun 27 17:00

8

2

RM10 ZhapFan

Set a live reminder

[Synopsis]

As we head into the mid-year, what is the assessment of the current economy and will interest rates take a turn? With a year of global elections, US rate changes, continued geopolitical risks, and potential stablization of the Chinese market - learn the analysis as we hit the emergence of a new season with our expert from Fullerton Fund Management. Tune in as well for potential quiz giveaways and stand a chance to be rewarded f...

As we head into the mid-year, what is the assessment of the current economy and will interest rates take a turn? With a year of global elections, US rate changes, continued geopolitical risks, and potential stablization of the Chinese market - learn the analysis as we hit the emergence of a new season with our expert from Fullerton Fund Management. Tune in as well for potential quiz giveaways and stand a chance to be rewarded f...

Emergence of a new season, in current interest rates cycle

Jun 27 15:00

7

1

1

RM10 ZhapFan

Set a live reminder

[Synopsis]

Kickstarting our live webinar fund series for 2024, we check-in with technology stocks and beyond - covering insights into the global market outlook, potential "controlled stabilisation" of the China market and potential strategies to employ beyond the Technology rally. Tune in and stand a chance to be rewarded for being with us on the show as we learn the analysis from our experts at Fidelity International. Olivia Higgins will guide you toward...

Kickstarting our live webinar fund series for 2024, we check-in with technology stocks and beyond - covering insights into the global market outlook, potential "controlled stabilisation" of the China market and potential strategies to employ beyond the Technology rally. Tune in and stand a chance to be rewarded for being with us on the show as we learn the analysis from our experts at Fidelity International. Olivia Higgins will guide you toward...

Beyond the Technology rally, what's next?

Jun 27 11:00

9

2

$ECA (0267.MY)$

noticed a lot new names (institutions / funds ) coming in , with acquisition of new land and upcoming qr, collecting tickets and wait

noticed a lot new names (institutions / funds ) coming in , with acquisition of new land and upcoming qr, collecting tickets and wait

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

RM10 ZhapFan : Ofc maybank will be winning PBB been sleeping this whole time