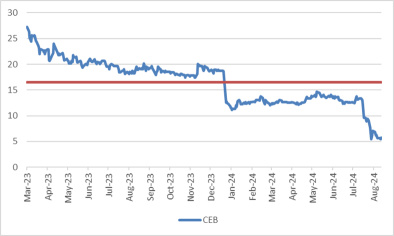

$CEB (5311.MY)$ finds itself at an inflection point, balancing growth initiatives with significant short-term challenges.

Revenue grew 17.2% for the first nine months of 2024, driven by the acquisition of iConn Inc. and increased contributions from the Americas and Asia.

Yet, profitability has suffered, with a Q3 loss before tax of RM22.4 million compared to a profit of RM15.2 million in the same period last year.

What Went Wrong?

1. Margi...

Revenue grew 17.2% for the first nine months of 2024, driven by the acquisition of iConn Inc. and increased contributions from the Americas and Asia.

Yet, profitability has suffered, with a Q3 loss before tax of RM22.4 million compared to a profit of RM15.2 million in the same period last year.

What Went Wrong?

1. Margi...

2

$DESTINI (7212.MY)$ shows signs of a potential rebound, with recent buy signals and consolidation above support at 0.315. The price is testing resistance at 0.345, and while volume is moderate, a breakthrough here could open the path to the 0.40–0.45 range, aligning with previous resistance. It’s a cautiously optimistic setup for those looking to enter before stronger momentum builds.

NFA, this is all based on price action. DYOR.

NFA, this is all based on price action. DYOR.

4

Success, like in all things, belongs not to the timid, but to those willing to face potential losses in pursuit of greater gains. It’s the essence of prudent risk-taking,accepting the unpredictable, preparing for the worst, but positioning for the best. $IonQ Inc (IONQ.US)$

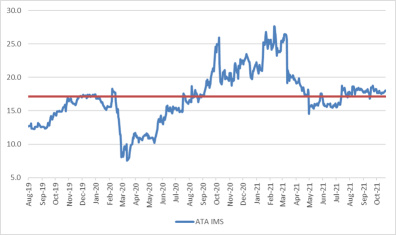

Waiting for $CEB (5311.MY)$ to do the same.

Waiting for $CEB (5311.MY)$ to do the same.

8

In markets, periods of consolidation are like a waiting room, where neither buyers nor sellers hold the upper hand. The longer this period persists, the more anticipation builds. Consolidation reflects indecision, but it’s also where pressure accumulates. Much like compressing a spring, the potential energy grows with time. When the breakout eventually occurs, whether upward or downward, it often leads to an outsized move.

Historically, we’ve seen this pattern repeat. T...

Historically, we’ve seen this pattern repeat. T...

4

1

1

In reviewing the recent earnings report, it’s clear that the results fell short of expectations. The topline came in 18% below consensus estimates, and the bottom line missed by 15%. This shortfall can be attributed to a combination of higher administrative, distribution, and other expenses, alongside an elevated tax rate.

As a result, we must reconcile ourselves to a lower earnings trajectory, with the annualized earnings for FY24 projected to be around RM60 million.

With t...

As a result, we must reconcile ourselves to a lower earnings trajectory, with the annualized earnings for FY24 projected to be around RM60 million.

With t...

14

3

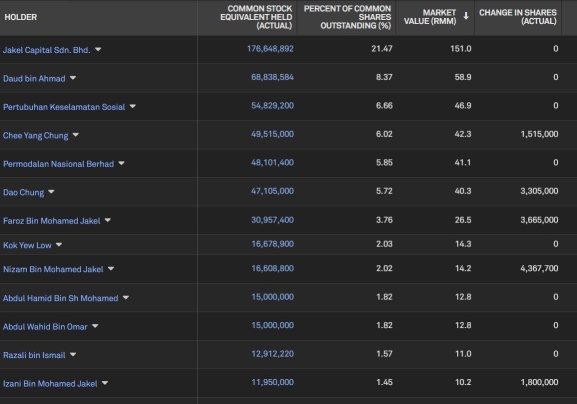

In the world of investing, rare opportunities often present themselves in the wake of unfortunate events. Such is the case with the recent margin call faced by a founder, which has opened a window for savvy investors.

It’s not uncommon for founders to pledge shares as collateral; it’s one of the most tax-efficient ways to unlock the value of their holdings while retaining control over the company. However, leverage is a double-edged sword, and in this instance, it worked ag...

It’s not uncommon for founders to pledge shares as collateral; it’s one of the most tax-efficient ways to unlock the value of their holdings while retaining control over the company. However, leverage is a double-edged sword, and in this instance, it worked ag...

16

2

When the biggest shareholder family starts buying up shares of the company, it's not just a casual investment – it's a signal, a harbinger of potential value creation. These folks have skin in the game, and their actions speak louder than any quarterly earnings report.

They see something we might not fully appreciate yet – a turnaround coming. It’s the kind of opportunity where the upside potential far outweighs the downside risk. This isn't mere speculation; it's a...

They see something we might not fully appreciate yet – a turnaround coming. It’s the kind of opportunity where the upside potential far outweighs the downside risk. This isn't mere speculation; it's a...

11

4

2

Policy Consistency: No surprises here, BNM's tone and stance are as steady as ever, supporting the economy and balancing inflation and growth. 🧘♂️📉📈

Diesel Price Hike? No Biggie! Despite a whopping 55.8% rise in diesel prices, BNM keeps its cool with inflation forecasts unchanged. They've got it all figured out.🤣 🛢️⬆️➡️😌

Growth Optimism: Export-led recovery on the horizon, thanks to Malaysia's strong positi...

Diesel Price Hike? No Biggie! Despite a whopping 55.8% rise in diesel prices, BNM keeps its cool with inflation forecasts unchanged. They've got it all figured out.🤣 🛢️⬆️➡️😌

Growth Optimism: Export-led recovery on the horizon, thanks to Malaysia's strong positi...

10

2

🌞 Solar Power Moves: Big Solar Wins: Cypark is turning on the juice with its 100MW solar plant in Terengganu! Future revenues and cash flows are set to shine bright.

🌞💰21-Year Goldmine: Transitioning projects to Operation & Maintenance for long-term, stable income. This is a 21-year money-making machine!

🏦💸 🔥 Efficiency Overhaul: Fixing the WTE Plant: After a temporary hiccup, Cypark is upgrading its Waste-to-Energy plant. Expect a power-packed comeback wit...

🌞💰21-Year Goldmine: Transitioning projects to Operation & Maintenance for long-term, stable income. This is a 21-year money-making machine!

🏦💸 🔥 Efficiency Overhaul: Fixing the WTE Plant: After a temporary hiccup, Cypark is upgrading its Waste-to-Energy plant. Expect a power-packed comeback wit...

8

1

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)