Rodney Chua

voted

Hi, mooers! 👋

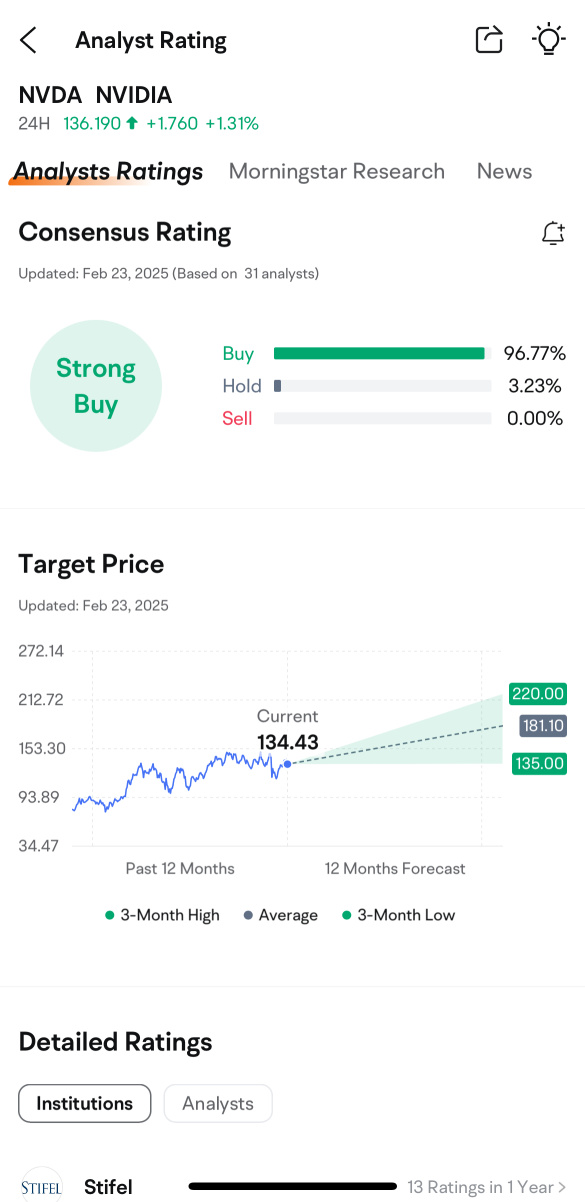

The AI world holds its breath! $NVIDIA (NVDA.US)$ will release its Q4 FY2025 earnings on February 26, just before the market opens. As the AI kingpin faces heightened scrutiny amid market volatility, will it defy expectations again? This is your chance to earn rewards and gain insights by predicting the opening price. Let’s get into it! 🎉

Stay Ahead of the Game

Subscribe to @Moo Live for real-time updates, expert analysis, and t...

The AI world holds its breath! $NVIDIA (NVDA.US)$ will release its Q4 FY2025 earnings on February 26, just before the market opens. As the AI kingpin faces heightened scrutiny amid market volatility, will it defy expectations again? This is your chance to earn rewards and gain insights by predicting the opening price. Let’s get into it! 🎉

Stay Ahead of the Game

Subscribe to @Moo Live for real-time updates, expert analysis, and t...

641

1022

40

Rodney Chua

voted

Hi, mooers!

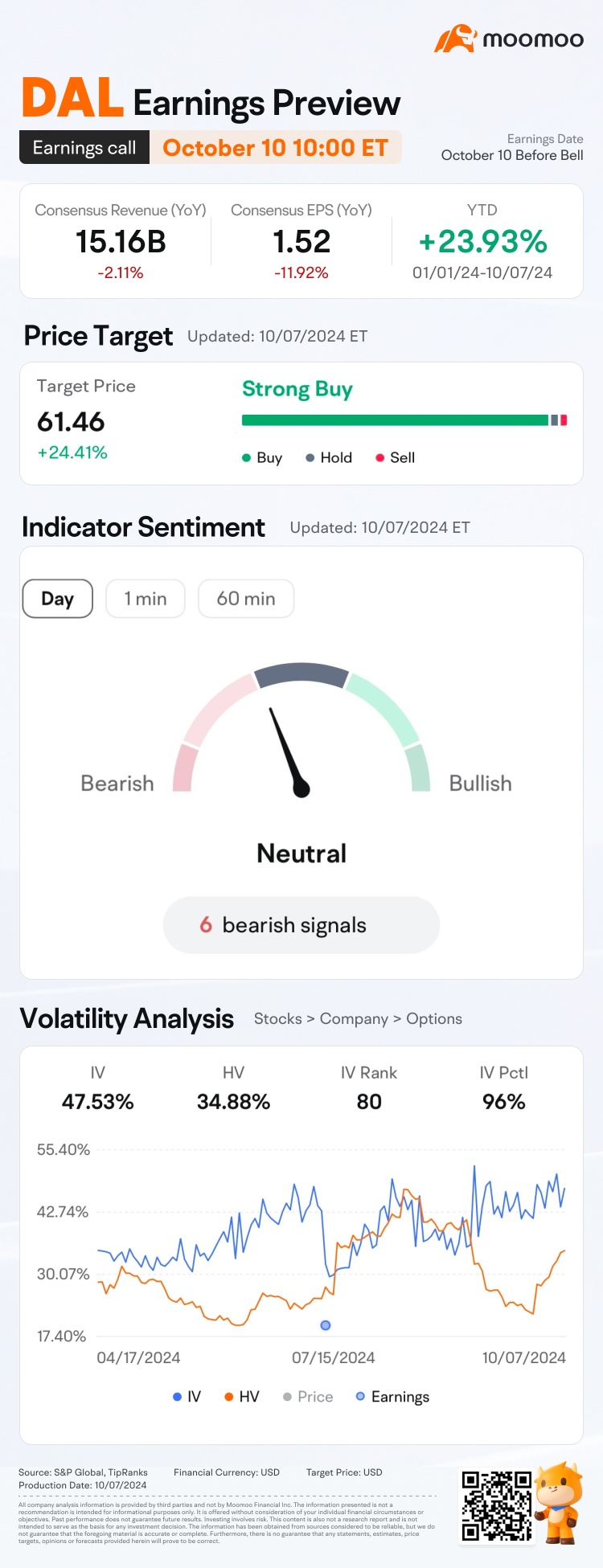

$Delta Air Lines (DAL.US)$ is releasing its Q3 2024 earnings on October 10 before the bell. Unlock insights with DAL Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q2 2024 earnings release, shares of $Delta Air Lines (DAL.US)$ have seen an increase of 15.42%. How will the market react to the upcoming results? Make your guess now!

Rewards

● An equal share of 5,000 points: Fo...

$Delta Air Lines (DAL.US)$ is releasing its Q3 2024 earnings on October 10 before the bell. Unlock insights with DAL Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q2 2024 earnings release, shares of $Delta Air Lines (DAL.US)$ have seen an increase of 15.42%. How will the market react to the upcoming results? Make your guess now!

Rewards

● An equal share of 5,000 points: Fo...

Expand

Expand 51

91

10

Rodney Chua

voted

Hi, mooers!

$Micron Technology (MU.US)$ is releasing its Q4 FY2024 earnings on September 25 after the bell. Unlock insights with MU Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q3 FY2024 earnings release, shares of $Micron Technology (MU.US)$ have seen decrease of 34.22%. How will the market react to the upcoming results? Make your guess now!

Rewards

● An equal share of 5,000 poin...

$Micron Technology (MU.US)$ is releasing its Q4 FY2024 earnings on September 25 after the bell. Unlock insights with MU Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q3 FY2024 earnings release, shares of $Micron Technology (MU.US)$ have seen decrease of 34.22%. How will the market react to the upcoming results? Make your guess now!

Rewards

● An equal share of 5,000 poin...

Expand

Expand 76

132

13

Rodney Chua

commented on

$United Money Market Fund-Class R (MYU9100AN000.MF)$ now only 2++%, very low rate

4

2

Rodney Chua

commented on

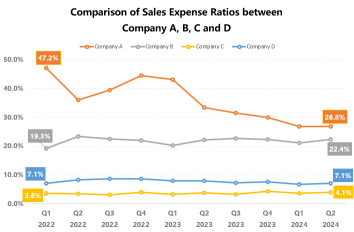

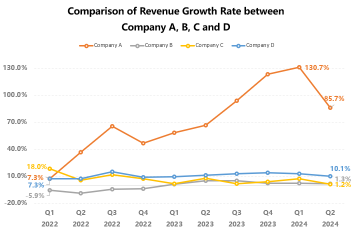

E-commerce stocks have gain a lot of attention these years, especially with some popular stocks' price skyrocketing. But this market has transformed from a "blue ocean" 20 years ago, to a highly competitive market today. So how do we tell if an e-commerce company is winning more market shares over its competitors?

Sales expense ratio, the percentage of marketing expenses on total revenue, might be the key indicator...

Sales expense ratio, the percentage of marketing expenses on total revenue, might be the key indicator...

+1

39

79

4

Rodney Chua

voted

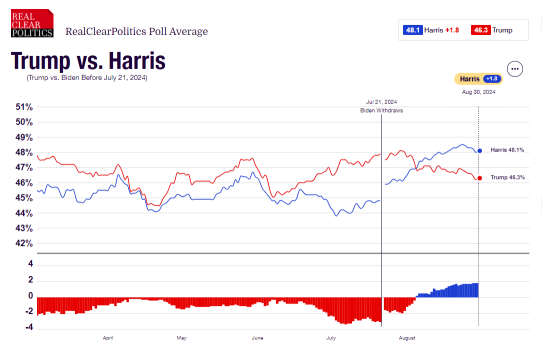

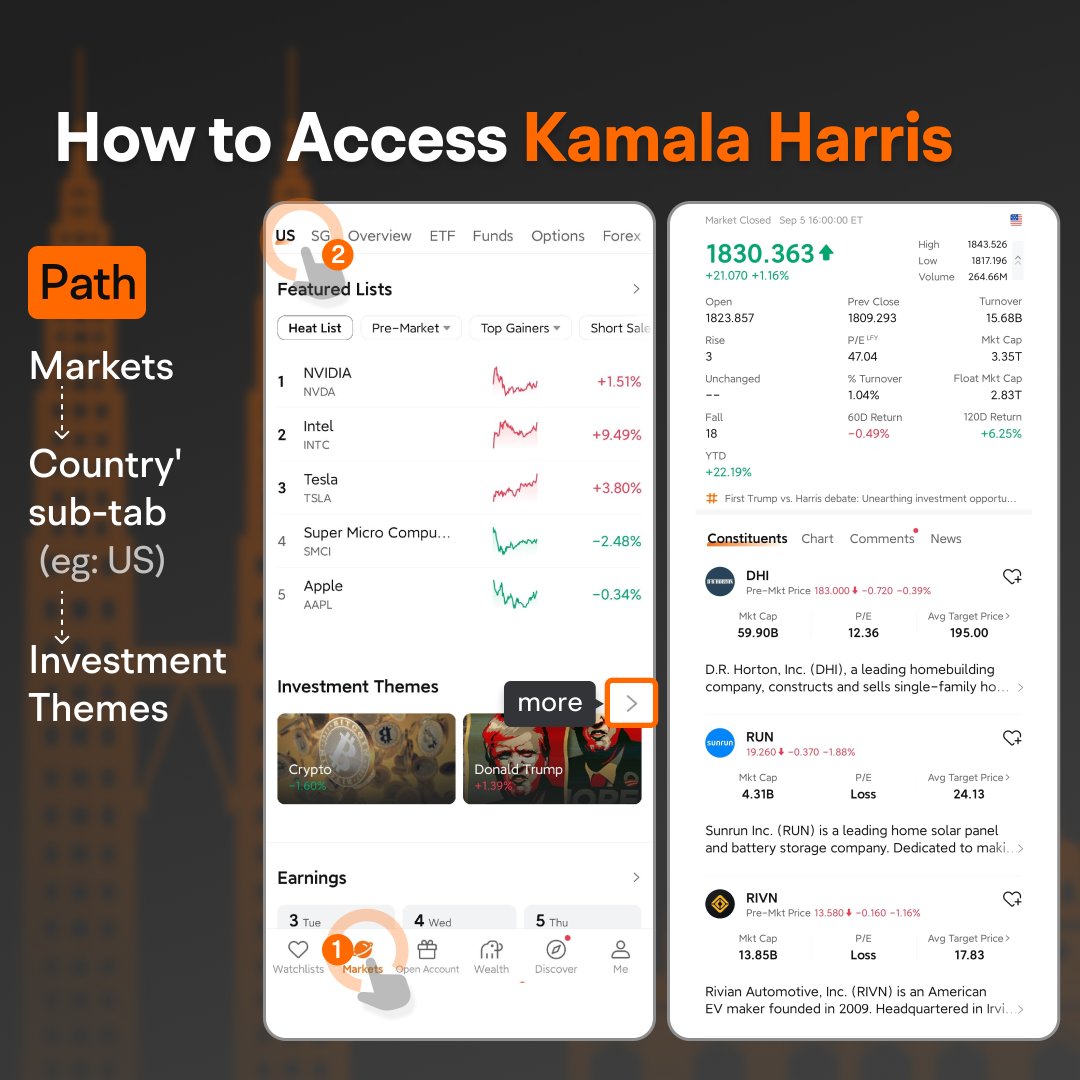

In the previous article, we introduced "Trump Trade" strategy. According to RCP poll, as of August 30, Harris's chance of being elected was 48.1%, ahead of Trump's 46.3%. At this point, it is time to talk about "Harris Trade".

Source: Realclear Polling. Data as of August 30, 2024.

![]() What are the differences in Harris's new policy?

What are the differences in Harris's new policy?

1. Core: Reducing the cost of living

In Harris's economic policy speech, the focus is on reducing ...

Source: Realclear Polling. Data as of August 30, 2024.

1. Core: Reducing the cost of living

In Harris's economic policy speech, the focus is on reducing ...

+2

410

252

56

Rodney Chua

liked

$Lamb Weston (LW.US)$ ..F.. analysts!.

they said it was worth one price, then after it falls, they change the rating to the new price!

If they were so wrong before, ? why listen to them now?

their ACTIONS PROVE they don't know their butts from holes in the ground.

they said it was worth one price, then after it falls, they change the rating to the new price!

If they were so wrong before, ? why listen to them now?

their ACTIONS PROVE they don't know their butts from holes in the ground.

3

2

Rodney Chua

voted

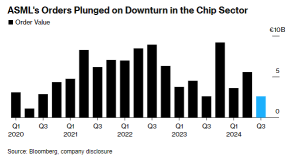

Updated on October 15

Semiconductor company $ASML Holding (ASML.US)$ experienced its largest drop in 26 years on October 15 after reporting only about half the orders that analysts had anticipated from chipmakers, signaling a significant slowdown for this key industry player, according to Bloomberg.

The disappointing results were further exacerbated by the company accidentally releasing its earnings report a day early. This news prompted a wid...

Semiconductor company $ASML Holding (ASML.US)$ experienced its largest drop in 26 years on October 15 after reporting only about half the orders that analysts had anticipated from chipmakers, signaling a significant slowdown for this key industry player, according to Bloomberg.

The disappointing results were further exacerbated by the company accidentally releasing its earnings report a day early. This news prompted a wid...

+2

442

195

164

Rodney Chua

voted

Timetable of IPO

Figure 1: IPO timetable of SDCG

Source: $SDCG (0321.MY)$ IPO Prospectus

-Will be listed on the ACE Board

Full Video for SDCG IPO (Chinese version) - YouTube

Info of IPO

Enlarged no. of shares upon listing: 423.82246 million

IPO price: RM0.38

Market capitalization: RM161.05 million

Estimated funds to raise from Public Issue: RM45.09 million

PE ratio = 25.36x (based on FY2023)

Business Model

Figure 2: Business model of SDCG

Sour...

Figure 1: IPO timetable of SDCG

Source: $SDCG (0321.MY)$ IPO Prospectus

-Will be listed on the ACE Board

Full Video for SDCG IPO (Chinese version) - YouTube

Info of IPO

Enlarged no. of shares upon listing: 423.82246 million

IPO price: RM0.38

Market capitalization: RM161.05 million

Estimated funds to raise from Public Issue: RM45.09 million

PE ratio = 25.36x (based on FY2023)

Business Model

Figure 2: Business model of SDCG

Sour...

+4

3

1

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)