Today might be a good time to prepare for the financial report. $NVIDIA (NVDA.US)$ A good timing. Last Friday, technology stocks pulled back, with Nvidia plunging 3.26%. $NVIDIA (NVDA.US)$

However, trouble does not come alone. Over the weekend, 'The Information' suddenly revealed that there are overheating issues when the Blackwell processor is installed in high-capacity server racks, causing concerns among clients like Google, Meta, and Microsoft, which may affect deployment deadlines.

If there is another delay, a large-scale deployment being postponed for another quarter will indeed impact investor expectations.

This week is nvidia's FY25Q3 financial report, one of the most important reports of the year, with some divergence among market analysts.

Market expectations:

Given that the previous few quarters have all been significantly above expectations, it is definitely not appropriate to use the current market consensus as a performance comparison baseline. Not only is it mixed with outdated expectations from analysts who have not updated their forecasts in time, but also investors know that it will exceed expectations, so the expectations will be raised.

Therefore, it is necessary to compare how much the actual expectations exceed the Consensus.

Income: It has been consistently outperforming by around 2 billion in the recent quarters, so the Q3 Consensus of 33.2 billion actually equals 35.2 billion.

Also, it is important to look at the guidance for the next quarter. Currently, the Consensus for Q4 is 37.05 billion, as well...

However, trouble does not come alone. Over the weekend, 'The Information' suddenly revealed that there are overheating issues when the Blackwell processor is installed in high-capacity server racks, causing concerns among clients like Google, Meta, and Microsoft, which may affect deployment deadlines.

If there is another delay, a large-scale deployment being postponed for another quarter will indeed impact investor expectations.

This week is nvidia's FY25Q3 financial report, one of the most important reports of the year, with some divergence among market analysts.

Market expectations:

Given that the previous few quarters have all been significantly above expectations, it is definitely not appropriate to use the current market consensus as a performance comparison baseline. Not only is it mixed with outdated expectations from analysts who have not updated their forecasts in time, but also investors know that it will exceed expectations, so the expectations will be raised.

Therefore, it is necessary to compare how much the actual expectations exceed the Consensus.

Income: It has been consistently outperforming by around 2 billion in the recent quarters, so the Q3 Consensus of 33.2 billion actually equals 35.2 billion.

Also, it is important to look at the guidance for the next quarter. Currently, the Consensus for Q4 is 37.05 billion, as well...

Translated

1

EY does not trust SMCI, executives have directly resigned, but only a few days left until the deadline, it's hard to find another accounting firm willing to sign. If there is another extension, it's hard not to recall 2017...

On August 29, 2017, the same extension request was made again due to accounting issues.

Another extension request was made on September 14 of the same year.

After the hearing on March 16 of the following year, a one-time extension was successfully granted, but still not submitted.

Suspension in August 2018.

Returned to nasdaq in 2020.

We can only say that the company's previous practice was to delay until suspension to survive. Will it be different this time? $Super Micro Computer (SMCI.US)$

On August 29, 2017, the same extension request was made again due to accounting issues.

Another extension request was made on September 14 of the same year.

After the hearing on March 16 of the following year, a one-time extension was successfully granted, but still not submitted.

Suspension in August 2018.

Returned to nasdaq in 2020.

We can only say that the company's previous practice was to delay until suspension to survive. Will it be different this time? $Super Micro Computer (SMCI.US)$

Translated

1

1

The most beautiful maple leaves are still in Agungkun!

Translated

2

The big shots at the Bank of Canada may bring us a big bullish news on October 23 - a 50 basis point rate cut, directly lowering the key interest rate to 3.75%!

Looking at the latest inflation data, the annual inflation rate in August has dropped to 2%, if it weren't for the lending interest rates supporting it, it probably would have dropped to 1.2% long ago. This is clearly a preventive measure for the central bank to cut interest rates!

The current interest rate of 4.25% is truly a bit high, it needs to be quickly reduced, otherwise the economy will be dragged down by this high interest rate. Look at the unemployment rate now, especially for young people, it's so difficult to find a job. Companies also don't want to hire, the market is stagnant like this, if it continues like this, a wave of layoffs may come.

So the central bank must cut interest rates this time, to loosen the economy. I heard they have to continue cutting, maybe it will reach 2.25% by next summer. This wave of operations, although it can alleviate inflation, also needs to be careful about economic recession and deflation.

Housing pressure is still high, the housing prices are frighteningly high, although the rise has slowed down, buying a house is still not easy. However, the interest rate cut is always good news.![]()

![]() $Bank of Montreal (BMO.CA)$ $The Toronto-Dominion Bank (TD.CA)$ $Royal Bank of Canada (RY.CA)$

$Bank of Montreal (BMO.CA)$ $The Toronto-Dominion Bank (TD.CA)$ $Royal Bank of Canada (RY.CA)$

Looking at the latest inflation data, the annual inflation rate in August has dropped to 2%, if it weren't for the lending interest rates supporting it, it probably would have dropped to 1.2% long ago. This is clearly a preventive measure for the central bank to cut interest rates!

The current interest rate of 4.25% is truly a bit high, it needs to be quickly reduced, otherwise the economy will be dragged down by this high interest rate. Look at the unemployment rate now, especially for young people, it's so difficult to find a job. Companies also don't want to hire, the market is stagnant like this, if it continues like this, a wave of layoffs may come.

So the central bank must cut interest rates this time, to loosen the economy. I heard they have to continue cutting, maybe it will reach 2.25% by next summer. This wave of operations, although it can alleviate inflation, also needs to be careful about economic recession and deflation.

Housing pressure is still high, the housing prices are frighteningly high, although the rise has slowed down, buying a house is still not easy. However, the interest rate cut is always good news.

Translated

7

Whenever I am busy during the day, the A-share market will soar. Today, I was having lunch with a friend, and when I glanced at my phone, I found out that it had suddenly surged in a straight line?!!

I don't know if anyone took the opportunity to collect chips during this pullback over the past week. For those who established positions during this period, I estimate that they probably recouped all their paper losses in one go today.

Today should be the first day for the 500 billion mutual substitution and convenience to start establishing positions. The previous substantial pullback was also to create room for them to enter the market. They are likely to prioritize buying their own stocks. I guess the ETFs they are most likely to buy are: sse science and technology innovation board 50 index ETF, yifangda gem ETF, and chip ETF.

This morning, a classmate chatted with me and bought a lot in the US stock market. $Direxion Daily FTSE China Bull 3X Shares ETF (YINN.US)$ and $Direxion Daily CSI China Internet Index Bull 2x Shares ETF (CWEB.US)$ , due to the relationships of triple and double leverages, the recent downturn has been severe, which is a bit worrying. I explained to him the candlesticks of several sectors in the A-share market, especially the candlesticks of sse science and technology innovation board 50 index: after a whole week of adjustment, everyone who bought in before National Day was not in the red at all, indicating extremely strong support. Indeed, the best performance this afternoon is sse science and technology innovation board 50 index, very close to the previous high.

From what I see in this round of market movements, the most...

I don't know if anyone took the opportunity to collect chips during this pullback over the past week. For those who established positions during this period, I estimate that they probably recouped all their paper losses in one go today.

Today should be the first day for the 500 billion mutual substitution and convenience to start establishing positions. The previous substantial pullback was also to create room for them to enter the market. They are likely to prioritize buying their own stocks. I guess the ETFs they are most likely to buy are: sse science and technology innovation board 50 index ETF, yifangda gem ETF, and chip ETF.

This morning, a classmate chatted with me and bought a lot in the US stock market. $Direxion Daily FTSE China Bull 3X Shares ETF (YINN.US)$ and $Direxion Daily CSI China Internet Index Bull 2x Shares ETF (CWEB.US)$ , due to the relationships of triple and double leverages, the recent downturn has been severe, which is a bit worrying. I explained to him the candlesticks of several sectors in the A-share market, especially the candlesticks of sse science and technology innovation board 50 index: after a whole week of adjustment, everyone who bought in before National Day was not in the red at all, indicating extremely strong support. Indeed, the best performance this afternoon is sse science and technology innovation board 50 index, very close to the previous high.

From what I see in this round of market movements, the most...

Translated

23

1

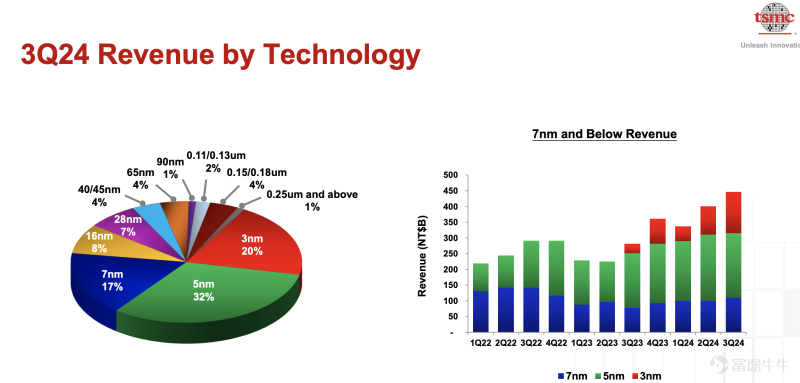

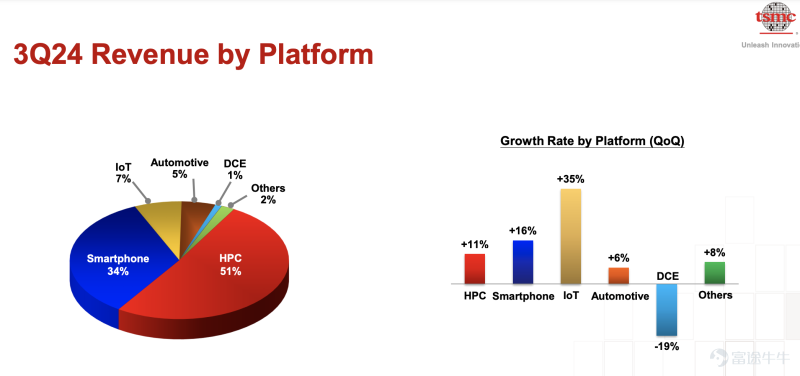

Looking at Taiwan Semiconductor's third-quarter performance and annual outlook, as the current leader in computing power, Taiwan Semiconductor's performance is still very impressive. In the current and foreseeable future, Taiwan Semiconductor will maintain a relative advantage over other competitors.

Firstly, in terms of revenue technology, the 3nm and 5nm processes account for over 50% of the company's revenue, which are also the highest-profit margin businesses for Taiwan Semiconductor, mainly used for manufacturing CPUs, GPUs, smart phones, and other products. From the current overall market situation, high-performance GPUs are likely to be the main growth drivers, which also means that AI companies represented by NVIDIA will continue to maintain high prosperity.

Secondly, looking downstream, the PC and smart phone markets are gradually maturing and stabilizing. GPUs, as representatives of high-performance computing, are maintaining a high growth trend. Based on the communication between the company and the market, this trend is expected to continue.

Thirdly, benefiting from Taiwan Semiconductor's high-gross-margin operating model, the company's asset structure will be further optimized. Coupled with a favorable downstream environment and strong negotiating power, the company's cash flow situation remains healthy.

Fourth, as the leader of the industry, Taiwan Semiconductor has been continuously expanding its scale while pulling away from followers such as Samsung in terms of technology. Furthermore, with the impact of building factories in Arizona, Japan, and other places, the company's capital expenditure will also remain high. In theory, this is a bullish signal for companies like AMSL, LAM, AMAT, and TEL, as at least for a period of time in the future, their orders are secure.

Fifth, AI, it's all about AI...

Firstly, in terms of revenue technology, the 3nm and 5nm processes account for over 50% of the company's revenue, which are also the highest-profit margin businesses for Taiwan Semiconductor, mainly used for manufacturing CPUs, GPUs, smart phones, and other products. From the current overall market situation, high-performance GPUs are likely to be the main growth drivers, which also means that AI companies represented by NVIDIA will continue to maintain high prosperity.

Secondly, looking downstream, the PC and smart phone markets are gradually maturing and stabilizing. GPUs, as representatives of high-performance computing, are maintaining a high growth trend. Based on the communication between the company and the market, this trend is expected to continue.

Thirdly, benefiting from Taiwan Semiconductor's high-gross-margin operating model, the company's asset structure will be further optimized. Coupled with a favorable downstream environment and strong negotiating power, the company's cash flow situation remains healthy.

Fourth, as the leader of the industry, Taiwan Semiconductor has been continuously expanding its scale while pulling away from followers such as Samsung in terms of technology. Furthermore, with the impact of building factories in Arizona, Japan, and other places, the company's capital expenditure will also remain high. In theory, this is a bullish signal for companies like AMSL, LAM, AMAT, and TEL, as at least for a period of time in the future, their orders are secure.

Fifth, AI, it's all about AI...

Translated

14

Asmack, the leader in the lithography industry ( $ASML Holding (ASML.US)$ ) Yesterday, I had big news for the market. My old investors working in Canada were all shocked. Today I'm going to talk to you about this.

Asmak's earnings report for this quarter is supposed to be seen on Wednesday. The results were leaked ahead of time due to a “technical failure,” causing the US stock market to blow up. The performance figures are pretty good. Profits and gross margins are better than everyone thought, but the order volume and future prospects are far below expectations.The stock price dived directly, falling more than 16% at the close.This decline was followed by the Philadelphia Semiconductor Index. The NASDAQ, Dow, and S&P all slipped from new highs.

The point is, Asmack received only 2.63 billion euros in orders in the third quarter, and analysts are all expecting 5.39 billion euros. Moreover, they also lowered their future performance expectations. Sales in 2025 were reduced from 30-40 billion euros to 30-35 billion euros, and gross margin was also lowered.Management explained that AI chips are in high demand, but the rest of the semiconductor market is much weaker than expected. Orders on the logic chip side have been delayed, and the memory chip manufacturer's new production capacity is limited.

Most of Asma's sales are still in China, and 47% of sales in the third quarter were contributed by China. However, due to geopolitical issues, the share of the Chinese market may decline in the future, and may be only 20% by 2025.

Speaking of...

Asmak's earnings report for this quarter is supposed to be seen on Wednesday. The results were leaked ahead of time due to a “technical failure,” causing the US stock market to blow up. The performance figures are pretty good. Profits and gross margins are better than everyone thought, but the order volume and future prospects are far below expectations.The stock price dived directly, falling more than 16% at the close.This decline was followed by the Philadelphia Semiconductor Index. The NASDAQ, Dow, and S&P all slipped from new highs.

The point is, Asmack received only 2.63 billion euros in orders in the third quarter, and analysts are all expecting 5.39 billion euros. Moreover, they also lowered their future performance expectations. Sales in 2025 were reduced from 30-40 billion euros to 30-35 billion euros, and gross margin was also lowered.Management explained that AI chips are in high demand, but the rest of the semiconductor market is much weaker than expected. Orders on the logic chip side have been delayed, and the memory chip manufacturer's new production capacity is limited.

Most of Asma's sales are still in China, and 47% of sales in the third quarter were contributed by China. However, due to geopolitical issues, the share of the Chinese market may decline in the future, and may be only 20% by 2025.

Speaking of...

Translated

9

1

Currently, Chinese concept stocks are experiencing a major rebound. Positive central policies, interest rate cuts in the USA, any more bad news???

Hot China concept stocks are on a general rise: $BILIBILI-W (09626.HK)$ Bilibili surged over 15%, $JD-SW (09618.HK)$ Surged over 14%, $PDD Holdings (PDD.US)$ Surged over 13%, $Futu Holdings Ltd (FUTU.US)$ rising more than 7%, $Alibaba (BABA.US)$Surged over 10% , $NIO-SW (09866.HK)$ Rising more than 10%. $BIDU-SW (09888.HK)$ rose over 9%.

Let's talk separately about the three stocks I am currently most focused on:

$Alibaba (BABA.US)$ The current valuation is still relatively low! It is expected to open directly above 105 next Monday.

$Direxion Daily FTSE China Bull 3X Shares ETF (YINN.US)$ Music playing and dancing, advancing towards 45! Are we going to take down the USA server tonight as well? Such as pulling the network cable, etc.?

$PDD Holdings (PDD.US)$ Pinduoduo is really amazing, such a big pit, climbed up in one month, and back to the financial report level in one month! It is normal to be at 160-180 within three months, unless the next quarter's performance and profits are cut in half, otherwise it will continue to rise.

In conclusion...

Hot China concept stocks are on a general rise: $BILIBILI-W (09626.HK)$ Bilibili surged over 15%, $JD-SW (09618.HK)$ Surged over 14%, $PDD Holdings (PDD.US)$ Surged over 13%, $Futu Holdings Ltd (FUTU.US)$ rising more than 7%, $Alibaba (BABA.US)$Surged over 10% , $NIO-SW (09866.HK)$ Rising more than 10%. $BIDU-SW (09888.HK)$ rose over 9%.

Let's talk separately about the three stocks I am currently most focused on:

$Alibaba (BABA.US)$ The current valuation is still relatively low! It is expected to open directly above 105 next Monday.

$Direxion Daily FTSE China Bull 3X Shares ETF (YINN.US)$ Music playing and dancing, advancing towards 45! Are we going to take down the USA server tonight as well? Such as pulling the network cable, etc.?

$PDD Holdings (PDD.US)$ Pinduoduo is really amazing, such a big pit, climbed up in one month, and back to the financial report level in one month! It is normal to be at 160-180 within three months, unless the next quarter's performance and profits are cut in half, otherwise it will continue to rise.

In conclusion...

Translated

8

1

$Alibaba (BABA.US)$Exciting! Even if competitors are eager to compete, like in a martial arts competition, what about Alibaba? Calm and composed, while repurchasing its own stocks, distributing money to shareholders as if giving out red envelopes, and running swiftly in various business lines, as busy as bees collecting honey, earning buckets of gold for everyone. Alibaba plans to continue this repurchase drama, along with playing new tricks in technological innovation and market expansion, almost bursting with the rhythm of holding back and then unleashing big moves. As a result, Alibaba's valuation is expected to soar rapidly, so for investor friends, get ready to count the money until your hands cramp, the returns are so lucrative that you'll be delighted to wake up laughing in the middle of the night! $Direxion Daily FTSE China Bull 3X Shares ETF (YINN.US)$

Translated

8

I know that the Canadian Revenue Agency (CRA) is always ambiguous about intraday trades in TFSA. For example, you just bought TD and CASH, but regretted it next week and wanted to sell them all to switch to XEQT and VFV.

Is it too soon for this buy and sell? Should I wait for a month or longer? I know they value holding period, but I'm not sure how it's defined. And I don't have much money, just a few thousand yuan. $VANGUARD S&P 500 INDEX ETF TR UNIT (VFV.CA)$ $ISHARES CORE EQUITY ETF PORTFOLIO UNITS CAD (XEQT.CA)$

Is it too soon for this buy and sell? Should I wait for a month or longer? I know they value holding period, but I'm not sure how it's defined. And I don't have much money, just a few thousand yuan. $VANGUARD S&P 500 INDEX ETF TR UNIT (VFV.CA)$ $ISHARES CORE EQUITY ETF PORTFOLIO UNITS CAD (XEQT.CA)$

Translated

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)