Shungou

voted

TSM is releasing its Q2 earnings on July 18 before the bell.

For the details of indicator sentiment, please tap the link and check.

Since its Q1 earnings release, shares of $Taiwan Semiconductor (TSM.US)$ have seen an increase of 22.28%.![]() How will the market react to the upcoming results? Make your guess now!

How will the market react to the upcoming results? Make your guess now! ![]()

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the price range of $Taiwan Semiconductor (TSM.US)$'s opening...

For the details of indicator sentiment, please tap the link and check.

Since its Q1 earnings release, shares of $Taiwan Semiconductor (TSM.US)$ have seen an increase of 22.28%.

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the price range of $Taiwan Semiconductor (TSM.US)$'s opening...

Expand

Expand 153

260

29

Shungou

Set a live reminder

[Synopsis]

With the global market transitions since the start of 2024, how can an active investor possibly capture these pivotal turns and evolutions for their investment strategy? With the final live webinar for our mid-year funds series, learn how investors like yourselves can potentially leverage on Income strategies to navigate the changes on a global scale with our experts from PIMCO and Moomoo Singapore. Join us and you may be rewarded with qu...

With the global market transitions since the start of 2024, how can an active investor possibly capture these pivotal turns and evolutions for their investment strategy? With the final live webinar for our mid-year funds series, learn how investors like yourselves can potentially leverage on Income strategies to navigate the changes on a global scale with our experts from PIMCO and Moomoo Singapore. Join us and you may be rewarded with qu...

A Pivotal Year: Strategies for Capturing Income

Jun 28 17:00

24

3

Shungou

Set a live reminder

[Synopsis]

Mid-2024 - where are we for Asia's Fixed Income space? What is the outlook and how can investors utilise the potential window of opportunities in the current global market context? We delve deeper into possible strategies you may leverage on for Fixed Income, so join us to find out more on the analysis as we transition into the second half of the year with our experts from UOB Asset Management. Come learn with us and stand a chance to win some...

Mid-2024 - where are we for Asia's Fixed Income space? What is the outlook and how can investors utilise the potential window of opportunities in the current global market context? We delve deeper into possible strategies you may leverage on for Fixed Income, so join us to find out more on the analysis as we transition into the second half of the year with our experts from UOB Asset Management. Come learn with us and stand a chance to win some...

Asia Fixed Income: A Window of Opportunity

Jun 28 15:00

7

2

Shungou

Set a live reminder

[Synopsis]

With the US interest rate cycle transitions since the start of 2024 - where are we now given there is no rate cutes in 2024 by the Fed? How can investors potentially benefit and what can we expect from the US market going into the second half of the year? Find out more in the latest live webinar with our expert from CSOP Asset Management. Join us and you might be rewarded with some giveaways and quiz questions.@olivehiggo

[Speake...

With the US interest rate cycle transitions since the start of 2024 - where are we now given there is no rate cutes in 2024 by the Fed? How can investors potentially benefit and what can we expect from the US market going into the second half of the year? Find out more in the latest live webinar with our expert from CSOP Asset Management. Join us and you might be rewarded with some giveaways and quiz questions.@olivehiggo

[Speake...

US Interest rate cycle overview by CSOP Asset Management

Jun 27 17:00

8

2

Shungou

Set a live reminder

[Synopsis]

As we head into the mid-year, what is the assessment of the current economy and will interest rates take a turn? With a year of global elections, US rate changes, continued geopolitical risks, and potential stablization of the Chinese market - learn the analysis as we hit the emergence of a new season with our expert from Fullerton Fund Management. Tune in as well for potential quiz giveaways and stand a chance to be rewarded f...

As we head into the mid-year, what is the assessment of the current economy and will interest rates take a turn? With a year of global elections, US rate changes, continued geopolitical risks, and potential stablization of the Chinese market - learn the analysis as we hit the emergence of a new season with our expert from Fullerton Fund Management. Tune in as well for potential quiz giveaways and stand a chance to be rewarded f...

Emergence of a new season, in current interest rates cycle

Jun 27 15:00

7

1

1

Shungou

Set a live reminder

[Synopsis]

Kickstarting our live webinar fund series for 2024, we check-in with technology stocks and beyond - covering insights into the global market outlook, potential "controlled stabilisation" of the China market and potential strategies to employ beyond the Technology rally. Tune in and stand a chance to be rewarded for being with us on the show as we learn the analysis from our experts at Fidelity International. Olivia Higgins will guide you toward...

Kickstarting our live webinar fund series for 2024, we check-in with technology stocks and beyond - covering insights into the global market outlook, potential "controlled stabilisation" of the China market and potential strategies to employ beyond the Technology rally. Tune in and stand a chance to be rewarded for being with us on the show as we learn the analysis from our experts at Fidelity International. Olivia Higgins will guide you toward...

Beyond the Technology rally, what's next?

Jun 27 11:00

9

2

Shungou

commented on

The U.S. economy appears to be stronger than expected, but investors are still shunning the consumer goods sector. With the current decline in stock prices and the rapid rise in Treasury yields, the attractiveness of stocks related to necessities is reducing. Year to date, the $S&P 500 Index (.SPX.US)$ is up 14%, while the $SPDR S&P Retail ETF (XRT.US)$ is down 0.4%, making it the largest spread since 2017. On an individual basis, more than ...

+1

28

70

2

Shungou

commented on

Buying utilities has been expensive in recent years, and now it's probably not. With the spike in long-term interest rates, the industry has been hammered and is in one of its worst bear markets in decades. The sector has gone from 20% overvalued to 20% undervalued, which offers a potential opportunity for buying utilities.

Let's dive into the companies that could lead or be impacted by this trend without further ado!

Question:

1...

Let's dive into the companies that could lead or be impacted by this trend without further ado!

Question:

1...

+1

28

55

4

Shungou

commented on

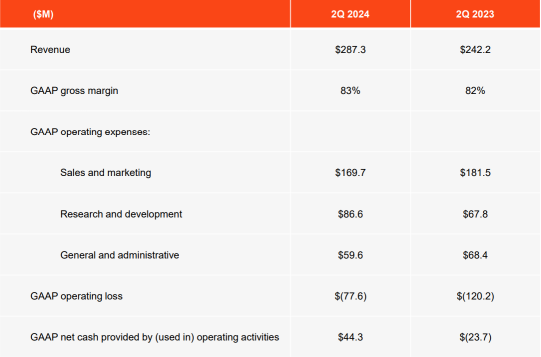

Event Description:

This event column is to help mooers learn more about the differences among companies and industries, identify hidden opportunities, and better navigate the market.

"My goal was never just to create a company. Many people misinterpret that, as if I don't care about revenue, profit, or anything else. But what not being 'just' a company means to me is building something that actually makes a really bi...

This event column is to help mooers learn more about the differences among companies and industries, identify hidden opportunities, and better navigate the market.

"My goal was never just to create a company. Many people misinterpret that, as if I don't care about revenue, profit, or anything else. But what not being 'just' a company means to me is building something that actually makes a really bi...

+2

32

83

1

Shungou

commented on

With the growing demand for chips and cloud services, companies are spending more on artificial intelligence, providing great upside potential for related stocks. Since mid-July, many tech stocks have pulled back, providing an opportunity to buy AI stocks amid poor market sentiment. Let's look for the best of the best in AI stocks to start the fourth quarter!

Rewards

1) 4,000 points: All mooers who answer the following questi...

Rewards

1) 4,000 points: All mooers who answer the following questi...

+1

42

68

7

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)