$Amazon (AMZN.US)$ is going to be the first $10 trillion company.

People still don’t see what’s coming.

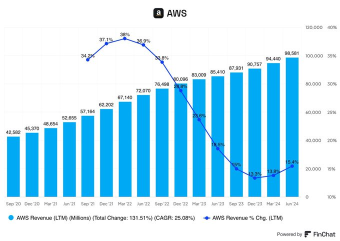

We saw yesterday with Google that cloud demand is exploding. Amazon leads this business and the growth is accelerating.

It will generate $700 billion cloud revenue in 2032 if the market grows as expected.

And the market is growing faster than expected, Google earnings proved this.

$AMZN is still very cheap.

People still don’t see what’s coming.

We saw yesterday with Google that cloud demand is exploding. Amazon leads this business and the growth is accelerating.

It will generate $700 billion cloud revenue in 2032 if the market grows as expected.

And the market is growing faster than expected, Google earnings proved this.

$AMZN is still very cheap.

1

$Alphabet-A (GOOGL.US)$ - earnings tomorrow AH.

Expected move is 6%, trend sales have improved on a monthly basis but marginally given weekly sales are down.

Guidance is what really matters with new Gemini 2.0 and AI features.

The skew is slightly bullish currently, wall C170 November term, also stronger positioning at C200 Jan term position.

Expected move is 6%, trend sales have improved on a monthly basis but marginally given weekly sales are down.

Guidance is what really matters with new Gemini 2.0 and AI features.

The skew is slightly bullish currently, wall C170 November term, also stronger positioning at C200 Jan term position.

4

Moomoo NX is great for traders! I appreciate the ability to customize alerts based on price movements and indicators. Plus, the multi-screen feature and advanced charts make analyzing stocks a breeze.

3

$Taiwan Semiconductor (TSM.US)$ just reported earnings; revenue +36% Y/Y $23.5B (beat). Gross margin 58%.

$Taiwan Semiconductor (TSM.US)$ just showed you that the real $ASML Holding (ASML.US)$ issue was $Taiwan Semiconductor (TSM.US)$ dominating the foundry business & boxing everyone else out. 3nm & 5nm = 51% of revenue now.

As I said many times $Taiwan Semiconductor (TSM.US)$ dominates!

$Taiwan Semiconductor (TSM.US)$ just showed you that the real $ASML Holding (ASML.US)$ issue was $Taiwan Semiconductor (TSM.US)$ dominating the foundry business & boxing everyone else out. 3nm & 5nm = 51% of revenue now.

As I said many times $Taiwan Semiconductor (TSM.US)$ dominates!

6

4

$Bank of America (BAC.US)$

✅Consumer loans/leases were up 1% - slight uptick, that's a modest increase

✅Net Charge Offs flat $1.5 billion - this is a positive economic indicator

✅Consumer Charges Offs increase of $264 million from Q3 2023 to $1.2 billion - this doesn't worry me, these numbers during Covid were at historical lows and are slowly rising

✅Net Charge Off ratio dropped .01% to .58% from Q2 2024 - this is healthy

✅Consu...

✅Consumer loans/leases were up 1% - slight uptick, that's a modest increase

✅Net Charge Offs flat $1.5 billion - this is a positive economic indicator

✅Consumer Charges Offs increase of $264 million from Q3 2023 to $1.2 billion - this doesn't worry me, these numbers during Covid were at historical lows and are slowly rising

✅Net Charge Off ratio dropped .01% to .58% from Q2 2024 - this is healthy

✅Consu...

3

Jefferies out making the call that $NVIDIA (NVDA.US)$ data center revenue in 2025 may be closer to $210 billion vs $170-$180 billion consensus driven by $Taiwan Semiconductor (TSM.US)$ ramping CoWoS (advanced packaging) to 70,000+ WPM in 2025.

Add to that the comments from NVDA and Hon Hai that Blackwell demand is strong = NVDA going higher the last two days and helping to fuel the “AI infrastructure” trade of late.

At $210 billion data center revenue in CY 2025, what does NVDA 2025 EPS look like? $5.00...

Add to that the comments from NVDA and Hon Hai that Blackwell demand is strong = NVDA going higher the last two days and helping to fuel the “AI infrastructure” trade of late.

At $210 billion data center revenue in CY 2025, what does NVDA 2025 EPS look like? $5.00...

1

Another day for the record books in Hong Kong !

The Hang Seng Tech Index closed 6.7% higher, bringing the 6-day gains to 28.3%! $KraneShares CSI China Internet ETF (KWEB.US)$ $KRANESHARES HANG SENG TECH INDEX ETF (KTEC.US)$ $Direxion Daily CSI China Internet Index Bull 2x Shares ETF (CWEB.US)$

The following CN tech names have the biggest premiums to their respective ADR close as of Friday:

$Alibaba (BABA.US)$ 5.6% premium

$JD.com (JD.US)$ 7.9%

$Bilibili (BILI.US)$ 8.9%

$Weibo (WB.US)$ 5.9%

$NIO Inc (NIO.US)$ 11.3% 🔥🔥🔥...

The Hang Seng Tech Index closed 6.7% higher, bringing the 6-day gains to 28.3%! $KraneShares CSI China Internet ETF (KWEB.US)$ $KRANESHARES HANG SENG TECH INDEX ETF (KTEC.US)$ $Direxion Daily CSI China Internet Index Bull 2x Shares ETF (CWEB.US)$

The following CN tech names have the biggest premiums to their respective ADR close as of Friday:

$Alibaba (BABA.US)$ 5.6% premium

$JD.com (JD.US)$ 7.9%

$Bilibili (BILI.US)$ 8.9%

$Weibo (WB.US)$ 5.9%

$NIO Inc (NIO.US)$ 11.3% 🔥🔥🔥...

8

In the midst of this China rally, which undervalued gems are still catching your fancy for some sky-high growth potential? Are we too late into entering the market? Or are we just getting started... Let's hear your thoughts and drop some ticker symbols you're digging into!![]()

![]()

$Alibaba (BABA.US)$ $JD.com (JD.US)$ $Direxion Daily FTSE China Bull 3X Shares ETF (YINN.US)$ $PDD Holdings (PDD.US)$

$Alibaba (BABA.US)$ $JD.com (JD.US)$ $Direxion Daily FTSE China Bull 3X Shares ETF (YINN.US)$ $PDD Holdings (PDD.US)$

5

2

$Amazon (AMZN.US)$ Prime Video Ads will be a big contributor to $AMZN's already high-growing ad business.

The Information reporting that $AMZN Prime Video upfront ad commitment exceeded their goals of $1.8B for next year.

For comparison even though $Netflix (NFLX.US)$ ads have been introduced sooner they only drew several hundred million dollars in upfronts.

The thesis here is simple IMO. $AMZN is the only streamer that can offer targeting streaming ads based on user shopping behaviour. This...

The Information reporting that $AMZN Prime Video upfront ad commitment exceeded their goals of $1.8B for next year.

For comparison even though $Netflix (NFLX.US)$ ads have been introduced sooner they only drew several hundred million dollars in upfronts.

The thesis here is simple IMO. $AMZN is the only streamer that can offer targeting streaming ads based on user shopping behaviour. This...

3

Trading FOMC increasingly seems to me like a bad idea. Anyone ever actually made money trading FOMC day?

Higher than expected rate cuts should make stocks go up.. right?

I think I’m done trying to trade macro news. Technical analysis & charts it is. Markets response to news is incredibly unpredictable, technical analysis is frowned upon but has proven a lot more reliable in my experience

Would love to know thoughts![]()

![]()

![]()

![]()

$S&P 500 Index (.SPX.US)$

Higher than expected rate cuts should make stocks go up.. right?

I think I’m done trying to trade macro news. Technical analysis & charts it is. Markets response to news is incredibly unpredictable, technical analysis is frowned upon but has proven a lot more reliable in my experience

Would love to know thoughts

$S&P 500 Index (.SPX.US)$

1

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)