Sir Bahamut

voted

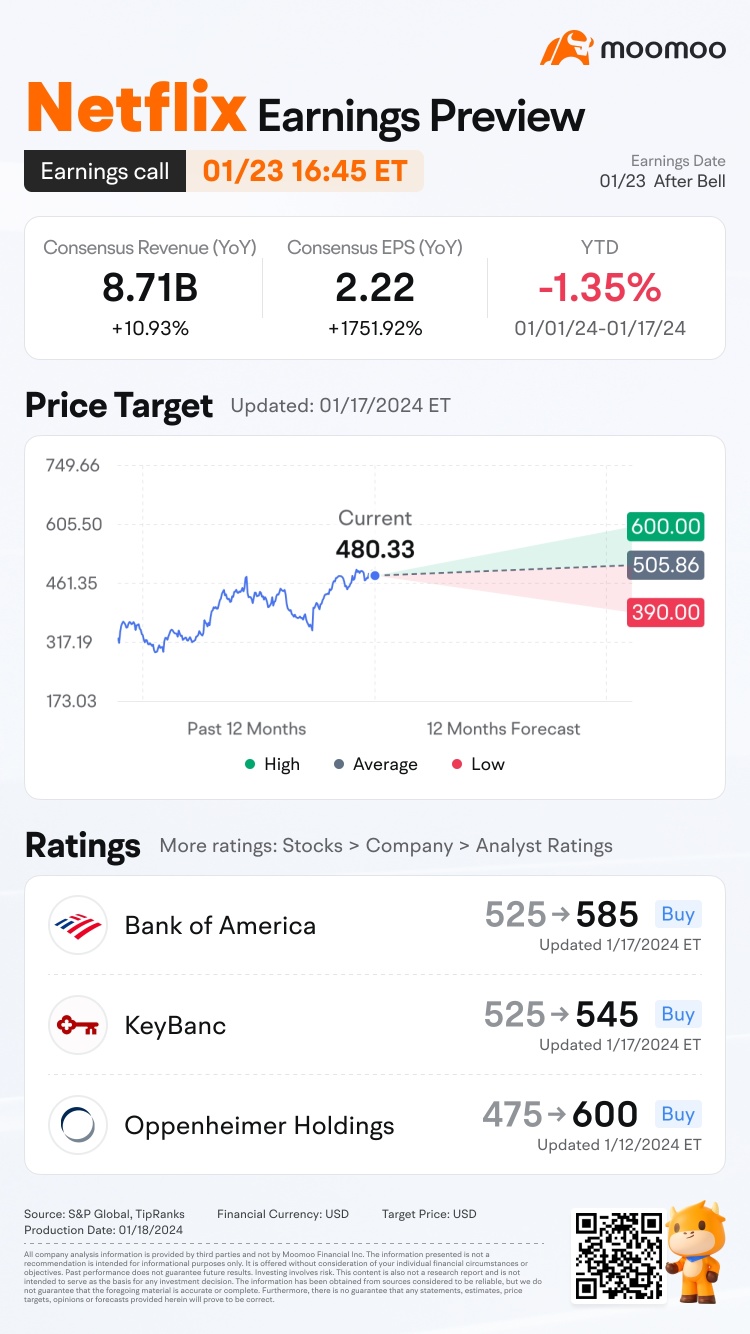

Netflix is releasing its Q4 2023 earnings on January 23, after the U.S. stock market close. How will the market react to the company's quarterly results? Vote your answer to participate!

Rewards

● An equal share of 1,000 points: For mooers who correctly guess the price range of $Netflix (NFLX.US)$'s opening price at 9:30 AM ET Jan 24 (e.g., If 50 mooers make a correct guess, each of them will get 20 points.)

(Vote will c...

Rewards

● An equal share of 1,000 points: For mooers who correctly guess the price range of $Netflix (NFLX.US)$'s opening price at 9:30 AM ET Jan 24 (e.g., If 50 mooers make a correct guess, each of them will get 20 points.)

(Vote will c...

68

64

Sir Bahamut

commented on

Sir Bahamut

commented on

$Razer Inc. (01337.HK)$ currently I am having few stocks under Razer. can anyone advise what will happen to thhose stockks now, do I need to sell it or will it automatically gets credited to my account?

2

4

Sir Bahamut

commented on

$Razer Inc. (01337.HK)$ so the payment for the privatisation will be credited to my moomoo account?

3

Sir Bahamut

commented on

$YOUZAN (08083.HK)$ Will this policy cause Youzan to collapse? Is it already at the end?

Translated

1

Sir Bahamut

liked

$MICROPORT (00853.HK)$

The launch of robots has not boosted the market value of minimally invasive medicine at all. Very disappointed. This was out of the blue. The medical and instrument sector has been cold recently. There was no interest from listed institutional investors. Equity issues are rare. The offering is worth just over $25 billion in Series C financing. Reflect on this increase did not achieve the desired purpose.

The launch of robots has not boosted the market value of minimally invasive medicine at all. Very disappointed. This was out of the blue. The medical and instrument sector has been cold recently. There was no interest from listed institutional investors. Equity issues are rare. The offering is worth just over $25 billion in Series C financing. Reflect on this increase did not achieve the desired purpose.

5

Sir Bahamut

liked

$Visa (V.US)$ Although this incident is not enough to shake the foundation of Visa and the leading position in credit card and debit card business, it does expose the shortcomings of traditional payment giants like Visa. Upstream e-commerce giants will have more bargaining power in the future, and traditional payment giants must invest more resources in new product development and vigorously develop their own ecosystem, especially in the area of social payment. The good days of relying on banks for protection fees will eventually be replaced by new business models.

Translated

13

2

Sir Bahamut

liked

$Salesforce (CRM.US)$

SALESFORCE FULLFORCE

SALESFORCE FULLFORCE

1

Sir Bahamut

commented on

$UP Fintech (TIGR.US)$

Hi All,

Came across this article from SCMP published in March 2021 about China attitude considering to ease their strict capital control in allowing investment aboard.

https://sg.news.yahoo.com/china-strict-capital-controls-may-061739623.html

A extract from the article:

‘The State Administration of Foreign Exchange, the nation’s foreign exchange regulator, said last month China was considering allowing personal investment in overseas stocks and insurance policies within an annual spending limit of US$50,000. Currently, mainland Chinese residents can convert up to US$50,000 per year on foreign currencies for travel, overseas study or work, but not for buying overseas property, securities or life insurance policies’

Futu and Tiger is currently one of the biggest fintech brokers in China that has oversea exposure. But currently “at regulatory risk”.

My thoughts is that China just wants to set the rule right and regulate them (play by their rule).. but not to chase them out of China or to crush them..

what do you think?

Hi All,

Came across this article from SCMP published in March 2021 about China attitude considering to ease their strict capital control in allowing investment aboard.

https://sg.news.yahoo.com/china-strict-capital-controls-may-061739623.html

A extract from the article:

‘The State Administration of Foreign Exchange, the nation’s foreign exchange regulator, said last month China was considering allowing personal investment in overseas stocks and insurance policies within an annual spending limit of US$50,000. Currently, mainland Chinese residents can convert up to US$50,000 per year on foreign currencies for travel, overseas study or work, but not for buying overseas property, securities or life insurance policies’

Futu and Tiger is currently one of the biggest fintech brokers in China that has oversea exposure. But currently “at regulatory risk”.

My thoughts is that China just wants to set the rule right and regulate them (play by their rule).. but not to chase them out of China or to crush them..

what do you think?

8

4

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)